Press release

C5 Fraction Market, Global Outlook and Forecast 2025-2032

2023 Market Value: US$ 868 MillionProjected 2030 Market Value: US$ 1,377 Million

CAGR (2023-2030): 6.7%

The "Global C5 Fraction Market" is on a growth trajectory, expected to expand significantly from US$ 868 Million in 2023 to US$ 1,377 Million by 2030.

This growth is driven by the increasing demand from key industries such as petrochemicals, automotive, and adhesives.

Asia-Pacific leads in both production and consumption, with China, India, South Korea, and Japan playing critical roles due to their robust petrochemical industries.

➣ For More Information or Query, Visit: https://www.24chemicalresearch.com/reports/173653/c5-fraction-market

The C5 fraction refers to a group of hydrocarbons that are typically derived from the cracking process in petroleum refining. This fraction contains molecules with five carbon atoms in their structure (C5 hydrocarbons). The C5 fraction includes a variety of compounds, primarily olefins, paraffins, and aromatics. The two most significant products from the C5 fraction are isoprene and C5 resins, which have widespread applications across industries like automotive, adhesives, and rubber manufacturing.

➣ Composition of C5 Fraction:

Isoprene (2-methyl-1,3-butadiene): A key monomer used to produce synthetic rubber, particularly in the tire industry.

C5 Olefins: These include compounds like butenes and pentenes, which are used in producing other petrochemicals.

C5 Resins: These are polymers made from C5 olefins, often used in adhesives, coatings, and other applications requiring high bonding strength.

Aromatics (e.g., benzene, toluene): Though present in smaller quantities, these aromatic compounds are valuable for chemical manufacturing.

This report delves deep into the C5 Fraction market, offering valuable insights across a range of essential areas, including market dynamics, competitive landscape, market segmentation, regional performance, key drivers and challenges, and more.

➣ Market Segmentation Analysis

➣ By Type

• Isoprene Manufacturing: Key for the production of synthetic rubbers and tires.

• C5 Resin Manufacturing: Essential for adhesives, coatings, and other industrial applications.

• Others: Including niche uses in various industrial sectors.

➣ By Application

• Tires: The largest end-use segment, driven by growing automotive production and demand for high-performance tires.

• Industrial Rubber: Widely used in manufacturing a variety of products like hoses, seals, and gaskets.

• Adhesives: Strong demand from construction, automotive, and electronics sectors.

• Others: Including uses in fragrances, flavors, and other niche applications.

➣ Geographic Segmentation

• Asia-Pacific: Dominates both production and consumption, with China, India, South Korea, and Japan leading the market.

• North America: Significant market share, driven by demand from the automotive and industrial sectors.

• Europe: Growing demand for C5 fractions in adhesives and automotive applications.

• South America: Increasing industrial activity in Brazil and Argentina contributing to market growth.

• Middle East & Africa: Emerging markets with expanding petrochemical industries.

➣ For More Information or Query, Visit: https://www.24chemicalresearch.com/reports/173653/c5-fraction-market

➣Competitive Landscape & Key Market Players

➣Top Companies in the C5 Fraction Market

• Mitsubishi Chemical Corporation

• SIBUR International

• Mitsui Chemicals, Inc.

• China Petrochemical Technology Development Co., Ltd.

• BASF

• INEOS Group

• Braskem

• Chevron Phillips Chemical

• DOW

• Sinochem

• Haldia Petrochemicals Ltd.

These players are major stakeholders in the C5 fraction market, and their strategies focus on capacity expansion, strategic mergers and acquisitions, and investments in innovation.

➣Regional Outlook and Market Trends

• Asia-Pacific remains the most dominant region due to the strong growth of petrochemical industries, particularly in China and India.

• North America is witnessing steady growth, especially in sectors like automotive manufacturing, where C5 fractions are crucial for tire and industrial rubber production.

• Europe and South America are expected to experience a surge in demand for adhesives and coatings, driving the market forward in these regions.

• Middle East & Africa will see growth in their petrochemical industries, with countries like Saudi Arabia and UAE investing in C5 fraction production.

