Press release

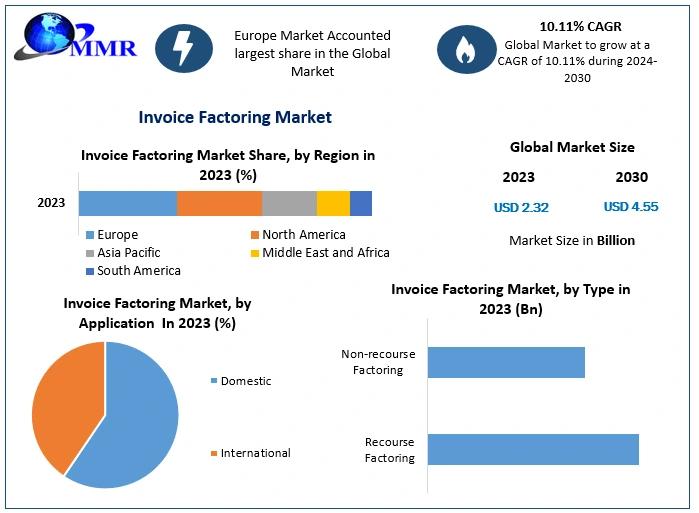

Invoice Factoring Market Projected to Reach USD 4.55 Billion by 2030

The 𝐈𝐧𝐯𝐨𝐢𝐜𝐞 𝐅𝐚𝐜𝐭𝐨𝐫𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 was valued at USD 2.32 Billion in 2023 and is expected to reach USD 4.55 Billion by 2030, exhibiting a CAGR of 10.11 % during the forecast period (2024-2030).𝐈𝐧𝐯𝐨𝐢𝐜𝐞 𝐅𝐚𝐜𝐭𝐨𝐫𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

Invoice factoring is a financial solution that allows businesses to improve cash flow by selling their accounts receivables to a factoring company at a discounted rate. This process helps companies unlock funds tied up in invoices, providing them with immediate working capital without taking on additional debt. Unlike traditional loans, invoice factoring is not classified as a liability, making it an attractive alternative for businesses aiming to maintain clean balance sheets. The global invoice factoring market is expanding rapidly, driven by its ability to provide quick access to funds, streamline cash flow management, and reduce administrative burdens through credit control services offered by factoring companies.

𝐖𝐚𝐧𝐭 𝐭𝐨 𝐒𝐞𝐞 𝐭𝐡𝐞 𝐓𝐫𝐞𝐧𝐝𝐬? 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐓𝐨𝐝𝐚𝐲: https://www.maximizemarketresearch.com/request-sample/168342/

𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐈𝐧𝐯𝐨𝐢𝐜𝐞 𝐅𝐚𝐜𝐭𝐨𝐫𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭:

The growth of the invoice factoring market is propelled by several key drivers. The integration of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), has enhanced the efficiency and reliability of factoring processes. Innovations like automated invoices, smart contracts, and improved transactional security are significantly boosting adoption rates. Moreover, the increasing prevalence of open account trading, coupled with the demand for faster financing solutions, is pushing businesses to choose factoring over traditional bank loans. The flexibility and scalability offered by factoring services make them particularly appealing to small and medium enterprises (SMEs), further fueling market growth. Additionally, the rise of international trade and the growing need for seamless cross-border financing solutions have elevated the demand for both domestic and international invoice factoring services.

𝐌𝐞𝐫𝐠𝐞𝐫𝐬 𝐚𝐧𝐝 𝐀𝐜𝐪𝐮𝐢𝐬𝐢𝐭𝐢𝐨𝐧𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐈𝐧𝐯𝐨𝐢𝐜𝐞 𝐅𝐚𝐜𝐭𝐨𝐫𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭:

𝐕𝐢𝐞𝐭𝐧𝐚𝐦: 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 𝐢𝐧 𝐈𝐧𝐯𝐨𝐢𝐜𝐞 𝐅𝐚𝐜𝐭𝐨𝐫𝐢𝐧𝐠

Vietnam's expanding SME sector and its increasing engagement in global trade have positioned it as a critical market for invoice factoring services. Factoring companies such as 𝐕𝐢𝐞𝐭𝐢𝐧𝐁𝐚𝐧𝐤 have been actively introducing innovative solutions to cater to the financial needs of SMEs. Recent government reforms encouraging digital payment adoption and financial inclusion are expected to drive further market expansion. Additionally, Vietnam's trade agreements with major economies have bolstered cross-border transactions, creating significant opportunities for international factoring.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐓𝐨𝐝𝐚𝐲 𝐟𝐨𝐫 𝐂𝐮𝐬𝐭𝐨𝐦 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬: https://www.maximizemarketresearch.com/inquiry-before-buying/168342/

