Press release

What Are the Key Opportunities and Trends Shaping the Future of the Global Insurance Third-Party Administrators (TPAs) Market (2025-2034)?

The insurance third-party administrators (TPAs) market report describes and explains the insurance third-party administrators (TPAs) market and covers 2019-2024, termed the historic period, and 2024-2029, 2034F termed the forecast period. The report evaluates the market across each region and the major economies within each region.The global insurance third-party administrators (TPAs) market reached nearly $342.52 billion in 2024, growing at a compound annual growth rate (CAGR) of 8.29% since 2019. The market is expected to grow from $342.52 billion in 2024 to $532.24 billion in 2029 at a rate of 9.22%. The market is expected to grow at a CAGR of 8.77% from 2029 and reach $810.26 billion in 2034.

What are the upcoming opportunities in the global insurance third-party administrators (TPAs) market?

The key players in the market are adopting extensive strategies in the insurance third-party administrators (TPAs) market such as:

• Focus on enhancing operational capabilities through new insurance plan launches and initiatives.

• Focus on enhancing operational capabilities through strategic partnerships and acquisitio

Get The Complete Scope Of The Report

https://www.thebusinessresearchcompany.com/report/insurance-third-party-administrators-global-market-report

To take advantage of the opportunities, The Business Research Company recommends the insurance third-party administrators (TPAs) companies to focus on:

• Developing innovative health insurance administration platforms.

• Focusing on developing innovative no-code core insurance platforms.

• Focusing on developing innovative solutions such as AI-powered claims management.

• Focusing on developing innovative solutions in the billing process.

What is insurance third-party administrators (TPAs): market definition?

Fan engagement refers to the interaction process between a club and a particular entity, such as a sports team, musician, brand, or celebrity, focusing on how clubs communicate, listen to, and involve fans in the club's day-to-day operations and decision-making. It emphasizes both online and offline interactions where fans voluntarily engage in team-creating value and providing support directly through actions such as attending games or purchasing merchandise, as well as indirectly through recommendations, volunteering, and other supportive behaviors.

The main types of engagement for fan engagement include personalized messages, live video calls, master classes, and others. Personalized Messages refer to customized communications geared to individual fans, generally provided via social media, email, or direct messaging services. These provide various user locations such as tier-1 cities, and tier-2-3 cities. These are used for several applications including entertainment, art, social media personalities, music, and others.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of Our Research Report

https://www.thebusinessresearchcompany.com/sample_request?id=14711&type=smp

Who are the major companies operating in the global insurance third-party administrators (TPAs) market?

The global insurance third-party administrators market is concentrated, with a large players operating in the market. The top ten competitors in the market made up to 43.7% of the total market in 2023. CVS Health Corporation (Caremark) was the largest competitor with a 9.35% share of the market, followed by:

• Helmsman Management Services LLC (Liberty Mutual Insurance Company)

• United HealthCare Services, Inc

• Trustmark Health Benefits Inc. (Health Care Service Corporation (HCSC)).

• Sedgwick Claims Management Services Inc (Marsh McLennan).

• The Cigna Group.

• CorVel Corporation

• Kaiser Permanente.

• AssuredPartners Inc.

• Charles Taylor Plc with 1.19%.

We Offer Customized Report, Click Here

https://www.thebusinessresearchcompany.com/Customise?id=14711&type=smp

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 15,000 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release What Are the Key Opportunities and Trends Shaping the Future of the Global Insurance Third-Party Administrators (TPAs) Market (2025-2034)? here

News-ID: 3809958 • Views: …

More Releases from The Business research company

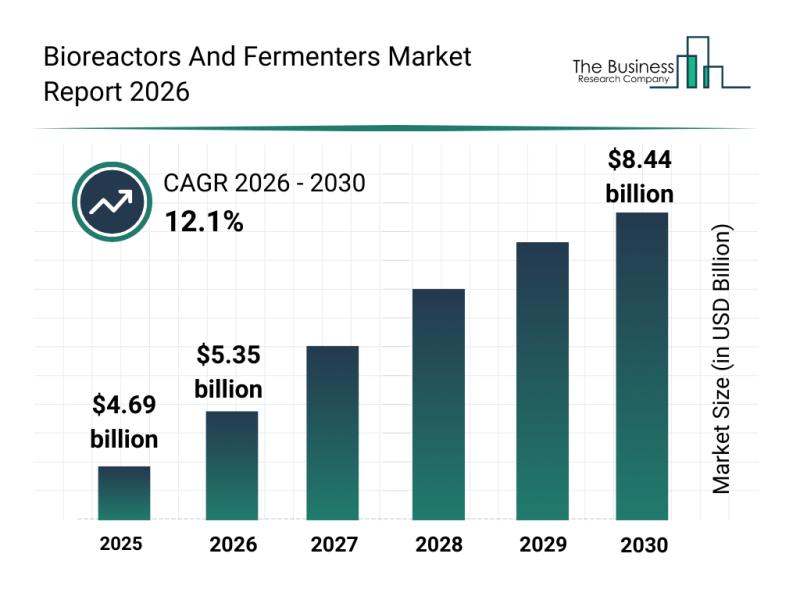

Segmentation, Major Trends, and Competitive Overview of the Bioreactors and Ferm …

The bioreactors and fermenters market is poised for significant expansion over the coming years, driven by advances in biotechnology and increasing demand for efficient bioprocessing technologies. This sector is attracting considerable attention due to its crucial role in the development and production of biologics, biosimilars, and cell and gene therapies. Let's explore the market's forecasted size, major players, emerging trends, and key segments shaping its future.

