Press release

Pharmaceutical Packaging Equipment Market Size, Trends and New Developments

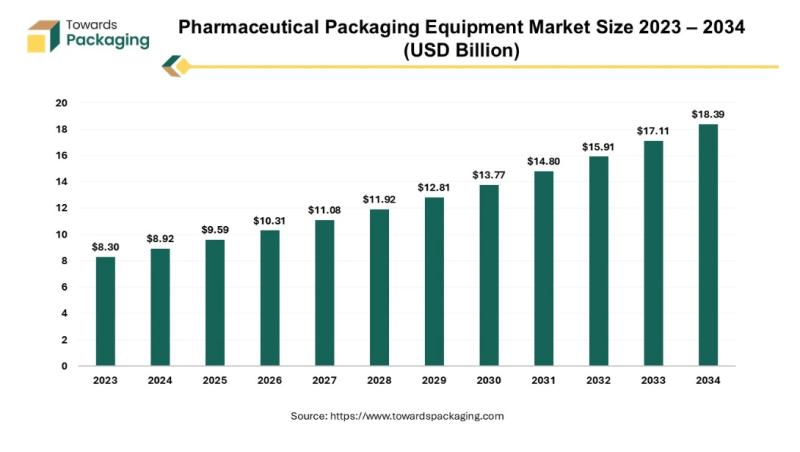

The global pharmaceutical packaging equipment market is experiencing robust growth, reflecting the increasing demand for safety, efficiency, and compliance within the healthcare sector. With an estimated value of USD 8.92 billion in 2024, the market is projected to soar to USD 18.39 billion by 2034, expanding at a compound annual growth rate (CAGR) of 7.5%. This growth signifies a thriving industry that plays a pivotal role in ensuring the integrity, safety, and effectiveness of pharmaceutical products from manufacturing to distribution.Download Statistical Data: https://www.towardspackaging.com/download-statistics/5159

A Booming Industry

The pharmaceutical packaging equipment sector is witnessing rapid expansion, driven by the increasing global need for efficient packaging solutions. The market size, valued at USD 7.76 billion in 2022, is forecast to grow significantly, reaching an estimated USD 15.92 billion by 2032. The sustained growth at a CAGR of 7.5% between 2023 and 2032 underscores the growing importance of this sector, which ensures that pharmaceutical products remain effective and safe throughout the supply chain.

North America is expected to play a major role in this growth, with the pharmaceutical packaging equipment industry in the region expanding swiftly. The Asia-Pacific region also contributes significantly to this upward trend, marking its presence as a key player in the global market. These developments reflect a heightened demand for advanced packaging solutions that cater to diverse pharmaceutical needs across regions.

The Role of Pharmaceutical Packaging Equipment

Pharmaceutical packaging equipment encompasses a wide array of machinery and tools essential to the creation of secure, effective packages for drugs. Using heat-sealable and flexible materials, this equipment forms packages that are filled with pharmaceutical products and then sealed to ensure they remain free from contamination or damage during distribution.

This specialized packaging ensures that pharmaceutical products maintain their safety, efficacy, and integrity at every stage of the supply chain. Given the critical nature of the pharmaceutical industry, it is essential that these products are packaged with the highest standards of care, as improper packaging can lead to contamination, ineffective dosages, and compliance issues.

Modern pharmaceutical packaging equipment includes a variety of machines such as sealers, label applicators, case packers, hand packing stations, and hard film overwrappers. These tools are designed to handle a diverse range of products, including solid tablets, liquids, and specialized dosage forms. Flexibility is a key feature of pharmaceutical packaging equipment, as it must be adaptable to different products with varying requirements. Liquid drugs, for instance, demand precise measurement, which necessitates packaging systems that can handle a wide array of formulations while ensuring accuracy and consistency in each dose.

