Press release

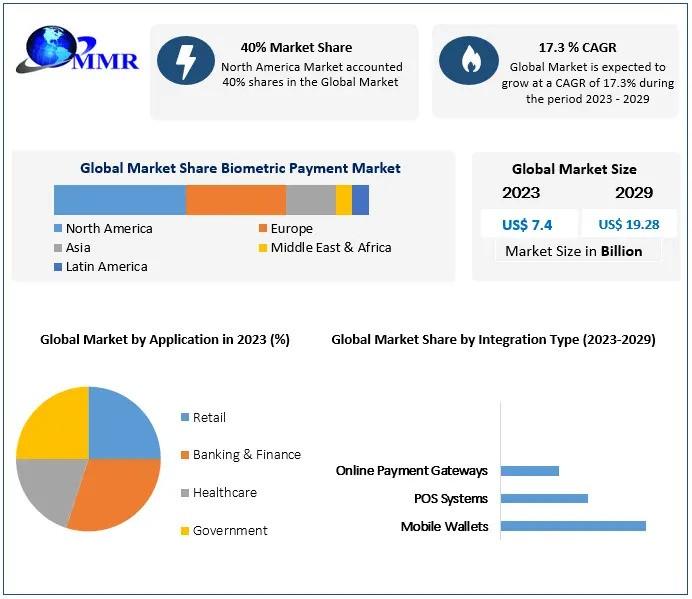

Biometric Payment Market Set to Redefine Digital Transactions, Projected to Reach USD 19.28 Billion by 2029

𝐁𝐢𝐨𝐦𝐞𝐭𝐫𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 was valued at USD 7.4 billion in 2022 and is projected to reach USD 19.28 billion by 2029, growing at a CAGR of 17.3% during the forecast period.𝐁𝐢𝐨𝐦𝐞𝐭𝐫𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

The biometric payment market is transforming the global payment ecosystem by offering seamless, secure, and efficient transaction solutions. Biometric authentication leverages unique physiological or behavioral traits, such as fingerprints, facial recognition, or iris scans, to verify identities, ensuring heightened security and reduced fraud. The market's rapid growth is fueled by the increasing adoption of digital payments and the rising concerns over data breaches in traditional payment systems. Additionally, the proliferation of smartphones and wearable devices with built-in biometric sensors has made biometric payment systems more accessible to consumers. Governments and financial institutions worldwide are investing in biometric technology to enhance security measures, further propelling the market. Emerging economies are embracing these systems due to the increasing penetration of digital wallets and contactless payment methods. As privacy concerns persist, advancements in encryption and data protection technologies are enhancing user trust. By 2030, the biometric payment market is expected to achieve significant growth, driven by its potential to revolutionize the way consumers interact with payment systems in both physical and online environments.

𝐆𝐞𝐭 𝐘𝐨𝐮𝐫 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐭𝐡𝐞 𝐋𝐚𝐭𝐞𝐬𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬: https://www.maximizemarketresearch.com/request-sample/190525/

𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐁𝐢𝐨𝐦𝐞𝐭𝐫𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭:

The biometric payment market is driven by key factors, including the increasing demand for secure and user-friendly payment solutions. Rising incidents of data breaches and identity theft have highlighted the limitations of traditional authentication methods like PINs and passwords. Biometric systems offer a more secure alternative, significantly reducing the risk of fraud and unauthorized access. The growing adoption of smartphones equipped with biometric sensors, such as fingerprint readers and facial recognition technology, has also played a pivotal role in driving market growth. In addition, the COVID-19 pandemic accelerated the adoption of contactless payment systems, with biometric authentication emerging as a preferred option for its convenience and hygiene benefits. Financial institutions and fintech companies are integrating biometric systems into their services to enhance customer experiences and comply with stringent regulatory requirements for payment security. Furthermore, advancements in artificial intelligence and machine learning are making biometric systems more accurate and reliable, expanding their applications across various sectors, including retail, healthcare, and e-commerce.

