Press release

Packaging Automation Market Size, Growth and Industry Trends (2023-2032)

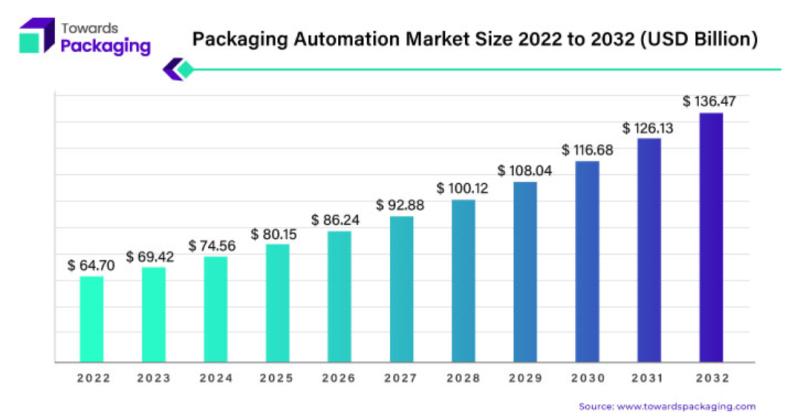

The global packaging automation market is on the brink of a significant transformation, driven by rapid technological advancements, shifting consumer preferences, and the demand for efficiency and sustainability. Estimated to grow from USD 64.70 billion in 2022 to an impressive USD 136.47 billion by 2032, the sector is set to expand at a robust compound annual growth rate (CAGR) of 7.8% over the forecast period.Download Statistical Data: https://www.towardspackaging.com/download-statistics/5135

A Snapshot of the Market

The packaging automation industry has witnessed remarkable progress in recent years, becoming an indispensable component of the global packaging ecosystem. Automation solutions such as robotic packaging systems, filling machines, and software platforms are revolutionizing workflows by enabling faster, more accurate, and cost-effective packaging processes. These innovations are critical for addressing evolving market demands, ensuring high product quality, and minimizing operational inefficiencies.

Regional Dynamics: A Competitive Landscape

• North America: Leading the global market, North America continues to dominate the packaging automation landscape. The region's well-established industrial base, coupled with its focus on adopting advanced technologies, positions it as a key player in driving automation across industries such as food, beverage, and healthcare.

• Asia Pacific: Emerging as a powerhouse in the packaging automation industry, Asia Pacific is experiencing substantial growth. This expansion is fueled by a burgeoning manufacturing sector, rising consumer demand, and investments in modernizing production facilities.

Industry Trends Shaping the Future

• Technological Innovations: Advanced robotic systems, artificial intelligence, and machine learning are reshaping the way businesses approach packaging. These technologies reduce human error, improve accuracy, and enhance efficiency, giving companies a competitive edge.

• Sustainability in Focus: With growing awareness of environmental issues, manufacturers are increasingly integrating eco-friendly practices into their packaging automation processes. Solutions that optimize resource utilization and reduce waste are gaining traction, helping businesses meet sustainability goals while appealing to environmentally conscious consumers.

• Sector-Specific Advancements:

Food and Beverage: Automation is proving transformative in this sector, ensuring product safety, extending shelf life, and optimizing packaging for perishable items.

Retail: The retail industry's growth, fueled by e-commerce and consumer preferences for customized packaging, is driving demand for innovative automation solutions.

The Role of Industry Leaders

Prominent companies in the packaging automation sector are investing heavily in research and development to create bespoke solutions tailored to industry-specific requirements. Their efforts are paving the way for continuous innovation and growth in the market.

One notable example is SEE's introduction of the CRYOVAC Brand Vertical Form-Fill-Seal System in November 2023. This automated liquid packaging system exemplifies the industry's focus on innovation and efficiency, offering solutions designed to optimize operations while maintaining sustainability standards.

Why Automation Matters

In today's competitive business landscape, packaging automation is more than a trend-it's a necessity. By adopting these technologies, companies can:

• Minimize labor costs.