Driving Forces Behind the Market's Growth

The pharmaceutical packaging equipment industry is being driven by several key factors, foremost among them being patient safety, product quality, and regulatory compliance. The demand for packaging systems that can meet the stringent requirements of pharmaceutical products is growing as the industry continues to innovate and adapt to new drug formulations and distribution methods. Packaging is no longer just about securing a product; it is an integral part of the product's safety and efficacy. With growing concerns about counterfeit drugs, packaging plays a vital role in ensuring the authenticity and integrity of pharmaceutical products.

Technological advancements in packaging equipment have made it possible to streamline the manufacturing and production processes for pharmaceuticals, improving efficiency and reducing human error. Automation has revolutionized packaging lines, increasing both speed and accuracy. Modern systems offer greater flexibility, which is crucial in meeting the rising demand for customized and specialized drugs. Whether packaging liquid medications, solid pills, or other specialized dosage forms, pharmaceutical packaging equipment must adapt to different needs while maintaining the highest levels of quality and compliance.

Innovations in Pharmaceutical Packaging Equipment

The growing trend of personalized medicine and the increasing demand for small-batch production have spurred the need for more adaptable packaging solutions. Pharmaceutical packaging equipment now must be capable of handling diverse product specifications, from intricate blister packs to specialized containers for biologics and other sensitive medications. This shift has led to the development of new technologies and equipment designed to meet these emerging needs.

One such innovation is the automated packaging system, which is significantly enhancing operational efficiency and reducing the margin for error in packaging processes. A notable example is Capsa Healthcare's introduction of the NexPak automated system in March 2024. This system automates the packaging of patient prescriptions, increasing both the accuracy of drug administration and the operational efficiency of pharmacies. By streamlining pharmacy operations, NexPak not only enhances the accuracy of patient drug administration but also improves the overall workflow, benefiting both pharmacies and patients alike.

Emerging Trends in Pharmaceutical Packaging Equipment: A Closer Look at Innovation and Sustainability

The pharmaceutical packaging industry is undergoing a remarkable transformation as it responds to the evolving needs of the healthcare sector. From advancements in automation to increasing demands for sustainability, the industry is adapting to meet the challenges posed by modern pharmaceutical production and distribution. Below, we explore some of the most notable trends shaping the future of pharmaceutical packaging equipment.

The Rise of Automation in Pharmaceutical Packaging

One of the most significant trends in the pharmaceutical packaging sector is the rapid adoption of automation. As pharmaceutical manufacturers strive to increase production speeds, reduce human error, and enhance operational efficiency, automation has become a crucial component of packaging lines. Equipment incorporating advanced technologies, such as machine learning, predictive maintenance, and real-time monitoring, is increasingly becoming standard.

These intelligent systems allow for more precise control over packaging processes, enabling manufacturers to optimize workflows and ensure that products are packaged quickly and safely. Predictive maintenance, in particular, helps minimize downtime by identifying potential equipment failures before they happen, ultimately boosting productivity and reducing costs. Furthermore, real-time monitoring provides manufacturers with detailed insights into each stage of the packaging process, enhancing overall efficiency and product quality. As automation continues to advance, pharmaceutical companies are not only improving speed and precision but also ensuring greater reliability in their packaging operations.

Growth in Vaccine and Biopharmaceutical Production Drives Packaging Demand

The pharmaceutical industry is witnessing a significant rise in the production of vaccines, biologics, and personalized medicines. This surge in demand is creating a parallel need for specialized packaging solutions that can safeguard the integrity and safety of these highly sensitive products. Unlike traditional pharmaceuticals, vaccines and biologics often require more complex packaging solutions due to their unique formulation, temperature sensitivity, and smaller batch sizes.

Packaging equipment is now being designed to accommodate these specific needs, particularly in managing cold chain requirements, which are essential for maintaining the efficacy of temperature-sensitive products. As the world turns to biologics and personalized medicine as key drivers of healthcare innovation, packaging solutions must evolve to meet the challenges posed by these advanced therapies. From packaging materials that ensure sterility to systems that manage complex formulations, pharmaceutical packaging equipment is becoming more specialized to support the production and distribution of these cutting-edge treatments.