Projected Growth and Market Size…

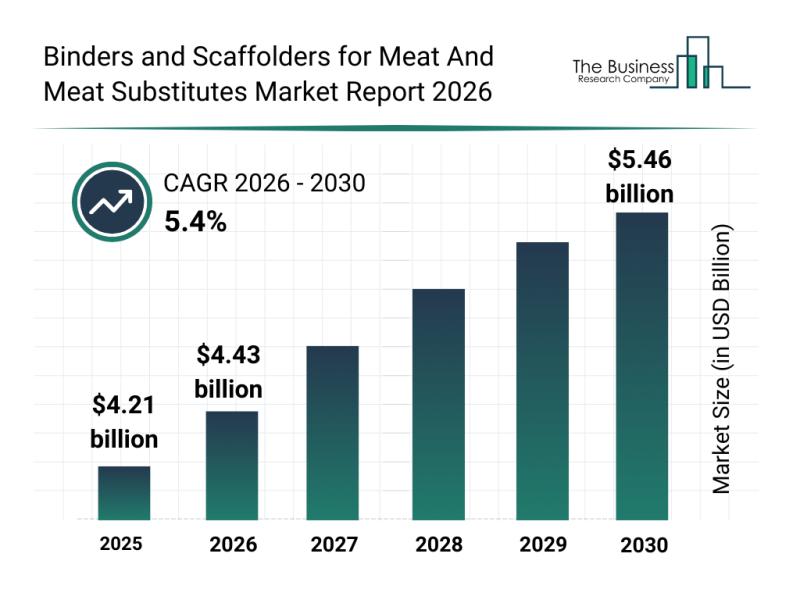

Competitive Landscape: Leading Companies and New Entrants in the Binders and Sca …

The market for binders and scaffolders used in meat and meat substitutes is gaining significant traction as the food industry shifts toward innovative protein sources and sustainable alternatives. This sector is expected to expand notably in the coming years, driven by advancements in technology and evolving consumer preferences. Let's explore the market's projected growth, the major players influencing its development, emerging trends, and the key segments shaping its future.

Projected Market…

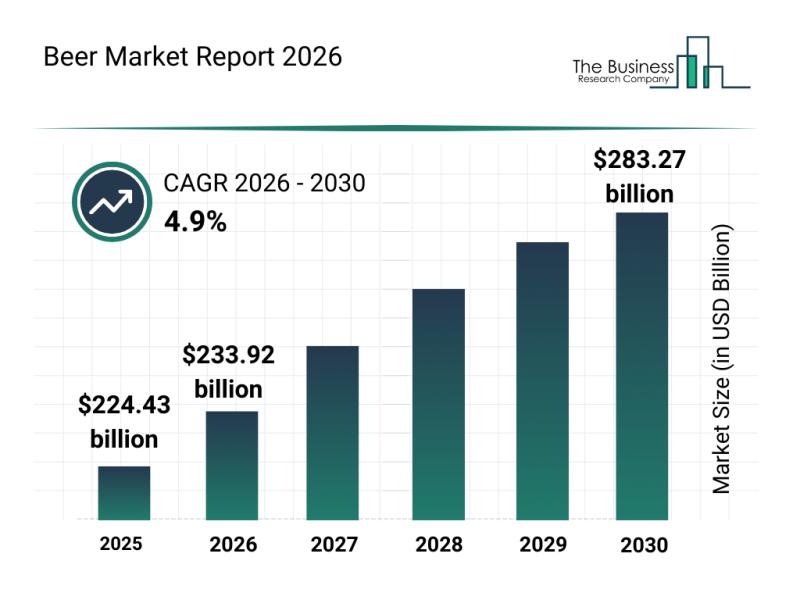

Future Perspectives: Key Trends Shaping the Beer Market Up to 2030

The beer market is poised for steady expansion over the coming years, driven by evolving consumer preferences and innovations in brewing. This sector is witnessing notable shifts that promise to shape its future through 2030. Let's explore the market's size forecast, leading players, influential trends, and segmentation to better understand where the beer industry is heading.

Projected Growth Trajectory of the Beer Market Size Through 2030

The beer market is…

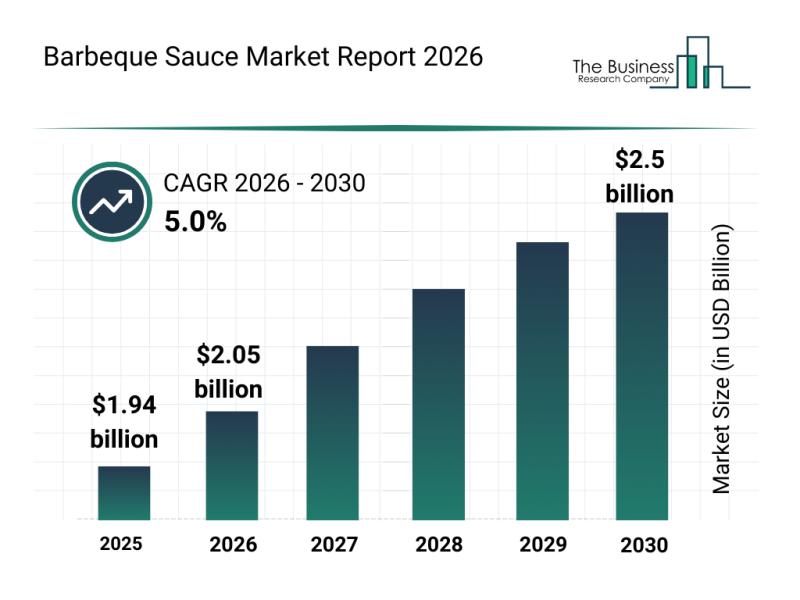

Leading Companies Reinforce Their Presence in the Barbeque Sauce Market

The barbeque sauce market is poised for significant expansion over the coming years, driven by evolving consumer preferences and innovative product offerings. As tastes shift towards healthier and more diverse options, this sector is attracting both established brands and new entrants eager to capture growing demand. Let's explore the market's projected size, key players, emerging trends, and segment breakdown to understand the landscape better.

Projected Growth and Market Size of the…

More Releases for TPAs

Insurance Third-Party Administration Market Forecast: Industry to Expand from US …

The Insurance Third-Party Administration Market report provides in-depth insights into market size, growth trends, competitive landscape, key drivers, opportunities, and regional developments across the global insurance ecosystem.

Insurance Third-Party Administration Market Overview:

The Insurance Third-Party Administration Market is witnessing robust growth as insurers increasingly outsource claims processing, policy administration, and risk management services to improve operational efficiency and reduce costs. Third-party administrators (TPAs) play a crucial role in handling claims settlement, employee…

Insurance Third-Party Administration Market Survey, In-depth Analysis, Share, Ke …

As per MRFR analysis, the Insurance Third-Party Administration (TPA) Market was estimated at USD 428.94 billion in 2024. The Insurance TPA industry is projected to grow from USD 470.55 billion in 2025 to USD 1,187.83 billion by 2035, exhibiting a compound annual growth rate (CAGR) of 9.7% during the forecast period 2025-2035.

The growth is primarily driven by the increasing demand for cost-efficient claims management, regulatory compliance, and outsourcing of administrative…

Insurance Third-Party Administrator Market: Growth Analysis, Key Trends, and For …

The Insurance Third-Party Administrator market size is projected to reach US$ 681.16 million by 2031 from US$ 413.50 million in 2024, registering a compound annual growth rate (CAGR) of 7.6% during 2025-2031. Growing demand for cost-efficient insurance administration and rising insurance penetration globally propel market growth.

The Insight Partners is pleased to announce its latest market report, "The Insurance Third-Party Administrator Market: An In-depth Analysis of the Insurance Third-Party Administrator Market."…

Insurance Third-Party Administration Market to Reach USD 1,082.78 Billion by 203 …

The global Insurance Third-Party Administration (TPA) market was valued at USD 428.94 billion in 2024 and is projected to reach USD 1,082.78 billion by 2034, growing at a CAGR of 9.7% during the forecast period from 2025 to 2034.

The market is expanding due to increasing demand for cost-effective claims processing, policy administration outsourcing, and the integration of digital technologies into insurance operations.

Key Market Drivers

• Cost Optimization through Outsourcing

Insurance companies are…

Insurance Third-Party Administrators Market to Witness Stunning Growth |Big Gian …

HTF MI recently introduced Global Insurance Third-Party Administrators Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence.

𝗠𝗮𝗷𝗼𝗿 𝗰𝗼𝗺𝗽𝗮𝗻𝗶𝗲𝘀 𝒊𝒏 Insurance Third-Party Administrators 𝑴𝒂𝒓𝒌𝒆𝒕 𝒂𝒓𝒆:

Sedgwick Claims Management, Crawford & Company, Gallagher Bassett Services, CorVel Corporation, York Risk Services…

Insurance Third Party Administrators Market Research Report 2023-2030 | Sedgwick …

Infinity Business Insights has recently released a comprehensive research report titled "Insurance Third Party Administrators Market Insights, Extending to 2030." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory.

Market Overview: Insurance Third Party Administrators (TPAs) play a crucial role in the insurance industry, serving as intermediaries between insurance companies, policyholders, and healthcare providers. TPAs handle various functions, including claims…