Press release

Bioplastic Packaging Market Trends, Drivers and Opportunities

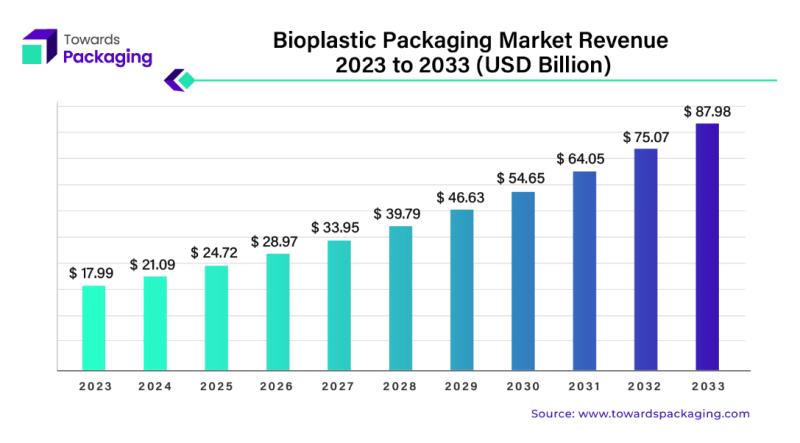

The bioplastic packaging market has been experiencing significant growth, with the global market size reaching approximately USD 17.99 billion in 2023. This industry is expected to continue its upward trajectory, with projections indicating it could reach around USD 87.98 billion by 2033, reflecting a robust compound annual growth rate (CAGR) of 17.2% during the forecast period from 2024 to 2033.As consumer demand for sustainable alternatives to traditional plastics increases, bioplastics have emerged as a viable and eco-friendly solution. Made from renewable resources such as corn starch, sugarcane, or algae, bioplastics offer a promising option for reducing the environmental impact associated with conventional plastic packaging. The rise in environmental consciousness, coupled with stricter regulations on plastic use, is driving the market's growth.

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5215

One of the key factors contributing to the rapid expansion of the bioplastic packaging market is the growing demand for fast-moving beverages. As the beverage industry continues to innovate and release new products, there is an increasing need for packaging solutions that align with sustainability goals. This trend is particularly evident in the rising demand for bottle caps, which are essential components of beverage packaging. Manufacturers are increasingly adopting bioplastic materials for these products, driven by their renewable nature and biodegradability.

The market's growth is further supported by the technological advancements in bioplastics, such as improvements in material properties and cost-effectiveness, which are making them more competitive against traditional plastic packaging. As a result, businesses across various industries, from food and beverage to personal care and pharmaceuticals, are opting for bioplastic alternatives to meet both consumer demand and regulatory requirements.

In addition to environmental benefits, bioplastics offer practical advantages, such as lightweight properties, durability, and the ability to preserve product freshness. These attributes make bioplastics a favorable choice for packaging companies looking to improve their sustainability practices while maintaining the quality of their products.

Looking ahead, the bioplastic packaging market is poised for further growth as more companies embrace sustainable packaging solutions. The rising consumer demand for environmentally friendly products and the ongoing innovation in bioplastic materials will continue to drive the market's expansion. By 2033, the market is expected to be worth nearly USD 88 billion, solidifying bioplastic packaging's place as a dominant force in the global packaging industry.

As the bioplastic packaging market evolves, industry players are expected to invest heavily in research and development to enhance bioplastic material performance and expand their application in new areas. Consumers' increasing preference for sustainable options, coupled with regulatory pressures, will undoubtedly accelerate the shift towards bioplastics, making it a key area for growth in the coming years.

The Growing Shift Toward Bioplastics: Revolutionizing the Beer Cans Market and Beyond

Key Takeaways:

• Europe led the global beer cans market in 2023, holding a significant market share.

• Asia Pacific is expected to experience substantial growth in the beer cans sector during the forecast period.

• The biodegradable segment dominated the beer cans market in 2023, showing significant promise for the future.

• Flexible beer cans are poised to see considerable growth over the next few years.

• The food & beverages segment remains the dominant application for beer cans, contributing significantly to the market share in 2023.

Market Overview: The Rise of Bioplastics

The packaging industry is undergoing a revolutionary transformation, driven largely by the shift toward sustainable materials. One of the key players in this evolution is bioplastics-innovative materials that offer a sustainable alternative to traditional plastics made from fossil fuels.