A Shift Toward Eco-friendly and Sustainable Packaging

Environmental concerns are making a profound impact on the pharmaceutical packaging industry. In response to growing consumer and regulatory pressure, pharmaceutical companies are placing an increased emphasis on sustainability and reducing the environmental footprint of their packaging operations. As sustainability goals become more integral to corporate strategies, the demand for eco-friendly packaging solutions has risen sharply.

Pharmaceutical packaging equipment is now being developed with a focus on minimizing waste and utilizing biodegradable or recyclable materials. Manufacturers are exploring options such as compostable films, recyclable plastics, and plant-based materials as alternatives to traditional packaging materials. The industry is also looking at ways to reduce overall packaging volume, ensuring that materials are used efficiently without compromising the protection or safety of the product. These efforts are not only in line with global environmental goals but also contribute to the growing demand for products that align with the sustainability values of consumers and healthcare providers alike.

Serialization and Track & Trace Regulations: Ensuring Safety and Compliance

As the pharmaceutical industry becomes more globalized, regulatory requirements are becoming stricter, especially when it comes to the tracking and traceability of pharmaceutical products. To combat the rising threat of counterfeit drugs and ensure patient safety, governments worldwide are enforcing stringent regulations such as the U.S. Drug Supply Chain Security Act (DSCSA) and the European Union's Falsified Medicines Directive (FMD). These regulations mandate the use of serialization and track-and-trace systems to monitor the movement of pharmaceutical products throughout the supply chain.

Pharmaceutical packaging equipment is now increasingly integrated with serialization technology to comply with these regulations. The use of unique serial numbers and barcodes allows manufacturers to track the movement of drugs from production through to distribution and even to the end consumer. This not only helps prevent counterfeiting but also provides valuable data that enhances product safety and facilitates recalls when necessary. Serialization and track-and-trace systems are becoming critical components of pharmaceutical packaging, ensuring that products can be accurately monitored and their authenticity verified at every stage of the supply chain.

The Emergence of Smart Packaging

The rise of digital technologies is ushering in a new era of smart packaging in the pharmaceutical sector. Smart packaging solutions are equipped with technologies such as RFID tags, QR codes, and temperature sensors, which provide real-time data on the condition, location, and status of pharmaceutical products. This innovation is particularly relevant for high-value or temperature-sensitive drugs, such as biologics, vaccines, and other life-saving therapies.

RFID tags and QR codes allow consumers, healthcare providers, and regulatory authorities to access product information instantly, ensuring transparency and traceability. Temperature sensors, meanwhile, provide crucial data about whether products have been stored within the required temperature ranges, which is essential for maintaining the efficacy of sensitive medications. As pharmaceutical manufacturers and distributors seek to optimize supply chains and ensure product quality, the integration of smart packaging will continue to grow. These systems not only enhance safety but also improve the overall customer experience by offering real-time visibility into product conditions.

The Demand for Sterile and Single-use Packaging Solutions

Another notable trend in the pharmaceutical packaging industry is the growing demand for sterile and single-use packaging solutions, particularly in the context of biologics and parenteral products. These products, which are administered through injection or infusion, require packaging that ensures sterility and prevents contamination. Single-use packaging solutions are increasingly favored because they eliminate the risk of cross-contamination and often reduce the need for additional sterilization procedures.

Sterile packaging technologies are designed to preserve the integrity of biologic drugs by creating an airtight seal that prevents contamination during the handling and transportation process. The rise in chronic diseases and an aging population, combined with an increased focus on biologics and gene therapies, has made sterile packaging even more critical. As the healthcare landscape continues to shift toward biologics, the demand for single-use, sterile packaging solutions is expected to rise significantly.

Driving Forces Behind the Pharmaceutical Packaging Equipment Market's Growth

As the pharmaceutical industry continues to innovate and expand, the demand for packaging equipment tailored to the latest drug delivery systems, increased production needs, and changing regulatory landscapes is rapidly evolving. In particular, the rise of biologics, vaccines, injectables, and other advanced drug delivery systems is spurring the need for specialized packaging solutions. These trends are not only reshaping the way packaging equipment is designed but also creating substantial growth opportunities for manufacturers in the pharmaceutical packaging sector.

