Press release

Surety Market indicates a projected size of USD 30030.21 Million by the year 2030

The 𝐒𝐮𝐫𝐞𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 size was valued at USD 21251.17 Million in 2023 and the total Surety Market revenue is expected to grow at a CAGR of 5.06 % from 2024 to 2030, reaching nearly USD 30030.21 Million.𝐒𝐮𝐫𝐞𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

The Surety Market plays a pivotal role in ensuring contractual obligations are met, particularly in large-scale infrastructure projects. Surety bonds act as financial guarantees, providing a safety net for project owners and stakeholders in case of contractor default. With growing investments in infrastructure development globally, the demand for surety bonds has surged. Governments and private sectors alike are leveraging surety solutions to mitigate risks, safeguard project timelines, and ensure seamless execution. This market's resilience is further strengthened by regulatory frameworks mandating the use of surety bonds for critical projects, especially in regions like North America and Europe.

𝐖𝐡𝐚𝐭'𝐬 𝐧𝐞𝐱𝐭 𝐟𝐨𝐫 𝐲𝐨𝐮𝐫 𝐛𝐮𝐬𝐢𝐧𝐞𝐬𝐬? 𝐅𝐢𝐧𝐝 𝐨𝐮𝐭 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐲𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐭𝐨𝐝𝐚𝐲 :https://www.maximizemarketresearch.com/request-sample/185094/

𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐒𝐮𝐫𝐞𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭:

The rising demand for infrastructure development is a key driver of the Surety Market. With governments globally prioritizing large-scale projects like highways, bridges, and smart cities, the need for financial guarantees has grown significantly. For instance, initiatives like the $1.2 trillion infrastructure bill in the United States have fueled the demand for surety bonds to secure project completion and compliance. In emerging economies such as India, the launch of surety insurance bonds has unlocked new opportunities for contractors by enhancing their bidding capacity and reducing reliance on traditional bank guarantees.

Regulatory changes and government-backed programs further propel market growth. Policies like the U.S. Small Business Administration's increased contract limits under the Surety Bond Guarantee Program have enabled small businesses to secure larger projects, fostering economic development. Similarly, the European Union's emphasis on compliance and financial security has driven the adoption of surety bonds across various sectors. These developments highlight the importance of surety solutions in facilitating growth, mitigating risks, and ensuring adherence to contractual obligations in diverse industries.

𝐒𝐮𝐫𝐞𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐊𝐞𝐲 𝐓𝐫𝐞𝐧𝐝𝐬:

Technological innovation is revolutionizing the Surety Market, with blockchain and AI leading the charge. Blockchain technology offers unparalleled transparency and security in bond issuance, reducing the risks of fraud and error. AI-powered tools are enhancing underwriting processes by improving risk assessment and fraud detection capabilities. Collaborations like the one between Bond-Pro and Xenex Enterprises demonstrate how digital solutions are addressing long-standing challenges in the surety industry, streamlining processes, and making bonds more accessible to a broader audience.

𝐰𝐡𝐚𝐭 𝐢𝐬 𝐭𝐡𝐞 𝐞𝐱𝐩𝐞𝐜𝐭𝐞𝐝 𝐠𝐫𝐨𝐰𝐭𝐡 𝐨𝐟 𝐒𝐮𝐫𝐞𝐭𝐲 𝐛𝐲 𝐁𝐨𝐧𝐝 𝐓𝐲𝐩𝐞 𝐬𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧?

The Contract Surety Bonds segment is expected to dominate the Surety Market, owing to its critical role in infrastructure and construction projects. These bonds, including bid bonds, performance bonds, and payment bonds, ensure contractors fulfill their obligations, protecting project owners from financial losses. As global investments in public infrastructure surge, the demand for contract surety bonds continues to rise. For example, performance bonds are essential in large-scale projects, providing assurance that work will be completed on time and within budget. This segment's growth is driven by its indispensable nature in risk mitigation for both public and private ventures.

𝐓𝐡𝐞 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐒𝐭𝐚𝐤𝐞𝐡𝐨𝐥𝐝𝐞𝐫𝐬 𝐜𝐚𝐧 𝐄𝐧𝐪𝐮𝐢𝐫𝐞 𝐟𝐨𝐫 𝐭𝐡𝐞 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 :https://www.maximizemarketresearch.com/inquiry-before-buying/185094/

𝐒𝐮𝐫𝐞𝐭𝐲 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 𝐢𝐧 𝐕𝐢𝐞𝐭𝐧𝐚𝐦

Vietnam's construction and infrastructure sectors have shown tremendous growth, boosting the demand for surety bonds. With significant investments from companies such as 𝐇𝐚𝐧𝐰𝐡𝐚 𝐂𝐨𝐫𝐩𝐨𝐫𝐚𝐭𝐢𝐨𝐧 and 𝐒𝐚𝐦𝐬𝐮𝐧𝐠 𝐂&𝐓,, the market is poised for expansion. Recent government projects in transportation and urban development have further created lucrative opportunities for the surety market.