• Improve production speed and accuracy.

• Enhance product quality.

• Align with sustainability goals.

Asia Pacific: The Powerhouse Behind the Global Packaging Automation Industry

The Asia Pacific region has firmly established itself as the powerhouse of the global packaging automation market, fueled by rapid industrialization, economic expansion, and a surge in demand for automation technologies. With a diverse and expansive manufacturing base spanning key sectors such as electronics, automotive, food and beverage, and pharmaceuticals, the region has become the epicenter for the adoption of automated packaging solutions.

The Rise of Asia Pacific's Industrial Giants

The Asia Pacific region is home to some of the largest and most influential economies in the world, including China, India, Japan, and South Korea. These countries are at the forefront of a manufacturing revolution that has been marked by increased industrial production, technological innovation, and a shift toward automation to stay competitive in a globalized market.

• China, the world's largest economy, has witnessed an explosion in demand for packaging automation solutions. With its vast manufacturing sector, China is both the largest consumer and producer of industrial robots. By 2022, China had installed a staggering 290,258 units of industrial robots, making it the largest robot market globally. This immense demand is not just due to the size of China's market, but also the country's strategic push toward automating key industries such as electronics, consumer goods, and food production. To meet this demand, both domestic and international robot manufacturers are rapidly increasing their production capacities within China.

• Japan, a global leader in robotics and automation, continues to play a pivotal role in shaping the packaging automation landscape. The country's robot installations grew by 9% in 2022, surpassing pre-pandemic levels. Japan remains the dominant force in robot manufacturing, accounting for nearly 46% of the world's industrial robot production. The Japanese manufacturing sector is widely recognized for its high-tech sophistication and its early adoption of automation across various industries, making it a global benchmark in packaging and manufacturing efficiency.

• South Korea has also become an important player in the global robotics market. Although the country's growth rate in robot installations was modest in 2022, with only a 1% increase to 31,716 installations, it marks the second consecutive year of growth after a period of stagnation. South Korea's focus on high-tech industries such as automotive, electronics, and heavy machinery has driven the adoption of automation technologies, making it a key player in the Asia Pacific region.

Key Drivers Behind the Surge in Automation Demand

The surge in demand for packaging automation solutions in Asia Pacific can be attributed to several key drivers:

1. Industrialization and Economic Growth: The rapid industrialization of Asia Pacific's economies, particularly in countries like China and India, has driven an increasing need for efficient, scalable packaging solutions. As the region's manufacturing capabilities expand, companies are turning to automation to streamline production processes, reduce costs, and meet rising consumer demand for speed and consistency.

2. Manufacturing Modernization: In the face of intense global competition, manufacturers are turning to automation as a way to modernize their production lines. Automation technologies like robotics, filling machines, and intelligent packaging systems are crucial for maintaining competitiveness. The integration of automation helps companies improve throughput, accuracy, and overall production efficiency-key elements to thriving in a fast-paced global market.

3. Consumer Expectations: With the rise of e-commerce and increasingly discerning consumers, there is a growing demand for packaged products that are not only visually appealing but also convenient, safe, and eco-friendly. Packaging automation enables manufacturers to meet these expectations by offering fast and accurate packaging that maintains product quality while reducing costs and labor.

4. Technological Advancements: The evolution of automation technologies, such as collaborative robots (cobots), artificial intelligence (AI), and machine learning, has opened up new possibilities for packaging automation. These technologies enable manufacturers to optimize production lines, reduce human error, and adapt to rapidly changing consumer preferences and regulatory requirements.

Sector-Specific Growth in Packaging Automation

While the demand for packaging automation spans multiple industries, certain sectors in Asia Pacific are seeing more pronounced growth due to automation's ability to address unique industry challenges.

• Food and Beverage: The food and beverage sector in Asia Pacific has become a major driver of packaging automation, as companies seek to address the challenges of packaging perishable products, ensuring quality and safety, and meeting the growing demand for convenience. Automated packaging systems are critical for improving product shelf-life, reducing packaging waste, and meeting hygiene standards. With Asia Pacific being home to some of the largest food production markets globally, automation is expected to play a crucial role in optimizing production and packaging processes in this sector.

