Press release

B2B2C Insurance Market Current Scenario with Future Trends Analysis to 2031

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks & Financial Institution, Automotives, Utilities, Retailers, Travel, Housing, Others (Lifestyle, Telecom, etc.)), By Distributional Channel (Online, Offline), By Application (Individual, Corporation)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."According to the latest research by InsightAce Analytic, the Global B2B2C Insurance Market is valued at US$ 767.53 Mn in 2022, and it is expected to reach US$ 1.77 Bn by 2031, with a CAGR of 9.96% during a forecast period of 2023-2031.

Request for Sample Pages:

https://www.insightaceanalytic.com/request-sample/2162

2B2C insurance, also known as business-to-business-to-consumer insurance, is a distribution model where insurance companies collaborate with retailers to sell insurance to consumers. This arrangement can involve insurance agents, telecom companies, private banks, retailers, and various digital entities. The increasing awareness among consumers regarding insurance and the growing number of insurance providers are expected to expand global B2B2C insurance trends. Intensifying competition among major industry players will propel the global market's growth. Additionally, stringent government regulations overseeing insurance services will contribute to the market's global growth. The rapid digitalization and the increasing use of social media platforms will foster the global market's expansion. A technological paradigm shift, marked by the advent of AI, telematics, and chatbots, has also played a pivotal role in driving the market's global expansion.

Moreover, the increasing adoption of insurance-related devices will further augment the size of the global market in the foreseeable future. Businesses have the opportunity to customize insurance products to align with their customer's specific needs, resulting in more personalized and relevant offerings. This, in turn, can enhance client satisfaction and foster customer loyalty.

List of Prominent Players in the B2B2C Insurance Market:

• Aditya Birla General Insurance

• Edelweiss General Insurance Company Limited

• AXA SA

• BNP Paribas SA.

• Allianz S

• Assicurazioni Generali S.p.A.

• Berkshire Hathaway Inc

• ICICI Lombard

• UnitedHealth Group Inc

• Tata-AIG General Insurance Co. Ltd.

• Aviva plc

• Berkshire Hathaway Inc.

• China Life Insurance Group

• Japan Post Holdings Co., Ltd.

• Munich Re Group

• Prudential plc

• UnitedHealth Group Inc.

• Others.

Market Dynamics:

Drivers-

The insurance industry's digital transformation has opened doors for B2B2C models, enabling insurers and businesses to harness digital platforms for more efficient insurance product distribution and improved customer experiences. As consumers increasingly seek personalized insurance solutions, B2B2C models enable collaboration between businesses and insurers to create tailored insurance products, ultimately driving higher customer satisfaction and loyalty. A technological paradigm shift, characterized by the emergence of AI, telematics, and chatbots, has been a key driver in the global expansion of this market. The growing adoption of insurance-related devices is poised to further expand the global market's size in the foreseeable future. Businesses can adapt insurance products to meet the specific needs of their customers, resulting in more individualized and pertinent offerings. This, in turn, has the potential to boost customer satisfaction and foster customer loyalty.

Enquiry Before Buying:

https://www.insightaceanalytic.com/enquiry-before-buying/2162

Challenges:

B2B2C models involve multiple stakeholders, including insurers, businesses, and consumers. Coordinating and aligning the interests and operations of these different parties can be complex and challenging. Economic and market fluctuations can impact the demand for insurance and the profitability of insurance products. B2B2C models may need to adapt to changing economic conditions and customer preferences. Furthermore, implementing and integrating new technologies to support B2B2C operations can be challenging. It often involves bridging legacy systems with modern digital platforms, which can be time-consuming and costly, which hinders market growth.

Regional Trends:

The Asia Pacific green chemicals market is expected to register a major market share. As a result of the increasing awareness among customers in countries like Canada and the United States regarding the advantages of B2B2C insurance purchases, the demand for safety, security, and dependability will continue to propel the trends in the regional industry. Besides, North America had a substantial share of the market. Additionally, the expanding urban population and the growing per capita income in emerging economies will drive the expansion of the regional market.

Recent Developments

• In July 2023, Aviva agreed with Barclays UK to acquire its home insurance portfolio, which includes a consumer base of 350,000 individuals. This acquisition facilitated the insurer's aspirations to expand its retail insurance division, ensured that customers continued to receive exceptional service, and preserved Aviva's dominant position in the home insurance sector.