𝐒𝐮𝐫𝐞𝐭𝐲 𝐆𝐫𝐨𝐰𝐭𝐡 𝐢𝐧 𝐓𝐡𝐚𝐢𝐥𝐚𝐧𝐝

Thailand's surety market has witnessed steady growth due to the government's focus on mega-projects in infrastructure and renewable energy. 𝐁𝐚𝐧𝐠𝐤𝐨𝐤 𝐁𝐚𝐧𝐤 and 𝐊𝐫𝐮𝐧𝐠𝐭𝐡𝐚𝐢 𝐁𝐚𝐧𝐤 have introduced innovative surety solutions, catering to the needs of local businesses. Moreover, recent mergers between 𝐥𝐨𝐜𝐚𝐥 𝐢𝐧𝐬𝐮𝐫𝐞𝐫𝐬 and international players have strengthened market dynamics.

𝐒𝐮𝐫𝐞𝐭𝐲 𝐓𝐫𝐞𝐧𝐝𝐬 𝐢𝐧 𝐉𝐚𝐩𝐚𝐧

Japan's highly developed infrastructure sector continues to drive the demand for surety bonds. The integration of digital platforms by firms like 𝐒𝐨𝐦𝐩𝐨 𝐉𝐚𝐩𝐚𝐧 and 𝐓𝐨𝐤𝐢𝐨 𝐌𝐚𝐫𝐢𝐧𝐞 𝐇𝐨𝐥𝐝𝐢𝐧𝐠𝐬 has emerged as a key trend, ensuring faster and more efficient issuance of bonds. The market is also seeing increased adoption of eco-friendly and green bonds.

𝐒𝐮𝐫𝐞𝐭𝐲 𝐂𝐨𝐧𝐬𝐨𝐥𝐢𝐝𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐒𝐨𝐮𝐭𝐡 𝐊𝐨𝐫𝐞𝐚

South Korea's surety market has experienced consolidation, with key players such as 𝐇𝐲𝐮𝐧𝐝𝐚𝐢 𝐌𝐚𝐫𝐢𝐧𝐞 & 𝐅𝐢𝐫𝐞 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 acquiring smaller firms to expand their market presence. Government initiatives to support SMEs through financial guarantees have further bolstered market growth. Strategic partnerships between banks and insurers are also driving innovation in the sector.

𝐒𝐮𝐫𝐞𝐭𝐲 𝐔𝐩𝐝𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐒𝐢𝐧𝐠𝐚𝐩𝐨𝐫𝐞

Singapore's position as a financial hub has made it a hotspot for surety market advancements. Leading companies like 𝐃𝐁𝐒 𝐁𝐚𝐧𝐤 and 𝐔𝐧𝐢𝐭𝐞𝐝 𝐎𝐯𝐞𝐫𝐬𝐞𝐚𝐬 𝐁𝐚𝐧𝐤 are leveraging fintech to streamline the surety process. Recent updates in regulatory frameworks have encouraged foreign players to enter the market, enhancing competition and service quality.

𝐒𝐮𝐫𝐞𝐭𝐲 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐔𝐧𝐢𝐭𝐞𝐝 𝐒𝐭𝐚𝐭𝐞𝐬

The United States remains the largest market for surety bonds, driven by a robust construction industry and federal mandates for bonding. Major companies such as 𝐓𝐡𝐞 𝐇𝐚𝐫𝐭𝐟𝐨𝐫𝐝 and 𝐙𝐮𝐫𝐢𝐜𝐡 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐆𝐫𝐨𝐮𝐩 continue to dominate, with recent acquisitions strengthening their market share. Digital transformation in surety underwriting is a significant trend reshaping the landscape.

