Press release

India Gold Loan Market Expected to Surge to USD 139.64 Billion by 2030

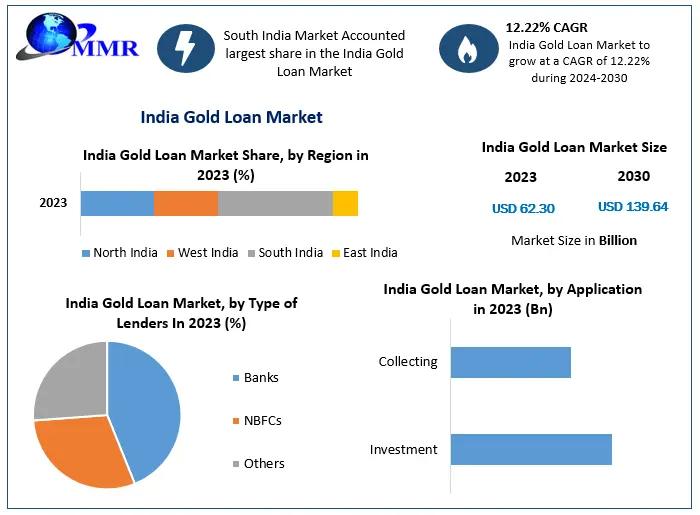

The 𝐈𝐧𝐝𝐢𝐚 𝐆𝐨𝐥𝐝 𝐋𝐨𝐚𝐧 𝐌𝐚𝐫𝐤𝐞𝐭 size was valued at USD 62.30 Billion in 2023 and the total India Gold Loan Market is expected to grow at a CAGR of 12.22% from 2024 to 2030, reaching nearly USD 139.64 Billion.𝐈𝐧𝐝𝐢𝐚 𝐆𝐨𝐥𝐝 𝐋𝐨𝐚𝐧 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

The India Gold Loan Market has emerged as a vital segment of the financial services industry, offering a quick and reliable credit option for individuals and businesses. Gold loans are secured loans where borrowers pledge gold jewellery as collateral in exchange for a loan amount determined by the gold's value. With flexible repayment terms typically spanning 6 months to a year, gold loans have gained popularity for their accessibility and efficiency. Their appeal lies in minimal documentation, quick disbursement, and the ability to cater to urgent financial needs. As a result, gold loans have become a trusted financing choice across urban, semi-urban, and rural India.

𝐆𝐞𝐭 𝐘𝐨𝐮𝐫 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐭𝐡𝐞 𝐋𝐚𝐭𝐞𝐬𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬: https://www.maximizemarketresearch.com/request-sample/213911/

𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐈𝐧𝐝𝐢𝐚 𝐆𝐨𝐥𝐝 𝐋𝐨𝐚𝐧 𝐌𝐚𝐫𝐤𝐞𝐭:

The primary driver of the India Gold Loan Market is the cultural and economic significance of gold in India. With households holding vast reserves of gold jewellery, gold loans have become a preferred financing option, especially for addressing immediate financial requirements. Additionally, the growing awareness of gold loans as a cost-effective alternative to unsecured loans has further boosted demand. Banks, non-banking financial companies (NBFCs), and fintech players are leveraging this trend by offering competitive interest rates and user-friendly digital platforms to expand their customer base.

Another significant factor propelling market growth is the digitization of financial services and the rise of fintech innovations. Digital platforms have made gold loans more accessible by enabling customers to apply online, evaluate gold value virtually, and even opt for doorstep gold appraisal services. The integration of AI and machine learning is helping lenders assess credit risk effectively while enhancing customer experience. Furthermore, regulatory support from the Reserve Bank of India (RBI), including increasing loan-to-value (LTV) ratios during economic uncertainties, has made gold loans an even more attractive financing option.

