Press release

Factoring Services Market on Track to Hit USD 5,680 Billion by 2031 | Persistence Market Research

IntroductionFactoring services are a financial transaction method where businesses sell their accounts receivables to third-party factoring companies to improve liquidity, manage cash flow, and meet immediate financial obligations. This industry has gained prominence due to its role in supporting small and medium enterprises (SMEs), enabling them to access funds without incurring traditional debt. The factoring services market is witnessing steady growth, attributed to expanding trade activities, increasing adoption of non-traditional financing methods, and a focus on mitigating credit risks.

This report delves into the current state and future prospects of the global factoring services market, focusing on key drivers, trends, challenges, technological advancements, and regional insights shaping the industry.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): www.persistencemarketresearch.com/samples/34659

Market Projections and Forecast

According to Persistence Market Research, the global factoring services market is projected to reach a valuation of USD 5,680 billion by 2031, growing at a compound annual growth rate (CAGR) of 5.5% during the forecast period from 2024 to 2031. This growth is driven by the increasing preference for factoring as an alternative financing option and the rising demand for liquidity solutions in both developed and emerging markets.

The factoring services market is benefiting from technological advancements in digital platforms that streamline operations, improve client onboarding, and enhance transaction security. Additionally, the growing emphasis on global trade, coupled with government initiatives to support SMEs, is expected to create significant opportunities for the industry.

Market Dynamics

Drivers of Market Growth

Rising Adoption Among SMEs

Small and medium enterprises (SMEs) are increasingly turning to factoring services as a reliable financing tool. Factoring offers quick access to funds without the need for collateral, making it an attractive option for businesses with limited credit histories.

Global Trade Expansion

The rise in cross-border trade and globalization has boosted the demand for international factoring services. Exporters rely on factoring companies to mitigate risks associated with delayed payments and defaulting buyers, ensuring seamless cash flow in foreign transactions.

Focus on Cash Flow Optimization

Factoring services are instrumental in improving cash flow and working capital efficiency, enabling businesses to focus on growth and operational improvements. The need for liquidity during uncertain economic conditions has further emphasized the importance of factoring.

Digitization of Financial Services

The integration of digital platforms and AI-driven solutions in factoring has revolutionized the industry. Automated credit assessments, real-time transaction processing, and enhanced fraud detection mechanisms have improved service efficiency and expanded the client base.

Challenges in the Market

Stringent Regulatory Environment

The factoring services market is subject to diverse regulatory frameworks across regions, often creating complexities for global providers. Compliance with financial regulations and anti-money laundering standards requires continuous monitoring and adaptation.

Risk of Bad Debts

Factoring companies face the risk of bad debts in case of customer defaults. This challenge is particularly pronounced during periods of economic downturns, where buyers may struggle to meet payment obligations.

Market Fragmentation

The industry is characterized by a high degree of fragmentation, with numerous small players operating regionally. This creates intense competition, affecting pricing strategies and profit margins.

Market Trends and Innovations

Rise of Digital Factoring Platforms

Digital transformation in factoring services has introduced platforms that provide a seamless and secure experience for both clients and service providers. Features such as instant approvals, real-time payment tracking, and automated workflows are gaining popularity.

Integration with Blockchain Technology

Blockchain technology is being adopted to enhance transparency, reduce fraud, and streamline international factoring processes. Smart contracts are enabling secure and automated payment settlements, boosting client confidence.

Sustainability-Driven Factoring Services

Companies are introducing green factoring services that cater to businesses promoting sustainability and eco-friendly practices. These solutions align with global ESG (Environmental, Social, Governance) objectives, attracting environmentally conscious clients.

Focus on Customized Solutions

Factoring service providers are tailoring their offerings to meet specific industry needs, such as healthcare, construction, and manufacturing. This sector-specific approach enhances client satisfaction and opens new revenue streams.

Factoring Services Market Segmentation

By Factoring Type

Domestic

International

By Provider Type

Banks

NBFCs

By Enterprise Size

Small & Medium Enterprises

Large Enterprises

By End User

Construction

Manufacturing

Healthcare

Logistics

Regional Analysis

North America

North America is a leading market for factoring services, driven by robust trade activities, technological innovation, and a mature financial services sector. The region's focus on supporting SMEs and startups further propels growth in the factoring industry.

