Press release

Produce Packaging Market Size, Trends and Regional Insights

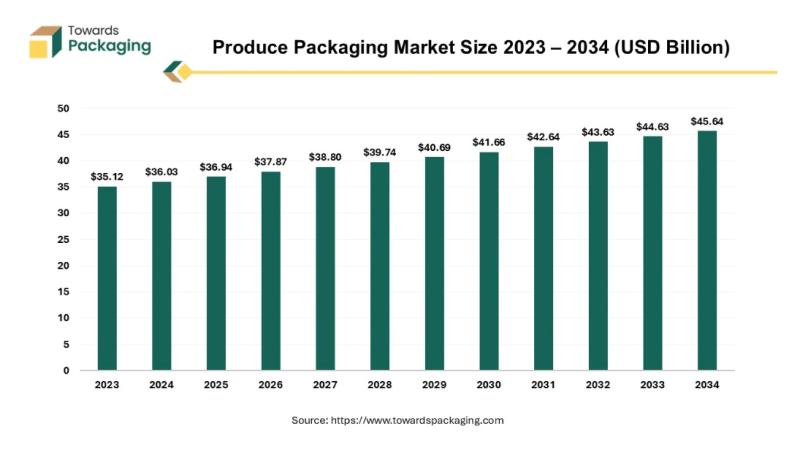

The global produce packaging market has seen remarkable growth, with the industry reaching a size of US$ 35.12 billion in 2023. Projections suggest this figure will grow to approximately US$ 45.64 billion by 2034, expanding at a compound annual growth rate (CAGR) of 2.64% from 2024 to 2034. This growth is driven by evolving consumer preferences for fresh, convenient, and sustainable packaging solutions for fruits, vegetables, and other fresh produce.Download Statistical Data: https://www.towardspackaging.com/download-statistics/5193

A Growing Need for Convenience

Fresh produce is an essential part of the modern diet, providing necessary vitamins, minerals, and antioxidants for healthy living. It serves as a vital component of meals, whether as the primary ingredient or an accompaniment. In today's fast-paced world, consumers increasingly demand convenience in their food purchases, especially when it comes to fresh produce. Packaging plays a crucial role in delivering the on-the-go convenience that modern shoppers seek.

The packaging of fresh produce must not only serve practical purposes but also meet consumer expectations for freshness and appearance. Shoppers prefer produce that retains its natural goodness, vibrant color, and unspoiled look while sitting on store shelves. Packaging helps protect these attributes, keeping fruits and vegetables fresh and extending their shelf life. Therefore, produce packaging is essential in ensuring that consumers receive high-quality, fresh items.

The Role of Sustainable Packaging

Sustainability has emerged as a key consideration in packaging choices. Many consumers now prioritize products that are environmentally friendly and use minimal plastic. This shift toward sustainability is influencing packaging trends, especially for produce. Manufacturers are adopting packaging solutions that reduce carbon footprints and promote resource efficiency. Lightweight packaging, designed to reduce CO2 emissions during transport, is gaining traction. Additionally, the use of recyclable, biodegradable, and plastic-free materials is becoming more common as manufacturers aim to meet growing consumer demand for eco-friendly packaging.

The focus on sustainability in the produce packaging market is not only about reducing waste but also about reducing costs. Resource-efficient packaging, which reduces material usage without compromising product protection, can significantly lower the cost per package, benefitting both manufacturers and consumers.

Packaging Innovation for Fresh Produce

The produce packaging sector has witnessed continuous innovation as manufacturers seek to develop solutions that address various challenges in preserving freshness while ensuring ease of transport. Common packaging options include cardboard boxes, plastic containers, bags, pouches, trays, and crates. However, manufacturers must strike a balance between durability and environmental impact.

For instance, in January 2024, Cascades Inc., based in Kingsey Falls, Quebec, introduced new produce basket designs made from up to 100% recycled fibers. These baskets, which feature flaps, offer a sustainable alternative to traditional, hard-to-recycle packaging. This innovation is part of a broader trend toward sustainable, eco-conscious packaging solutions in the fresh produce sector.

