Press release

Green Hydrogen: Igniting the Global Energy Revolution - Policies, Prices, and the Path to a Sustainable Future

"As the world battles the climate crisis, green hydrogen emerges as the ultimate disruptor, reshaping industries and economies with its limitless potential. What is fueling this transformation? What hurdles must we overcome? Dive deep into the policies, costs, and innovations driving this green wave, and discover why the future runs on hydrogen."Introduction:

Green hydrogen, produced via electrolysis powered by renewable energy, is emerging as a transformative solution in the fight against climate change. With the potential to decarbonize sectors that are traditionally hard to reduce, including steel, chemicals, aviation, and shipping, it offers a pathway to achieving net-zero emissions globally.

Green hydrogen production, conversion and end uses across the energy system:

What Led to the Situation:

Dependence on Fossil Fuels

Traditionally, over 95% of hydrogen production comes from fossil fuels (grey hydrogen), contributing to significant carbon emissions. The global commitment to limiting temperature rises to 1.5°C above pre-industrial levels has necessitated a shift towards renewable energy solutions.

Advances in Renewable Energy:

Renewable energy costs, a critical factor for green hydrogen production, have dropped significantly:

Solar photovoltaic (PV) costs decreased by 82% over the past decade.

Onshore wind costs declined by 39% during the same period.

Rising Global Interest:

More than 120 countries have announced net-zero targets, recognizing green hydrogen as a vital technology for achieving deep decarbonization. Over 20 countries have adopted national hydrogen strategies.

Current Scenario

Cost and Capacity Challenges:

Green hydrogen production costs currently range between USD 4-6 per kilogram, which is 2-3 times higher than grey hydrogen. Ongoing investments aim to scale up electrolyser capacity to 25 GW by 2026.

Technological Progress

Electrolyser costs have fallen by 60% since 2010, with projections suggesting an additional 40% reduction by 2030. Efficiency improvements, from 65% in 2020 to an anticipated 76% by 2050, will further enhance the viability of green hydrogen.

Infrastructure Gaps

Despite technological advancements, infrastructure remains a significant bottleneck. With only 5,300 km approx. of hydrogen pipelines globally and limited refueling stations, substantial investments are required to develop a robust hydrogen infrastructure.

Future Prospects

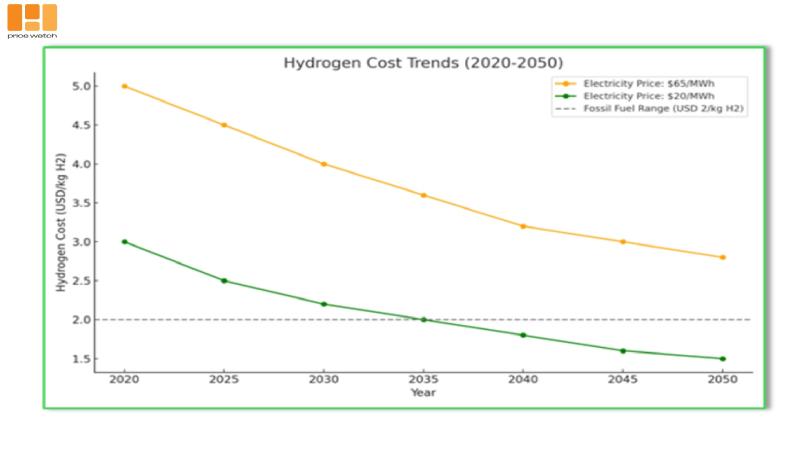

Cost Competitiveness

By 2030, green hydrogen production costs are expected to drop below USD 2/kg, making it competitive with grey and blue hydrogen. This will be a crucial milestone for the widespread adoption of green hydrogen.

Integration Across Sectors

Green hydrogen is set to revolutionize energy systems, offering solutions for seasonal energy storage and grid balancing. Its role in integrating renewable energy and supporting industrial processes will expand significantly by 2050.

Policy and Collaboration

Comprehensive national strategies, coupled with public-private partnerships, are essential for the rapid deployment of green hydrogen. Policies must focus on enabling incentives, setting deployment targets, and standardizing certifications for green hydrogen.

Conclusion

Green hydrogen represents a transformative opportunity for decarbonizing global energy systems and achieving net-zero emissions. The convergence of falling renewable energy costs, electrolyser innovations, and supportive policies positions green hydrogen as a cornerstone for the energy transition. However, achieving widespread adoption requires addressing infrastructure gaps, market barriers, and cost challenges through coordinated efforts between governments, industries, and stakeholders.

By 2050, green hydrogen is expected to be a globally traded energy commodity, fostering economic growth, creating jobs, and providing energy security in a sustainable manner.

Stay ahead in the world of commodities. Subscribe to the Price-Watch newsletter for weekly insights, expert analysis, and actionable data to help you make smarter decisions. Don't miss out on the latest market trends and updates with Price-Watch:- https://www.linkedin.com/newsletters/7282274809965617152/

Stay tuned-this market is primed for dramatic moves, and PriceWatch is committed to delivering timely, actionable insights to help you navigate every twist and turn.