𝐈𝐧𝐝𝐢𝐚 𝐆𝐨𝐥𝐝 𝐋𝐨𝐚𝐧 𝐌𝐚𝐫𝐤𝐞𝐭 𝐊𝐞𝐲 𝐓𝐫𝐞𝐧𝐝𝐬:

A notable trend in the India Gold Loan Market is the increasing adoption of technology to streamline processes and enhance customer convenience. Fintech companies are collaborating with traditional lenders to introduce hybrid models that combine physical appraisal with digital loan disbursement. Additionally, NBFCs are focusing on expanding their presence in semi-urban and rural areas by leveraging mobile technology and local partnerships. Another key trend is the growing preference for short-term gold loans with flexible repayment options, catering to the liquidity needs of small businesses and individuals. This digital and customer-centric approach is reshaping the market landscape, making gold loans more accessible and efficient.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐭𝐡𝐞 𝐞𝐱𝐩𝐞𝐜𝐭𝐞𝐝 𝐠𝐫𝐨𝐰𝐭𝐡 𝐨𝐟 𝐈𝐧𝐝𝐢𝐚 𝐆𝐨𝐥𝐝 𝐋𝐨𝐚𝐧 𝐌𝐚𝐫𝐤𝐞𝐭 𝐛𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐲𝐩𝐞 𝐬𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧?

The India Gold Loan Market is expected to witness robust growth across various market types, including banks, non-banking financial companies (NBFCs), and informal lenders. NBFCs are anticipated to dominate the market, driven by their wide-reaching networks, faster processing times, and tailored loan products designed to cater to diverse customer needs, particularly in semi-urban and rural areas. Banks are also experiencing growth, leveraging digital platforms to streamline gold loan services and attract urban customers seeking formal lending options. Meanwhile, informal lenders, though gradually declining due to increased awareness and regulatory support for formal channels, still play a significant role in remote areas. The market's growth is fueled by the increasing accessibility of formal lending services and the growing trust in institutional gold loan providers.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐓𝐨𝐝𝐚𝐲 𝐟𝐨𝐫 𝐂𝐮𝐬𝐭𝐨𝐦 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬: https://www.maximizemarketresearch.com/inquiry-before-buying/213911/

𝐂𝐨𝐮𝐧𝐭𝐫𝐲-𝐒𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬

𝐈𝐧𝐝𝐢𝐚 𝐆𝐨𝐥𝐝 𝐋𝐨𝐚𝐧 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 𝐢𝐧 𝐕𝐢𝐞𝐭𝐧𝐚𝐦

Vietnam's strong cultural connection to gold positions the country as a potential market for Indian gold loan companies exploring international expansions. 𝐌𝐮𝐭𝐡𝐨𝐨𝐭 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 and 𝐌𝐚𝐧𝐚𝐩𝐩𝐮𝐫𝐚𝐦 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 are assessing opportunities to collaborate with Vietnamese banks to provide gold-backed loans in regions with high gold holdings and limited credit access.

𝐈𝐧𝐝𝐢𝐚 𝐆𝐨𝐥𝐝 𝐋𝐨𝐚𝐧 𝐆𝐫𝐨𝐰𝐭𝐡 𝐢𝐧 𝐓𝐡𝐚𝐢𝐥𝐚𝐧𝐝

Thailand's financial landscape, with its significant gold reserves, offers promising growth opportunities for Indian gold loan companies. 𝐈𝐈𝐅𝐋 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 has shown interest in entering this market by forming partnerships with local financial institutions to introduce streamlined gold loan services, leveraging their expertise in India to address similar consumer needs in Thailand.

𝐈𝐧𝐝𝐢𝐚 𝐆𝐨𝐥𝐝 𝐋𝐨𝐚𝐧 𝐓𝐫𝐞𝐧𝐝𝐬 𝐢𝐧 𝐉𝐚𝐩𝐚𝐧

Japan's increasing adoption of alternative lending solutions has drawn the attention of Indian gold loan players. 𝐒𝐭𝐚𝐭𝐞 𝐁𝐚𝐧𝐤 𝐨𝐟 𝐈𝐧𝐝𝐢𝐚 (𝐒𝐁𝐈), with its global presence, is exploring partnerships with Japanese fintech firms to introduce digital gold loan platforms, catering to a growing demand for accessible and technology-driven financial services.

𝐈𝐧𝐝𝐢𝐚 𝐆𝐨𝐥𝐝 𝐋𝐨𝐚𝐧 𝐂𝐨𝐧𝐬𝐨𝐥𝐢𝐝𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐒𝐨𝐮𝐭𝐡 𝐊𝐨𝐫𝐞𝐚

South Korea's well-regulated financial system has attracted Indian lenders like 𝐌𝐮𝐭𝐡𝐨𝐨𝐭 𝐅𝐢𝐧𝐚𝐧𝐜𝐞, which are considering joint ventures to tap into the market's urban centers. Collaborative efforts with South Korean financial firms aim to introduce gold loan services, leveraging the growing trend of collateralized lending in the country.