• In Dec 2020, ICICI Lombard has launched a digital platform for small and medium companies (SMEs) to purchase business insurance. The SME owners found the new site convenient for purchasing or renewing insurance products, endorsing policies, and registering claims. The corporation revealed that the business owners chose several insurance choices, including marine insurance and workmen's compensation.

Curious about this latest version of the report? Enquiry Before Buying:

https://www.insightaceanalytic.com/customisation/2162

Segmentation of B2B2C Insurance Market-

By Product-

• Life

• Non-life

o Health Insurance

o Home Insurance

o Vehicle Insurance

o Personal Insurance

o Accident Insurance

o Others (Transport, Credit Insurance, etc.)

By Geographical scope

• National

• Multi-Country

• Regional

• Global

By Company size

• Large Enterprise

• Small & medium Enterprise

By Nature of business

• Brick & Mortar

• E-Commerce

• Multi channel

• Non-Commercial

• Service Company

By End Use Industry

• Banks & Financial Institution

• Automotives

• Utilities

• Retailers

• Travel

• Housing

• Others (Lifestyle, Telecom, etc.)

By Distributional Channel

• Online

• Offline

By Application

• Individual

• Corporation

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Get more information: @

https://www.insightaceanalytic.com/report/b2b2c-insurance-market/2162

Contact us:

info@insightaceanalytic.com

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 551 226 6109

Asia: +91 79 72967118

Follow Us on LinkedIn @ bit.ly/2tBXsgS

Follow Us On Facebook @ bit.ly/2H9jnDZ

Twitter: https://twitter.com/Insightace

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain a competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets, and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.https://www.insightaceanalytic.com/images_data/148861653.JPG

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release B2B2C Insurance Market Current Scenario with Future Trends Analysis to 2031 here

News-ID: 3846761 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

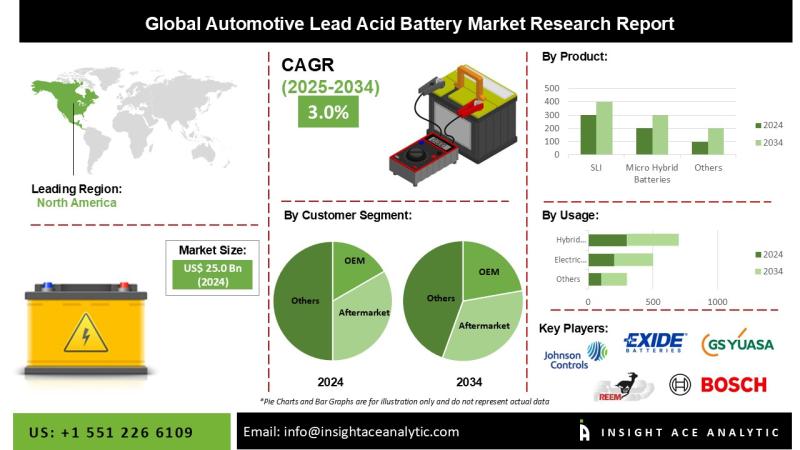

Automotive Lead Acid Battery Market Strategic Growth Drivers and Outlook 2026 to …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Lead Acid Battery Market Size, Share & Trends Analysis Report By Product (SLI and Micro-Hybrid Batteries), Type (Flooded, Enhanced Flooded, and VRLA), Customer Segment (OEM and Aftermarket), End User (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheeler, and Three-Wheeler), and Application (Hybrid Vehicles, Electric Vehicles, Light Motor Vehicles, and Heavy Motor Vehicles)- Market…

