Press release

US Short-Term Care Insurance Market to Surpass US$ 110.1 Billion by 2033 | Persistence Market Research

Introduction:Short-term care insurance (STCI) is emerging as a vital financial tool in the United States, offering coverage for medical and non-medical expenses over a limited period. Designed to bridge gaps in long-term care or traditional health insurance, short-term care insurance provides affordable and flexible coverage options for aging populations and individuals with temporary care needs.

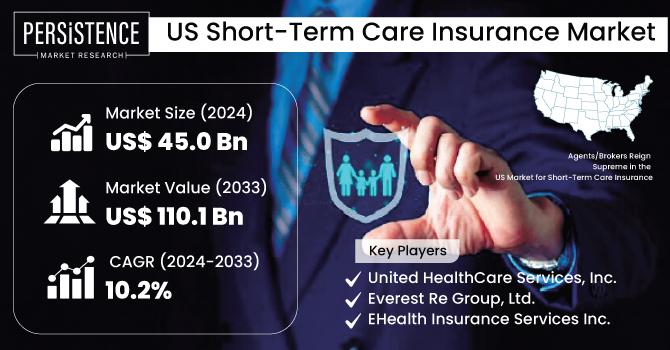

This report delves into the dynamics of the US short-term care insurance market, offering insights into key drivers, challenges, trends, and opportunities. With the market poised to grow at a compound annual growth rate (CAGR) of 10.2% from 2024 to 2033, stakeholders across the healthcare, insurance, and financial planning sectors are taking note of its transformative potential.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): www.persistencemarketresearch.com/samples/33452

Market Projections and Forecast:

According to Persistence Market Research, the US short-term care insurance market, valued at approximately USD 45 billion in 2023, is projected to reach USD 110.1 billion by 2033. This growth is fueled by increasing healthcare costs, an aging population, and rising consumer awareness of affordable care options.

As healthcare costs continue to escalate, STCI is viewed as a cost-effective alternative to long-term care insurance, especially among individuals seeking short-duration coverage without high premiums. The market's robust growth trajectory is underpinned by innovation in insurance products and enhanced customer-centric solutions.

Market Dynamics:

Drivers of Market Growth:

Aging Population and Increased Care Needs

The aging US population is a primary driver of the STCI market. With the number of individuals aged 65 and above growing rapidly, there is an increasing demand for solutions that address short-term care needs related to recovery from illnesses, surgeries, or accidents.

Cost-Effective Alternative to Long-Term Care Insurance

STCI offers lower premiums and greater flexibility than long-term care insurance, making it an attractive option for middle-income families and individuals. This affordability enables broader market access, especially among demographics that cannot afford comprehensive long-term policies.

Rising Healthcare Costs

Escalating healthcare expenses have heightened the need for insurance policies that cover temporary care needs without the financial burden of extended coverage. STCI serves as a viable solution for individuals seeking financial protection against sudden medical costs.

Increased Awareness and Consumer Education

Efforts by insurers and healthcare providers to educate consumers about the benefits of STCI have significantly increased its adoption. Digital platforms and targeted campaigns are playing a crucial role in disseminating information and simplifying the purchasing process.

Challenges in the Market:

Regulatory Complexity

Navigating the complex regulatory landscape across various states poses challenges for insurers. Variations in state-level guidelines on policy offerings, benefits, and premium structures can hinder uniform market growth.

Limited Awareness in Key Demographics

While awareness is increasing, a significant portion of the target audience remains unaware of the availability and benefits of STCI. Bridging this gap requires continued education and marketing efforts.

Competition from Other Insurance Products

Products like critical illness insurance and hospital indemnity plans sometimes overlap with STCI, leading to market competition and consumer confusion.

Market Trends and Innovations:

Digital Transformation in Insurance Offerings

The adoption of digital tools and platforms has revolutionized how STCI products are marketed and sold. Online portals, mobile apps, and AI-driven recommendation engines simplify the purchase process, enhance transparency, and improve customer experience.

Customized Coverage Plans

Insurers are increasingly offering tailored policies to cater to diverse consumer needs. Options such as short-term disability coverage, recovery care plans, and hybrid insurance solutions allow customers to choose coverage based on their specific requirements.

Integration with Health Savings Accounts (HSAs)

Linking STCI policies with HSAs and other tax-advantaged savings plans has emerged as a strategic trend. This integration allows policyholders to use pre-tax funds to pay premiums, making short-term care insurance even more affordable.

Telehealth and Remote Monitoring Services

Many STCI policies now include value-added services such as telehealth consultations and remote health monitoring. These features not only enhance policyholder convenience but also align with the broader healthcare industry's shift toward digitalization.

Market Segmentation

By Distribution Channel:

Direct Sales

Brokers/Agents

Banks

Others

By Age Group:

Senior Citizens

Adults

Minors

By Type of Plan:

Preferred Provider Organizations (PPOs)

Point of Service (POS)

Health Maintenance Organizations (HMOs)

Exclusive Provider Organizations (EPOs)

By End User:

Groups

Individuals

Regional Analysis:

The US short-term care insurance market is characterized by regional variations driven by demographics, healthcare costs, and state-level regulations.

North-East US

Home to an aging population and well-established healthcare systems, the North-East leads in STCI adoption. States like New York and Massachusetts have a high concentration of policyholders due to increased awareness and regulatory support.

Mid-West US

The Mid-West has seen steady growth, driven by affordability-focused consumers and a growing awareness of STCI as a viable financial planning tool.

South-East US

This region is expected to witness significant growth, driven by rising healthcare costs and increasing consumer education efforts. Florida, with its large retiree population, is a key market within this region.

West US

States such as California and Arizona are experiencing increased demand due to demographic shifts and a strong focus on digital insurance solutions.

Key Players in the Market:

Genworth Financial

Mutual of Omaha

Transamerica Corporation

Aetna

Bankers Life

Colonial Penn

GoldenCare

Medico Insurance Company

Future Outlook:

The US short-term care insurance market is positioned for robust growth in the coming decade. Its affordability, flexibility, and ability to fill critical gaps in healthcare coverage make it an indispensable product in the evolving insurance landscape.

Innovation in digital platforms, coupled with targeted education campaigns, will play a pivotal role in expanding consumer reach. Regulatory clarity and the introduction of standardized policies across states can further propel market growth.

As healthcare costs continue to rise and demographics shift, STCI is expected to solidify its position as a critical component of financial planning for temporary care needs. By 2033, with an estimated market value exceeding USD 110 billion, short-term care insurance will become a cornerstone of the US insurance industry.

Conclusion:

The US short-term care insurance market offers significant growth opportunities for insurers, driven by rising healthcare costs, an aging population, and increased consumer awareness. While challenges like regulatory complexity and competition from overlapping products exist, innovations in technology and product customization will enable the market to overcome these barriers.

With its projected CAGR of 10.2% over the forecast period, STCI is poised to transform the insurance sector, offering accessible and affordable care solutions for millions of Americans. As the market evolves, stakeholders across the industry will play a crucial role in shaping its future trajectory.

Explore the Latest Trending "Exclusive Article" @

• https://prnewssync.medium.com/bauxite-market-size-and-growth-projections-for-2025-a9992f3534a0

• https://apsnewsmedia.wordpress.com/2025/01/20/bauxite-market-trends-shaping-the-industry-in-2025/

• https://apsnewsmedia.blogspot.com/2025/01/bauxite-market-analysis-key-drivers-and.html

• https://www.manchesterprofessionals.co.uk/article/marketing-pr/80425/bauxite-market-demand-in-the-global-aluminum-industry

• https://vocal.media/stories/cloud-telephony-service-market-innovations-in-ai-integration

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release US Short-Term Care Insurance Market to Surpass US$ 110.1 Billion by 2033 | Persistence Market Research here