Innovation in Drug Delivery Systems: A Major Market Driver

The rapid development of new drug delivery systems, including vaccines, biologics, and injectables, has placed a significant emphasis on the need for highly specialized packaging equipment. These products require precision in both packaging and handling to ensure that they maintain their efficacy, safety, and integrity throughout the supply chain.

A prime example of this innovation is the introduction of Evonik Industries AG's latest product in September 2024. The company launched a new functional, ready-to-fill capsule as part of its EUDRACAP line. This capsule is designed to deliver sensitive active ingredients directly to the ileo-colonic region, making it especially suitable for live biotherapeutic products (LBPs). This innovation caters to the growing demand for more advanced drug delivery solutions, providing a unique example of how specialized packaging machinery is key to supporting new and emerging drug formulations.

The Expansion of the Pharmaceutical Industry in Emerging Markets

The rapid growth of the pharmaceutical industry in emerging markets, particularly in regions like Asia-Pacific and Latin America, is driving an increased demand for cost-effective, high-quality pharmaceutical packaging equipment. These regions are seeing robust market growth due to increased healthcare investments and rising healthcare needs driven by population growth, aging demographics, and an expanding middle class.

In June 2024, a noteworthy collaboration between NC Health Ventures and Verily, a precision health technology company, led to the formation of Exolvo Biosciences, a biotech startup focused on next-generation biologic medication delivery. Exolvo's innovation centers on modular, adaptable capsule designs that are capable of delivering a wide range of biologic medications efficiently. This trend toward greater customization and flexibility in packaging equipment is reflective of broader shifts within the pharmaceutical sector, especially as emerging markets seek packaging solutions that support the delivery of complex biologics and personalized medicines.

The Rapid Growth of North America's Pharmaceutical Packaging Equipment Industry

North America continues to play a dominant role in the global pharmaceutical packaging equipment market. This region is experiencing a surge in demand for packaging solutions driven by an aging population, an increase in chronic diseases, and the growing need for new and innovative medical treatments. As pharmaceutical companies work to meet stringent regulatory requirements-including serialization and tamper-resistant packaging-there has been a significant increase in investment in advanced packaging technologies.

Smart packaging, automation, and robotics are transforming North America's pharmaceutical packaging industry. These technologies not only improve efficiency but also reduce production costs, lower the risk of human error, and ensure regulatory compliance. As sustainability becomes an increasingly important factor, pharmaceutical companies in North America are also investing in eco-friendly and energy-efficient packaging solutions.

For instance, in May 2023, DWK Life Sciences, a global leader in laboratory glassware and packaging, acquired Assem-Pak, a U.S.-based company. This acquisition underscores the region's ongoing efforts to enhance its technological capabilities and stay ahead of packaging innovations.

Asia-Pacific's Growing Influence in the Pharmaceutical Packaging Sector

The Asia-Pacific (APAC) region is undergoing a rapid transformation, and the pharmaceutical packaging equipment market is reaping the rewards of this expansion. Nations such as China, India, and Japan are seeing heightened demand for specialized packaging solutions, driven by stringent regulatory standards designed to prevent counterfeit products and reduce errors in drug packaging. The rising healthcare needs in these countries are further intensifying the demand for advanced pharmaceutical packaging technologies.

India, for example, has become a global leader in pharmaceutical manufacturing, with over 10,500 manufacturing units and 3,000 drug companies. The Indian pharmaceutical market is projected to reach $132 billion by 2030, highlighting its growing influence on the global market. As India continues to expand its pharmaceutical sector, it will be increasingly important to meet the demand for innovative packaging solutions that ensure the safety and effectiveness of these products.

The Asia-Pacific region is also seeing a surge in the production of vaccines and COVID-19-related medications, which has further underscored the importance of packaging and labeling in ensuring the safe distribution of these essential drugs. With these developments, the region's pharmaceutical packaging equipment market is expected to continue its rapid growth trajectory.

