Press release

Global Mortgage Lender Market: Unveiling Market Size, CAGR, Key Market Drivers, and Trend Insights

Rapid Rise and Expected Boom in Mortgage Lender MarketWhat Is The Projected Market Size Of The Global Mortgage Lender Market And Its Growth Rate?

• The booming mortgage lender market projects a growth from $1153.86 billion in 2024 to $1300.55 billion in 2025 achieving a compound annual growth rate (CAGR) of 12.7%.

• Growth elements involved increased interest rates and cost of living, advanced per capita income, population surge, and credit market tightening.

• A leap to $2046.53 billion in 2029 is expected at a CAGR of 12.0% considering indicators like increased inflation, mortgage rates, government regulations and initiatives, and a rise in disposable income.

What Is Driving The Growth In The Mortgage Lender Market?

The upsurge in the demand for housing is seen as the major propelling factor in the market growth. Housing facilitated by mortgage lenders offers flexible payment alternatives, long-term financing, low-interest rates, and strategic counseling in the home purchasing process, making them an optimum choice. For instance, in May 2023, data from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development conveyed a 12.2% hike in new single-family dwellings sales as compared to the April rate, marking a 20% advance over the May 2022 estimate.

Get your Free Sample Copy:

https://www.thebusinessresearchcompany.com/sample.aspx?id=12645&type=smp

Who are the Key Players Driving Mortgage Lender Market Growth?

• Santander Bank N.A.

• Wells Fargo & Company

• Citibank N.A.

• U.S. Bank N.A.

• Bank of America Corporation

• Ally Financial Inc.

• BNP Paribas Fortis

• Navy Federal Credit Union

• Rocket Mortgage LLC

• Guild Mortgage Company

• United Wholesale Mortgage LLC

• PennyMac Financial Services Inc.

• Finance of America Mortgage LLC

• Flagstar Bank NA

• Freedom Mortgage Corporation

• Caliber Home Loans Inc.

• Loan Depot LLC

• Texas Capital Bank N.A.

• Amerifirst Financial Corporation

• Primary Residential Mortgage Inc.

• AmeriHome Mortgage Company

• Stearns Lending LLC

• RoundPoint Mortgage Servicing Corporation

• Fairway Independent Mortgage Corporation

• Guaranteed Rate Inc.

• Carrington Mortgage Services

• Homebridge Financial Services Inc.

• CrossCountry Mortgage LLC

What Are The Key Trends In The Mortgage Lender Market?

• Innovative solutions

• Technological advancements

• Strategic collaborations

• Adoption of mortgage processing and workflow software

• Green loans and sustainability

What Are The Segments Of The Global Mortgage Lender Market?

• By Type: Residential, Commercial Estate

• By Provider: Banks, Credit Unions, Mortgage Brokers

• By Mortgage Rate: Fixed-Rate, Adjustable-Rate

• By Repayment Period: Short-Term, Long-Term

• By Application: New House, Second-Hand House

Which Region Leads The Mortgage Lender Market?

Despite the global coverage of the mortgage lender market, North America claims the largest regional scope in 2024. Future reports look forward to a detailed regional breakdown including Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Pre-book the Report for Swift Delivery:

https://www.thebusinessresearchcompany.com/report/mortgage-lender-global-market-report

What Is Covered In The Mortgage Lender Market Global Market Report?

- Market Size Analysis: Analyze the Mortgage Lender Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Mortgage Lender Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall Mortgage Lender Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Mortgage Lender Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Customize This Report To Meet Your Business Requirements:

https://www.thebusinessresearchcompany.com/customize?id=12645&type=smp

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Mortgage Lender Market: Unveiling Market Size, CAGR, Key Market Drivers, and Trend Insights here