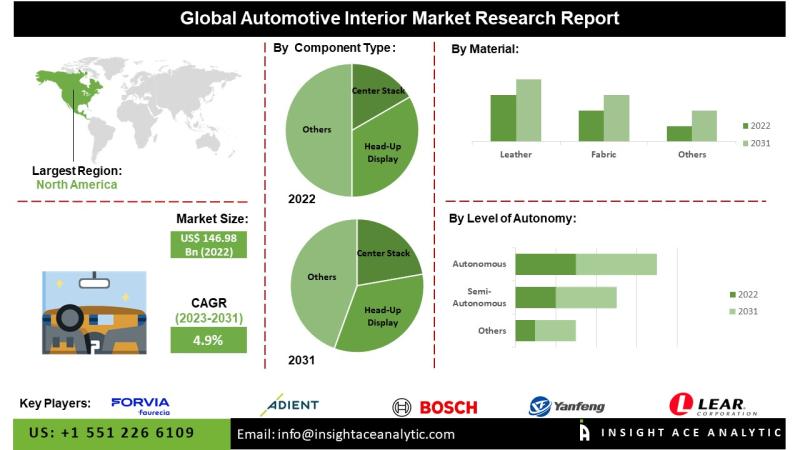

Automotive Interior Market Investment Opportunities and Forecast 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Interior Market- (By Component Type (Center Stack, Head-up Display, Instrument Cluster, Rear Sear Entertainment, Dome Module, Headliner, Seat, Interior Lighting Door Panel, Center Console, Adhesives & Tapes, Upholstery, Others), By Material (Leather, Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon Fiber Composite, Metal), By Level of Autonomy (Semi-Autonomous, Autonomous, Non-Autonomous),By Electric Vehicle (Battery Electric Vehicle…

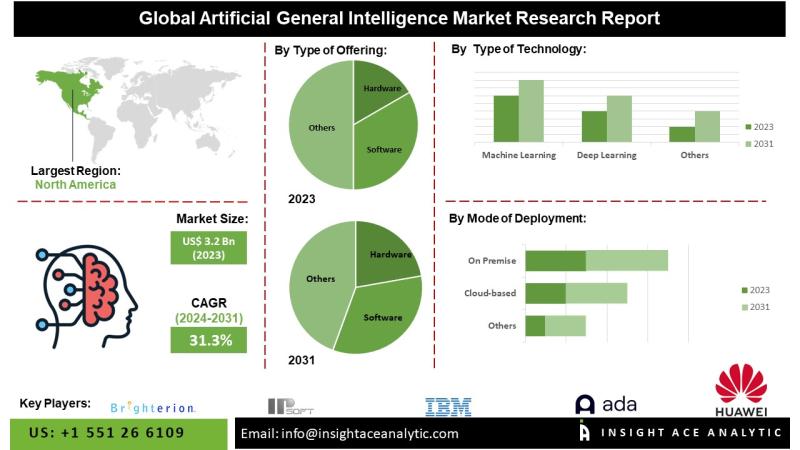

Artificial General Intelligence Market Future Landscape and Industry Evolution 2 …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Artificial General Intelligence (AGI) Market - (By Type of Offering (Hardware, Software and Service), Type of Technology (Machine Learning, Deep Learning, Natural Language Processing and Robotics), Mode of Deployment (Cloud-based, On Premise and Web-based), Type of AI (Weak AI, Strong AI and Superintelligence), Type of Processing (Image, Text and Voice Processing), Company Size (SMEs and…

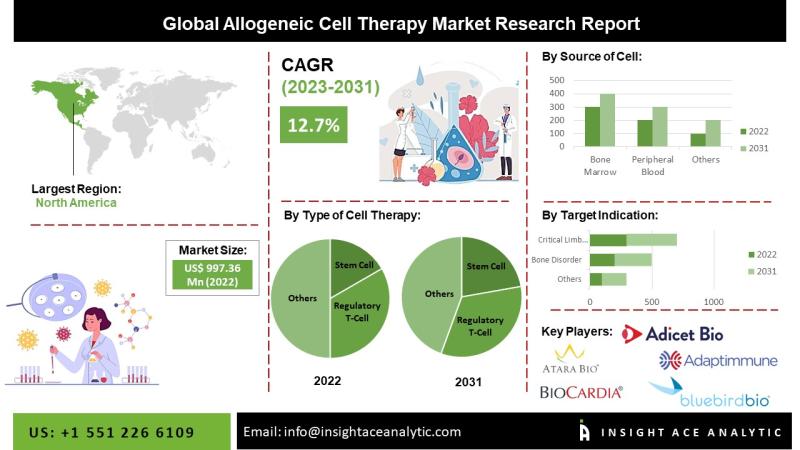

Allogenic Cell Therapies Market Revenue Trends and Growth Potential 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Allogenic Cell Therapies Market- by Cell Type(Cardiosphere-Derived Cells (CDCs), Fibroblasts, T-cells, Mesenchymal Stem Cells (MSCs), Hematopoietic Stem Cells (HSCs) and Others),Tissue Source(Skin, Blood, PBC, BM and Others), Indication (Acute graft-versus-host disease (GVHD), Chronic Ulcers and Diabetic Foot Ulcers, Osteoarthritis, Crohn's Disease, Cardiovascular Disease, Solid Tumors/Cancers and Others (Alzheimer's Disease, etc.)), Trends, Industry Competition Analysis, Revenue…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…