The Global Market Landscape

The produce packaging market is influenced by both regional trends and product types. In 2023, the Asia Pacific region held the largest market share, driven by the rapid growth of the food processing industry and the rising demand for packaged fresh produce in countries like China and India. The region's significant agricultural production also plays a role in the demand for packaging solutions.

North America, on the other hand, is expected to see substantial growth during the forecast period. Factors such as the increasing focus on sustainability, innovations in packaging technology, and changing consumer preferences for convenient, eco-friendly packaging solutions are expected to drive this growth.

Key Packaging Segments

Among the various packaging materials used for fresh produce, corrugated boxes dominate the market with the largest share. These boxes are favored for their ability to withstand rough handling, protect delicate produce, and allow for easy stacking and transportation. Their recyclability and eco-friendly nature make them an attractive choice for both manufacturers and consumers.

In terms of product categories, the vegetable segment is projected to lead the market in the coming years. Vegetables, often more delicate than fruits, require packaging solutions that provide maximum protection from damage while maintaining freshness. Innovations in packaging materials and designs are likely to continue to emerge to address these needs effectively.

The Road Ahead: Challenges and Opportunities

While the growth prospects for the produce packaging market are strong, there are challenges that manufacturers must address. One common issue is overspecification in packaging, where packages are often overwrapped or overstuffed, leading to excess material use and higher costs. To address this, it is essential for packaging to be precisely dimensioned to match the size of the produce, minimizing waste and ensuring efficiency in both material use and transportation.

Furthermore, packaging solutions must meet the demands of diverse climates, heavy loads, and rough handling throughout the supply chain. This makes it crucial for packaging to be both durable and environmentally friendly to meet the needs of both consumers and the planet.

In conclusion, the produce packaging market is poised for continued growth, driven by rising demand for fresh, convenient, and sustainable packaging solutions. With ongoing innovations and increasing consumer awareness of environmental issues, the future of produce packaging will be shaped by advancements in resource-efficient materials and packaging designs that balance functionality with sustainability.

Key Takeaways

• The global produce packaging market reached US$ 35.12 billion in 2023 and is expected to grow at a CAGR of 2.64% to reach US$ 45.64 billion by 2034.

• Asia Pacific dominated the market in 2023, while North America is expected to see notable growth during the forecast period.

• Corrugated boxes lead the packaging material segment, and the vegetable segment is expected to lead the product segment.

• Innovations like Cascades Inc.'s recycled fiber produce baskets highlight the industry's shift toward sustainable packaging.

Drivers and Opportunities in the Produce Packaging Market: Shaping the Future of Fresh Produce

The produce packaging market is undergoing a transformation driven by technological advancements and a shift towards sustainability. As consumers become more eco-conscious and technological innovations continue to evolve, companies are adapting their packaging strategies to meet these new demands. This article explores the key drivers and opportunities influencing the market, highlighting how these trends are shaping the future of produce packaging.

Driver: Technological Advancements and the Shift Towards Eco-Friendly Packaging

In recent years, one of the most significant drivers of growth in the produce packaging market has been the increasing shift towards eco-friendly materials. As environmental concerns rise globally, both consumers and manufacturers are focusing on minimizing their carbon footprint. Recyclable and biodegradable packaging materials have become central to this shift, as they align with sustainability goals and the broader movement towards reducing plastic waste.

Additionally, advancements in packaging technology have played a pivotal role in preserving the freshness and quality of fresh produce. Modified Atmosphere Packaging (MAP), active packaging, and the integration of smart labels are some of the innovations that are enhancing the shelf life of fruits and vegetables, while also providing consumers with more information about the products they purchase.

For instance, MAP technology helps control the levels of oxygen, carbon dioxide, and humidity around the produce, ensuring that it stays fresher for longer. Active packaging, on the other hand, actively alters its properties to extend freshness and prevent spoilage. Smart labels, such as QR codes and RFID tags, provide consumers with real-time information on the freshness of their produce and even track its journey from farm to table, enhancing traceability.

A key example of a company embracing these advancements is the 2M Group of Companies, a global chemical leader that expanded its biomaterial portfolio in 2024 by establishing a new business unit focused on sustainable packaging innovations. This move underscores the growing emphasis on developing eco-friendly and technologically advanced packaging solutions in the produce sector.

Opportunity: The Expansion of E-commerce and Online Grocery Platforms

Another notable opportunity that is significantly impacting the produce packaging market is the rapid expansion of e-commerce and online grocery shopping platforms. As consumer preferences shift towards the convenience of home deliveries, the need for robust and protective packaging solutions has never been greater. Fresh produce, which is often delicate and susceptible to damage, requires packaging that can withstand the rigors of shipping, while also ensuring it arrives fresh and intact.

In particular, the rise of online grocery platforms has led to an increased demand for packaging solutions that can handle the challenges of extended supply chains, fluctuating temperatures, and potential contamination during transit. Packaging materials such as MAP and vacuum-sealed options are crucial for maintaining the freshness of produce throughout the shipping process, preserving product quality, and extending shelf life. These packaging innovations are necessary for overcoming the challenges posed by long-distance transportation and storage.

The demand for customized packaging that not only protects but also enhances the consumer experience is also on the rise. E-commerce platforms are increasingly using aesthetically pleasing packaging to build brand identity and differentiate themselves in a competitive market. This has proven to be a powerful tool for attracting repeat customers, further driving the growth of the packaging market.

A noteworthy example of this trend is Zepto, a fast-commerce app that delivers a wide range of products, including fresh fruits and vegetables, directly to consumers' doors. According to data from the Entrepreneurs Association of India, Zepto saw an 87% increase in revenue from product sales in 2023 compared to 2022. The success of platforms like Zepto highlights the growing consumer preference for the convenience of having groceries delivered quickly, and it reinforces the need for specialized packaging solutions that can support this demand.

In 2024, fast commerce companies such as Blinkit, Zepto, Swiggy Instamart, and Flipkart Minutes accounted for nearly 50% of Kirana sales, a significant shift in consumer behavior that demonstrates the growing importance of online grocery delivery services.

Produce Packaging Market Trends

The produce packaging market is also being shaped by several emerging trends that reflect the changing preferences of consumers and the evolving landscape of food packaging.

• Sustainability: With increasing environmental concerns about packaging waste, sustainability remains one of the most important trends in the produce packaging sector. Consumers are increasingly aware of the environmental impact of packaging materials and are favoring products that use recyclable, biodegradable, or reusable packaging solutions. This trend is not only driven by consumer preferences but also by regulatory pressures in many regions, which are pushing for more sustainable packaging practices.

• Reusable Packaging: As part of the sustainability movement, reusable packaging has gained traction in the produce sector. Packaging solutions that can be used multiple times not only reduce waste but also provide cost-saving benefits for both manufacturers and consumers. For example, reusable plastic containers or cloth bags are becoming popular alternatives to single-use packaging, offering both durability and eco-friendliness.

• Convenience Packaging: Modern consumers value convenience, and this is reflected in the growing demand for pre-cut fruits and vegetables, as well as other ready-to-eat or easy-to-prepare produce. Convenience packaging helps meet the needs of busy consumers who seek quick and easy meal solutions. As lifestyles become increasingly fast-paced, the demand for packaging that offers time-saving benefits is expected to continue to rise.

• Smart Packaging: The integration of technology into packaging is another trend gaining momentum in the produce sector. Smart packaging, which includes features such as QR codes, RFID tags, and even temperature sensors, is helping enhance the traceability and freshness of produce. These technologies allow consumers to scan a code and access detailed information about the produce, such as its origin, freshness, and even potential allergens. Additionally, these smart solutions enable retailers and manufacturers to track the supply chain and ensure that products are stored and transported at optimal conditions.

Regional Insights: Growth of the Produce Packaging Market in Asia Pacific and North America

As the global produce packaging market continues to grow, the Asia Pacific region and North America are emerging as key players in driving this expansion. The dynamics in these regions highlight the increasing demand for fresh produce, innovative packaging solutions, and the continued focus on sustainability and convenience. In this article, we delve into the specific regional trends that are shaping the future of the produce packaging market.

Asia Pacific: A Hub for Fresh Produce and Packaging Innovation

The Asia Pacific region is not only the largest food producer in the world but also holds the dominant share in the global produce packaging market. With over three-quarters of global vegetable production and 73% of the total fruit production area based in this region, Asia plays a central role in the agricultural supply chain. The region's trade and exhibition events, such as Asia's leading trade show for fresh fruit and vegetables, are a testament to its significance in the global produce market. This annual exhibition is dedicated solely to the fresh produce sector, highlighting Asia's pivotal role in the international fruit and vegetable trade.

The demand for fresh produce in Asia is growing rapidly, with consumption of vegetables and fruits expected to rise at an annual rate of 12.3% by 2028. Southeast Asian countries like Indonesia, the Philippines, and Thailand are among the leading fresh fruit producers, but the region still faces challenges, such as being a net importer of fresh produce in some areas. This growing demand for fresh produce directly correlates with the increasing need for innovative and sustainable packaging solutions to maintain product quality, ensure safety during transportation, and extend shelf life.

Asia's prominence as a packaging production hub is supported by its strong manufacturing base, which facilitates the mass production of food packaging products. The rise in consumer demand for convenience, particularly in on-the-go packaging, is driving the future growth of the produce packaging market in the region. This shift towards convenience packaging aligns with changing lifestyles and consumer preferences for easy-to-carry, ready-to-eat produce.

A notable development in the region's packaging landscape was seen in October 2023, when Australia's Pacific Fresh citrus packing business, based in Leeton, New South Wales, was sold to Mildura Fruit Company (MFC). This acquisition reflects the growing importance of packaging solutions in the fresh produce sector and highlights how companies in the Asia Pacific are adapting to evolving market needs.

North America: Sustainability, Convenience, and Climate Change Impacting the Packaging Landscape

In North America, the produce packaging market is poised for rapid growth, largely driven by shifts in consumer behavior and increasing environmental concerns. As consumer lifestyles evolve, there is a growing demand for packaged fruits and vegetables, with many consumers preferring the convenience of pre-packaged produce. This shift is fueling the need for more efficient, durable, and eco-friendly packaging solutions.

One of the most significant factors influencing the North American produce packaging market is the increased focus on sustainability. With more stringent waste disposal regulations for packaging materials, especially in the United States, there is a growing push for recyclable and biodegradable packaging options. As environmental concerns continue to rise, a majority of fresh produce packaging in the region is expected to be recyclable or biodegradable in the coming years. This trend aligns with the growing awareness among consumers and businesses about the environmental impact of packaging waste.

The U.S. fresh produce industry, particularly in California, has long been a leader in fruit, vegetable, and nut production. California provides more than half of the fresh produce consumed in the United States, making it a critical player in the produce packaging market. However, the region's reliance on agriculture is increasingly vulnerable to the impacts of climate change. Over-farming in certain areas and under-farming in others have led to imbalances in the supply chain, putting pressure on the fresh produce industry. This situation has spurred the need for more efficient packaging solutions that can help extend the shelf life of produce, reduce waste, and ensure the safe transportation of goods.

Other regions in the United States, such as Washington, Oregon, Texas, Florida, Georgia, South Carolina, and North Carolina, are emerging as potential hubs for fresh produce production. As these areas increase their output of fruits and vegetables, the demand for advanced packaging solutions will rise accordingly. Packaging innovations that can help preserve the quality of produce, reduce spoilage, and enhance the consumer experience will be essential in meeting the demands of these growing markets.

A key development in the North American market occurred in February 2023

when PPC Flexible Packaging LLC, a prominent provider of custom flexible packaging, acquired StePac, an Israeli-based company known for its innovative modified atmosphere packaging (MAP) solutions. This acquisition underscores the increasing focus on packaging technologies that help maintain the freshness of produce during long-distance transportation. By leveraging MAP and other advanced packaging technologies, StePac's expertise is now available to fresh produce markets in the early stages of development, supporting the growing demand for sustainable packaging solutions across the globe.

Segment Analysis: The Dominance of Corrugated Boxes and Vegetables in Produce Packaging

The produce packaging industry is experiencing rapid growth, driven by evolving consumer preferences and innovations in packaging technology. Among the various packaging materials and product categories, the corrugated boxes segment and the vegetable segment stand out as the key players in the market. This article takes a closer look at why corrugated boxes remain the leading packaging material for produce and how vegetables continue to dominate the market in terms of consumption and packaging requirements.

Corrugated Boxes: The Undisputed Leader in Produce Packaging

Corrugated boxes have long been the preferred choice for packaging fresh produce, and they show no signs of losing their dominant position in the market. The versatility, durability, and cost-effectiveness of corrugated fiberboard make it an ideal material for transporting a wide variety of produce, from fruits to vegetables. This packaging solution is not only lightweight but also offers excellent protection, making it the go-to option for both local and international shipments.

The strength and tensile durability of corrugated fiberboard have evolved significantly in recent years. Today, it can be manufactured in various styles and weight specifications, making it suitable for different types of produce. One of the most notable trends is the use of triple-wall corrugated fiberboard containers. These robust containers are increasingly used as one-way pallet bins for bulk shipments to processors and retailers. The ability to transport produce like cabbage, melons, potatoes, pumpkins, and citrus without compromising product integrity has further boosted the popularity of corrugated boxes in the supply chain.

One of the major advantages of corrugated boxes is their low cost compared to traditional packaging solutions. These containers are significantly cheaper-sometimes up to one-fourth the price of conventional packaging. Moreover, they are often designed to be reusable, helping to further reduce packaging costs. The majority of corrugated fiberboard used in the packaging industry is made from a mix of recycled and new fibers, aligning with increasing environmental awareness and sustainability goals. Many regions now mandate the use of recycled materials in packaging, and this trend is expected to rise in the coming years.

For fresh produce packaging, corrugated boxes have proven to be a reliable and sustainable option. Many organic foods, including fruits and vegetables, are shipped in corrugated boxes, as they offer a softer surface that minimizes the risk of damage during transportation. This added protection ensures that delicate produce, such as berries and tomatoes, reaches its destination in optimal condition. The growth of the corrugated box market in produce packaging is projected to be exponential, driven by both the increasing demand for fresh produce and the growing preference for sustainable, cost-effective packaging solutions.

A significant development in the industry occurred in February 2023 when Cepac, a leading corrugated packaging manufacturer, acquired a majority stake in Lancashire-based EW Carton. This acquisition, which led to the rebranding of EW Carton to Flutepac, highlights the growing focus on sustainable corrugated board in the packaging of fresh produce. The move further strengthens Cepac's position in the market and its commitment to eco-friendly packaging solutions.

Vegetables: The Key Driver in Produce Packaging Demand

When it comes to global trade and consumption, vegetables remain the top contender in the produce packaging market. Vegetables are the most widely traded and consumed agricultural products, with a growing demand that is closely linked to dietary requirements and population growth. Packaging plays a crucial role in ensuring the freshness, quality, and shelf life of vegetables, making it an essential part of the supply chain.

The packaging of vegetables is varied, with boxes, crates, baskets, and bags being the most common options. Among the vegetables driving export demand are onions, mixed vegetables, potatoes, tomatoes, and green chilies. These products are in high demand in global markets, with leading export destinations including China, the United States, Germany, the Netherlands, and the United Kingdom. As these regions continue to import significant quantities of vegetables, the need for efficient, cost-effective, and durable packaging solutions becomes even more apparent.

Corrugated cardboard packaging has several advantages when it comes to transporting vegetables. It is strong, lightweight, and highly durable, ensuring that produce remains protected during transit. Additionally, corrugated cardboard's design allows for space-efficient stacking in both vehicles and warehouses, reducing transportation costs by optimizing space and minimizing fuel consumption. This is particularly important in the global trade of fresh vegetables, where shipping efficiency is key to maintaining product quality and reducing overall logistics costs.

One of the key benefits of corrugated packaging for vegetables is its ability to control moisture levels. Moisture is one of the primary factors that contribute to the spoilage and rotting of fresh produce. Corrugated boxes create an environment that helps regulate moisture, preventing vegetables from becoming waterlogged and ensuring that they remain fresh throughout their journey. By maintaining the optimal moisture balance, these boxes help extend the shelf life of vegetables, allowing them to reach consumers in the best possible condition.

As demand for vegetables continues to rise, driven by increasing health consciousness and dietary preferences, the packaging industry is seeing a surge in vegetable-related packaging requirements. Companies in the fresh produce sector are increasingly seeking sustainable, efficient, and cost-effective solutions that can meet both consumer expectations and environmental regulations.

In February 2024, SPAR Hungary announced its plan to introduce a new type of eco-friendly, reusable transport container for its vegetable departments. This initiative reflects the growing emphasis on sustainability within the vegetable packaging segment. The new container system is designed to reduce plastic waste while ensuring the safe and efficient transport of vegetables across the supply chain. Such initiatives are expected to drive the adoption of reusable and recyclable packaging solutions in the vegetable sector, further accelerating the market's growth.

Competitive Dynamics in the Produce Packaging Market: Giants, Innovation, and Sustainability

The produce packaging market is undergoing a profound transformation as sustainability, innovation, and consumer preferences shape its competitive dynamics. The market is dominated by well-established global packaging giants, such as Amcor, Berry Global, Sealed Air, Ball Corporation, Crown Holdings, International Paper Co., Mondi, Smurfit Kappa Group, Stora Enso, Plastipak Holdings, Bemis Company, Avery Dennison, Alpha Packaging, DS Smith, and Pactiv LLC. These industry leaders not only battle for market share but also face competition from newer, direct-to-consumer companies leveraging digital platforms to gain traction. Amidst this competition, key factors such as product innovation, sustainable practices, and the ability to adapt to changing consumer demands are driving the evolution of the sector.

Established Players and Upstart Competitors

The global players in the produce packaging sector have long established themselves through vast networks, deep industry knowledge, and substantial market reach. Companies like Amcor, Sealed Air, and Ball Corporation are known for their large-scale operations, comprehensive product lines, and innovative approaches to packaging. These organizations continue to focus on creating high-performance, sustainable packaging solutions that meet the growing demand for environmentally friendly materials and efficient logistics.

On the other hand, a new wave of direct-to-consumer companies is rising in the market. These firms are embracing digital tools and platforms to directly engage with customers, often bypassing traditional distribution channels. Through e-commerce, personalized packaging, and direct customer relationships, these startups are gaining market share. They offer flexible and customized packaging solutions, creating new competition for the traditional players.

In this evolving landscape, the major players and upstarts alike are competing on several fronts-product innovation, sustainability, and responsiveness to changing consumer needs. As environmental concerns grow and demand for eco-friendly packaging intensifies, both traditional giants and new entrants are vying to develop solutions that not only perform well but also align with the values of eco-conscious consumers.

DS Smith's Strategy: The Shift from Wax Boxes to Sustainable Alternatives

One example of how established companies are adapting to the changing market is DS Smith. Historically, farmers in the produce industry have used wax-coated boxes for packaging, a standard practice for many years. However, with increasing awareness of the environmental impact of such materials, there has been a shift towards more sustainable alternatives. Initially, many farmers were hesitant to change packaging due to the entrenched nature of wax boxes, but financial and performance benefits are now convincing many to make the switch.

In March 2024, DS Smith introduced "Shop.able Carriers," a range of recyclable and reusable boxes designed to replace traditional plastic grocery bags. These new carriers feature Green Coat technology, which makes them water-resistant while also being environmentally friendly. This innovative solution reflects DS Smith's commitment to reducing waste and providing more sustainable options for the produce industry. The company's strategy is a clear example of how traditional packaging companies are evolving to meet the sustainability demands of modern consumers.

Recent Developments in the Produce Packaging Market

As sustainability takes center stage in packaging design, many industry leaders are introducing innovative solutions that cater to environmental concerns. In January 2024, Sealed Air Corporation (SEE), a global packaging solutions provider, unveiled the first-ever biobased, industrial compostable tray for protein packaging. This tray, made from a USDA-certified biobased resin with 54% biobased content derived from sustainable wood cellulose, marks a significant step toward replacing traditional packaging made from expanded polystyrene (EPS). The new biodegradable overwrap tray is designed as an alternative to EPS, a material that, while commonly used for packaging fresh meats like chicken and red meat, has the downside of being non-recyclable and non-biodegradable. By introducing this compostable tray, SEE is addressing growing concerns about plastic waste and offering a more sustainable solution for food packaging. This development aligns with the company's ongoing efforts to help clients meet their sustainability goals while still providing reliable, functional packaging solutions.

Similarly, in October 2024, Yangi, a company known for its creativity in renewable packaging, introduced a groundbreaking fiber-based food tray designed to replace traditional plastic trays used in the food industry. This multipurpose tray meets the increasing demand for sustainable products and offers a viable alternative for packaging ready meals, meat trays, and takeout. Yangi's eco-friendly food tray not only reduces the reliance on plastic but also demonstrates the growing market potential for renewable, biodegradable materials in the packaging sector.

These recent developments showcase how the industry is shifting toward sustainable solutions, not only driven by regulatory pressures but also by increasing consumer expectations for environmentally responsible packaging. Companies that can innovate while reducing their environmental footprint will be better positioned to thrive in an increasingly conscious market.

The Competitive Landscape: A Shift Toward Sustainability

The competitive dynamics of the produce packaging market are increasingly shaped by the pressure to meet sustainability goals. As consumers become more environmentally aware, they are demanding packaging solutions that minimize waste and reduce their carbon footprint. Packaging companies, both large and small, are responding by integrating sustainable practices into their operations and focusing on biodegradable, recyclable, and reusable packaging options.

Moreover, with the rise of e-commerce and direct-to-consumer business models, packaging companies are under pressure to adapt their products to the needs of an increasingly digital marketplace. The ability to respond quickly to consumer preferences, offer customization, and create packaging solutions that align with sustainability goals is becoming a key competitive advantage.

For established players like Amcor, Sealed Air, and Smurfit Kappa, product innovation is critical to staying competitive in this rapidly evolving market. By developing new materials, enhancing recyclability, and reducing waste, these companies are positioning themselves as leaders in the race for sustainable packaging solutions. At the same time, smaller firms and startups are making their mark by offering fresh perspectives, agile operations, and direct customer engagement.

Source: https://www.towardspackaging.com/insights/produce-packaging-market-sizing

Baner

Buy Premium Global Insight: https://www.towardspackaging.com/price/5193

Review the Full TOC for the Produce Packaging Market Report: https://www.towardspackaging.com/table-of-content/produce-packaging-market-sizing

Get the latest insights on packaging industry segmentation with our Annual Membership - https://www.towardspackaging.com/get-an-annual-membership

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

Towards Healthcare: https://www.towardshealthcare.com

Towards Automotive: https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Produce Packaging Market Size, Trends and Regional Insights here

News-ID: 3806887 • Views: …

More Releases from Towards Packaging

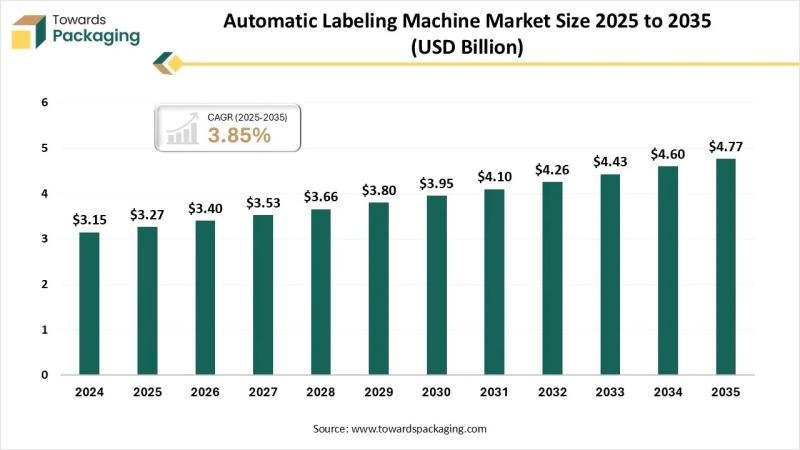

Automatic Labeling Machine Market Set for Strong Growth Through 2035

The global automatic labeling machine market is poised for steady expansion, rising from USD 3.4 billion in 2026 to USD 4.77 billion by 2035 at a CAGR of 3.85%. Demand is being driven by rapid automation in packaging lines, stringent labeling regulations, and the shift toward high-speed, error-free production across industries.

