Press release

How Have Small Personal Loans Become an Ideal Financial Solution for Modern-Age Consumers?

Small personal loans are low-amount loans that help individuals manage financial situations without taking funds out of their savings. They are also called instant cash loans that are used for personal financial needs. These financial instruments are simple and quick ways to get cash at the time of accuracy. They serve as a convenient way to deal with financial emergencies, offering flexible repayment structures to the customers, often from 1 to 12 months. This enables borrowers to handle financial emergencies without making long-term commitments.Small personal loans, which typically range from are used for a wide array of things, such as managing cash flow, making special purchases, and paying for unexpected needs. Peer-to-peer platforms, internet giants, and traditional banks are the main lenders that serve a variety of borrowers willing to avail themselves of these types of loans.

Allied Market Research published a report, titled, "Small Personal Loans Market by Type (P2P Marketplace Lending and Balance Sheet Lending), by Age (Less than 30 years, 30-50 years and More than 50 years), and Distribution Channel (Banks, Credit Unitions, Online Lenders and Peer-to-peer Lending): Global Opportunity Analysis and Industry Forecast, 2024-2032". According to the report, the small personal loans market was valued at $31.3 billion in 2023, and is estimated to reach $158.7 billion by 2032, growing at a CAGR of 20.1% from 2024 to 2032.

Get Your Sample Report & TOC Today: https://www.alliedmarketresearch.com/request-sample/A324099

The P2P marketplace lending segment is expected to grow faster throughout the forecast period.

Based on the type, the P2P marketplace lending segment held the highest market share in 2023. The increase in P2P lending can be attributed to several factors, including technological advancements, the appeal of potentially higher returns for investors, and more accessible loan options for borrowers compared to conventional banking routes.

The 30-50 segment is expected to grow faster throughout the forecast period.

Based on age, the 30-50 segment held the highest market share in 2023. Individuals in the 30-50 age range are often more financially stable, with established careers and higher disposable incomes, making them more likely to engage in lending, investment, and borrowing activities.

The banks segment is expected to grow faster throughout the forecast period.

Based on the distribution channel, the banks segment held the highest market share in 2023. Banks offer a comprehensive range of financial products and services, from savings and checking accounts to loans and investment services.

North America to maintain its dominance by 2032.

Based on region, North America held the highest market share in terms of revenue in 2023, and is expected to boost in terms of revenue throughout the forecast timeframe. Well-developed financial infrastructure is accelerating the adoption of the most recent technologies, including small personal loans in North America.

Get More Information Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A324099

Players: -

American Express

Avant, LLC

Barclays PLC

DBS Bank Ltd

Goldman Sachs

LendingClub Bank

Prosper Funding LLC

Social Finance, Inc.

Truist Financial Corporation

Wells Fargo

Why are small personal loans beneficial for individuals?

These types of loans are unsecured loans and do not need to offer collateral as security to get the loan amount. They are highly helpful for individuals who are unable to offer any assurance, however, require funds urgently. Moreover, these types of loans comprise minimal documentation. The lack of collateral ensures that people are able to apply for these loans without submitting detailed documents. They simply process their application and get it completed with minimal paperwork including basic KYC documents and proof of income.

On the other hand, certain small loans are offered through a faster disbursal process. Individuals applying for the loans are able to get the loan amount on the same day the loan application is approved. Thus, customers do not need to wait for the funds to be disbursed for a longer period. In addition, the verification process of these loans is straightforward, which leads to easier and faster loan approval, making them the perfect option to be relied on at the time of financial emergencies.

Purchase This Comprehensive Report (PDF with Insights, Charts, Tables, and Figures) @ https://bit.ly/3YbgsjU

LendingKart and Upwards collaborated to provide personal loans to blue-collar workers

The small personal market has experienced notable expansion in recent years due to the active participation of leading players in the industry. According to Allied Market Research, the sector is expected to grow at a CAGR of 20.1% between 2024 and 2032. In February 2023, Upwards, a well-known provider of personal loans, was acquired by LendingKart, a digital lending platform for micro, small, and medium-sized businesses. Lendingkart hopes to keep the Upwards name and its whole 100-member staff through this transaction. It allows the company to emphasize lending to micro-entrepreneurs and its MSME borrowers to extend personal loan offerings to their blue-collar workforce. The firm exited the financial year 2023 with an overall revenue of $100 million and a notable loan book of $500 million.

Summing up

Small personal loans are unsecured loans that do not require collateral and are intended to satisfy the various needs of borrowers. They are ideal for a wider range of borrowers to cover unforeseen needs and consolidate debts due to their simple approval process and low documentation requirements. Furthermore, rise in demand for flexible financing alternatives among consumers is anticipated to support the industry's expansion in the years to come.

Trending Reports in BFSI Industry (Book Now with 10% Discount + Covid-19 scenario):

Revenue-Based Financing Market https://www.alliedmarketresearch.com/revenue-based-financing-market-A07537

Business Travel Accident Insurance Market https://www.alliedmarketresearch.com/business-travel-accident-insurance-market-A119319

Embedded Finance Market https://www.alliedmarketresearch.com/embedded-finance-market-A110805

Employment Screening Services Market https://www.alliedmarketresearch.com/employment-screening-services-market

Trade Credit Insurance Market https://www.alliedmarketresearch.com/trade-credit-insurance-market-A08305

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://www.quora.com/profile/Pooja-BFSI

https://medium.com/@psaraf568

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms the utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high-quality data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How Have Small Personal Loans Become an Ideal Financial Solution for Modern-Age Consumers? here

News-ID: 3818713 • Views: …

More Releases from Allied Market Research

Tourism Source Market to Grow at a CAGR of 6.6% and will Reach USD 1.1 Trillion …