• Pharmaceuticals: Packaging automation is also increasingly important in the pharmaceutical industry, where stringent regulatory standards must be met. Automated packaging systems ensure the accurate labeling, sealing, and protection of pharmaceutical products, minimizing human error and improving production speed. The rising demand for over-the-counter (OTC) medications, as well as the expansion of healthcare in emerging economies, is further fueling the need for advanced packaging solutions.

• Electronics and Consumer Goods: The electronics industry is another sector where packaging automation is seeing rapid growth. As the demand for consumer electronics continues to rise in Asia Pacific, companies are turning to automation to handle the large-scale production and packaging of components such as mobile phones, computers, and televisions. Automated systems provide the necessary speed and precision to meet the tight deadlines of high-demand markets while ensuring the safe handling of delicate components.

Strategic Investments in the Region

In addition to organic growth driven by demand, strategic investments are also playing a significant role in the growth of packaging automation in Asia Pacific. Companies from around the world are looking to capitalize on the region's growth potential by establishing a presence and investing in local markets.

A notable example is SIG's acquisition of Pactiv Evergreen Inc.'s Asia Pacific Fresh business ("Evergreen Asia") for $335 million in January 2022. This acquisition is indicative of the growing importance of the Asia Pacific market for global packaging automation companies. SIG's investment reflects the company's commitment to expanding its footprint in a rapidly evolving market where automation and sustainability are becoming increasingly important.

Source: https://www.towardspackaging.com/insights/packaging-automation-market-sizing

Baner

Buy Premium Global Insight: https://www.towardspackaging.com/price/5135

Review the Full TOC for the Packaging Automation Market Report: https://www.towardspackaging.com/table-of-content/packaging-automation-market-sizing

Get the latest insights on packaging industry segmentation with our Annual Membership - https://www.towardspackaging.com/get-an-annual-membership

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

Towards Healthcare: https://www.towardshealthcare.com

Towards Automotive: https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Packaging Automation Market Size, Growth and Industry Trends (2023-2032) here

News-ID: 3808433 • Views: …

More Releases from Towards Packaging

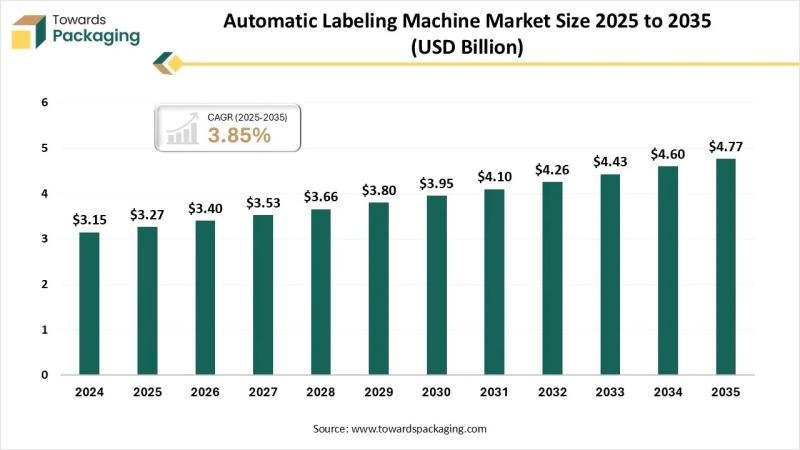

Automatic Labeling Machine Market Set for Strong Growth Through 2035

The global automatic labeling machine market is poised for steady expansion, rising from USD 3.4 billion in 2026 to USD 4.77 billion by 2035 at a CAGR of 3.85%. Demand is being driven by rapid automation in packaging lines, stringent labeling regulations, and the shift toward high-speed, error-free production across industries.

