Press release

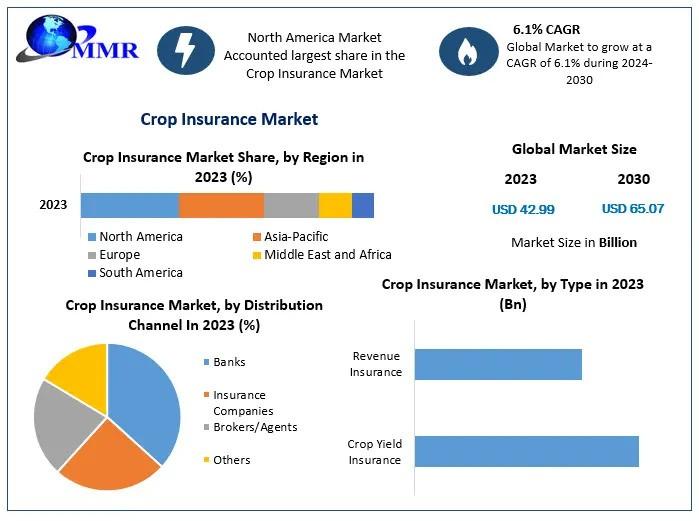

Crop Insurance Market to Expand from USD 42.99 Bn in 2023 to USD 65.07 Bn by 2030, Growing at a 6.1 Percentage CAGR

𝐂𝐫𝐨𝐩 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 was valued at US$ 42.99 Bn in 2023 and is expected to reach US$ 65.07 Bn by 2030, at a CAGR of 6.1% during the forecast period.𝐂𝐫𝐨𝐩 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

The crop insurance market plays a critical role in safeguarding agricultural producers from financial losses due to natural disasters and adverse weather conditions. As climate change intensifies the frequency of extreme weather events such as droughts, floods, and storms, the demand for crop insurance is expected to rise globally. This sector is experiencing significant growth, driven by governmental support, increased awareness, and the need for farmers to secure their crops. Advanced technologies like satellite monitoring and data analytics are also enhancing the accuracy and efficiency of risk assessment in crop insurance.

𝐆𝐞𝐭 𝐘𝐨𝐮𝐫 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐭𝐡𝐞 𝐋𝐚𝐭𝐞𝐬𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬: https://www.maximizemarketresearch.com/request-sample/148613/

𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐂𝐫𝐨𝐩 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 :

Several factors are propelling the crop insurance market forward. Government subsidies and regulations that make insurance affordable and accessible to farmers are significant drivers. In many regions, policies that encourage the adoption of crop insurance are being implemented to secure food production and rural economies. Additionally, the increasing vulnerability of crops to unpredictable weather patterns due to climate change is boosting demand for protection. Technological innovations, including precision farming tools and weather forecasting systems, allow insurers to offer more tailored solutions, further promoting market growth.

𝐂𝐫𝐨𝐩 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬:

A notable trend in the crop insurance market is the shift towards customized insurance products. As the farming landscape diversifies, insurers are offering more specialized coverage that considers the unique risks faced by different crops and geographical regions. Another trend is the integration of technology in policy administration, from automated claims processing to the use of drones and satellite imagery for damage assessment. Furthermore, the rise of sustainable agricultural practices is influencing crop insurance offerings, with some insurers incorporating environmental impact factors and risk mitigation practices into their policies. These trends signal a growing focus on efficiency, personalization, and sustainability in the sector.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐓𝐨𝐝𝐚𝐲 𝐟𝐨𝐫 𝐂𝐮𝐬𝐭𝐨𝐦 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬: https://www.maximizemarketresearch.com/inquiry-before-buying/148613/

𝐌𝐞𝐫𝐠𝐞𝐫𝐬 𝐚𝐧𝐝 𝐀𝐜𝐪𝐮𝐢𝐬𝐢𝐭𝐢𝐨𝐧𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐂𝐫𝐨𝐩 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

𝐆𝐫𝐨𝐰𝐭𝐡 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 𝐢𝐧 𝐕𝐢𝐞𝐭𝐧𝐚𝐦

Vietnam's crop insurance sector is witnessing increased adoption due to government initiatives and private sector involvement. Key players such as Vietnam Insurance Corporation are expanding their offerings.

𝐂𝐫𝐨𝐩 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐆𝐫𝐨𝐰𝐭𝐡 𝐢𝐧 𝐓𝐡𝐚𝐢𝐥𝐚𝐧𝐝

Thailand is witnessing steady growth in the crop insurance market, driven by natural disaster risks. The government's support is boosting the sector's adoption, with companies like Thai General Insurance leading the way.