The Tourism Source Market Size was valued at $599.40 billion in 2022, and is estimated to reach $1.1 Trillion by 2032, growing at a CAGR of 6.6% from 2023 to 2032.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/6807

Traveling to other locations for pleasure, recreation, or business is referred to as tourism. It entails travelling to and taking in a variety of locations, points of interest, and cultural…

Sharing Economy Market Predicted to Hit USD 827.1 billion by 2032, with a 7.7% C …

The global sharing economy market size was valued at $387.1 billion in 2022, and is projected to reach $827.1 billion by 2032, growing at a CAGR of 7.7% from 2023 to 2032.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/231156

The sharing economy market is driven by factors such as cost-effectiveness of sharing economy services and diversification of services in sharing economy platforms. However, rise in concerns for consumer…

Live Events Industry Poised to Reach US$ 1.2 trillion by 2032 with a 5.9% CAGR

The live events industry market was valued at $652.60 billion in 2022, and is estimated to reach $1.2 trillion by 2032, growing at a CAGR of 5.9% from 2023 to 2032.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/157202

Live events refer to public gathering of populace at a determined time and place for a purpose. Events are organized with various purposes, each of which serves different business objectives.…

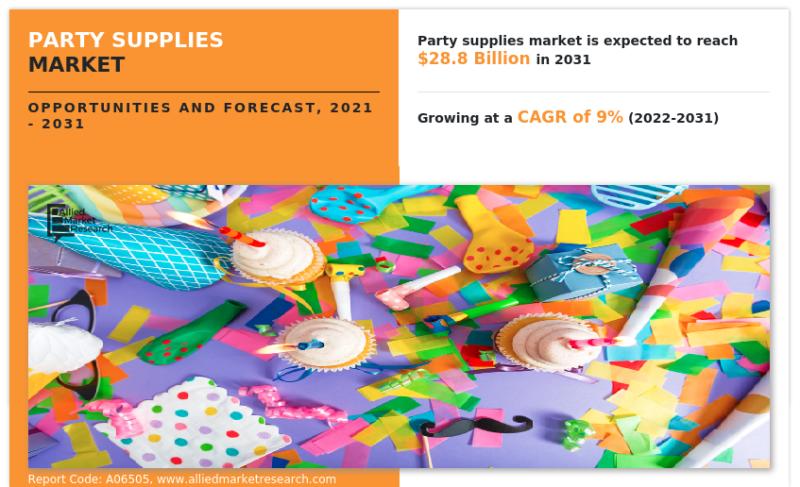

Party Supplies Market reach nearly USD 28.8 billion by 2031, exhibiting a robust …

According to a new report published by Allied Market Research, titled, "Party Supplies Market," The party supplies market was valued at $12.3 billion in 2021, and is estimated to reach $28.8 billion by 2031, growing at a CAGR of 9% from 2022 to 2031.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/6870

Party supplies are materials that are required for a party or event. They include various decorative materials such…

More Releases for Small

Succeeding Small Launches Small Business Give-Back Giveaway in Celebration of Sm …

Succeeding Small Launches Small Business Give-Back Giveaway in Celebration of Small Business Month

Honoring Local Colorado Springs Businesses That Make a Difference in Their Community

COLORADO SPRINGS, CO - Succeeding Small, a go-to guide for small business success in small business marketing, is celebrating Small Business Month with the launch of its Small Business Give-Back Giveaway - a contest aimed at honoring the small, service-based businesses that make a meaningful difference in…

Small Molecules, Big Impact: The Rise of the Small Molecule Immunomodulators Mar …

Small Molecule Immunomodulators Market worth $270.8 Bn by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Small Molecule Immunomodulators Market - (By Product (Disposable, Reusable), By Application (Colorectal, Thoracic, Orthopedic, Ophthalmology, Neurosurgery, Cardiac Surgery, Gynecology, Others), By End User (Hospitals, Ambulatory Surgical Centers, Clinics, Others)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to…

Powering Small: Small Gas Engines Market Advances (2023-2032)

"According to the research report, the global small gas engines market was valued at USD 2.75 billion in 2022 and is expected to reach USD 4.23 billion by 2032, to grow at a CAGR of 4.4% during the forecast period."

Polaris Market Research has recently published the latest update on Small Gas Engines Market: By Size, Latest Trends, Share, Huge Growth, Segments, Analysis and Forecast, 2030 that offers detailed market analysis,…

Small Batch Freeze Dryer Market: Increasing Demand for Small-scale Freeze Drying …

Global Small Batch Freeze Dryer Market Overview:

The Small Batch Freeze Dryer market is a broad category that includes a wide range of products and services related to various industries. This market comprises companies that operate in areas such as consumer goods, technology, healthcare, and finance, among others.

In recent years, the Small Batch Freeze Dryer market has experienced significant growth, driven by factors such as increasing consumer demand, technological advancements, and…

Global Small Gas Engines Market, Global Small Gas Engines Industry, Covid-19 Imp …

The Small Gas Engines market is expected to grow from USD X.X million in 2020 to USD X.X million by 2026, at a CAGR of X.X% during the forecast period. The Global Small Gas Engines Market report is a comprehensive research that focuses on the overall consumption structure, development trends, sales models and sales of top countries in the global Small Gas Engines market. The report focuses on well-known providers…

Small Appliances Market: Strategic Assessment of Emerging Technologies in Small …

Small appliances market is forecasted to grow substantially in all market segments through 2016 owing to the rise in living standards and need for more comfort. Small appliance industry consists of home appliances that are movable or partially movable and can be used on tables, counters, or other platforms. The growth of small appliances market is expected to be driven by product innovation, upgradation of existing products, and value-added features…