➣Industry Dynamics

➣1. Drivers

➣Growth in End-Use Industries:

• The demand for C5 fractions is closely linked to growth in industries such as automotive, construction, and electronics. Increased automotive production, particularly in emerging markets, is a major driver, especially for tire and rubber manufacturing, where C5 fractions are essential. The adhesives segment also benefits from expanding industries like packaging and construction, where C5-based resins are increasingly used.

➣Technological Advancements:

• Innovations in petrochemical refining and C5 fraction production technologies have made the process more efficient, cost-effective, and sustainable. Advances in isoprene production have expanded its use in high-performance tires and industrial rubber, boosting the overall C5 market. The development of more eco-friendly resins is also increasing adoption in adhesives and coatings, further driving demand.

➣Growing Demand for Specialty Chemicals:

• As the demand for specialty chemicals grows across sectors like cosmetics, paints, and coatings, the need for high-quality C5 resins and derivatives is increasing. The refinement of the resin application in adhesives for packaging and construction materials is anticipated to drive market growth.

➣Regional Industrialization:

• Rapid industrialization in Asia-Pacific, especially in China, India, and Southeast Asia, is increasing the demand for petrochemical products, including C5 fractions. The region's growing middle class and increasing urbanization are boosting consumption in automotive, construction, and manufacturing, all of which rely heavily on C5 fractions.

• Increased Consumer Awareness and Product Demand:

Consumers are becoming more aware of sustainable and durable products, such as eco-friendly tires, adhesives, and rubbers. Manufacturers are responding by creating products with improved performance characteristics and environmentally responsible ingredients, thus increasing demand for high-quality C5 fractions.

➣2. Restraints

➣Environmental Concerns and Regulatory Pressures:

• As the environmental impact of the petrochemical industry comes under greater scrutiny, companies face mounting pressure to reduce emissions and improve sustainability. Regulations governing the production and disposal of petrochemical products, including C5 fractions, are becoming stricter, particularly in Europe and North America. These regulations may increase production costs and restrict the growth of C5 fraction markets in some regions.

➣Volatile Raw Material Prices:

• C5 fractions are primarily derived from crude oil and natural gas, making the market vulnerable to fluctuations in the global price of these raw materials. The volatility in oil prices, driven by geopolitical events, economic instability, and shifts in energy demand, can have a significant impact on the cost and availability of C5 fractions.

➣High Initial Investment Costs for Production:

• Setting up production facilities for C5 resins and other derivatives requires significant capital investment. The cost of plant setup, technological upgrades, and skilled labor can deter new entrants from tapping into the market. Moreover, companies need to invest heavily in research and development (R&D) to remain competitive, particularly in the rapidly evolving segment of bio-based chemicals.

➣Competition from Alternative Materials:

• The rise of bio-based chemicals and alternative synthetic materials poses a challenge to the traditional petrochemical industry. Bio-based resins and rubbers are gaining traction due to their environmentally friendly characteristics. As consumer demand for sustainable alternatives grows, C5 fraction-based products could face stiffer competition from more eco-friendly options, potentially slowing market growth.

➣3. Opportunities

➣Emerging Markets Expansion:

• The Asia-Pacific region, led by China and India, presents significant growth opportunities due to its booming industrial sectors and high demand for automotive and construction products. In addition, Africa and parts of South America are expected to see increased industrial activity, driving demand for petrochemical products like C5 fractions.

➣Innovation in Green Technologies:

• There is a significant push toward more sustainable petrochemical production methods, including bio-based C5 fractions and the integration of green chemistry technologies. As governments worldwide increase their focus on carbon emissions and climate change, companies that innovate with environmentally friendly production processes and products will find new opportunities in the market. Companies can capitalize on these trends by investing in renewable feedstocks and improving the sustainability of their products.

➣Strategic Partnerships and Acquisitions:

• To expand their reach and strengthen market position, companies are likely to form strategic partnerships or engage in mergers and acquisitions (M&As). Collaboration between petrochemical giants and specialty chemical companies can facilitate the development of innovative products and open new markets. This trend is particularly evident in the shift toward bio-based chemicals and the incorporation of more sustainable practices in production processes.