𝐑𝐞𝐜𝐞𝐧𝐭 𝐓𝐫𝐞𝐧𝐝𝐬 𝐢𝐧 𝐉𝐚𝐩𝐚𝐧

In Japan, technological innovations, particularly AI-driven solutions, are shaping the future of crop insurance. Companies like Sompo Japan are investing heavily in digital platforms to increase efficiency and reach.

𝐂𝐨𝐧𝐬𝐨𝐥𝐢𝐝𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐒𝐨𝐮𝐭𝐡 𝐊𝐨𝐫𝐞𝐚

South Korea's crop insurance market is consolidating, with major mergers between key players such as Samsung Fire & Marine Insurance and other industry leaders, aiming to streamline services and improve risk management strategies.

𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐔𝐩𝐝𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐒𝐢𝐧𝐠𝐚𝐩𝐨𝐫𝐞

Singapore's regulatory framework for crop insurance is evolving, with increased focus on supporting sustainable agricultural practices. Great Eastern Life has been at the forefront of implementing these changes.

𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐔𝐒

The US is witnessing significant growth in crop insurance, driven by new government programs and innovations. Leading companies like Farmers Mutual Hail Insurance Company are expanding their portfolios through acquisitions.

𝐑𝐞𝐜𝐞𝐧𝐭 𝐃𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭𝐬 𝐢𝐧 𝐄𝐮𝐫𝐨𝐩𝐞

Europe's crop insurance market is undergoing transformation with rising climate-related risks. Allianz Global Corporate & Specialty has been actively acquiring smaller firms to broaden its product offerings across the region.

𝐂𝐮𝐫𝐢𝐨𝐮𝐬 𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬? 𝐆𝐫𝐚𝐛 𝐘𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐓𝐨𝐝𝐚𝐲: https://www.maximizemarketresearch.com/request-sample/148613/

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐂𝐫𝐨𝐩 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 :

by Coverage Type

Multi-peril Crop Insurance (MPCI)

Crop-hail Insurance

by Distribution Channel

Banks

Insurance Companies

Brokers/Agents

Others

by Type

Crop Yield Insurance

Revenue Insurance

𝐖𝐡𝐨 𝐢𝐬 𝐭𝐡𝐞 𝐥𝐚𝐫𝐠𝐞𝐬𝐭 𝐦𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐞𝐫𝐬 𝐨𝐟 𝐂𝐫𝐨𝐩 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐰𝐨𝐫𝐥𝐝𝐰𝐢𝐝𝐞?

North America

1. American Finlands Group Inc

2. American International Group Inc

3. AmTrust Financial Services Inc

4. VANE (Insurance)

5. Duck Creek Technologies

Europe

6. axa insurance

7. Chubb Ltd

8. groupama assurances mutuelles

9. Zurich Insurance Co. Ltd

10. The Co-operators

APAC

11. Agriculture Insurance Co. of India Ltd.

12. ICICI Bank Ltd.

13. Indian Farmers Fertiliser Cooperative Ltd. (IFFCO)

14. QBE Insurance Group Ltd

15. Sompo Holdings In

16. The New India Assurance Co. Ltd.

17. Tokio Marine Holdings Inc.

18. Zking Insurance

19. SBI

20. QBE Insurance Group

ME

21. Santam Ltd.

22. Royal Exchange General Insurance

23. Farmcrowdy

𝐊𝐧𝐨𝐰 𝐌𝐨𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐓𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.maximizemarketresearch.com/market-report/crop-insurance-market/148613/

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐌𝐨𝐫𝐞: 𝐕𝐢𝐬𝐢𝐭 𝐎𝐮𝐫 𝐖𝐞𝐛𝐬𝐢𝐭𝐞 𝐟𝐨𝐫 𝐀𝐝𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

♦Global Clinical Information System Market https://www.maximizemarketresearch.com/market-report/global-clinical-information-systems-market/25362/

♦North America Enterprise Risk Management Market https://www.maximizemarketresearch.com/market-report/north-america-enterprise-risk-management-market/39648/

♦Global 4K Set-Top Box Market https://www.maximizemarketresearch.com/market-report/global-4k-set-top-box-market/102764/

♦global Airbag Electronics Market https://www.maximizemarketresearch.com/market-report/global-airbag-electronics-market/42272/

♦Global Playout Automation and Channel in a Box Market https://www.maximizemarketresearch.com/market-report/global-playout-automation-and-channel-in-a-box-market/25184/