News-ID: 3827430 • Views: …

More Releases from Persistence Market Research

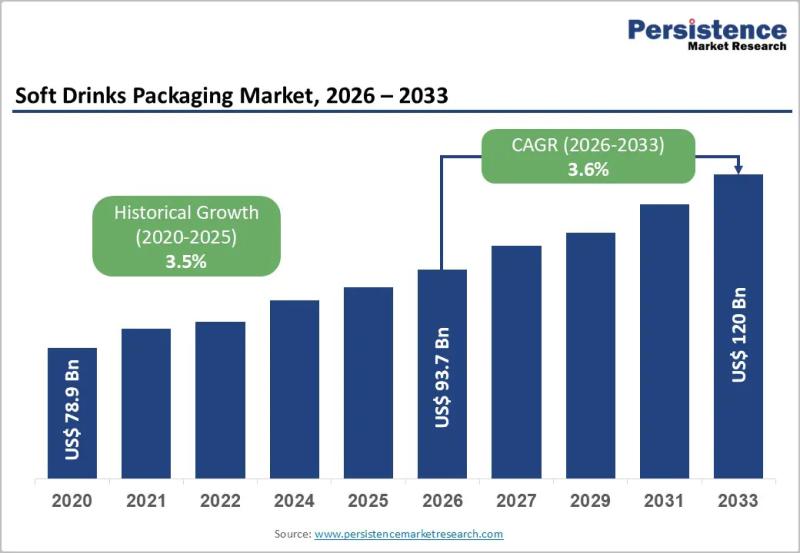

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

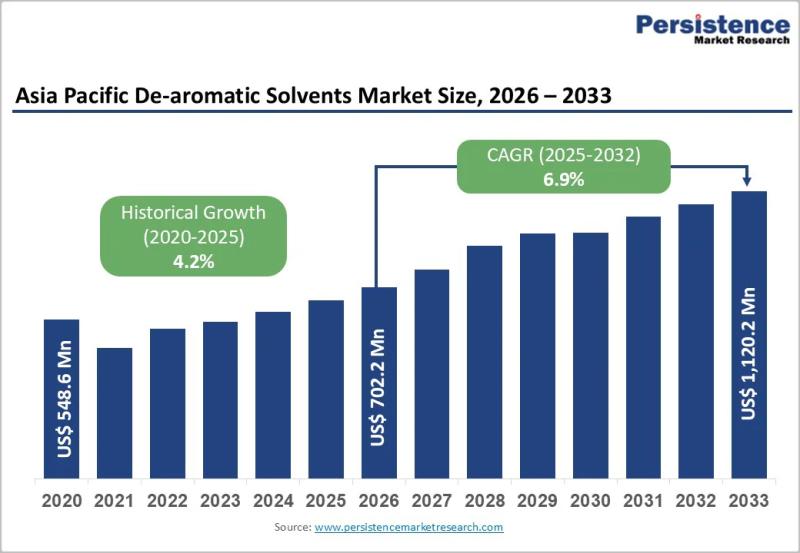

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for STCI

US Short-Term Care Insurance Market on a Strong Upward Trend to US$110.1 Bn by 2 …

The US short-term care insurance market, valued at approximately US$45 billion in 2024, is rapidly evolving, driven by the rising demand for affordable and flexible healthcare coverage. This niche market is forecasted to expand at a CAGR of 10.2%, reaching US$110.1 billion by 2033. Designed to provide coverage for up to 12 months, short-term care insurance helps individuals manage healthcare costs related to illness, injury, or disability without long-term commitments.

Key…

U.S. Short-Term Care Insurance Market to Reach $110.1 Billion by 2033 | Persiste …

The US short-term care insurance market has witnessed significant growth in recent years, with the market size projected to increase from approximately USD 45 billion in 2024 to an estimated USD 110.1 billion by 2033, at a robust compound annual growth rate (CAGR) of 10.2%. Short-term care insurance is designed to provide temporary coverage for individuals who are unable to perform daily living activities due to illness, injury, or disability.…

US Short-Term Care Insurance Market to Surpass US$ 110 Billion by 2033

Introduction

The US short-term care insurance (STCI) market has seen rapid growth as an affordable alternative to traditional long-term care (LTC) insurance. Short-term care insurance provides coverage for a limited time, typically up to a year, and serves as a flexible solution for those requiring temporary care due to injury, surgery recovery, or other short-term health issues. In light of rising healthcare costs, increased awareness, and a growing aging population, the…