News-ID: 3833515 • Views: …

More Releases from The Business Research Company

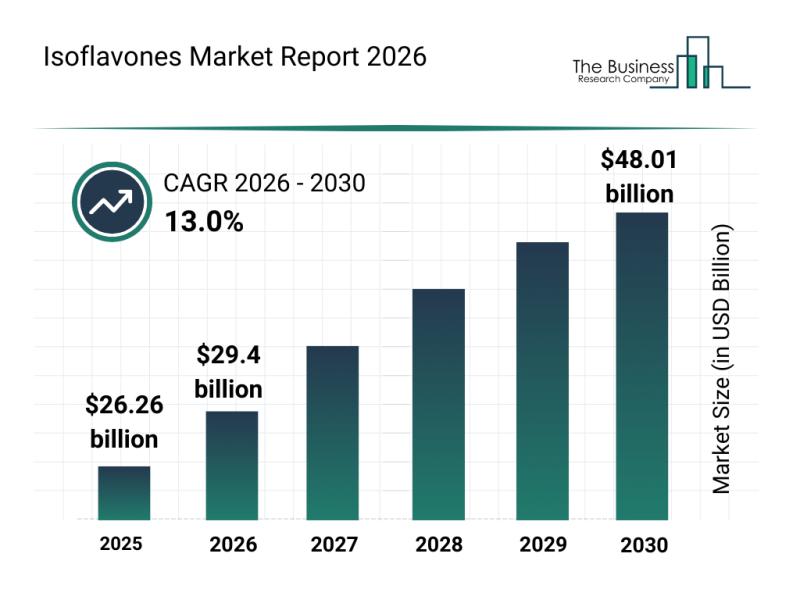

Segment Analysis and Major Growth Areas in the Isoflavones Market

The isoflavones market is poised for remarkable growth over the coming years, driven by increasing consumer awareness and expanding applications across various industries. With rising interest in health supplements and natural ingredients, this market is attracting significant attention from manufacturers and investors alike. Let's delve into the market's size, key players, emerging trends, and segment breakdowns shaping its trajectory.

Projected Market Size and Growth Outlook for Isoflavones

The isoflavones market…

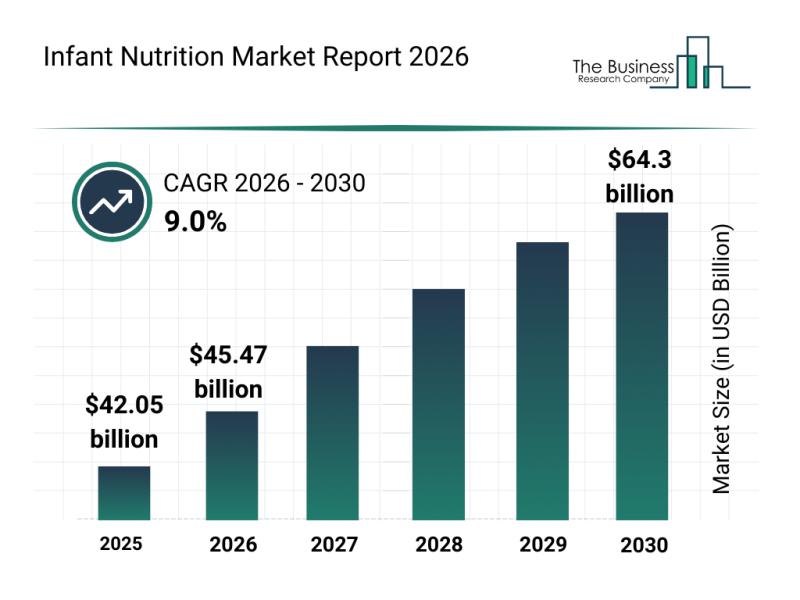

Key Strategic Developments and Emerging Changes Shaping the Infant Nutrition Mar …

The infant nutrition market is on track for substantial expansion in the coming years, driven by evolving consumer preferences and advancements in product offerings. As parents increasingly seek high-quality nutrition solutions tailored to their babies' needs, the sector is poised for remarkable growth through innovative products and diverse distribution channels. Let's explore the market's size projections, key players, emerging trends, and segment breakdowns shaping this dynamic industry.