♦Asia Pacific Digital Banking Platform Market https://www.maximizemarketresearch.com/market-report/asia-pacific-digital-banking-platform-market/44572/

♦Global Private Long-Term Evolution (LTE) in Mining Industry Market https://www.maximizemarketresearch.com/market-report/global-private-long-term-evolution-lte-in-mining-industry-market/108500/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crop Insurance Market to Expand from USD 42.99 Bn in 2023 to USD 65.07 Bn by 2030, Growing at a 6.1 Percentage CAGR here

News-ID: 3805223 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

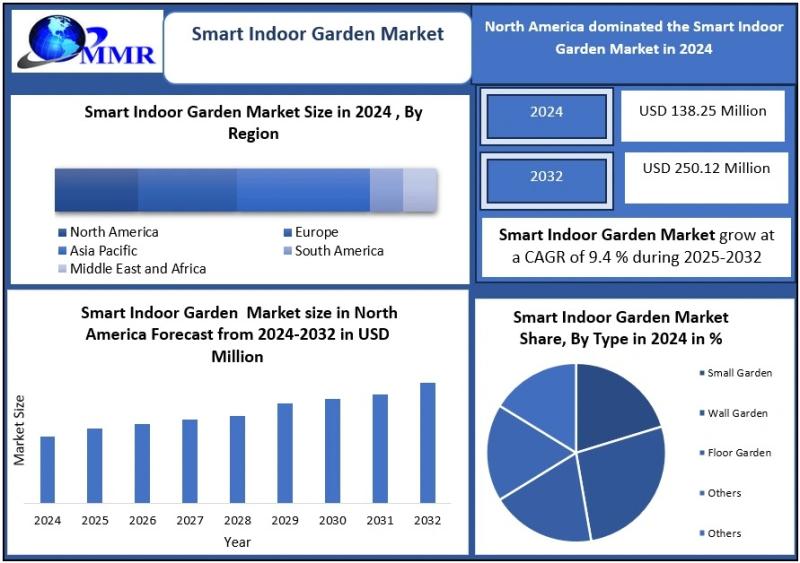

Smart Indoor Garden Market to Grow at 9.4% CAGR, Reaching USD 250.12 Million by …

Smart Indoor Garden Market: Growth, Dynamics, and Future Outlook

The Smart Indoor Garden Market size was valued at USD 2.18 Billion in 2024, and the total Smart Indoor Garden Market revenue is expected to grow at a CAGR of 9.4% from 2025 to 2032, reaching nearly USD 4.45 Billion.

Market Overview

The Smart Indoor Garden Market represents a fast-growing segment within the smart home and urban farming ecosystem. These systems enable consumers to…

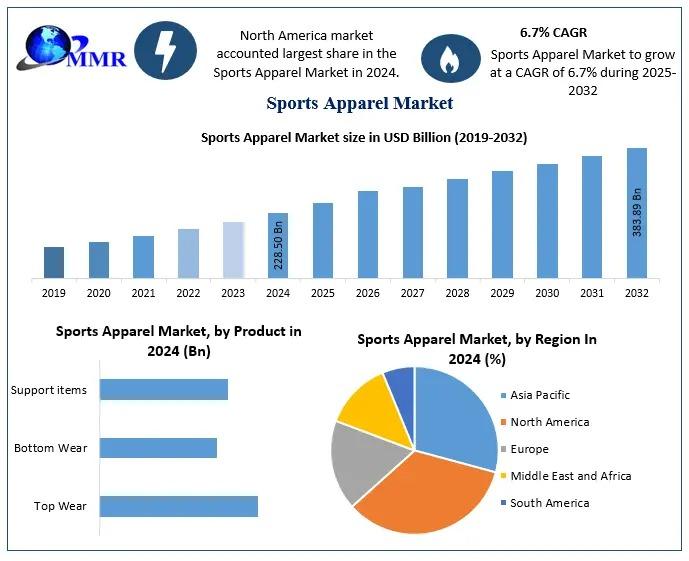

Sports Apparel Market Poised to Reach USD 383.89 Billion by 2032 at 6.7% CAGR

Sports Apparel Market: Growth, Dynamics, and Future Outlook

The Sports Apparel Market size was valued at USD 228.50 Billion in 2024, and the total Sports Apparel Market revenue is expected to grow at a CAGR of 6.7% from 2025 to 2032, reaching nearly USD 383.89 Billion.