Europe

Europe is witnessing significant growth in factoring services, attributed to its export-driven economy and supportive regulatory frameworks. Countries like Germany, Italy, and the UK are prominent contributors, with well-established domestic and international factoring markets.

Asia-Pacific

Asia-Pacific is emerging as a key region for factoring services, fueled by the rapid growth of SMEs, increasing international trade, and digitization of financial services. China, India, and Southeast Asian nations are expected to be major growth hubs in the coming years.

Latin America and Middle East & Africa

These regions are experiencing steady growth, supported by increasing awareness about factoring solutions and efforts to integrate SMEs into formal financial ecosystems.

Key Companies Profiled in the Report

BNP Paribas

Deutsche Bank AG

Hitachi Capital Corporation

China Construction Bank Corporation

Eurobank Ergasias SA

HSBC Group

Mizuho Financial Group, Inc.

Triumph Business Capital

Riviera Finance

Future Outlook

The factoring services market is poised for consistent growth as businesses increasingly adopt alternative financing models to optimize liquidity and cash flow. The integration of technology, rising trade volumes, and government support for SMEs will continue to drive market expansion.

The adoption of digital platforms and blockchain technology will enhance service efficiency and transparency, ensuring a competitive edge for industry leaders. While regulatory challenges and market fragmentation persist, the overall outlook remains optimistic.

Conclusion

Factoring services are becoming an indispensable tool for businesses seeking financial flexibility and risk mitigation. With a projected CAGR of 5.5% during the forecast period, the market is set to play a pivotal role in the global financial ecosystem. As businesses navigate economic uncertainties and expand their operations, factoring services will remain a cornerstone for maintaining liquidity and supporting sustainable growth.

The industry's future lies in continued innovation, client-centric strategies, and alignment with global trade and financial trends, ensuring that factoring services remain relevant and resilient in an evolving marketplace.

Explore the Latest Trending "Exclusive Article" @

• https://prnewssync.medium.com/mining-simulation-software-market-trends-driving-industry-growth-2ad60ed817ef

• https://prnewssync.wordpress.com/2025/01/16/mining-simulation-software-market-insights-for-2025-and-beyond/

• https://apsnewsmedia.blogspot.com/2025/01/mining-simulation-software-market.html

• https://www.manchesterprofessionals.co.uk/article/marketing-pr/80244/mining-simulation-software-market-growth-opportunities-to-watch

• https://vocal.media/stories/mining-simulation-software-market-innovations-transforming-operations

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Factoring Services Market on Track to Hit USD 5,680 Billion by 2031 | Persistence Market Research here

News-ID: 3819926 • Views: …

More Releases from Persistence Market Research

Current Transducer Market to Reach US$1,090 Million by 2033, Driven by Rising En …

Current Transducer Market Overview and Growth Outlook

The current transducer market is witnessing steady growth as industries increasingly prioritize accurate current measurement, system safety, and energy efficiency. According to the latest study by Persistence Market Research, the global current transducer market size is likely to be valued at US$ 770.7 million in 2026 and is projected to reach US$ 1,090 million by 2033, growing at a CAGR of 5.1% between 2026…

Tungsten Carbide Powder Market Poised to Hit US$27.5 Billion by 2033, Driven by …

Tungsten Carbide Powder Market Overview and Growth Outlook

The tungsten carbide powder market is experiencing consistent growth as industries increasingly rely on high-performance materials for durability, precision, and efficiency. According to the latest study by Persistence Market Research, the global tungsten carbide powder market size is likely to be valued at US$ 18.2 billion in 2026 and is projected to reach US$ 27.5 billion by 2033, expanding at a CAGR of…