Projected Growth Trajectory and…

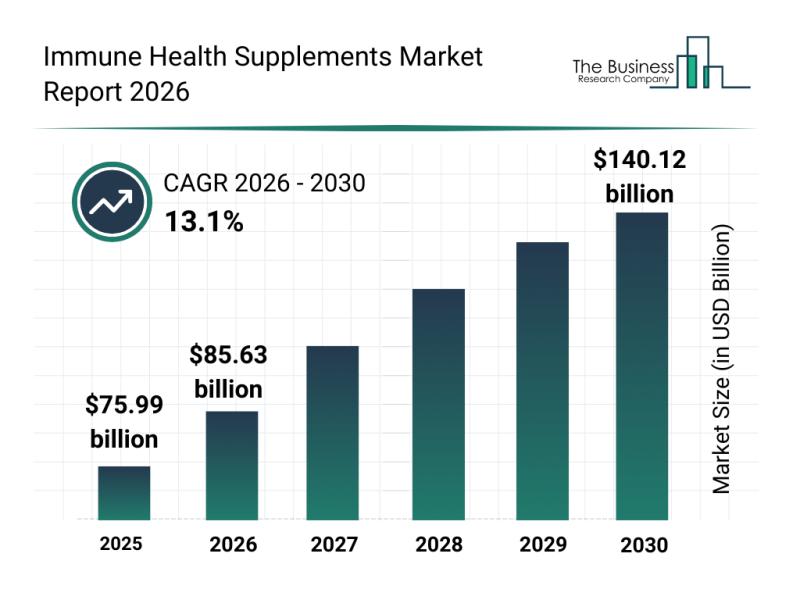

Leading Companies Advancing Innovation and Growth in the Immune Health Supplemen …

The immune health supplements sector is gaining significant traction as consumers increasingly prioritize wellness and preventive care. With a growing interest in personalized nutrition and plant-based options, this market is set to expand rapidly. Let's explore the expected market size, key players, emerging trends, and segmentation that define the future of immune health supplements.

Projected Expansion of the Immune Health Supplements Market by 2030

The immune health supplements market is…

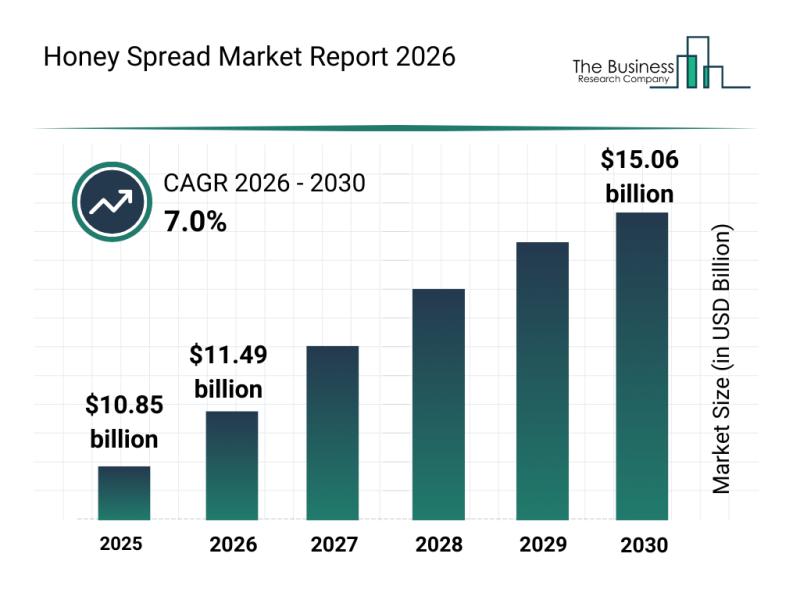

Honey Spread Market Overview: Major Segments, Strategic Developments, and Leadin …

The honey spread market is gaining significant momentum as consumers increasingly seek healthier and more flavorful alternatives to traditional spreads. Growing awareness around natural ingredients and sustainability, combined with e-commerce expansion and innovative product offerings, is set to shape the future of this sector. Below, we explore the market's size, key players, emerging trends, and segmentation to provide a comprehensive outlook through 2030.

Robust Expansion Expected in the Honey Spread Market…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…