Market Overview

The Sports Apparel Market represents a fast-growing segment of the global apparel industry, encompassing clothing designed for sports, fitness, athleisure, and outdoor activities. The market…

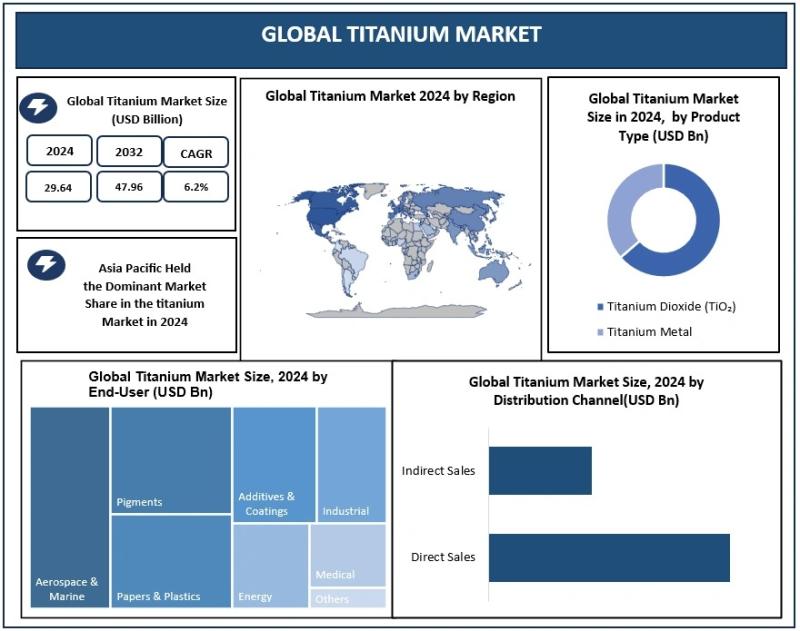

Titanium Market Growth at 6.2% CAGR to Reach USD 47.96 Bn by 2032

Titanium Market: Growth, Dynamics, and Future Outlook

The Titanium Market size was valued at USD 26.45 Billion in 2024, and the total Titanium Market revenue is expected to grow at a CAGR of 5.2% from 2025 to 2032, reaching nearly USD 39.72 Billion.

Market Overview

The Titanium Market plays a crucial role across multiple industries, including aerospace, automotive, medical devices, chemical processing, and construction. Titanium is widely preferred due to its exceptional strength-to-weight…

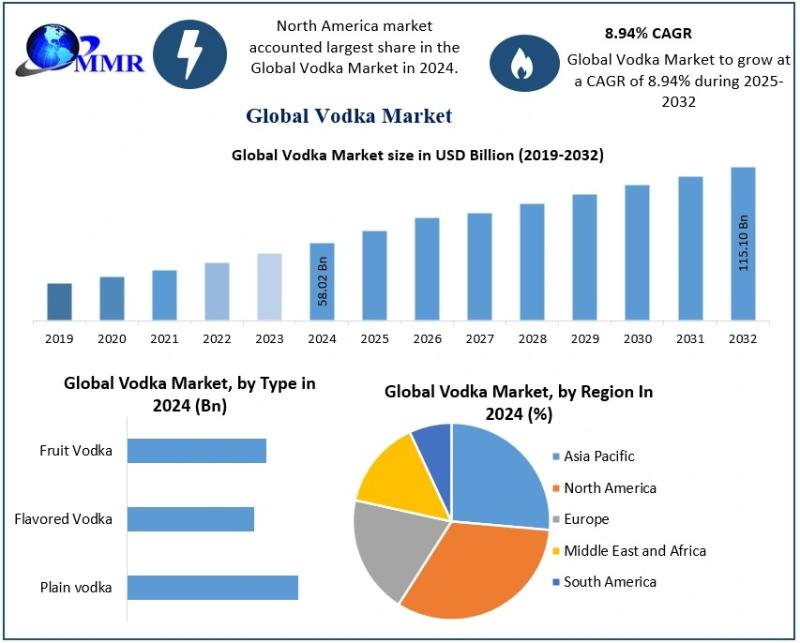

Vodka Market Growth Outlook: 8.94% CAGR Driving USD 115.10 Billion Valuation by …

Vodka Market: Growth, Dynamics, and Future Outlook

The Vodka Market size was valued at USD 48.26 Billion in 2024, and the total Vodka Market revenue is expected to grow at a CAGR of 5.2% from 2025 to 2032, reaching nearly USD 72.15 Billion.

Market Overview

The Vodka Market represents a major segment of the global alcoholic beverages industry, driven by rising consumption across both developed and emerging economies. Vodka remains one of the…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…