𝐁𝐢𝐨𝐦𝐞𝐭𝐫𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬:

The biometric payment market is witnessing several transformative trends that are shaping its future. One significant trend is the integration of multimodal biometric systems, which combine multiple biometric modalities such as fingerprints, facial recognition, and voice recognition to enhance security and usability. The adoption of biometric authentication in wearable devices, including smartwatches and fitness trackers, is also on the rise, enabling consumers to make payments conveniently on the go. Blockchain technology is being explored to secure biometric data, ensuring transparency and privacy in transactions. Additionally, biometric payment cards are gaining traction, offering a combination of traditional card features with fingerprint authentication for enhanced security. Another emerging trend is the adoption of behavioral biometrics, which analyze unique user behaviors such as typing patterns or mouse movements to authenticate identities. With the increasing digitization of economies and the expansion of e-commerce, biometric payment solutions are becoming indispensable for ensuring seamless and secure transactions, making this a rapidly evolving and highly competitive market.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐓𝐨𝐝𝐚𝐲 𝐟𝐨𝐫 𝐂𝐮𝐬𝐭𝐨𝐦 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬: https://www.maximizemarketresearch.com/inquiry-before-buying/190525/

𝐌𝐞𝐫𝐠𝐞𝐫𝐬 𝐚𝐧𝐝 𝐀𝐜𝐪𝐮𝐢𝐬𝐢𝐭𝐢𝐨𝐧𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐁𝐢𝐨𝐦𝐞𝐭𝐫𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭

𝐆𝐫𝐨𝐰𝐭𝐡 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 𝐢𝐧 𝐕𝐢𝐞𝐭𝐧𝐚𝐦

Vietnam's biometric payment market is experiencing rapid growth, fueled by increasing smartphone penetration and a shift towards digital payments. Government initiatives supporting cashless transactions have further propelled the adoption of biometric solutions. Vietcombank recently partnered with tech firms to integrate fingerprint and facial recognition technologies into its payment systems, enhancing security and user convenience.

𝐓𝐫𝐞𝐧𝐝𝐬 𝐢𝐧 𝐓𝐡𝐚𝐢𝐥𝐚𝐧𝐝

Thailand's biometric payment market is shaped by the rising adoption of contactless payment solutions. The government's "Thailand 4.0" initiative has encouraged businesses to adopt advanced technologies, including biometrics. SCB (Siam Commercial Bank) introduced facial recognition-enabled ATMs, offering a secure and user-friendly experience. Recent collaborations with fintech firms have expanded the biometric payment landscape in the country.

𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐲 𝐆𝐫𝐨𝐰𝐭𝐡 𝐢𝐧 𝐉𝐚𝐩𝐚𝐧

In Japan, the market for biometric payment systems is booming, driven by technological innovation and the demand for secure payment methods. Companies like NEC Corporation are at the forefront, introducing advanced facial recognition systems integrated with blockchain technology. The adoption of biometric payments in retail and transportation sectors is a notable trend, ensuring faster and safer transactions.

𝐂𝐨𝐧𝐬𝐨𝐥𝐢𝐝𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐒𝐨𝐮𝐭𝐡 𝐊𝐨𝐫𝐞𝐚

South Korea's biometric payment market is marked by significant consolidation, with leading companies investing in mergers and acquisitions to strengthen their market positions. Samsung Electronics, a key player, has integrated fingerprint and iris recognition in its payment platform, Samsung Pay. Recent collaborations between banks and tech firms have accelerated the adoption of biometric payment systems.

𝐔𝐩𝐝𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐒𝐢𝐧𝐠𝐚𝐩𝐨𝐫𝐞

Singapore's biometric payment market is evolving with the introduction of innovative solutions catering to its tech-savvy population. The government's Smart Nation initiative has fostered the adoption of biometric authentication in various sectors. DBS Bank recently launched face recognition-enabled banking services, enhancing the customer experience. These advancements highlight the market's growth potential.

𝐁𝐢𝐨𝐦𝐞𝐭𝐫𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐫𝐨𝐰𝐭𝐡 𝐢𝐧 𝐭𝐡𝐞 𝐔𝐒

The US market is leading in the adoption of biometric payment systems, driven by technological advancements and a growing preference for secure payment methods. Companies like Apple and Google have integrated biometric authentication into their payment platforms, Apple Pay and Google Pay, respectively. The increasing number of partnerships between banks and tech firms is boosting market growth.

𝐓𝐫𝐞𝐧𝐝𝐬 𝐢𝐧 𝐄𝐮𝐫𝐨𝐩𝐞

Europe's biometric payment market is characterized by a strong focus on security and privacy, in line with GDPR regulations. Companies like Gemalto are developing biometric payment cards with integrated fingerprint scanners. The retail sector's growing demand for contactless payment solutions has further fueled the adoption of biometrics across the region.