➣Diversification into Specialty Chemicals:

• Expanding into specialty chemicals like high-performance resins for adhesives, coatings, and electronics is a growing opportunity for companies involved in C5 fraction production. This market segment promises higher margins and product differentiation, helping companies achieve growth in the competitive landscape.

➣4. Challenges

Global Supply Chain Disruptions:

• The global supply chain for C5 fractions is highly interconnected with the petroleum and chemical industries. Disruptions caused by geopolitical tensions, natural disasters, or health crises (e.g., the COVID-19 pandemic) can affect the supply of raw materials or the transportation of finished goods. Such disruptions can delay production timelines and increase costs, affecting profitability.

➣Fluctuating Consumer Preferences:

• The increasing awareness of environmental impacts has led to shifting consumer preferences. Companies need to stay agile and adapt to rapidly changing market demands, especially regarding eco-friendly products. If C5 fraction-based products fail to meet consumer expectations for sustainability, manufacturers may lose market share to more sustainable alternatives.

➣Technological Advancements by Competitors:

• The pace of innovation in the chemicals and materials industry is high. New technologies, such as those enabling the use of renewable raw materials or producing advanced resins, could reduce the reliance on traditional C5 fractions. Companies that fail to keep up with technological advancements may find themselves at a competitive disadvantag

➣Industry Factors Influencing the Market

➣Global Trade Policies:

• Tariffs and trade policies, especially in major producing regions like China and the U.S., can impact the global distribution of C5 fractions. Policies that restrict imports or exports may affect pricing and availability in certain markets.

➣R&D Investment:

• Increased investment in research and development to create high-performance and low-impact environmental products will be key for market players to stay competitive. Companies that focus on innovation in bio-based or recycled C5 fractions will likely lead the charge in the coming years.

➣Public Perception and Reputation:

• Consumer attitudes toward petrochemical industries and their environmental impact are shifting. Companies that take proactive steps in corporate social responsibility (CSR), such as investing in sustainability and greener production processes, may benefit from improved public perception and loyalty.

➣Strategic Insights and Future Outlook

➣Market Opportunities:

• Expansion of C5 fraction use in bio-based applications offers new growth potential.

• Growth in automotive and construction sectors is expected to drive demand for

• C5 fractions used in tires, adhesives, and rubbers.

• Increased investment in green chemistry technologies could create opportunities for more sustainable C5 fraction production

➣Challenges:

• Environmental concerns around petrochemical production processes could lead to stricter regulations.

• Price fluctuations in crude oil and natural gas could affect the cost and availability of C5 fractions

• Future Outlook: The C5 fraction market is expected to continue its upward trajectory, fueled by technological innovations, regional expansions, and an increasing focus on sustainability. The market is poised for further development, especially in the Asia-Pacific region, and companies that adapt to the changing regulatory and market dynamics will likely lead in this competitive space.

➣Key Reasons to Invest in This Report

• Comprehensive Market Data: In-depth analysis of historical, current, and projected market size.

• Competitive Landscape Insights: Understand the market positions, strategies, and recent developments of key players.

• Geographic Trends: Discover which regions are expected to experience the fastest growth and why.

• Strategic Guidance: Gain insights on potential market opportunities and competitive strategies for sustained growth.

• Post-Sales Support: Enjoy access to six months of analyst support for further clarification and strategic assistance.

➣ For More Information or Query, Visit: https://www.24chemicalresearch.com/reports/173653/c5-fraction-market

Explore More Topics:

https://www.thailandindustrytimes.com/article/765703363-black-pellets-market-size-share-global-outlook-and-forecast-2024-2030

https://www.24chemicalresearch.com/reports/285566/europe-matting-agents-for-paint-coating-forecast-market-2025-2030-184

https://www.24chemicalresearch.com/reports/285542/europe-powder-coating-additives-forecast-market-2025-2030-875

https://www.24chemicalresearch.com/reports/285541/europe-wood-furniture-paint-additives-forecast-market-2025-2030-996

https://www.24chemicalresearch.com/reports/281409/united-states-polycarbonate-film-market-2024-2030-781

https://www.24chemicalresearch.com/reports/281410/united-states-polyetheramide-market-2024-2030-3

https://www.24chemicalresearch.com/reports/281411/united-states-polyethylene-glycol-market-2024-2030-372