𝐈𝐧𝐝𝐢𝐚 𝐆𝐨𝐥𝐝 𝐋𝐨𝐚𝐧 𝐔𝐩𝐝𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐒𝐢𝐧𝐠𝐚𝐩𝐨𝐫𝐞

Singapore's thriving fintech ecosystem provides an ideal platform for Indian companies like 𝐌𝐚𝐧𝐚𝐩𝐩𝐮𝐫𝐚𝐦 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 to implement innovative digital solutions for gold loans. By integrating blockchain and AI, these companies aim to revolutionize loan disbursal processes, offering quick and secure financial services to Singapore's tech-savvy consumers.

𝐈𝐧𝐝𝐢𝐚 𝐆𝐨𝐥𝐝 𝐋𝐨𝐚𝐧 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐔𝐒

Indian gold loan companies are increasingly eyeing the US market, targeting regions with significant Indian diaspora populations. 𝐇𝐃𝐅𝐂 𝐁𝐚𝐧𝐤 has expanded its reach by collaborating with local community banks to offer gold-backed loans tailored to the specific needs of Indian-American communities, emphasizing trust and familiarity.

𝐈𝐧𝐝𝐢𝐚 𝐆𝐨𝐥𝐝 𝐋𝐨𝐚𝐧 𝐆𝐫𝐨𝐰𝐭𝐡 𝐢𝐧 𝐄𝐮𝐫𝐨𝐩𝐞

Europe's robust financial regulations and growing demand for alternative credit options have drawn the attention of Indian gold loan providers. 𝐀𝐱𝐢𝐬 𝐁𝐚𝐧𝐤 is working to establish partnerships with European financial institutions to introduce gold loan products, focusing on urban centers with a high density of South Asian residents.

𝐂𝐮𝐫𝐢𝐨𝐮𝐬 𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬? 𝐆𝐫𝐚𝐛 𝐘𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐓𝐨𝐝𝐚𝐲: https://www.maximizemarketresearch.com/request-sample/213911/

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐈𝐧𝐝𝐢𝐚 𝐆𝐨𝐥𝐝 𝐋𝐨𝐚𝐧 𝐌𝐚𝐫𝐤𝐞𝐭:

by Market Type

Organized

Unorganized

by Type of Lenders

Banks

NBFCs

Others

by Application

Investment

Collecting

𝐊𝐧𝐨𝐰 𝐌𝐨𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐓𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.maximizemarketresearch.com/market-report/india-gold-loan-market/213911/

𝐖𝐡𝐨 𝐢𝐬 𝐭𝐡𝐞 𝐥𝐚𝐫𝐠𝐞𝐬𝐭 𝐦𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐞𝐫𝐬 𝐨𝐟 𝐈𝐧𝐝𝐢𝐚 𝐆𝐨𝐥𝐝 𝐋𝐨𝐚𝐧 𝐌𝐚𝐫𝐤𝐞𝐭 𝐰𝐨𝐫𝐥𝐝𝐰𝐢𝐝𝐞?

1. Axis Bank of India

2. Central Bank of India

3. Federal Bank Limited

4. HDFC Bank Limited

5. ICICI Limited

6. Kotak Mahindra Bank Limited

7. Manappuram Finance Limited

8. Muthoot Finance Limited

9. State Bank of India

10. Union Bank of India

11. India Infoline Finance Limited

12. Canara Bank

13. Bank of Baroda

14. Punjab National Bank

15. Nitstone Finserv

16. Attica Gold Company

17. Rupeek Gold Loans

18. Reliant Gold Loan

19. Indian Overseas Bank

20. Tamilnad Mercantile Bank

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐌𝐨𝐫𝐞: 𝐕𝐢𝐬𝐢𝐭 𝐎𝐮𝐫 𝐖𝐞𝐛𝐬𝐢𝐭𝐞 𝐟𝐨𝐫 𝐀𝐝𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

♦ Global Film Capacitor Market https://www.maximizemarketresearch.com/market-report/global-film-capacitor-market/58111/

♦ Open-Source Intelligence Market https://www.maximizemarketresearch.com/market-report/global-open-source-intelligence-market/66653/