Key Players and Competitive Dynamics in the Pharmaceutical Packaging Equipment Market

The pharmaceutical packaging equipment market is a highly competitive and evolving sector, dominated by well-established industry giants. Major players like Robert Bosch GmbH, MULTIVAC Group, Coesia S.P.A., Romaco Group, and Uhlmann Group continue to drive innovation, catering to the growing demand for efficient, compliant, and sustainable packaging solutions. These companies not only dominate the traditional manufacturing processes but are also engaging in strategic partnerships and acquisitions to strengthen their market presence and technological capabilities.

Robert Bosch GmbH: Innovating for Future Packaging Solutions

Robert Bosch GmbH, a leader in technological innovations, focuses on developing state-of-the-art packaging solutions designed to meet the ever-evolving demands of the pharmaceutical industry. Bosch's dedication to research and development has led to the introduction of advanced technologies, including automation and robotics, to improve productivity, reduce costs, and ensure regulatory compliance. Their solutions are known for their precision and ability to handle complex pharmaceutical packaging needs.

For instance, in December 2023, Pharmalucence Partners, a U.S.-based company, expanded its contract pharmaceutical manufacturing business by purchasing a filling line from Robert Bosch Packaging Technology. This acquisition underscores Bosch's role in providing top-tier equipment tailored to the needs of the pharmaceutical sector.

MULTIVAC: A Focus on Customization and Flexibility

MULTIVAC has earned its reputation by focusing on the adaptability and customization of its packaging equipment. The company works closely with pharmaceutical businesses to provide tailored packaging solutions that cater to specific manufacturing requirements and product specifications. MULTIVAC's solutions are designed to ensure that the packaging process aligns seamlessly with the pharmaceutical product's unique needs.

In December 2023, the company expanded its footprint with the official opening of its new production and sales facility in Ghiloth, India. This expansion reinforces MULTIVAC's commitment to delivering flexible and efficient packaging solutions, particularly to meet the growing demand in emerging markets.

Coesia S.P.A.: Leveraging Synergies for Comprehensive Solutions

Coesia S.P.A. employs a diversified approach to providing pharmaceutical packaging solutions, utilizing its subsidiaries' synergies to offer comprehensive packaging systems. With a strong emphasis on innovation, Coesia's strategy is rooted in leveraging its group's collective capabilities to cater to the diverse packaging needs of the pharmaceutical industry. Their range of solutions, from bottling to labeling and filling, ensures that pharmaceutical companies can meet the highest standards of quality and efficiency.

In February 2023, Coesia entered into a significant partnership with Oji Holdings Corporation, a leading player in the Japanese pulp and paper industry. This agreement underscores Coesia's commitment to driving technological advancements and expanding its global presence through strategic collaborations.

Romaco Group: Pioneering Performance and Differentiation

Romaco Group is known for its high-performance packaging and processing equipment tailored to the pharmaceutical industry. The company emphasizes innovation by integrating features like serialization and tamper-evident packaging to enhance security and regulatory compliance. Romaco's solutions are designed to address specific pharmaceutical challenges, offering products that provide clear differentiation in the marketplace.

A notable example of Romaco's growth came in March 2021 when it acquired STE Tecpharm, a leading Spanish producer of processing technology. By adding STE Tecpharm to its portfolio, Romaco strengthened its position as a provider of cutting-edge solutions for pharmaceutical processing and packaging.

Emerging Players and Innovations

Beyond the industry giants, the pharmaceutical packaging equipment market has witnessed the rise of smaller, upstart firms that leverage digital platforms to directly reach consumers and expand market share. These new entrants are emphasizing product innovation, sustainability, and the ability to respond rapidly to changing consumer preferences.

Noteworthy Companies in the Market

In addition to the leaders mentioned, a range of notable companies plays an integral role in shaping the market:

• ACG Worldwide

• Marchesini Group

• MULTIVAC Group

• Uhlmann Pac-Systeme

• Körber AG

• Romaco Group

• Optima Packaging Group

• Vanguard Pharmaceutical Equipment

• Bausch + Strobel Maschinenfabrik

These companies are not just focused on producing packaging machinery; they are also driving the industry forward by embracing automation, robotics, and sustainable practices. They invest heavily in research and development to stay ahead of the curve, producing solutions that cater to the increasing complexity of pharmaceutical packaging needs.