CONTACT US: City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, India 411014 International: +1(332) 2424 294 Asia: +91 9169162030

24chemicalresearch was founded in 2015 and has quickly established itself as a leader in the chemical industry segment, delivering comprehensive market research reports to clients. Our reports have consistently provided valuable insights, aiding our clients, including over 30 Fortune 500 companies, in achieving significant business growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release C5 Fraction Market, Global Outlook and Forecast 2025-2032 here

News-ID: 3809244 • Views: …

More Releases from 24chemicalresearch

Molded Fiber Pulp Packaging for Food market 2026-2034: Pathways to Innovation & …

Global Molded Fiber Pulp Packaging for Food market demonstrates robust expansion, valued at USD 2.25 billionin 2026 with projections indicating growth to USD 3.80 billion by 2034, reflecting a 6.0% CAGR. This sustainable packaging solution gains traction as food manufacturers and retailers prioritize eco-friendly alternatives to plastic, driven by regulatory pressures and shifting consumer preferences.

Molded fiber pulp packaging, manufactured from recycled paperboard or agricultural byproducts, offers superior biodegradability and cushioning…

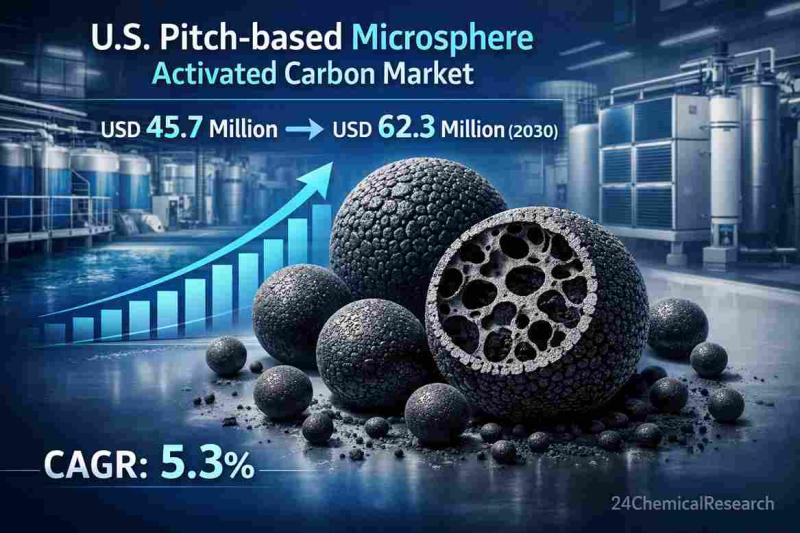

Is the global Pitch-based Microsphere Activated Carbon market growing rapidly an …

The United States Pitch-based Microsphere Activated Carbon market was valued at USD 45.7million in 2026 and is projected to reach USD 62.3 million by 2032, growing at a CAGR of 5.3 % during the forecast period. This specialized adsorbent material - featuring spherical particles with controlled pore structures - continues gaining traction across high-performance purification applications where standard granular activated carbon falls short.