♦ Global Contract Lifecycle Management Market https://www.maximizemarketresearch.com/market-report/global-contract-lifecycle-management-market/74488/

♦ Retail Loss Prevention Market https://www.maximizemarketresearch.com/market-report/retail-loss-prevention-market/189144/

♦ Life Reinsurance Market https://www.maximizemarketresearch.com/market-report/life-reinsurance-market/189286/

♦ Second hand Product Market https://www.maximizemarketresearch.com/market-report/second-hand-product-market/191282/

♦ Portable Air Conditioner Market https://www.maximizemarketresearch.com/market-report/portable-air-conditioner-market/194526/

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Gold Loan Market Expected to Surge to USD 139.64 Billion by 2030 here

News-ID: 3827438 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

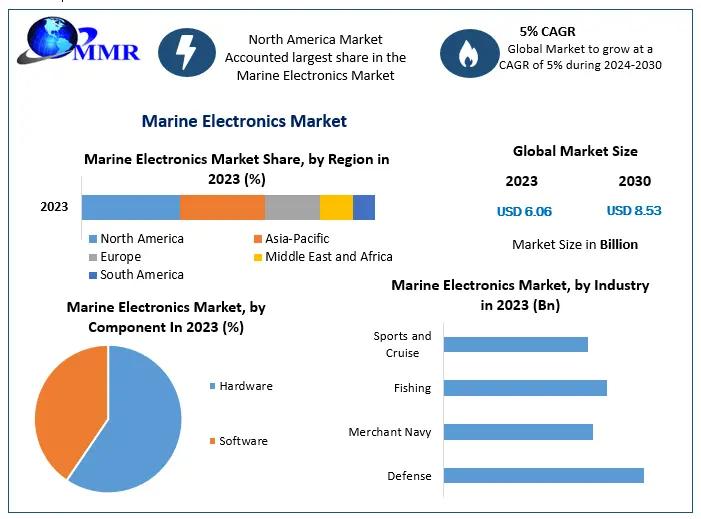

Marine Electronics Market Expected to Reach USD 8.53 Bn by 2030 - Growth Forecas …

Marine Electronics Market Size: According to Maximize Market Research, the Global Marine Electronics Market was valued at US$ 6.06 billion in 2023 and is expected to reach US$ 8.53 billion by 2030, growing at a CAGR of around 5% during 2024-2030.

Market Overview

The Global Marine Electronics Market encompasses electronic devices and systems designed specifically for marine environments. These include navigation systems, communication devices, safety equipment, sonar & radar, vessel management systems,…

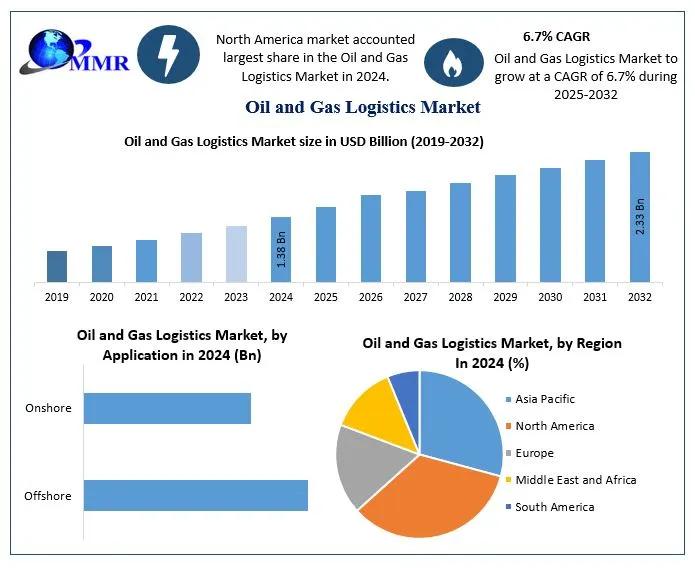

Oil and Gas Logistics Market to Reach USD 2.33 Billion by 2032 | Growth, Trends, …

The Oil and Gas Logistics Market was valued at USD 1.38 Billion in 2024 and is forecasted to grow to USD 2.33 Billion by 2032, exhibiting a CAGR of 6.7% during 2025 to 2032, driven by rising global energy demand, technological innovation, and expanding upstream and downstream supply chain activities.