Latest Announcements by Industry Leaders

One significant development in the pharmaceutical packaging sector came in February 2024, when Aptar CSP Technologies, a division of AptarGroup, introduced ProActive Intelligence Moisture Protect (MP-1000) in partnership with ProAmpac, a leading flexible packaging supplier. This new packaging solution combines ProAmpac's flexible blown film technology with Aptar CSP's innovative 3-Phase Activ-Polymer technology. The result is a next-generation platform that absorbs moisture, ensuring the protection and preservation of pharmaceutical products, particularly those prone to degradation due to moisture.

Badre Hammond, General Manager of Aptar CSP Technologies, explained that the collaboration aims to revolutionize active packaging delivery, offering a flexible, multi-layer film solution. The goal is to reduce the risk of product degradation and enhance the overall potency and performance of pharmaceutical products.

Source: https://www.towardspackaging.com/insights/pharmaceutical-packaging-equipment-market-sizing

Baner

Buy Premium Global Insight: https://www.towardspackaging.com/price/5159

Review the Full TOC for the Pharmaceutical Packaging Equipment Market Report: https://www.towardspackaging.com/table-of-content/pharmaceutical-packaging-equipment-market-sizing

Get the latest insights on packaging industry segmentation with our Annual Membership - https://www.towardspackaging.com/get-an-annual-membership

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

Towards Healthcare: https://www.towardshealthcare.com

Towards Automotive: https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Pharmaceutical Packaging Equipment Market Size, Trends and New Developments here

News-ID: 3806932 • Views: …

More Releases from Towards Packaging

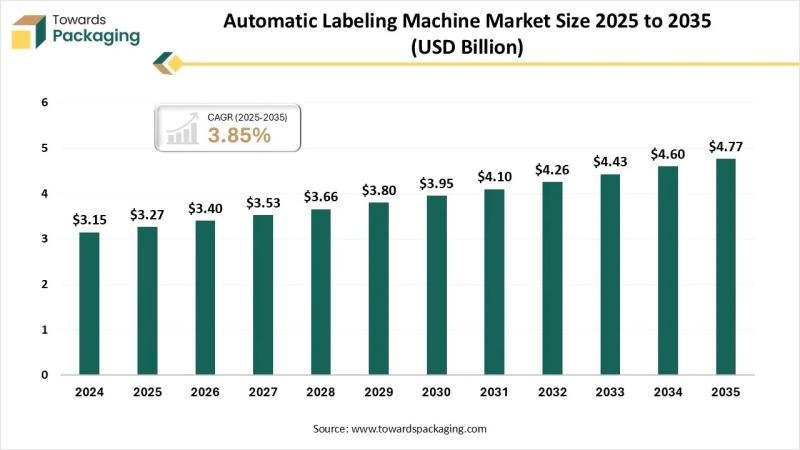

Automatic Labeling Machine Market Set for Strong Growth Through 2035

The global automatic labeling machine market is poised for steady expansion, rising from USD 3.4 billion in 2026 to USD 4.77 billion by 2035 at a CAGR of 3.85%. Demand is being driven by rapid automation in packaging lines, stringent labeling regulations, and the shift toward high-speed, error-free production across industries.

Download Sample: https://www.towardspackaging.com/download-sample/5882

Self-adhesive labeling systems currently hold the largest share at 39%, supported by their versatility and cost efficiency. Meanwhile,…

Unleashing Growth in the Liquid Packaging Market with Strategic Innovations

The liquid packaging industry is experiencing remarkable growth, with projections indicating an increase from USD 397.36 billion in 2025 to USD 645.43 billion by 2034. This growth, at a compound annual growth rate (CAGR) of 5.7%, signifies the expanding demand for liquid packaging solutions across a variety of sectors. As we delve into the market dynamics, it becomes clear that the liquid packaging sector is evolving rapidly, with several key…

Advancements in Hot-Fill Food Packaging Paving the Way for a Sustainable Future

The global hot-fill food packaging market is experiencing a steady rise, with an expected market value of USD 71.26 billion by 2033, up from USD 49.85 billion in 2023. This growth is projected to follow a compound annual growth rate (CAGR) of 3.76% from 2024 to 2033, reflecting the increasing demand for innovative packaging solutions in the food and beverage sector.