Discover more at https://www.price-watch.ai/

Price-Watch.ai

Sholinganallur, Chennai

Pincode - 600119

Contact:- sales@price-watch.ai

Linkedin: https://www.linkedin.com/company/price-watch-ai/

X.com:- https://x.com/pricewatchai

Facebook:- https://www.facebook.com/people/Price-Watch/61568490385598/

Price-Watch empowers businesses with real-time, data-driven insights into the global commodity market. With cutting-edge technology and unmatched expertise, we deliver the intelligence needed to navigate market volatility, boost profitability, and make bold, strategic decisions. In a fast-paced commodities landscape, we help businesses stay ahead-every step of the way.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Green Hydrogen: Igniting the Global Energy Revolution - Policies, Prices, and the Path to a Sustainable Future here

News-ID: 3821993 • Views: …

More Releases from PriceWatch

PriceWatch: Your Trusted Source for Real-Time Raw Material Market Intelligence

PriceWatch Becomes the Go-To Source for Real-Time Raw Material Market Intelligence

In today's unpredictable global economy-marked by supply chain disruptions, commodity volatility, and rapid market shifts-businesses can no longer rely on outdated reports or lagging data for sourcing and procurement decisions. That's where PriceWatch steps in, setting a new standard in real-time raw material intelligence and empowering organizations with the data-driven clarity they need to stay ahead.

Smarter Procurement Starts with Real-Time…

Styrene Butadiene Rubber: Driving the Future of the Tire Industry

The Styrene Butadiene Rubber (SBR) is a synthetic rubber which is produced by polymerizing Styrene and Butadiene. It is produced in large amounts because of its low cost and its high effectiveness as a material in tire production. It also serves in the construction of automotive vehicles and as a key component in the manufacturing of vehicle tires and other rubber goods. In response to the changing market needs, SBR…

Global Tire Market Insights: What's Driving Growth and Disruption?

Market Overview: A Growing and Competitive Industry

As of 2024, the global tire market is valued at over $240 billion, with a projected growth rate of 4-5% CAGR over the next few years. This expansion spans various tire segments, including Passenger Vehicle Tires, Commercial Vehicle Tires, Off-the-Road Tires, and Two-Wheeler Tires.

Despite the large market size, the tire industry remains fragmented, with major players such as Michelin, Bridgestone, Goodyear, Continental, and Pirelli…

Revolutionizing Composite Materials: From Basics to High-Performance Solutions

The market for composite materials has gone through a remarkable transformation over the last few years. In the past, these materials were made using basic natural fibers and binders, which limited their performance due to a lack of chemical involvement. Today, however, advancements in chemical science have revolutionized the way of manufacturing high-performance composites which are tailored to meet specific industrial requirements. Chemicals now have a crucial role throughout the…

More Releases for Price

Bitcoin Price, XRP Price, and Dogecoin Price Analysis: Turn Volatility into Prof …

London, UK, 4th October 2025, ZEX PR WIRE, The price movements in the cryptocurrency market can be crazy. Bitcoin price (BTC price), XRP price, and Dogecoin price vary from day to day, which can make it complicated for traders. Some investors win, but many more lose, amid unpredictable volatility. But there's a more intelligent way and that is Hashf . Instead of contemplating charts, Hashf provides an opportunity for investors…

HOTEL PRICE KILLER - BEAT YOUR BEST PRICE!

Noble Travels Launches 'Hotel Price Killer' to Beat OTA Hotel Prices

New Delhi, India & Atlanta, USA - August 11, 2025 - Noble Travels, a trusted name in the travel industry for over 30 years, has launched a bold new service called Hotel Price Killer, promising to beat the best hotel prices offered by major online travel agencies (OTAs) and websites.

With offices in India and USA, Noble Travels proudly serves an…

Toluene Price Chart, Index, Price Trend and Forecast

Toluene TDI Grade Price Trend Analysis - EX-Kandla (India)

The pricing trend for Toluene Diisocyanate (TDI) grade at EX-Kandla in India reveals notable fluctuations over the past year, influenced by global supply-demand dynamics and domestic economic conditions. From October to December 2023, the average price of TDI declined from ₹93/KG in October to ₹80/KG in December. This downward trend continued into 2024, with October witnessing a significant drop to ₹73/KG, a…

Glutaraldehyde Price Trend, Price Chart 2025 and Forecast

North America Glutaraldehyde Prices Movement Q1:

Glutaraldehyde Prices in USA:

Glutaraldehyde prices in the USA dropped to 1826 USD/MT in March 2025, driven by oversupply and weak demand across manufacturing and healthcare. The price trend remained negative as inventories rose and procurement slowed sharply in February. The price index captured this decline, while the price chart reflected persistent downward pressure throughout the quarter.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/glutaraldehyde-pricing-report/requestsample

Note: The analysis can…

Butane Price Trend 2025, Update Price Index and Real Time Price Analysis

MEA Butane Prices Movement Q1 2025:

Butane Prices in Saudi Arabia:

In the first quarter of 2025, butane prices in Saudi Arabia reached 655 USD/MT in March. The pricing remained stable due to consistent domestic production and strong export activities. The country's refining capacity and access to natural gas feedstock supported price control, even as global energy markets saw fluctuations driven by seasonal demand and geopolitical developments impacting the Middle East.

Get the…

Tungsten Price Trend, Chart, Price Fluctuations and Forecast

North America Tungsten Prices Movement:

Tungsten Prices in USA:

In the last quarter, tungsten prices in the United States reached 86,200 USD/MT in December. The price increase was influenced by high demand from the aerospace and electronics industries. Factors such as production costs and raw material availability, alongside market fluctuations, also contributed to the pricing trend.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/tungsten-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific…