Press release

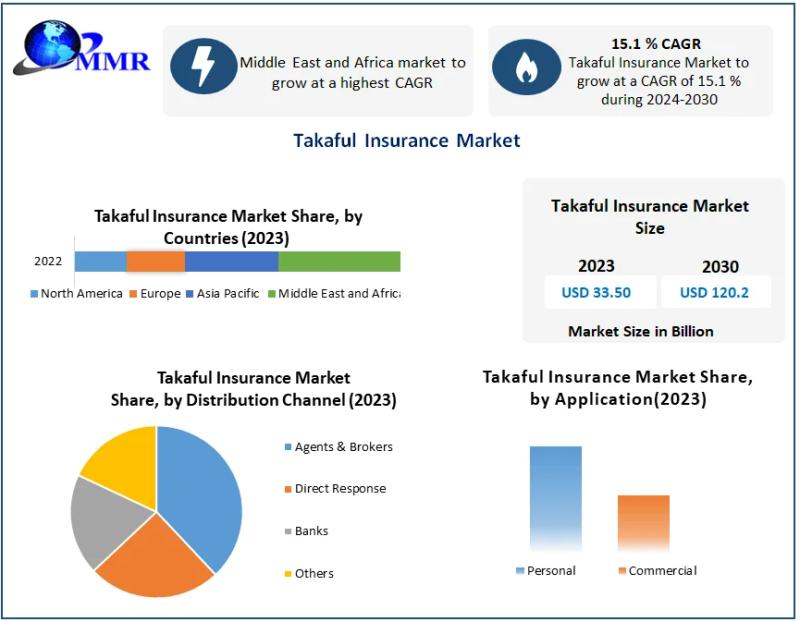

Takaful Insurance Market Growth and Size Outlook Forecasted to Reach USD 120.2 Billion by 2030

The 𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 size was valued at USD 33.50 Bn. in 2023 and the total Takaful Insurance Market revenue is expected to grow by 15.1% from 2024 to 2030, reaching nearly USD 120.2 Bn.𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

The Takaful insurance market, a form of Islamic insurance, is experiencing steady growth globally as awareness about Islamic financial principles increases. In this system, members pool funds to safeguard one another against losses, adhering to Shariah principles. The market serves essential life, health, and general insurance needs, including education, savings, and retirement plans, and is particularly gaining traction in Muslim-majority countries and regions with substantial Muslim populations like Southeast Asia and the Middle East.

𝐆𝐞𝐭 𝐘𝐨𝐮𝐫 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐭𝐡𝐞 𝐋𝐚𝐭𝐞𝐬𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬: https://www.maximizemarketresearch.com/request-sample/213737/

𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭:

Rising demand for Sharia-compliant financial products and increasing awareness of Takaful insurance's benefits are significant factors propelling market growth. Many Muslim-majority regions, including Southeast Asia and the Middle East, are seeing expanding penetration due to the growing interest in Islamic finance. The market is also fueled by a gap in conventional insurance options in certain regions, with Takaful offering solutions tailored to the needs of the Muslim population.

𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬:

The Takaful insurance market is evolving with innovations and diverse product offerings to cater to various sectors such as life, health, and retirement planning. As consumers and businesses increasingly seek Sharia-compliant financial solutions, the market is witnessing advancements that enhance product accessibility and usability. This trend is further supported by a growing acceptance of Islamic financial products beyond traditional markets, particularly among younger generations in Muslim-majority nations.

𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬:

The expansion of Takaful insurance presents numerous opportunities, especially in regions with large Muslim populations. There is significant potential for market growth in Southeast Asia and the Middle East, where awareness and the demand for Sharia-compliant financial products continue to rise. Additionally, as conventional insurance options remain limited in some areas, Takaful can step in to offer tailored, compliant alternatives, fostering further market penetration and growth.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐓𝐨𝐝𝐚𝐲 𝐟𝐨𝐫 𝐂𝐮𝐬𝐭𝐨𝐦 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬: https://www.maximizemarketresearch.com/inquiry-before-buying/213737/

𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 𝐢𝐧 𝐕𝐢𝐞𝐭𝐧𝐚𝐦

Vietnam's Takaful insurance market is in its early stages, offering ample growth potential. The Vietnamese government's support for Islamic financial solutions is expected to drive the adoption of Takaful policies. As local awareness of ethical insurance solutions grows, companies are well-positioned to capture a share of the emerging market.

𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡 𝐢𝐧 𝐓𝐡𝐚𝐢𝐥𝐚𝐧𝐝

In Thailand, the Takaful market is gaining traction with an increase in the Muslim population. The government's efforts to promote Islamic finance, coupled with rising demand for ethical products, are driving the growth of Takaful insurance, particularly in sectors like health and life insurance.

𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬 𝐢𝐧 𝐉𝐚𝐩𝐚𝐧

Japan's Takaful market is characterized by growing interest from Islamic investors, despite Japan's low Muslim population. Japanese financial institutions are gradually introducing Takaful products, targeting expatriates and local investors seeking Sharia-compliant insurance alternatives.

𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐂𝐨𝐧𝐬𝐨𝐥𝐢𝐝𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐒𝐨𝐮𝐭𝐡 𝐊𝐨𝐫𝐞𝐚

South Korea's Takaful market is undergoing consolidation, with several local and international players vying for market leadership. South Korean companies are adopting innovative strategies to make Takaful offerings more accessible, especially for the growing Muslim population and ethical investors.

𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐔𝐩𝐝𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐒𝐢𝐧𝐠𝐚𝐩𝐨𝐫𝐞

Singapore, a key financial hub in Asia, has seen the integration of Takaful products into the mainstream insurance market. The increasing popularity of ethical finance and the country's robust regulatory framework has made it an ideal market for Takaful growth, with innovations in micro-Takaful and health-focused policies leading the way.

𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐔𝐧𝐢𝐭𝐞𝐝 𝐒𝐭𝐚𝐭𝐞𝐬

The US market is witnessing a surge in demand for Takaful insurance, driven by both the Muslim community and ethical investors seeking alternatives to conventional insurance. The market's growth is supported by educational initiatives and collaborations between Islamic financial institutions and US-based insurers.

𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 𝐢𝐧 𝐄𝐮𝐫𝐨𝐩𝐞

Europe, especially the UK and France, is witnessing growing interest in Takaful products due to the rising Muslim population and increasing awareness of Islamic finance principles. The adoption of Takaful in these countries is bolstered by a more favorable regulatory environment and greater collaboration between European insurers and Islamic financial institutions.

𝐊𝐞𝐲 𝐑𝐞𝐜𝐞𝐧𝐭 𝐃𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭𝐬

♦ 𝐌𝐞𝐫𝐠𝐞𝐫 𝐚𝐧𝐝 𝐀𝐜𝐪𝐮𝐢𝐬𝐢𝐭𝐢𝐨𝐧 𝐀𝐜𝐭𝐢𝐯𝐢𝐭𝐲: Recently, 𝐀𝐈𝐀 𝐆𝐫𝐨𝐮𝐩 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 and 𝐙𝐮𝐫𝐢𝐜𝐡

𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐆𝐫𝐨𝐮𝐩 have explored joint ventures with regional Takaful insurers in Southeast Asia to expand their Sharia-compliant offerings.

♦ 𝐏𝐫𝐨𝐝𝐮𝐜𝐭 𝐈𝐧𝐧𝐨𝐯𝐚𝐭𝐢𝐨𝐧: Companies like 𝐀𝐛𝐮 𝐃𝐡𝐚𝐛𝐢 𝐍𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐂𝐨 have launched customized health insurance products that cater specifically to the needs of young families, contributing to market growth.

𝐂𝐮𝐫𝐢𝐨𝐮𝐬 𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬? 𝐆𝐫𝐚𝐛 𝐘𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐓𝐨𝐝𝐚𝐲: https://www.maximizemarketresearch.com/request-sample/213737/

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭:

by Type

Family

General

by Distribution Channel

Agents & Brokers

Direct Response

Banks

Others

by Application

Personal

Commercial

𝐖𝐡𝐨 𝐢𝐬 𝐭𝐡𝐞 𝐥𝐚𝐫𝐠𝐞𝐬𝐭 𝐦𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐞𝐫𝐬 𝐨𝐟 𝐓𝐚𝐤𝐚𝐟𝐮𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐰𝐨𝐫𝐥𝐝𝐰𝐢𝐝𝐞?

1. Abu Dhabi National Takaful Co. [Abu Dhabi, United Arab Emirates]

2. Allianz

3. AMAN Insurance

4. Islamic Insurance

5. Prudential BSN Takaful Berhad

6. Qatar Islamic Insurance [Doha, Qatar]

7. SALAMA Islamic Arab Insurance Company

8. Syarikat Takaful Brunei Darussalam

9. Takaful International

10. Zurich Malaysia

11. HSBC Insurance

12. AIG Prudential

13. Tokio Marine

𝐊𝐧𝐨𝐰 𝐌𝐨𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐓𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.maximizemarketresearch.com/market-report/takaful-insurance-market/213737/

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐌𝐨𝐫𝐞: 𝐕𝐢𝐬𝐢𝐭 𝐎𝐮𝐫 𝐖𝐞𝐛𝐬𝐢𝐭𝐞 𝐟𝐨𝐫 𝐀𝐝𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

♦ Global Food E-Commerce Market https://www.maximizemarketresearch.com/market-report/food-e-commerce-market-global-market/147963/

♦ Global Yeast Market https://www.maximizemarketresearch.com/market-report/yeast-market/617/

♦ Shipping Software Market https://www.maximizemarketresearch.com/market-report/global-shipping-software-market/87018/

♦ Global Vinegar market https://www.maximizemarketresearch.com/market-report/global-vinegar-market/26017/

♦ Hydrochloric Acid Market https://www.maximizemarketresearch.com/market-report/global-hydrochloric-acid-market/66787/