Market Overview

The oil and gas logistics market encompasses the transportation, storage, handling, and distribution of crude oil, refined products, natural gas,…

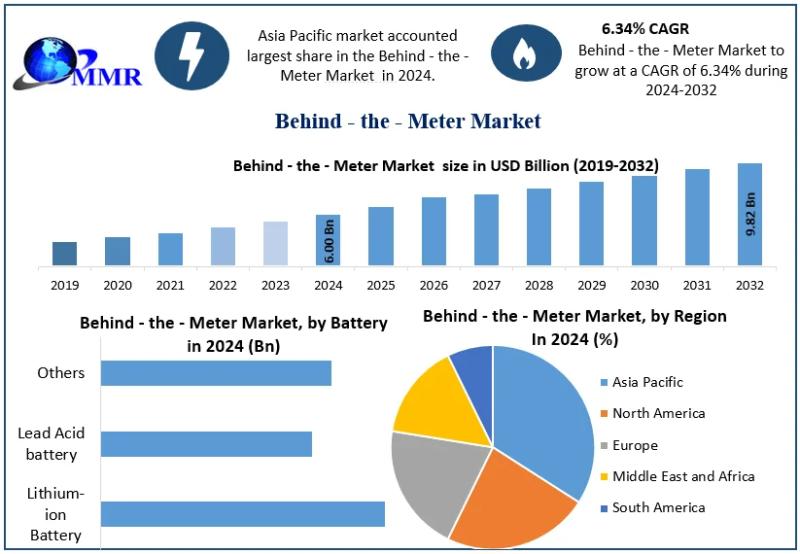

Behind the Meter Market to Surge to USD 9.82 Billion by 2032 - Unmatched Growth …

According to Maximize Market Research, the Global Behind the Meter Market was valued at USD 6.00 Billion in 2024 and is projected to reach USD 9.82 Billion by 2032 at a 6.34 % CAGR, driven by growth in residential, commercial, and industrial energy storage adoption.

Market Overview

The Behind the Meter Market consists of energy storage systems installed on the consumer side of the utility meter. These systems store electricity generated from…

Commercial Paper Market Expected to Witness Steady Growth Driven by Short-Term C …

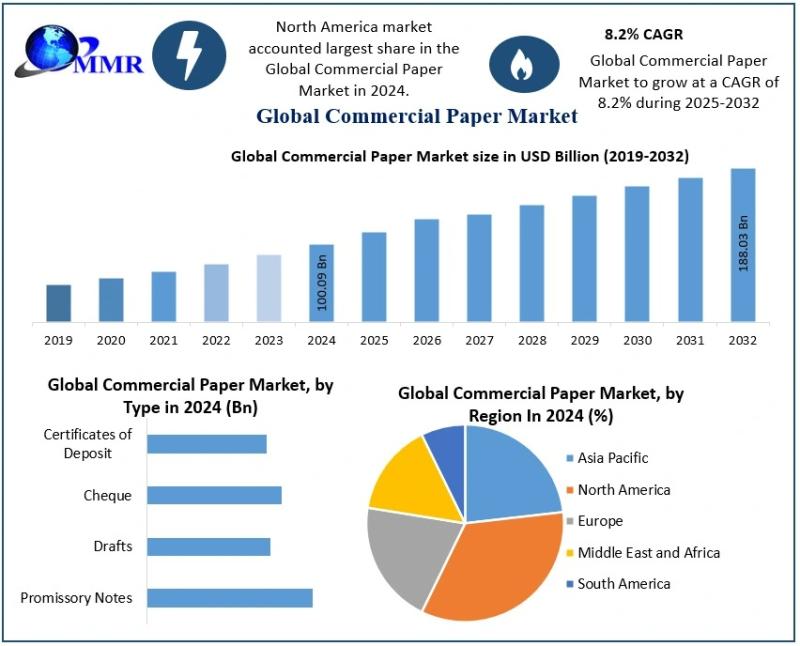

The Commercial Paper Market size was valued at USD 100.09 Billion in 2024 and the total Commercial Paper revenue is expected to grow at a CAGR of 8.2% from 2025 to 2032, reaching nearly USD 188.03 Billion.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/199690/

The Commercial Paper Market is gaining strong momentum as corporations, financial institutions, and large enterprises increasingly rely on short-term unsecured debt instruments…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…