Bioplastics are synthetic materials derived from renewable biomass sources, including maize starch, sawdust, vegetable oils, straw, wood chips, and even food waste. As a biodegradable substance, bioplastics help tackle the pressing environmental issues associated with plastic waste, which continues to choke ecosystems and harm wildlife. Unlike traditional plastics, which are produced from petroleum-based raw materials, bioplastics are made from renewable resources, such as starches from corn and wheat. These materials not only present an eco-friendly solution but also significantly reduce the carbon footprint in production.

Types of Bioplastics: PLA and PHA

Bioplastics come in two main categories: Polylactic Acid (PLA) and Polyhydroxyalkanoate (PHA). These materials are produced by using natural sugars derived from crops like maize, cassava, and sugarcane. PLA, one of the most common types of bioplastics, has gained popularity due to its biodegradable and carbon-neutral properties.

The production process of PLA involves breaking down corn kernels into carbohydrate, protein, and fiber by immersing them in hot water and sulfur dioxide. This process separates the starch and corn oil, which then undergo a series of transformations, resulting in long carbon molecule chains-essentially the building blocks of plastic. This gives PLA a chemical structure similar to polyethylene, a widely-used plastic, while still being biodegradable and safe for the environment. The sugars in these crops serve as the foundation for creating plastic-like materials, which not only make the material biodegradable but also offer energy savings in production.

PHA, another type of bioplastic, is produced by microorganisms that convert plant-based sugars into a plastic polymer. While PHA has similar environmental benefits, it differs in its chemical structure and its potential applications in various industries.

Environmental Impact and Health Benefits

The adoption of bioplastics is more than just an environmental benefit-it also presents key health advantages over traditional plastics. Bioplastics are free from harmful chemicals such as bisphenol A (BPA) and phthalates, substances often found in conventional plastics that have been linked to health issues. As such, bioplastics offer a safer, healthier alternative to the materials commonly used in food and beverage packaging, including beer cans.

Bioplastics contribute to a reduction in non-biodegradable waste, which is a major environmental concern. Since bioplastics are biodegradable, they break down more easily in nature, helping mitigate the long-lasting impact of plastic pollution. Additionally, bioplastics are produced with far less energy compared to traditional plastic, further reducing their environmental footprint.

Bioplastics in the Beer Cans Market

In the context of the beer cans market, bioplastics are gaining traction. Europe was the leading market for beer cans in 2023, but Asia Pacific is anticipated to see significant growth in this sector in the coming years. The rising demand for sustainable packaging solutions has been a major driver of this shift.

The biodegradable segment of the beer cans market took the largest share in 2023, and this trend is expected to continue as more breweries and packaging companies adopt bioplastics for their products. Flexible beer cans, which offer lightweight, eco-friendly alternatives, are also predicted to see significant growth over the forecast period.

The food and beverage industry, particularly the beer sector, remains one of the largest applications for bioplastics. As consumer demand for eco-conscious packaging increases, breweries are increasingly turning to bioplastics as a means to align their operations with sustainability goals and cater to an environmentally-aware market.

The Growing Bioplastic Packaging Market: Trends, Drivers, and Opportunities

The global bioplastic packaging market is poised for significant growth, driven by several key factors, ranging from rising environmental concerns to innovative technological advancements. The shift towards sustainable packaging solutions is not just a trend, but an urgent response to the growing issue of plastic waste and its environmental impact. This article explores the various factors contributing to the market's growth, the challenges it faces, and the opportunities that lie ahead.

Growth Drivers

Emerging Markets and Strategic Growth

One of the primary growth drivers for the bioplastic packaging market is the increasing adoption of bioplastics in emerging markets. As governments across the globe step up efforts to reduce plastic pollution and encourage sustainability, the demand for bioplastic packaging is expected to grow. In response, key players in the market are adopting inorganic growth strategies such as mergers and acquisitions, aimed at enhancing their manufacturing capacities. These strategic moves are anticipated to support the expansion of bioplastic packaging production, meeting the demand for more eco-friendly alternatives.

Regulatory Support and Policy Changes

Increasing regulatory support for sustainable solutions plays a pivotal role in driving market growth. Governments worldwide are enacting stringent laws to reduce plastic waste and encourage the use of biodegradable materials. For example, in March 2023, the Indian government banned the production, import, and sale of low utility, single-use plastic products that contribute to litter. This move is expected to accelerate the shift towards bioplastics, particularly in the packaging industry. Similar legislative measures in regions like the European Union, Canada, China, and India are creating a favorable environment for bioplastic packaging solutions.