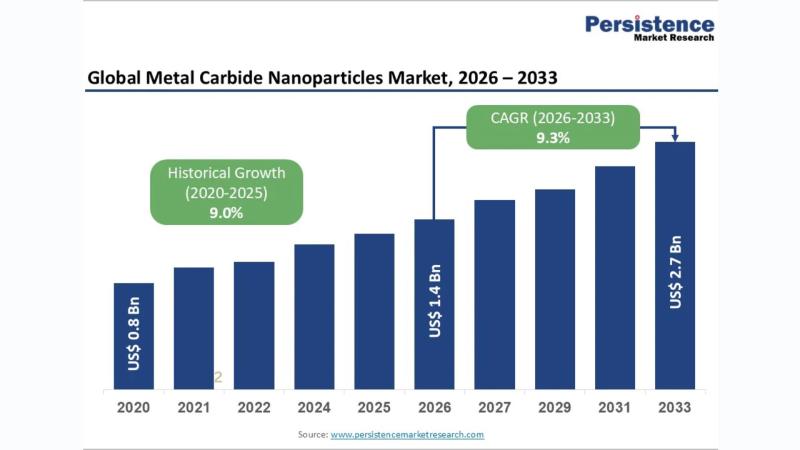

Metal Carbide Nanoparticles Market Set to Reach US$2.7 Billion by 2033, Driven b …

Metal Carbide Nanoparticles Market Overview and Growth Outlook

The metal carbide nanoparticles market is gaining strong momentum as industries increasingly demand materials with superior hardness, thermal stability, and wear resistance. According to the latest study by Persistence Market Research, the global metal carbide nanoparticles market size is likely to be valued at US$ 1.4 billion in 2026 and is expected to reach US$ 2.7 billion by 2033, growing at a CAGR…

Agricultural Lime Market Projected to See Steady Rise to US$3 Billion by 2033, D …

Agricultural Lime Market Overview and Growth Potential

The agricultural lime market plays a crucial role in improving soil fertility and crop productivity across global agricultural systems. According to the latest study by Persistence Market Research, the global Agricultural Lime Market was valued at US$ 1.7 billion in 2020 and reached US$ 2.1 billion in 2026. It is further projected to reach US$ 3 billion by 2033, growing at a CAGR of…

More Releases for Factoring

Growing Reverse Factoring Adoption Boosts Market Growth: Critical Driver Shaping …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Reverse Factoring Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

Over the past few years, the reverse factoring market has seen significant growth. It is expected to increase from $539.41 billion in 2024 up to $592.1 billion in 2025, representing a compound annual growth rate…

Factoring Market Next Big Thing | Major Giants BNP Paribas, HSBC, Deutsche Facto …

HTF MI just released the Global Factoring Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Giants in Factoring Market are:

BNP Paribas, HSBC, Deutsche Factoring Bank, Eurobank,…

What's Driving the Reverse Factoring Market 2025-2034: Growing Reverse Factoring …

What Are the Projections for the Size and Growth Rate of the Reverse Factoring Market?

The market size of reverse factoring has seen significant growth over the last few years. It is projected to expand from $539.41 billion in 2024 to $592.1 billion in 2025, displaying a compound annual growth rate (CAGR) of 9.8%. The growth trajectory in the past can be linked to the increased awareness of supply chain finance…

Reverse Factoring Market

The reverse factoring market has been experiencing significant growth, with its market size accounted for USD 530.8 billion in 2022. It is projected to achieve a remarkable market size of USD 1,452.1 billion by 2032, growing at a compound annual growth rate (CAGR) of 10.8% from 2023 to 2032. This substantial growth is driven by various market trends, emerging opportunities, and a competitive landscape that is continuously evolving.

Download Free Reverse…

Factoring Market Outlook 2024-2030: Trends and Opportunities|BNP Paribas, Deutsc …

Infinity Business Insights is providing qualitative and informative knowledge by adding the title factoring Market to recognize, describe and forecast the global market. The report provides systematic consideration analysis along with forecasts for market players. The report aims to facilitate understanding of the global factoring market forecast through statistical and numerical data in the form of tables, graphs, and charts. The study provides a calculated assessment of new recent developments,…

Factoring Services Market is Booming Worldwide | Deutsche Factoring Bank, Euroba …

The Latest Released Factoring Services market study has evaluated the future growth potential of Global Factoring Services market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers,…