𝐒𝐮𝐫𝐞𝐭𝐲 𝐆𝐫𝐨𝐰𝐭𝐡 𝐢𝐧 𝐄𝐮𝐫𝐨𝐩𝐞

Europe's surety market is driven by increased infrastructure spending in countries like Germany, France, and the UK. Companies such as 𝐄𝐮𝐥𝐞𝐫 𝐇𝐞𝐫𝐦𝐞𝐬 and 𝐀𝐭𝐫𝐚𝐝𝐢𝐮𝐬 are leading the charge with innovative solutions tailored to the region's regulatory requirements. Recent mergers, including 𝐌𝐮𝐧𝐢𝐜𝐡 𝐑𝐞 acquiring smaller competitors, have further consolidated the market.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐚 𝐅𝐫𝐞𝐞 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: 𝐅𝐮𝐥𝐥 𝐓𝐎𝐂, 𝐓𝐚𝐛𝐥𝐞𝐬, 𝐅𝐢𝐠𝐮𝐫𝐞𝐬 & 𝐂𝐡𝐚𝐫𝐭𝐬 𝐈𝐧𝐜𝐥𝐮𝐝𝐞𝐝@https://www.maximizemarketresearch.com/request-sample/185094/

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐒𝐮𝐫𝐞𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭:

by Bond Type

Contract Surety Bond

Commercial Surety Bond

Fidelity Surety Bond

Court Surety Bond

by End-User

Individuals

Enterprises

𝐅𝐨𝐫 𝐦𝐨𝐫𝐞 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐚𝐛𝐨𝐮𝐭 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭 𝐯𝐢𝐬𝐢𝐭:https://www.maximizemarketresearch.com/market-report/surety-market/185094/

𝐖𝐡𝐨 𝐢𝐬 𝐭𝐡𝐞 𝐥𝐚𝐫𝐠𝐞𝐬𝐭 𝐦𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐞𝐫𝐬 𝐨𝐟 𝐒𝐮𝐫𝐞𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐰𝐨𝐫𝐥𝐝𝐰𝐢𝐝𝐞?

1. AoN (United Kingdom)

2. Arch Insurance Group (Bermuda)

3. Berkshire Hathaway Specialty Insurance (U.S)

4. Chubb Limited (Switzerland)

5. CNA Financial Corporation(U.S)

6. Everest Re Group, Ltd.(Bermuda)

7. IAT Insurance Group (U.S)

8. Intact US insurance (NY)

9. Liberty Mutual Insurance Group (U.S)

10. Markel Corporation (U.S)

11. Marsh McLennan (NY)

12. Nationwide Mutual Insurance Company (Ohio)

13. Old Republic Surety Company (U.S)

14. QBE Insurance Group Limited (NY)

15. The Hanover Insurance Group (U.S)

16. The Hartford Financial Services Group, Inc (U.S)

17. The Travelers Companies, Inc. (U.S)

18. Tokio Marine HCC (U.S)

19. XL Catlin (Bermuda)

20. Zurich Insurance Group (Switzerland)

𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐛𝐲 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 :

♦ Mobility on Demand Market https://www.maximizemarketresearch.com/market-report/global-mobility-on-demand-market/62872/

♦ Food Emulsifiers Market https://www.maximizemarketresearch.com/market-report/global-food-emulsifiers-market/30778/

♦ Alternative Protein Market https://www.maximizemarketresearch.com/market-report/global-alternative-protein-market/52719/

♦ Stevia Market https://www.maximizemarketresearch.com/market-report/global-stevia-market/27578/

♦ Packaged Food Market https://www.maximizemarketresearch.com/market-report/packaged-food-market/122151/

♦ Cranes Market https://www.maximizemarketresearch.com/market-report/global-cranes-market/7784/

♦ Global Rubber Processing Chemicals Market https://www.maximizemarketresearch.com/market-report/global-rubber-processing-chemicals-market/55884/

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Surety Market indicates a projected size of USD 30030.21 Million by the year 2030 here

