Press release

Reinsurance Market Set to Hit USD 876.72 Billion by 2030

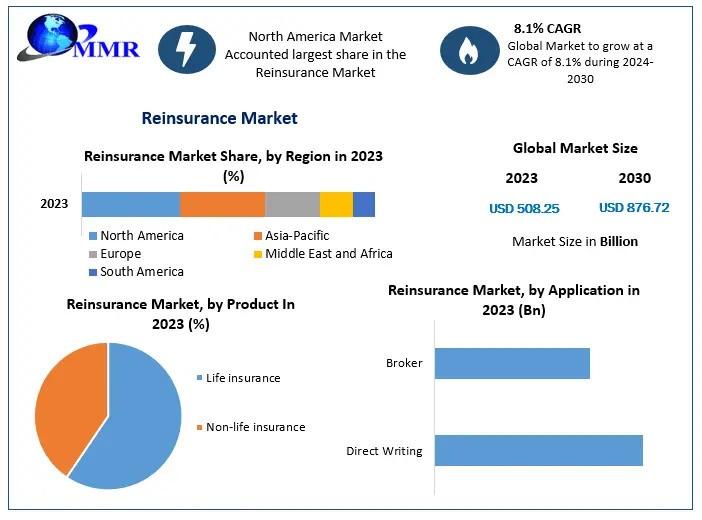

𝐑𝐞𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 size was valued at US$ 508.25 Bn. in 2023 and the total revenue is expected to grow at 8.1 % through 2024 to 2030, Reinsurance Market is reaching nearly US$ 876.72 Bn. by 2030𝐑𝐞𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

The reinsurance market plays a pivotal role in the global insurance industry by providing risk management solutions to primary insurers. Valued at approximately USD 508.25 billion in 2023, the market is expected to grow steadily over the forecast period, driven by increasing demand for risk mitigation in the face of natural disasters, economic uncertainties, and complex insurance policies. Reinsurance helps insurers manage large claims by sharing risks, ensuring financial stability, and maintaining capacity to underwrite new policies. The market is witnessing significant developments, including the adoption of advanced analytics, AI-driven risk assessment, and digital platforms to streamline operations. With a growing emphasis on climate-related risks and regulatory changes, the reinsurance sector is poised for sustained growth globally.

𝐆𝐞𝐭 𝐅𝐫𝐞𝐞 𝐀𝐜𝐜𝐞𝐬𝐬 𝐭𝐨 𝐎𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.maximizemarketresearch.com/request-sample/42133/

𝐑𝐞𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬:

Several emerging trends are shaping the reinsurance market. One of the key trends is the increasing integration of technology, such as artificial intelligence and blockchain, which enhances risk assessment, claim processing, and fraud detection. The shift towards parametric insurance products is also gaining traction, offering quicker payouts based on predefined triggers like weather events. Additionally, the reinsurance industry is focusing on sustainability, with companies incorporating environmental, social, and governance (ESG) criteria into their underwriting decisions. The growing frequency and severity of natural disasters have intensified the demand for catastrophe reinsurance, driving innovations in risk modeling and prediction. Furthermore, partnerships between reinsurers and insurtech startups are creating opportunities for innovation and efficiency in the sector.

𝐖𝐡𝐚𝐭 𝐚𝐫𝐞 𝐑𝐞𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐃𝐲𝐧𝐚𝐦𝐢𝐜𝐬?

The dynamics of the reinsurance market are influenced by a mix of drivers, challenges, and opportunities. Key drivers include the increasing frequency of natural disasters, rising economic losses from catastrophic events, and the growing complexity of insurance products. Regulatory changes and global economic uncertainties also play a significant role in shaping the market. However, the industry faces challenges such as pricing pressures, capital constraints, and the unpredictability of climate-related risks. Despite these challenges, the market offers immense opportunities, particularly in emerging economies where insurance penetration is low. Technological advancements and data-driven decision-making are enabling reinsurers to optimize risk management and improve underwriting practices. The increasing focus on cyber risk reinsurance and coverage for emerging risks such as pandemics further highlights the market's evolving landscape.