𝐓𝐡𝐚𝐢𝐥𝐚𝐧𝐝: 𝐓𝐫𝐞𝐧𝐝𝐬 𝐢𝐧 𝐈𝐧𝐯𝐨𝐢𝐜𝐞 𝐅𝐚𝐜𝐭𝐨𝐫𝐢𝐧𝐠 𝐆𝐫𝐨𝐰𝐭𝐡

In Thailand, the invoice factoring market has been fueled by robust industrial development and growing export activities. The adoption of digital financial tools, led by key players such as 𝐊𝐚𝐬𝐢𝐤𝐨𝐫𝐧𝐛𝐚𝐧𝐤 and 𝐒𝐂𝐁, has revolutionized factoring services. Mergers and acquisitions in the sector, such as 𝐊𝐫𝐮𝐧𝐠 𝐓𝐡𝐚𝐢 𝐁𝐚𝐧𝐤'𝐬 acquisition of local factoring firms, have further consolidated the market, enabling streamlined services and enhanced client trust. Thailand's strong focus on trade and export financing makes it a promising market for future growth.

𝐒𝐨𝐮𝐭𝐡 𝐊𝐨𝐫𝐞𝐚: 𝐆𝐫𝐨𝐰𝐭𝐡 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 𝐢𝐧 𝐈𝐧𝐯𝐨𝐢𝐜𝐞 𝐅𝐚𝐜𝐭𝐨𝐫𝐢𝐧𝐠

South Korea has emerged as a regional leader in adopting advanced financial technologies for invoice factoring. Leading banks such as 𝐊𝐨𝐨𝐤𝐦𝐢𝐧 𝐁𝐚𝐧𝐤 and 𝐇𝐚𝐧𝐚 𝐁𝐚𝐧𝐤 are leveraging AI-powered tools to offer customized factoring solutions. Recent developments include strategic partnerships with global fintech firms, enabling the introduction of non-recourse factoring services tailored for export-oriented businesses. The country's strong export economy and focus on innovation position it as a key market in the Asia-Pacific region.

𝐔𝐧𝐢𝐭𝐞𝐝 𝐒𝐭𝐚𝐭𝐞𝐬: 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 𝐚𝐧𝐝 𝐆𝐫𝐨𝐰𝐭𝐡 𝐢𝐧 𝐈𝐧𝐯𝐨𝐢𝐜𝐞 𝐅𝐚𝐜𝐭𝐨𝐫𝐢𝐧𝐠

The United States continues to dominate the invoice factoring market, driven by its robust SME sector and advancements in fintech. Companies such as 𝐂𝐈𝐓 𝐆𝐫𝐨𝐮𝐩 and 𝐁𝐥𝐮𝐞𝐕𝐢𝐧𝐞 are leading the market with innovative solutions tailored to various industries. The rise in e-commerce has also contributed to the growing demand for factoring services, particularly in the logistics and retail sectors. Recent mergers and acquisitions, including 𝐓𝐫𝐢𝐮𝐦𝐩𝐡 𝐁𝐚𝐧𝐜𝐨𝐫𝐩'𝐬 acquisition of factoring firms, have consolidated the market, creating opportunities for enhanced service delivery.

𝐄𝐮𝐫𝐨𝐩𝐞: 𝐂𝐨𝐧𝐬𝐨𝐥𝐢𝐝𝐚𝐭𝐢𝐨𝐧 𝐚𝐧𝐝 𝐓𝐫𝐞𝐧𝐝𝐬 𝐢𝐧 𝐅𝐚𝐜𝐭𝐨𝐫𝐢𝐧𝐠

Europe accounts for over 44% of the global invoice factoring market, with countries such as the UK, Germany, and France leading the way. Eastern Europe, including Poland and Romania, is experiencing the fastest growth, driven by increasing trade activities and improved regulatory standards. Key players, such as 𝐁𝐍𝐏 𝐏𝐚𝐫𝐢𝐛𝐚𝐬 and 𝐄𝐮𝐫𝐨𝐟𝐚𝐜𝐭𝐨𝐫, are leveraging blockchain for secure and efficient factoring. The region's emphasis on integrating Western banking practices with advanced technologies ensures a competitive and dynamic market environment.