News-ID: 3825238 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

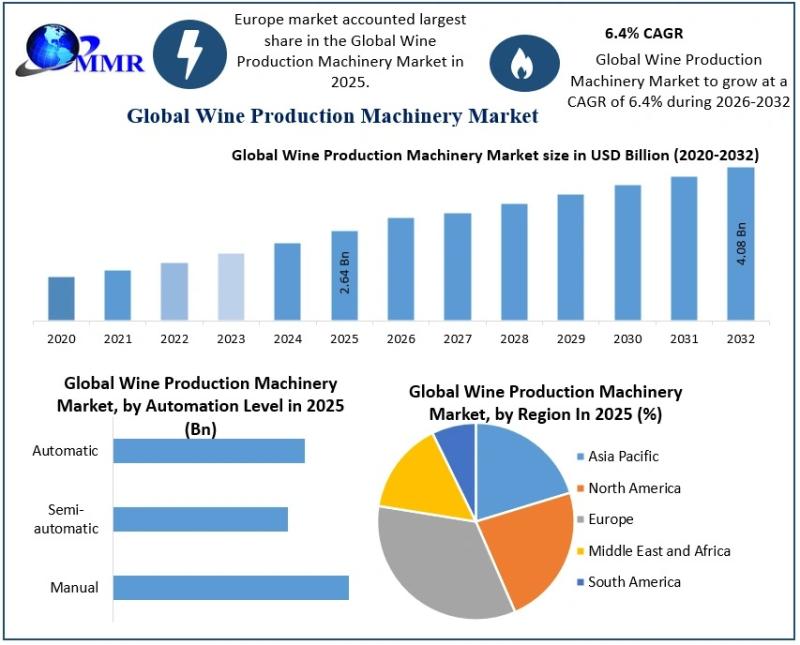

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

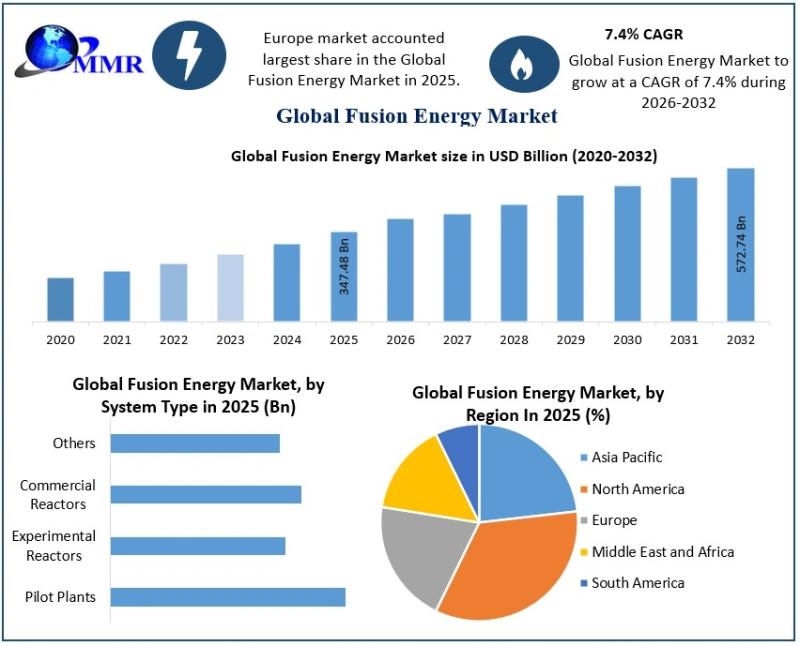

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Surety

Surety Bonds Without Private Equity Pressure

As private equity continues to reshape the insurance and surety landscape, White Lion Bonding & Insurance Services is reaffirming its commitment to surety bonds and performance bonds, including site improvement bonds, grading bonds, and utilities bonding, delivered through a founder-led, relationship-driven approach. This focus on surety bonds for site improvements, grading, and utilities has guided the firm from its earliest days to its growth as a nationally respected surety brokerage.

Founded…

Surety Market Size to Reach USD 33146.14 Million by 2032 | Global Surety Bonds I …

The global Surety Market was valued at USD 23462.34 Million in 2025 and is projected to grow at a CAGR of 5.06% from 2025 to 2032, reaching USD 33,146.14 Million by 2032, according to Maximize Market Research.

Market Overview

The Surety Market plays a critical role in global financial risk management by providing guarantees that contractual obligations will be met. In this arrangement, a surety assures an obligee (project owner or client)…

Growth Of Digital Payment Services Driving Expansion In The Surety Market: A Key …

The Surety Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Current Surety Market Size and Its Estimated Growth Rate?

The surety market has seen strong growth in recent years. It will grow from $19.62 billion in 2024 to $21 billion in 2025 at…

Top Factor Driving Surety Market Growth in 2025: Growth Of Digital Payment Servi …

Which drivers are expected to have the greatest impact on the over the surety market's growth?

The growing use of digital payment services is expected to fuel the growth of the surety market. Digital payments, facilitated by smartphones and enhanced security features, are transforming how people transact. Surety services provide financial guarantees for businesses, ensuring reliability and protection against risks like fraud or service disruptions. According to the Ministry of Electronics…

Surety Bond Market Future Business Opportunities 2022-2030 | HUB International L …

Global "Surety Bond Market" to grow with an impressive CAGR over the forecast period from 2022-2030. The report on Surety Bond offers the customers with a comprehensive analysis of vital driving factors, customer behavior, growth trends, product application, key player analysis, brand position and price patterns. The statistics on estimating patterns is obtained by studying product prices of key players as well as emerging market players. Additionally, Surety Bond market…

Surety Market- Industry Research Report by DeepResearchReport

DeepResearchReports has uploaded a latest report on Surety Industry from its research database. Surety Market is segmented by Regions/Countries. All the key market aspects that influence the Surety Market currently and will have an impact on it have been assessed and propounded in the Surety Market research status and development trends reviewed in the new report.

The new tactics of Surety Industry report offers a comprehensive market breakdown on…