𝐂𝐮𝐫𝐢𝐨𝐮𝐬 𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬? 𝐆𝐫𝐚𝐛 𝐘𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐓𝐨𝐝𝐚𝐲: https://www.maximizemarketresearch.com/request-sample/190525/

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐁𝐢𝐨𝐦𝐞𝐭𝐫𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭:

by Biometric Mode

1. Fingerprint Recognition

2. Facial Recognition

3. Voice Recognition

4. Iris Scans

by Application

1. Retail

2. Banking And Finance

3. Healthcare

4. Transportation

5. Government

by End-User

1. Individual Consumers

2. Businesses

3. Government Institutions

by Integration Type

1. Mobile Wallets

2. Point-Of-Sale (Pos) Systems

3. Online Payment Gateways

𝐖𝐡𝐨 𝐢𝐬 𝐭𝐡𝐞 𝐥𝐚𝐫𝐠𝐞𝐬𝐭 𝐦𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐞𝐫𝐬 𝐨𝐟 𝐁𝐢𝐨𝐦𝐞𝐭𝐫𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐰𝐨𝐫𝐥𝐝𝐰𝐢𝐝𝐞?

North America:

1. Apple Inc. (United States)

2. Google LLC (United States)

3. Mastercard Incorporated (United States)

4. Visa Inc. (United States)

5. PayPal Holdings, Inc. (United States)

Europe:

6. IDEMIA (France)

7. Gemalto (Netherlands)

8. Fingerprint Cards AB (Sweden)

9. Verifone Systems, Inc. (Republic of Ireland)

10. Payconiq International SA (Luxembourg)

Asia Pacific:

11. Alibaba Group Holding Limited (China)

12. Samsung Electronics Co., Ltd. (South Korea)

13. Tencent Holdings Limited (China)

14. Paytm (India)

15. Ant Group (China)

Latin America:

16. MercadoPago (Argentina)

17. PagSeguro Digital Ltd. (Brazil)

18. StoneCo Ltd. (Brazil)

19. Cielo S.A. (Brazil)

20. Rappi (Colombia)

Middle East and Africa:

21. Network International Holdings plc (United Arab Emirates)

22. PayTabs (Saudi Arabia)

23. Mada (Saudi Arabia)

24. Emerging Markets Payments (EMP) Africa (Egypt)

25. iVeri Payment Technologies (South Africa)

𝐊𝐧𝐨𝐰 𝐌𝐨𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐓𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.maximizemarketresearch.com/market-report/biometric-payment-market/190525/

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐌𝐨𝐫𝐞: 𝐕𝐢𝐬𝐢𝐭 𝐎𝐮𝐫 𝐖𝐞𝐛𝐬𝐢𝐭𝐞 𝐟𝐨𝐫 𝐀𝐝𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

♦Educational Toy Market https://www.maximizemarketresearch.com/market-report/educational-toy-market/147976/

♦Luxury Fashion Market https://www.maximizemarketresearch.com/market-report/luxury-fashion-market/126250/

♦Nuclear Medicine Market https://www.maximizemarketresearch.com/market-report/global-nuclear-medicine-market/98418/

♦Global Automotive Seats Market https://www.maximizemarketresearch.com/market-report/global-automotive-seats-market/79367/

♦Cyber Security in BFSI Market https://www.maximizemarketresearch.com/market-report/cyber-security-in-bfsi-market-global-market/169820/

♦Automotive Airbag Market https://www.maximizemarketresearch.com/market-report/automotive-airbag-market/11119/

♦Insights-as-a-Service Market https://www.maximizemarketresearch.com/market-report/global-insights-as-a-service-market/25221/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

Maximize Market Research is a rapidly expanding market research and business consulting firm with a global presence. Renowned for our growth-oriented strategies and impactful research insights, we proudly serve a significant portion of Fortune 500 companies. With a versatile portfolio, we cater to a wide range of industries, including Information Technology, Telecommunications, Chemicals, Food & Beverages, Aerospace & Defense, Healthcare, and many more. Our commitment to delivering actionable solutions drives success for businesses worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Biometric Payment Market Set to Redefine Digital Transactions, Projected to Reach USD 19.28 Billion by 2029 here

News-ID: 3808339 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Procurement Software Market Forecast: Automation, Analytics and Cloud Adoption

Procurement Software Market size was valued at USD 8.18 billion in 2024, and the total revenue is expected to grow at CAGR of 10.8 % from 2025 to 2032, reaching nearly USD 18.58 billion.

Procurement Software Market Overview:

The procurement software market is a core component of enterprise digital transformation, enabling organizations to automate, standardize, and optimize purchasing activities across goods and services. Procurement software solutions support functions such as supplier discovery,…

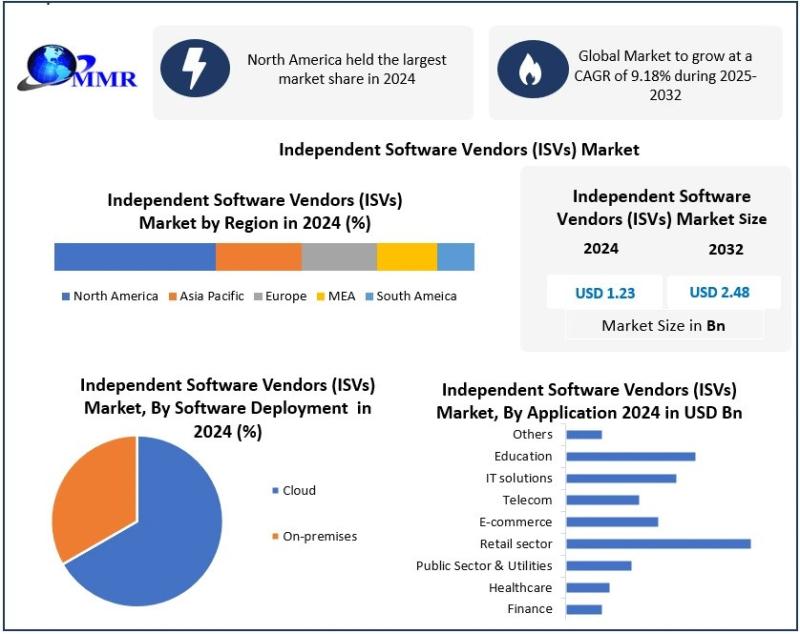

What Is Driving Growth in the Independent Software Vendors (ISVs) Market?

Independent Software Vendors (ISVs) Market was valued at USD 1.23 Bn in 2024, and total global Independent Software Vendors (ISVs) Market revenue is expected to grow at a CAGR of 9.18% and reach nearly USD 2.48 Bn from 2025 to 2032. Driven by Rising Demand for Multi-cloud & Hybrid Cloud.

Independent Software Vendors (ISVs) Market Overview:

The Independent Software Vendors (ISVs) market represents a critical layer of the global software ecosystem, delivering…

India Lighting Market Analysis: Industry Dynamics and Growth Forecast

India Lighting Market size was valued at USD 4139.2 Million in 2024 and the total India Lighting Market size is expected to grow at a CAGR of 7.1% from 2025 to 2032, reaching nearly USD 7674 Million by 2032.

India Lighting Market Overview:

The India lighting market is a rapidly evolving sector driven by urbanization, infrastructure expansion, and the transition toward energy-efficient illumination solutions. Lighting demand spans residential, commercial, industrial, and outdoor…

Custom Software Development Services Market Forecast: Cloud, AI and DevOps Trend …

Agricultural Waste Market size was valued at USD 20.20 Billion in 2025 and the total Agricultural Waste revenue is expected to grow at a CAGR of 7.20% from 2025 to 2032, reaching nearly USD 32.86 Billion by 2032.

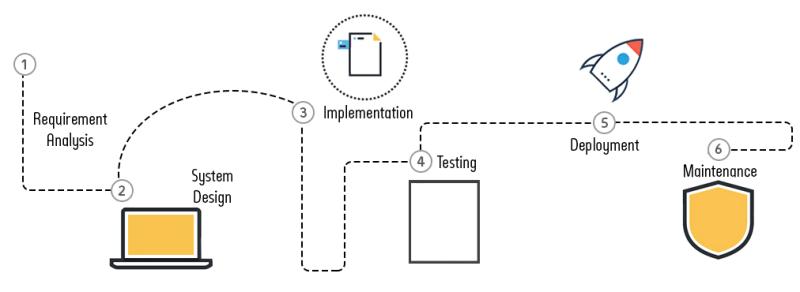

Custom Software Development Services Market Overview:

The custom software development services market plays a pivotal role in enabling enterprises to align digital systems with specific operational, regulatory, and customer-experience requirements. Unlike off-the-shelf solutions, custom…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…