Technological Advancements in Production

Another significant driver of the market is the growing focus on technology and innovation in bioplastic manufacturing. Advances in production techniques, such as the development of bio-based ethylene from renewable agricultural residues, are helping reduce production costs, making bioplastics more competitive with conventional plastics. Companies are increasingly investing in research and development to create bioplastic materials that are not only environmentally friendly but also cost-efficient to produce.

Market Dynamics

A Shift Towards Sustainable Packaging

The global shift towards sustainable packaging is being driven by growing public awareness of environmental sustainability. The negative impact of traditional plastic on the environment has raised significant concerns, leading to a growing preference for bioplastics. Consumers, particularly the younger generation, are more environmentally conscious and are willing to pay a premium for eco-friendly products. As a result, bioplastic packaging, made from renewable resources like sugarcane, maize starch, and vegetable oils, is gaining popularity across various industries, including food, beverage, and personal care.

The United Nations Environment Programme reports alarming statistics: plastic production worldwide increased from 1.5 million tons in 1950 to nearly 380 million tons in 2015, with less than 10% being recycled. This has contributed to the growing concern over plastic pollution, particularly in oceans and landfills. As a result, the demand for bioplastic packaging-seen as a more sustainable option-has been steadily increasing.

Government Regulations Driving Change

Governments around the world are increasingly focusing on reducing single-use plastic consumption. Many countries are enacting policies to limit or ban non-biodegradable plastics, creating a strong incentive for companies to adopt bioplastic alternatives. In nations such as the EU, Canada, and India, these regulations are leading to a significant rise in bioplastic packaging usage. The introduction of such policies is expected to fuel the global demand for bioplastics, with the packaging sector being one of the primary beneficiaries.

For instance, India's decision to phase out single-use plastics is expected to increase the demand for bioplastics significantly, particularly in food and beverage packaging. As such, favorable legislation and government initiatives will continue to be pivotal in driving the growth of the bioplastic packaging market.

Restraints and Challenges

Cost of Raw Materials and Production

Despite the positive growth outlook, the bioplastic packaging market faces a significant challenge-cost. The production of bioplastics is currently more expensive than traditional plastics, primarily due to the higher cost of raw materials and the need for advanced technology. Bioplastics, which are derived from renewable plant-based materials, are more costly to produce than conventional petroleum-based plastics. This price disparity has made it difficult for bioplastics to compete in mass-market applications, particularly where cost is a major concern.

Furthermore, while bioplastics offer environmental benefits, their production processes are not yet fully optimized for cost efficiency. The ongoing research into improving bioplastic manufacturing technology is expected to help reduce costs over time, but for now, price remains a key restraint in the widespread adoption of bioplastic packaging.

Opportunities for Growth

Consumer Demand for Eco-Friendly Products

As consumer awareness of environmental issues continues to rise, there is a growing demand for sustainable products, including packaging. This presents a significant opportunity for the bioplastic packaging market. Companies are increasingly focusing on developing bioplastics that meet consumer preferences for eco-friendly and biodegradable products. With more consumers willing to pay a premium for sustainable packaging, manufacturers are aligning their strategies to cater to this growing demand.

Collaboration and Innovation

The market is also witnessing increasing collaborations between companies to advance bioplastic technologies and develop new materials. For example, in May 2023, Dow partnered with New Energy Blue to develop bioplastic materials from renewable agricultural residues. This collaboration aims to produce bio-based ethylene, a key component in bioplastic production, which will be used in manufacturing packaging and footwear. Such partnerships are crucial for driving innovation in bioplastic materials and expanding their applications.

E-commerce Growth Boosting Demand

The rise of e-commerce is another factor contributing to the growth of the bioplastic packaging market. With online shopping becoming increasingly popular, the demand for packaging materials that are both sustainable and effective is on the rise. The U.S. Census Bureau reports a 6.9% increase in e-commerce sales in 2024, further fueling the need for sustainable packaging solutions. Bioplastics, with their environmentally friendly properties, are well-positioned to meet the growing demand for packaging in the e-commerce sector.

The Growing Dominance of Biodegradable Materials in the Bioplastic Packaging Market

As consumer awareness of environmental issues grows and governments push for sustainable solutions, the biodegradable segment has emerged as the dominant force in the bioplastic packaging market. Biodegradable plastics, unlike traditional plastic, break down completely after disposal, leaving no harmful residues. This property significantly reduces the pollution caused by conventional plastic, which can persist in landfills for centuries.

One of the key factors driving the rise of biodegradable materials is the increasing demand for environmentally friendly products. As the dangers of climate change become more pronounced, consumers are seeking products that have a smaller carbon footprint. This has accelerated the shift towards biodegradable, plant-based packaging alternatives. A growing awareness of the impact of plastic waste on oceans and landfills is also pushing this transformation.

Biodegradable plastics are derived from natural materials such as corn, rice, wheat, potatoes, and tapioca, and can include polymers like polylactic acid (PLA), starch blends, polybutylene adipate terephthalate (PBAT), polyhydroxyalkanoates (PHA), and cellulose acetate. Among these, starch-based blends and PBAT have historically led the biodegradable plastics market due to the abundance of natural resources from which they are derived. These alternatives to traditional plastics offer an eco-friendly solution that reduces reliance on fossil fuels.

However, it is PLA that is poised for the most significant growth in the coming years. PLA is particularly favored for its lower carbon emissions compared to conventional plastics. For instance, the production of one kilogram of PLA results in approximately 0.5 kg of carbon dioxide emissions. In contrast, the manufacturing of other common plastics, such as polyethylene or polypropylene, releases much higher levels of carbon dioxide, making PLA a highly attractive option for companies looking to reduce their environmental footprint.

In 2023, Sulzer Ltd., a leader in engineering and manufacturing, launched a new technology called CAPSUL. This technology is designed to produce polycaprolactone (PCL), a biodegradable polyester used in applications ranging from textiles to packaging. This type of innovation is expected to drive growth in the biodegradable plastics segment over the coming years as companies continue to invest in new, sustainable materials and manufacturing technologies.

Flexible Packaging: The Rising Star in Bioplastic Innovation

Flexible packaging is projected to experience significant growth during the forecast period, driven by innovations in bioplastic production technologies and consumer preferences for more convenient packaging solutions. Advances in case-ready packaging, coupled with enhanced packaging techniques, are creating new opportunities for bioplastics in flexible packaging.

One of the major reasons behind the growing demand for flexible packaging is its versatility and ability to protect products while minimizing material usage. Flexible packaging is particularly popular for snacks, beverages, and ready-to-eat meals, as it offers a lightweight, aesthetically pleasing alternative to rigid packaging. Consumers in North America and Europe, in particular, are increasingly choosing packaging that is not only functional but also visually appealing and eco-friendly.

Flexible packaging made from bioplastics offers several advantages over traditional plastics. These bioplastics can be molded into a variety of shapes, making them ideal for a wide range of products. They are also more effective at prolonging product freshness due to their barrier properties, which keep moisture and air out. Flexible packaging is also more sustainable, as it uses less material than rigid packaging and is easier to recycle.

The advantages of flexible bioplastics are driving their growing popularity in industries like food and beverages. Bioplastics allow products to be safely packaged, transported, and displayed while reducing the environmental impact associated with traditional packaging. Additionally, programs like Materials Recovery for the Future (MRFF) and partnerships with major corporations such as Procter & Gamble, PepsiCo, and Target are helping to drive the development of sustainable recycling solutions for flexible packaging.

Innovative recycling technologies, such as plasma technology, are being employed to separate the components of bioplastic packaging, ensuring that these materials can be more easily recycled. This helps close the loop in commercial and residential composting systems, enhancing the environmental profile of flexible packaging solutions.

Food & Beverage Sector Driving the Bioplastics Surge

In 2023, the food and beverage sector held the largest share of the bioplastic packaging market. This segment is being driven by the increasing popularity of quick-service restaurants and the growing demand for convenient, packaged food products. As consumer lifestyles become more fast-paced and retailers adapt to meet demand, manufacturers are ramping up production capacity to keep pace with the need for sustainable packaging.

Biodegradable films, which are made from natural, biodegradable materials, offer a sustainable alternative to conventional plastic packaging. These films are used for a variety of applications, including shrink wrap for fresh produce, snack packaging, and single-serve food items. Not only do biodegradable films provide a protective layer for food products, but they also break down naturally at the end of their life cycle, reducing the environmental impact of plastic waste.

In addition to their environmental benefits, biodegradable films are gaining popularity because they are lightweight, flexible, and cost-effective. For example, cellophane, a biodegradable material made from plant cellulose, is increasingly being used in food packaging as an eco-friendly alternative to plastic films.

The shift towards biodegradable films is also evident in the use of these materials for beverage packaging, where they help preserve freshness and extend shelf life without contributing to plastic pollution. As manufacturers continue to innovate and develop new biodegradable materials, the food and beverage packaging market is expected to see continued growth in the coming years.

The Growing Bioplastic Packaging Market: Regional Insights and Recent Developments

The bioplastic packaging industry is experiencing remarkable growth, driven by a rising global demand for sustainable solutions. Among the regions leading this change, Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa are key players. Each of these regions presents unique opportunities and challenges, creating diverse growth prospects within the market. Let's delve deeper into these regions and explore the developments shaping the future of bioplastic packaging.

Europe: The Dominant Force in Bioplastic Packaging

Europe stands at the forefront of the bioplastic packaging market, holding the largest share in 2023. This dominance is primarily attributed to the region's well-established e-commerce sector and the increasing focus on sustainability. The convenience of online shopping, combined with a robust logistical infrastructure, has greatly contributed to the growing demand for various packaging solutions. E-retailers across Europe have access to a wide range of packaging options at competitive prices, owing to the strong presence of packaging suppliers and manufacturers in the region.

The need for packaging is further driven by the region's commitment to sustainability. Packaging solutions emphasizing recyclability, tamper-proof seals, and easy returns are particularly valued by consumers and businesses alike. Moreover, continuous innovations in packaging designs and materials, such as bioplastics, are becoming commonplace in the market. A shift towards eco-friendly packaging, such as bioplastics made from renewable resources, aligns with Europe's environmental goals.

In addition, key players in Europe are focused on developing advanced biopolymers specifically for bioplastic packaging. This research and development effort is expected to significantly boost market growth in the coming years. Europe's emphasis on environmentally-conscious consumer habits, coupled with its established e-commerce platforms, positions it as the leader in bioplastic packaging demand.

Asia Pacific: The Fastest-Growing Region

While Europe leads in market share, Asia Pacific is projected to witness the fastest growth in the bioplastic packaging market over the forecast period. The rapid rise of internet retail, combined with the increasing disposable incomes of consumers in emerging markets, particularly in China, India, and Southeast Asia, has fueled demand for diverse packaging formats.

In these developing nations, online shopping has surged by more than 50% annually, a pace that exceeds even that of more established markets. This surge in e-commerce directly influences the packaging sector, creating significant opportunities for manufacturers. Packaging manufacturers in Asia Pacific benefit from the region's local manufacturing capabilities, inexpensive raw materials, and low labor costs, which attract multinational brand owners to establish operations in the area.

The Asia Pacific market also enjoys the advantage of a large customer base and well-established online retail marketplaces, making it a promising region for the future expansion of bioplastic packaging. As more multinational companies continue to invest in the region, the demand for bioplastic packaging solutions is expected to skyrocket. Key players in the region are also focusing on enhancing their production capacities by setting up new manufacturing plants, ensuring that the growth potential of the bioplastic packaging market is fully realized.

For instance, in January 2023, NatureWorks, a leading bioplastic manufacturer, announced its plan to establish a new plant in Thailand dedicated to bioplastic material production. This expansion is expected to significantly contribute to the supply of sustainable bioplastic packaging in the region.

Similarly, in March 2024, Sulzer Ltd, an engineering company, announced its collaboration with Balrampur Chini Mills Limited (BCML) to supply polylactic acid (PLA) manufacturing technologies for a new bioplastic plant in India. This partnership underscores the growing commitment to bioplastic innovation and the development of more sustainable packaging materials in Asia.

Latin America and the Middle East & Africa: Emerging Markets with Potential

Latin America (LA) and the Middle East & Africa (MEA) regions present emerging opportunities in the bioplastic packaging market. While they currently hold smaller market shares compared to Europe and Asia Pacific, both regions are gradually increasing their adoption of sustainable packaging solutions.

In Latin America, the growing awareness of environmental issues and the rise of e-commerce have created a favorable environment for the adoption of bioplastics. Similarly, the Middle East & Africa, with its increasing investment in infrastructure and manufacturing, is witnessing a gradual shift towards more sustainable packaging alternatives.

The potential for growth in these regions is substantial, especially as businesses and consumers alike begin to prioritize eco-friendly products and packaging materials. As the demand for bioplastics increases, both Latin America and the Middle East & Africa are likely to see significant investments in sustainable packaging technologies, further propelling the market forward.

Innovations in Sustainable Materials: The Role of Mushrooms

In addition to bioplastics, recent research into alternative eco-friendly materials has opened new frontiers in sustainable packaging. One of the most exciting innovations is the potential use of mushrooms as a replacement for traditional plastics. Researchers have discovered that certain mushroom species possess remarkable properties that could make them ideal for various applications, ranging from packaging to durable goods.

The versatility of mushrooms as a material lies in their three-layer structure, which can be engineered to create textures ranging from soft and spongy to tough and woody. The outer layer is particularly resistant to impact, making it suitable for coatings in products like windshields. The middle layer offers a leather-like texture, which could be used as a sustainable alternative to leather goods. The inner layer mimics the properties of wood, opening up possibilities for its use in structural materials.

This breakthrough in mushroom-based materials highlights the potential for entirely new forms of sustainable packaging, capable of reducing the environmental impact of conventional plastic waste. With ongoing advancements in material science and manufacturing techniques, mushrooms could soon become a key player in the future of eco-friendly packaging solutions.

Recent Developments in Bioplastic Packaging

Several recent developments underscore the growing momentum of the bioplastic packaging market:

• In August 2023, AIMPLAS, the Spanish plastics technology research center, initiated a project focused on developing eco-friendly and sustainable bio-based plastic materials. Funded by the Horizon Programme, a UK-based foundation supporting biodegradable materials, AIMPLAS is leading the way in advancing bioplastics for various industrial applications.

• In July 2024, Essentra PLC, a leading manufacturer of packaging materials, announced the acceleration of its bioplastic material production. This initiative is part of the company's broader strategy to offer more sustainable products to retailers and consumers, further contributing to the growth of the bioplastic packaging market.

Key Players in the Bioplastic Packaging Market

Several companies are at the helm of innovation in the bioplastic packaging market. Key players include:

• Amcor plc

• Novamont S.p.A

• NatureWorks, LLC

• Coveris

• Sealed Air

• Alpha Packaging

• Constantia Flexibles Group GmbH

• Mondi plc

• Truegreen

• Transcontinental Inc.

• ALPLA

• Envigreen

• Nature's Bio Plastic

• Raepak Ltd.

• Tipa-corp Ltd.

• Treemera GmbH

• Element Packaging Ltd

• Alpagro Packaging

Source: https://www.towardspackaging.com/insights/bioplastic-packaging-market-sizing

Baner

Buy Premium Global Insight: https://www.towardspackaging.com/price/5215

Review the Full TOC for the Bioplastic Packaging Market Report: https://www.towardspackaging.com/table-of-content/bioplastic-packaging-market-sizing

Get the latest insights on packaging industry segmentation with our Annual Membership - https://www.towardspackaging.com/get-an-annual-membership

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

Towards Healthcare: https://www.towardshealthcare.com

Towards Automotive: https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Bioplastic Packaging Market Trends, Drivers and Opportunities here

News-ID: 3805344 • Views: …

More Releases from Towards Packaging

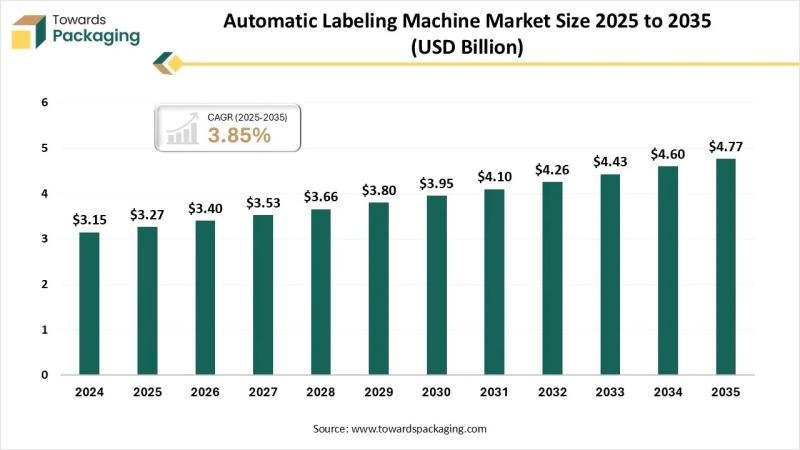

Automatic Labeling Machine Market Set for Strong Growth Through 2035

The global automatic labeling machine market is poised for steady expansion, rising from USD 3.4 billion in 2026 to USD 4.77 billion by 2035 at a CAGR of 3.85%. Demand is being driven by rapid automation in packaging lines, stringent labeling regulations, and the shift toward high-speed, error-free production across industries.

Download Sample: https://www.towardspackaging.com/download-sample/5882

Self-adhesive labeling systems currently hold the largest share at 39%, supported by their versatility and cost efficiency. Meanwhile,…

Unleashing Growth in the Liquid Packaging Market with Strategic Innovations

The liquid packaging industry is experiencing remarkable growth, with projections indicating an increase from USD 397.36 billion in 2025 to USD 645.43 billion by 2034. This growth, at a compound annual growth rate (CAGR) of 5.7%, signifies the expanding demand for liquid packaging solutions across a variety of sectors. As we delve into the market dynamics, it becomes clear that the liquid packaging sector is evolving rapidly, with several key…

Advancements in Hot-Fill Food Packaging Paving the Way for a Sustainable Future

The global hot-fill food packaging market is experiencing a steady rise, with an expected market value of USD 71.26 billion by 2033, up from USD 49.85 billion in 2023. This growth is projected to follow a compound annual growth rate (CAGR) of 3.76% from 2024 to 2033, reflecting the increasing demand for innovative packaging solutions in the food and beverage sector.

Download a Brochure of Hot-fill Food Packaging Market: https://www.towardspackaging.com/download-brochure/5266

Hot-Fill…

Driving Growth and Innovation in the Plastic Bag Market

The plastic bag market is undergoing significant growth, with its value reaching an estimated US$ 25.10 billion in 2023. Projections suggest that this market could hit a substantial US$ 35.41 billion by 2033, marking a steady compound annual growth rate (CAGR) of 3.5% from 2024 to 2034. This growth is largely driven by the expanding needs of various industries for efficient and cost-effective packaging solutions.

Download a Brochure of Plastic Bag…

More Releases for Bio

Human Plasma Products Market 2023: Industry Future Trends | Takeda, CSL, Grifols …

The Human Plasma Products market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with…

Gene Therapy Products Market | Advantagene, Avalanche Bio, Bluebird Bio, Cellado …

The global gene therapy products market report is a comprehensive report that provides a detailed analysis of the current status and future trends of the gene therapy products market worldwide. This report provides valuable information to industry stakeholders by offering an in-depth perspective on market dynamics, competitive landscape, growth opportunities, and key challenges faced by industry participants.

From the perspective of market dynamics, this report explores the factors driving the growth…

Bio-based Polymethyl Methacrylate (Bio-PMMA) Market 2023 | Detailed Report

The Bio-based Polymethyl Methacrylate (Bio-PMMA) report compiles the market information depending upon market development and growth factors, optimizing the growth path. In addition, it highlights the strategies and market share of the leading vendors in the particular market. The report follows a robust research methodology model that helps to make informed decisions. It obtains both qualitative and quantitative market information supported by primary research.

The Bio-based Polymethyl Methacrylate (Bio-PMMA) research report…

Bio Pharma Buffer Market – A comprehensive study by Key Players: Bio-Rad, Lonz …

Latest Market intelligence report released by HTF MI with title "COVID-19 Outbreak-Global Bio Pharma Buffer Industry Market Report-Development Trends, Threats, Opportunities and Competitive Landscape in 2020" is designed covering micro level of analysis by manufacturers and key business segments. The COVID-19 Outbreak-Global Bio Pharma Buffer Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary…

IVIG Market Anticipated a Noteworthy CAGR during 2019-2024 & Companies Included …

A report added to the rich database of Qurate Business Intelligence, titled “World IVIG Market by Product Type, Players and Regions - Forecast to 2024”, provides a 360-degree overview of the Global market. Approximations associated with the market values over the forecast period are based on empirical research and data collected through both primary and secondary sources. The authentic processes followed to exhibit various aspects of the market makes the…

Green & Bio-based Solvents Market Analysis, Demand, & Opportunities till 2023 | …

A latest research report titled as “Green & Bio-based Solvents Market for Paints & Coatings, Printing Inks, Commercial & Domestic Cleaning, Adhesives & Sealants, Pharmaceutical, Cosmetics, and Other Applications - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2015 - 2023” has been recently added to the vast portfolio of Market Research Reports Search Engine (MRRSE) online research offerings. This report is a professional and in-depth analysis on the…