Download a Brochure of Hot-fill Food Packaging Market: https://www.towardspackaging.com/download-brochure/5266

Hot-Fill…

Driving Growth and Innovation in the Plastic Bag Market

The plastic bag market is undergoing significant growth, with its value reaching an estimated US$ 25.10 billion in 2023. Projections suggest that this market could hit a substantial US$ 35.41 billion by 2033, marking a steady compound annual growth rate (CAGR) of 3.5% from 2024 to 2034. This growth is largely driven by the expanding needs of various industries for efficient and cost-effective packaging solutions.

Download a Brochure of Plastic Bag…

More Releases for Pharmaceutical

Metronidazole Market 2023 Latest Innovations and Outlook By Players - Hongyuan P …

The Metronidazole Market 2023 study focuses on a global evaluation of information from the most recent market developments. The purpose of MarketsandResearch.biz is to offer the company's customers a comprehensive market overview to formulate development plans.

Designing of the report is done with the help of infographics, charts, and graphs. The report initially analyzes the various segments of the global Metronidazole market in a brief manner, which includes product types, applications.…

Hyperthyroidism Treatment Market Analytical Overview and Future | Merck, Herbran …

The Hyperthyroidism Treatment market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development…

Mevastatin Market Is Booming Worldwide |Zhejiang Hisun Pharmaceutical, Guangdong …

Global Mevastatin Market Size research report 2022 offers in-depth assessment of revenue growth, market definition, segmentation, industry potential, influential trends for understanding the future outlook and current prospects for the market. This study provides information about the sales and revenue during the historic and forecasted period of (2022 to 2028). Understanding the segments helps in identifying the importance of different factors that aid market growth. Estimations about the CAGR value for…

Global Specialty Pharmaceutical Market Driving Future Growth on Specialty Pharma …

Global Specialty Pharmaceutical Industry Synopsis:

The Specialty Pharmaceutical Market report provides a detailed analysis of this business space. The market is analyzed in terms of production as well as consumption. Based on the production aspect, the report includes particulars pertaining to the manufacturing processes of the product, alongside revenue and gross margins of the respective manufacturers.

The Global Specialty Pharmaceutical Market will reach xxx Million USD in 2020 with CAGR xx%…

Metronidazole Market to 2023 (+5% CAGR Expected) Top Player Profiles – Hongyua …

Metronidazole is an antibiotic and antiprotozoal medication, with the chemical formula C6H9N3O3 of can be used either alone or with other antibiotics to treat pelvic inflammatory disease, endocarditis, and bacterial vaginosis among others. Metronidazole is white crystalline powder, which can also be called as Fragyl Orvagil, Trichazol, Metronid, etc.

Get Sample Copy of this Report @ https://www.bigmarketresearch.com/request-sample/2724380?utm_source=Anil&utm_medium=OPR

Scope of the Report:

This report focuses on the Metronidazole in global market, especially in…

Metronidazole Market by Top Key Participant Hongyuan Pharmaceutical, Yinhe Aarti …

Metronidazole is an antibiotic and antiprotozoal medication, with the chemical formula C6H9N3O3 of can be used either alone or with other antibiotics to treat pelvic inflammatory disease, endocarditis, and bacterial vaginosis among others. Metronidazole is white crystalline powder, which can also be called as Fragyl Orvagil, Trichazol, Metronid, etc.

Get Sample Copy of this Report @ https://www.researchbeam.com/global-metronidazole-2018-by-manufacturers-regions-type-and-application-forecast-to-2023-market/request-sample?utm_source=Anil

Scope of the Report:

This report focuses on the Metronidazole in global market, especially in North…