𝐑𝐞𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬:

The reinsurance market presents significant growth opportunities, particularly in regions with low insurance penetration and growing economies. Emerging markets in Asia-Pacific, Latin America, and Africa offer untapped potential for reinsurers looking to expand their portfolios. The rise of digital platforms and insurtech innovations provides opportunities for cost-efficient operations and improved customer experiences. Additionally, the increasing focus on climate resilience has led to the development of specialized products addressing risks associated with climate change and extreme weather events. The expansion of cyber reinsurance is another promising avenue, driven by the growing threat of cyberattacks and the need for robust risk mitigation strategies. As the global insurance ecosystem continues to evolve, reinsurers have the opportunity to play a critical role in addressing emerging risks and supporting sustainable development.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐑𝐞𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐈𝐧𝐬𝐢𝐠𝐡𝐭?

Regional insights reveal diverse growth patterns in the reinsurance market. North America remains a dominant player, driven by high insurance penetration, advanced risk modeling capabilities, and the presence of leading reinsurers. Europe follows closely, with a focus on regulatory compliance, climate-related risk management, and innovative reinsurance solutions. The Asia-Pacific region is experiencing rapid growth due to increasing insurance adoption, economic expansion, and vulnerability to natural disasters in countries like China, India, and Japan. Latin America and Africa are emerging as key markets, offering opportunities for reinsurers to tap into underinsured populations and growing infrastructure projects. The Middle East, with its developing insurance sector, is also showing promise for reinsurance growth. These regional dynamics highlight the importance of tailored strategies to address unique market needs and capitalize on growth opportunities in different parts of the world.

𝐆𝐞𝐭 𝐀𝐧 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐎𝐟 𝐓𝐡𝐞 𝐑𝐞𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐀𝐭 𝐓𝐡𝐢𝐬 𝐋𝐢𝐧𝐤 (𝐆𝐞𝐭 𝐓𝐡𝐞 𝐇𝐢𝐠𝐡𝐞𝐫 𝐏𝐫𝐞𝐟𝐞𝐫𝐞𝐧𝐜𝐞 𝐅𝐨𝐫 𝐂𝐨𝐫𝐩𝐨𝐫𝐚𝐭𝐞 𝐄𝐦𝐚𝐢𝐥 𝐈𝐃): https://www.maximizemarketresearch.com/request-sample/42133/

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐑𝐞𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧?

by Product

Life insurance

Non-life insurance

by Application

Direct Writing

Broker

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐓𝐨𝐝𝐚𝐲 𝐟𝐨𝐫 𝐂𝐮𝐬𝐭𝐨𝐦 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬: https://www.maximizemarketresearch.com/inquiry-before-buying/42133/

𝐑𝐞𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬:

1. Swiss Re

2. Hannover Re

3. SCOR SE

4. Lloyd's

5. Berkshire Hathaway

6. Great-West Lifeco

7. RGA

8. China RE

9. Korean Re

10. PartnerRe

11. GIC Re

12. Mapfre

13. Alleghany

14. Everest Re

15. XL Catlin

16. Maiden Re

17. Fairfax

18. AXIS

19. Mitsui Sumitomo

20. Sompo

21. Tokio Marine

𝐅𝐨𝐫 𝐝𝐞𝐞𝐩𝐞𝐫 𝐦𝐚𝐫𝐤𝐞𝐭 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐩𝐞𝐫𝐮𝐬𝐞 𝐭𝐡𝐞 𝐬𝐮𝐦𝐦𝐚𝐫𝐲 𝐨𝐟 𝐭𝐡𝐞 𝐫𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐫𝐞𝐩𝐨𝐫𝐭: https://www.maximizemarketresearch.com/market-report/global-reinsurance-market/42133/

𝐊𝐞𝐲 𝐎𝐟𝐟𝐞𝐫𝐢𝐧𝐠𝐬:

• Past Market Size and Competitive Landscape

• Reinsurance Market Size, Share, Size & Forecast by different segment

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

• Reinsurance Market Segmentation - A detailed analysis by Product

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

• Competitive landscape - Market Leaders, Market Followers, Regional player

• Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of business by region

• Lucrative business opportunities with SWOT analysis

• Recommendations

𝐅𝐨𝐫 𝐚𝐝𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐫𝐞𝐩𝐨𝐫𝐭𝐬 𝐨𝐧 𝐫𝐞𝐥𝐚𝐭𝐞𝐝 𝐭𝐨𝐩𝐢𝐜𝐬, 𝐯𝐢𝐬𝐢𝐭 𝐨𝐮𝐫 𝐰𝐞𝐛𝐬𝐢𝐭𝐞:

♦Car Care Products Market https://www.maximizemarketresearch.com/market-report/global-car-care-products-market/25224/

♦Light Field Market https://www.maximizemarketresearch.com/market-report/light-field-market/1701/

♦Flexible Electronics Market https://www.maximizemarketresearch.com/market-report/flexible-electronics-market/2156/

♦global Invisible Orthodontics Market https://www.maximizemarketresearch.com/market-report/global-invisible-orthodontics-market/102627/

♦DRAM Market https://www.maximizemarketresearch.com/market-report/global-dram-market/53352/

♦Thermal Management Market https://www.maximizemarketresearch.com/market-report/thermal-management-market/11222/

♦Solar Backsheet Market https://www.maximizemarketresearch.com/market-report/global-solar-backsheet-market/25895/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Reinsurance Market Set to Hit USD 876.72 Billion by 2030 here

News-ID: 3830913 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Reinsurance

Reinsurance Services Market SWOT Analysis by Key Players Hannover Re, Korean Rei …

The Latest research coverage on Reinsurance Services Market provides a detailed overview and accurate market size. The study is designed considering current and historical trends, market development and business strategies taken up by leaders and new industry players entering the market. Furthermore, study includes an in-depth analysis of global and regional markets along with country level market size breakdown to identify potential gaps and opportunities to better investigate market status,…

Crop Reinsurance Market Is Booming So Rapidly | Munich Reinsurance, Swiss Reinsu …

The Crop Reinsurance Market study with 65+ market data Tables, Pie charts & Figures is now released by HTF MI. The research assessment of the Market is designed to analyze futuristic trends, growth factors, industry opinions, and industry-validated market facts to forecast till 2029. The market Study is segmented by key a region that is accelerating the marketization. This section also provides the scope of different segments and applications that…

Agriculture Reinsurance Market Is Booming Worldwide : Agroinsurance, Swiss Reins …

The Latest Released Agriculture Reinsurance market study has evaluated the future growth potential of Agriculture Reinsurance market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers, challenges,…

Recent Reinsurance Market Investment Activity From Established Companies Are to …

The latest release from WMR titled Reinsurance Market Research Report 2022-2028 (by Product Type, End-User / Application, and Regions / Countries) provides an in-depth assessment of the Reinsurance including key market trends, upcoming technologies, industry drivers, challenges, regulatory policies, key players company profiles, and strategies. Global Reinsurance Market study with 100+ market data Tables, Pie Chat, Graphs & Figures is now released BY WMR. The report presents a complete assessment…

Life Reinsurance Market is Going to Boom | Swiss Re, Munich Reinsurance, Korean …

Advance Market Analytics published a new research publication on “Life Reinsurance Market Insights, to 2026″ with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Life Reinsurance market was mainly driven by the increasing R&D spending across the world.

Some of the key players profiled in…

Reinsurance Market To See Stunning Growth | Munich, Korean Reinsurance, Swiss

Latest Market Research on “Reinsurance Market” is now released to provide hidden gems performance analysis in recent years and years to come. The study explains a detailed overview of market dynamics, segmentation, product portfolio, business plans, and the latest development in the industry. Staying on top of market trends & drivers is always remain crucial for decision-makers and marketers to hold emerging opportunity.

Get the inside scoop with Sample report https://www.htfmarketreport.com/sample-report/3185812-global-reinsurance-market-26

Know…