Download Sample: https://www.towardspackaging.com/download-sample/5882

Self-adhesive labeling systems currently hold the largest share at 39%, supported by their versatility and cost efficiency. Meanwhile,…

Unleashing Growth in the Liquid Packaging Market with Strategic Innovations

The liquid packaging industry is experiencing remarkable growth, with projections indicating an increase from USD 397.36 billion in 2025 to USD 645.43 billion by 2034. This growth, at a compound annual growth rate (CAGR) of 5.7%, signifies the expanding demand for liquid packaging solutions across a variety of sectors. As we delve into the market dynamics, it becomes clear that the liquid packaging sector is evolving rapidly, with several key…

Advancements in Hot-Fill Food Packaging Paving the Way for a Sustainable Future

The global hot-fill food packaging market is experiencing a steady rise, with an expected market value of USD 71.26 billion by 2033, up from USD 49.85 billion in 2023. This growth is projected to follow a compound annual growth rate (CAGR) of 3.76% from 2024 to 2033, reflecting the increasing demand for innovative packaging solutions in the food and beverage sector.

Download a Brochure of Hot-fill Food Packaging Market: https://www.towardspackaging.com/download-brochure/5266

Hot-Fill…

Driving Growth and Innovation in the Plastic Bag Market

The plastic bag market is undergoing significant growth, with its value reaching an estimated US$ 25.10 billion in 2023. Projections suggest that this market could hit a substantial US$ 35.41 billion by 2033, marking a steady compound annual growth rate (CAGR) of 3.5% from 2024 to 2034. This growth is largely driven by the expanding needs of various industries for efficient and cost-effective packaging solutions.

Download a Brochure of Plastic Bag…

More Releases for Produce

Produce Packaging: A Leading Driver Behind Organic Fresh Produce Preference Fuel …

Stay ahead with our updated market reports featuring the latest on tariffs, trade flows, and supply chain transformations.

What Will the Produce Packaging Industry Market Size Be by 2025?

The size of the produce packaging market has seen a significant increase in the past few years. By progressing from $35.6 billion in 2024 to $37.66 billion in 2025, it demonstrates a compound annual growth rate (CAGR) of 5.8%. Factors contributing to this…

Organic Fresh Produce Preference Fuels Growth In The Produce Packaging Market: A …

The Produce Packaging Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Projected Growth of the Produce Packaging Market?

The market size for produce packaging has witnessed significant growth in the previous years. The market will see a rise from $35.6 billion in 2024…

Organic Fresh Produce Preference Fuels Growth In The Produce Packaging Market: A …

The Produce Packaging Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Projected Growth of the Produce Packaging Market?

The market size for produce packaging has witnessed significant growth in the previous years. The market will see a rise from $35.6 billion in 2024…

Informative Report On (COVID-19 Updates) Greenhouse Produce Market | Elk River G …

According to a new report published by Allied Market Research, titled, " Greenhouse Produce Market by Type (Vegetables, Fruits, Flowers, Herbs, and Others), by Production (In-ground Soil Culture, Container Culture, Tissue Culture, Transplant production, Hydroponics, and Others), and Distribution Channel (Super Markets / Hyper Markets, Farm Communities, Food Processing Companies, Organic Stores, and Others): Global Opportunity Analysis and Industry Forecast, 2018-2025" The report has offered an all-inclusive analysis of the…

Greenhouse Produce Market to Witness High Growth in near future: Nyboers Greenho …

Bigmarketresearch.com adds New “Global Greenhouse Produce Market by Manufacturers, Countries, Type and Application, Forecast to 2025” new report to its research database. The report spread across 101 pages with table and figures in it. The report provides information on Industry Trends, Demand, Top Manufacturers, Countries, Material and Application.

In 2017, the global Greenhouse Produce market size was million US$ and it is expected to reach million US$ by the end of…

Greenhouse Produce Market Increasing Demand with Leading Players- Nyboers Greenh …

HTF MI released a new market study on Global Greenhouse Produce Market with 100+ market data Tables, Pie Chat, Graphs & Figures spread through Pages and easy to understand detailed analysis. At present, the market is developing its presence. The Research report presents a complete assessment of the Market and contains a future trend, current growth factors, attentive opinions, facts, and industry validated market data. The research study provides estimates…