Pitch-based microsphere activated carbon demonstrates superior performance in…

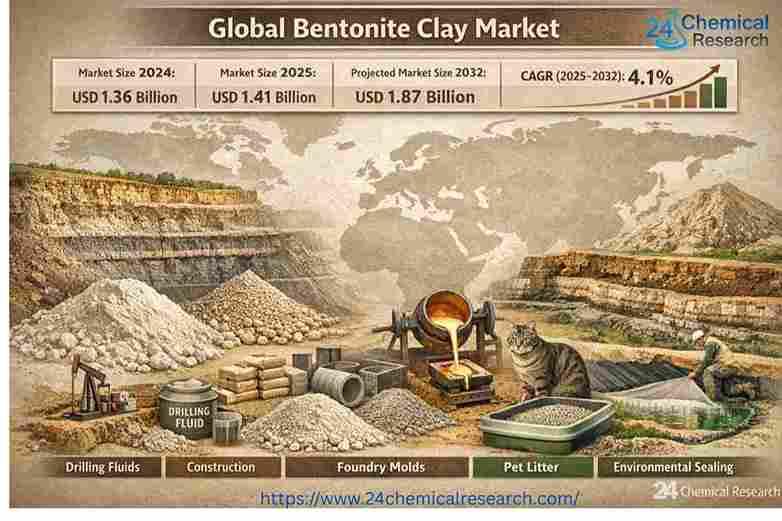

Global Bentonite Clay Market Poised for Steady Growth, Projected to Reach USD 1. …

Driven by construction boom and environmental applications, the versatile mineral market exhibits resilience and innovation amid challenges.

Global bentonite clay market, valued at USD 1.36 billion in 2024, is on a trajectory of consistent expansion, according to the latest comprehensive analysis by 24chemicalresearch. The market is projected to grow at aCAGR of 4.1%, reaching an estimated USD 1.41 billion in 2025 and USD 1.87 billion by 2032.

This growth underscores the enduring…

Global Ammonium Bicarbonate Market Report 2025-2032: Industry Size, Share & Stra …

Global Ammonium Bicarbonate Market continues to demonstrate stable demand across multiple industries, with its valuation reaching USD 1.23 billion in 2023. According to the latest industry analysis, the market is projected to decline to USD 800 million by 2029, exhibiting a CAGR of -6.90% during the forecast period. This contraction is attributed to regulatory shifts in Western markets, while Asia-Pacific continues to dominate consumption due to strong agricultural and food…

More Releases for Fraction

Butter Fat Fraction Market - Strategy Analysis Report

The global Butter Fat Fraction Market is gaining notable momentum as evolving consumer preferences, advancements in dairy processing, and expanding food applications continue to reshape the dairy ingredients landscape. Butter fat fraction, derived through controlled fractionation of milk fat, is increasingly valued for its functional properties, refined texture, and ability to enhance flavor profiles across a wide range of food products. As food manufacturers and processors focus on quality, performance,…

Industrial Fat Fraction Market Size 2024 to 2031.

Market Overview and Report Coverage

|KEYWORD | is a term used to describe the process of separating fats or oils into different fractions based on their melting points and other properties. This allows for the production of various fat and oil products with different characteristics and applications.

The Industrial Fat Fraction Market is expected to experience steady growth in the coming years, with a compound annual growth rate (CAGR) of…

Butter Fat Fraction Market Size 2024 to 2031.

Market Overview and Report Coverage

Butter fat fraction refers to the separation of different components of butter fat based on their melting points, leading to the creation of specific fractions with unique characteristics and applications in the food industry. The market for butter fat fraction is expected to experience significant growth in the coming years, with a projected CAGR of 8.50% during the forecasted period.

Key factors driving this growth…

Digital Inclination to drive the Plasma Fraction Market

The Plasma Fraction Market is slated to witness exponentiation going forward. The IoMT (Internet-of-Medical-Things) is already transforming every walk of life, including healthcare. Healthcare IT has let both - patients and doctors carry/download information about each other anywhere and anytime through their smartphones/tabs. In other words, more connectivity translates to better access to data, thereby rendering better healthcare for patients. This would be the future of the healthcare vertical in…

The Irrevocable Innovation To Drive The Butter Fat Fraction Market

A new report published by the Persistence Market Research, titled 'Butter Fat Fraction Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2018 - 2028', projects that the butter fat fraction market is expected to reach US$ 101.3 Mn in terms of market value by the end of 2018 (estimated year). The butter fraction market is forecasted to reach US$ 209 Mn by the end of 2028 (forecast…

Stromal Vascular Fraction Market

Prevalence of knee osteoarthritis is expected to provide a significant opportunity to the new class cell therapies to penetrate the market. Moreover, soaring demand for reconstructive breast therapies are also estimated to fuel the market in near future. Among all the clinical trials being conducted for stromal vascular fraction therapeutics, breast reconstruction procedures have reported highest proportion and outcomes for it to appear promising, as per the research conducted by…