𝐍𝐞𝐞𝐝 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨? 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐘𝐨𝐮𝐫 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐒𝐚𝐦𝐩𝐥𝐞: https://www.maximizemarketresearch.com/request-sample/168342/

𝐑𝐞𝐜𝐞𝐧𝐭 𝐃𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐈𝐧𝐯𝐨𝐢𝐜𝐞 𝐅𝐚𝐜𝐭𝐨𝐫𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭

𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐢𝐨𝐧: Companies such as 𝐓𝐚𝐥𝐥𝐲𝐬𝐭𝐢𝐜𝐤𝐬 have adopted blockchain to improve security and transparency in factoring transactions.

𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐢𝐜𝐚𝐥 𝐈𝐧𝐧𝐨𝐯𝐚𝐭𝐢𝐨𝐧𝐬: AI-driven solutions by leading players have enhanced credit risk assessment and process automation.

𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜 𝐏𝐚𝐫𝐭𝐧𝐞𝐫𝐬𝐡𝐢𝐩𝐬: Collaborations between financial institutions and fintech firms have expanded the scope and efficiency of factoring services globally.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐈𝐧𝐯𝐨𝐢𝐜𝐞 𝐅𝐚𝐜𝐭𝐨𝐫𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭:

by Type

Recourse Factoring

Non-recourse Factoring

by Application

Domestic

International

by Enterprise Size

Large Enterprises

Small and Medium-sized Enterprises

by Provider

Banks

NBFCs

by Industry Vertical

Construction

Manufacturing

Healthcare

Transportation and Logistics

Energy and Utilities

IT and Telecom

Staffing

Others

𝐅𝐨𝐫 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐀𝐛𝐨𝐮𝐭 𝐓𝐡𝐢𝐬 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐏𝐥𝐞𝐚𝐬𝐞 𝐕𝐢𝐬𝐢𝐭: https://www.maximizemarketresearch.com/market-report/invoice-factoring-market/168342/

𝐖𝐡𝐨 𝐢𝐬 𝐭𝐡𝐞 𝐥𝐚𝐫𝐠𝐞𝐬𝐭 𝐦𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐞𝐫𝐬 𝐨𝐟 𝐈𝐧𝐯𝐨𝐢𝐜𝐞 𝐅𝐚𝐜𝐭𝐨𝐫𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 𝐰𝐨𝐫𝐥𝐝𝐰𝐢𝐝𝐞?

1.Porter Capital

2. Adobe

3. Barclays Bank UK PLC

4. ICBC

5. Intuit Inc.

6. American Express Company

7. Lloyds Bank

8. Sonovate

9. Waddle

10. Velotrade

11. eCapital

12. Triumph Business Capital

13. Breakout Capital

14. Nav

15.altLINE

16. Riviera Finance

17. RTS Financial

18. Fundbox

19.Paragon Financial Group

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐛𝐲 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

♦ Knowledge Process Outsourcing Market https://www.maximizemarketresearch.com/market-report/knowledge-process-outsourcing-market/187554/

♦ Mobile Phone Protective Cover Market https://www.maximizemarketresearch.com/market-report/mobile-phone-protective-cover-market/187991/

♦ Sicca Syndrome Market https://www.maximizemarketresearch.com/market-report/sicca-syndrome-market/189319/

♦ Absorbent Mat market https://www.maximizemarketresearch.com/market-report/absorbent-mat-market/190777/

♦ Cybersecurity Mesh Market https://www.maximizemarketresearch.com/market-report/cybersecurity-mesh-market/200224/

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Invoice Factoring Market Projected to Reach USD 4.55 Billion by 2030 here

News-ID: 3812986 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

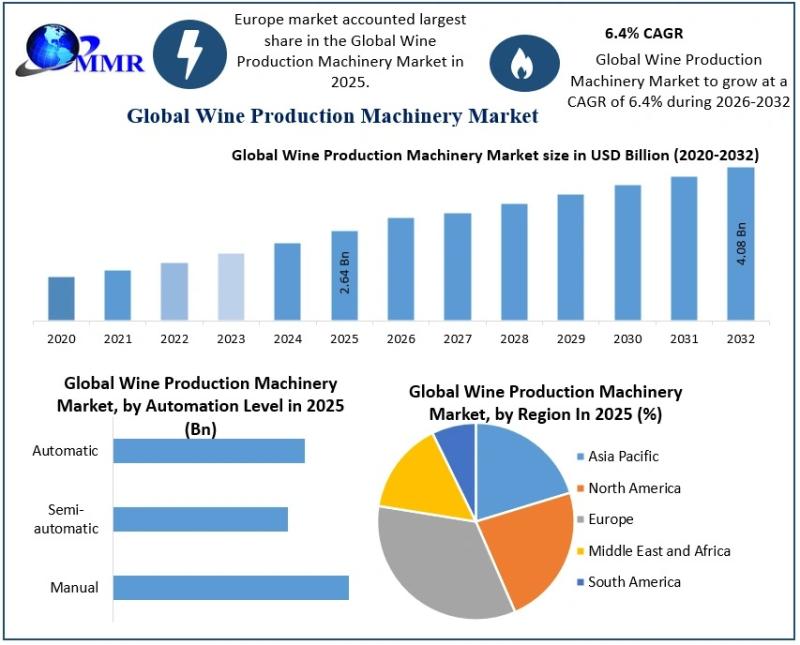

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

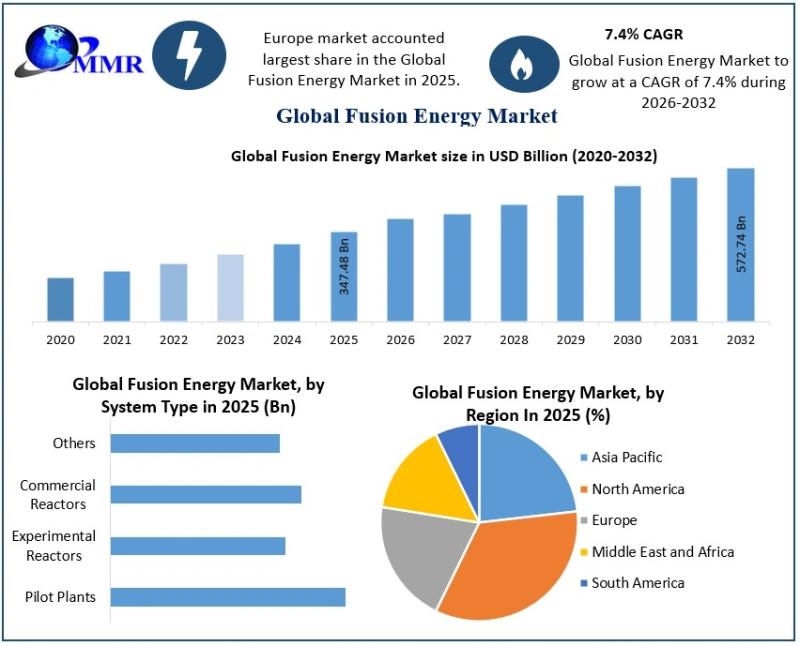

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Factoring

Growing Reverse Factoring Adoption Boosts Market Growth: Critical Driver Shaping …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Reverse Factoring Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

Over the past few years, the reverse factoring market has seen significant growth. It is expected to increase from $539.41 billion in 2024 up to $592.1 billion in 2025, representing a compound annual growth rate…

Factoring Market Next Big Thing | Major Giants BNP Paribas, HSBC, Deutsche Facto …

HTF MI just released the Global Factoring Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Giants in Factoring Market are:

BNP Paribas, HSBC, Deutsche Factoring Bank, Eurobank,…

What's Driving the Reverse Factoring Market 2025-2034: Growing Reverse Factoring …

What Are the Projections for the Size and Growth Rate of the Reverse Factoring Market?

The market size of reverse factoring has seen significant growth over the last few years. It is projected to expand from $539.41 billion in 2024 to $592.1 billion in 2025, displaying a compound annual growth rate (CAGR) of 9.8%. The growth trajectory in the past can be linked to the increased awareness of supply chain finance…

Reverse Factoring Market

The reverse factoring market has been experiencing significant growth, with its market size accounted for USD 530.8 billion in 2022. It is projected to achieve a remarkable market size of USD 1,452.1 billion by 2032, growing at a compound annual growth rate (CAGR) of 10.8% from 2023 to 2032. This substantial growth is driven by various market trends, emerging opportunities, and a competitive landscape that is continuously evolving.

Download Free Reverse…

Factoring Market Outlook 2024-2030: Trends and Opportunities|BNP Paribas, Deutsc …

Infinity Business Insights is providing qualitative and informative knowledge by adding the title factoring Market to recognize, describe and forecast the global market. The report provides systematic consideration analysis along with forecasts for market players. The report aims to facilitate understanding of the global factoring market forecast through statistical and numerical data in the form of tables, graphs, and charts. The study provides a calculated assessment of new recent developments,…

Factoring Services Market is Booming Worldwide | Deutsche Factoring Bank, Euroba …

The Latest Released Factoring Services market study has evaluated the future growth potential of Global Factoring Services market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers,…