♦ Mobile Security Market https://www.maximizemarketresearch.com/market-report/global-mobile-security-market/15333/

♦ India Electric Vehicle Market https://www.maximizemarketresearch.com/market-report/india-electric-vehicle-market-outlook-key-findings-market/127142/

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Takaful Insurance Market Growth and Size Outlook Forecasted to Reach USD 120.2 Billion by 2030 here

News-ID: 3806376 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

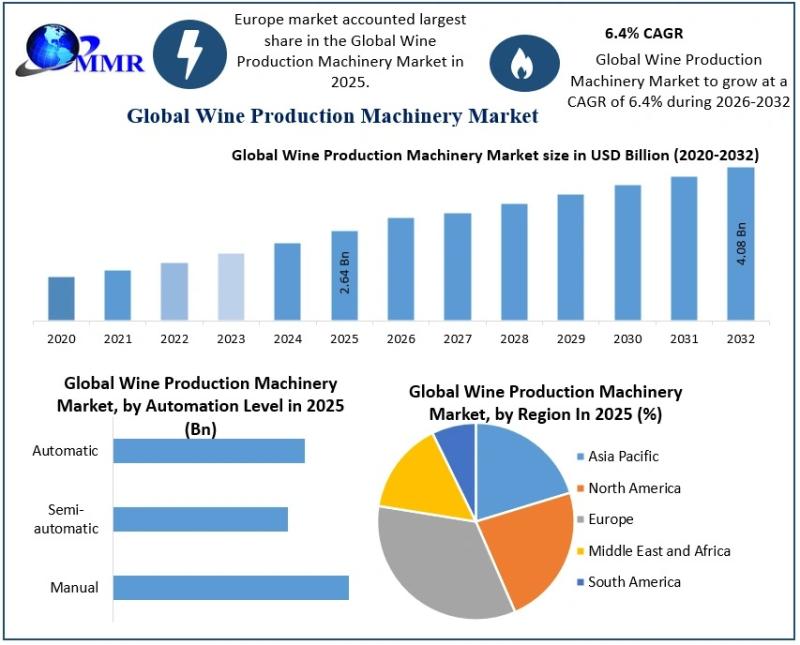

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

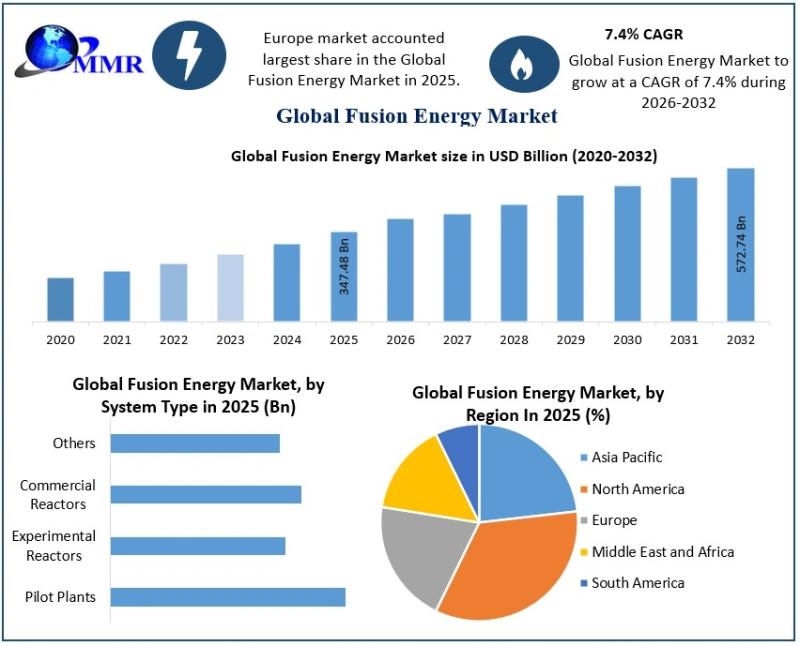

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Takaful

Islamic Insurance (Takaful) Market Hits New High | Major Giants Takaful Malaysia …

HTF MI recently introduced Global Islamic Insurance (Takaful) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Takaful Malaysia, Syarikat Takaful Malaysia, Abu Dhabi Islamic Insurance.

Download Sample Report PDF…

Takaful Market Is Going To Boom | Etiqa, SALAMA, Takaful Emarat

According to HTF Market Intelligence, the Global Takaful market is expected to grow from USD 35 Billion in 2023 to USD 65 Billion by 2032, with a CAGR of 9.10% from 2025 to 2032.

HTF MI recently introduced Global Takaful Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2032). The market Study is segmented by key regions which…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024-2032, Product Type (Life/Family Takaful, General Taka …

According to latest research report by IMARC Group, titled "Takaful Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032," The global takaful market size reached US$ 33.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 74.0 Billion by 2032, exhibiting a growth rate (CAGR) of 8.9% during 2024-2032.

Sample Copy of Report at - https://www.imarcgroup.com/takaful-market/requestsample

Takaful Market Trends:

The global takaful market is experiencing significant growth…