Download Sample: https://www.towardspackaging.com/download-sample/5882

Self-adhesive labeling systems currently hold the largest share at 39%, supported by their versatility and cost efficiency. Meanwhile,…

Unleashing Growth in the Liquid Packaging Market with Strategic Innovations

The liquid packaging industry is experiencing remarkable growth, with projections indicating an increase from USD 397.36 billion in 2025 to USD 645.43 billion by 2034. This growth, at a compound annual growth rate (CAGR) of 5.7%, signifies the expanding demand for liquid packaging solutions across a variety of sectors. As we delve into the market dynamics, it becomes clear that the liquid packaging sector is evolving rapidly, with several key…

Advancements in Hot-Fill Food Packaging Paving the Way for a Sustainable Future

The global hot-fill food packaging market is experiencing a steady rise, with an expected market value of USD 71.26 billion by 2033, up from USD 49.85 billion in 2023. This growth is projected to follow a compound annual growth rate (CAGR) of 3.76% from 2024 to 2033, reflecting the increasing demand for innovative packaging solutions in the food and beverage sector.

Download a Brochure of Hot-fill Food Packaging Market: https://www.towardspackaging.com/download-brochure/5266

Hot-Fill…

Driving Growth and Innovation in the Plastic Bag Market

The plastic bag market is undergoing significant growth, with its value reaching an estimated US$ 25.10 billion in 2023. Projections suggest that this market could hit a substantial US$ 35.41 billion by 2033, marking a steady compound annual growth rate (CAGR) of 3.5% from 2024 to 2034. This growth is largely driven by the expanding needs of various industries for efficient and cost-effective packaging solutions.

Download a Brochure of Plastic Bag…

More Releases for Asia

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

South East Asia Business Jet Market And Top Key Players are Asia Corporate Jet, …

By 2022, the South East Asia Business Jet Markets estimated to reach US$ XX Mn, up from US$ XX Mn in 2016, growing at a CAGR of XX% during the forecast period. The Global Business Jet Market, currently at 21 million USD, contributes the highest share in the market and is poised to grow at the fastest rate in the future. The three broad categories of business jets are Small,…

LIXIL Asia Presents Asia Pacific Property Awards

Through its power brands GROHE and American Standard, LIXIL Asia signs a three-year deal to become the Headline Sponsor of the Asia Pacific Property Awards from 2019 until 2022.

23rd January 2019: The International Property Awards, first established in 1993, are open to residential and commercial property professionals from around the globe. They celebrate the highest levels of achievement by companies operating within the architecture, interior design, real estate and property…

PEOPLEWAVE WINS ASIA TECH PODCAST PITCHDECK ASIA 2019 AWARDS

15 January 2019, Singapore – Peoplewave, Asia’s leading data-driven HR technology company, won the Asia Tech Podcast (ATP) Pitchdeck Asia 2019 Awards, being awarded “Startup Most Likely to Succeed in 2019".

The 2019 Pitchdeck Asia Awards is an opportunity for the Asian Startup Ecosystem to shine a spotlight on some of its best startups. The awards were decided by a public vote. More than 7,200 votes were cast by registered LinkedIn…

Undersea Defence Technology Asia, UDT Asia 2011

Latest Military Diving Technologies featured in UDT Asia

Equipping Asia’s navies with the latest diving technology for asymmetric warfare and

operations

SINGAPORE, 17 October 2011 - Naval diving and underwater special operations is a field that is

seeing increased attention and investment amongst navies in Asia. Units such as the Indonesian Navy‟s KOPASKA, the Republic of Singapore Navy‟s Naval Diving Unit (NDU), the Royal Malaysian Navy‟s PASKAL are increasingly utilising specialised equipment for conducting…

Asia Diligence – Specialist Investigative Due Diligence for Asia & Beyond

Asia Diligence today announced the opening of its European Customer Services office in the United Kingdom. The office is to be managed by Steve Fowler and will focus on providing services to Asia Diligence’s European customers. Asia Diligence is also planning to open a US office in the near future, which will provide customer service to its US and North American clients.

Asked to comment on the move, Luke Palmer, the…