Press release

Semiconductor Packaging Market Share and Future Trends

The global semiconductor packaging market was valued at approximately US$ 41.05 billion in 2023 and is expected to reach around US$ 108.82 billion by 2033, growing at a compound annual growth rate (CAGR) of 10.24% from 2024 to 2033.Advancements in technology, especially in the smartphone industry, have significantly boosted the demand for semiconductor packaging. Major companies in the market are increasingly focusing on mergers and partnerships to innovate and develop advanced packaging solutions for semiconductor devices. This trend is expected to drive growth in the semiconductor packaging market over the coming years.

The Semiconductor Packaging Market: An In-Depth Look at Trends, Growth Drivers, and Future Outlook

The semiconductor industry has long been at the heart of technological

innovation, powering everything from smartphones and computers to the next generation of artificial intelligence. However, behind every transistor, integrated circuit (IC), and microchip lies a critical component: semiconductor packaging. As technological advancements continue to shape the way we interact with electronic devices, semiconductor packaging materials have evolved, becoming essential for the success of modern electronic systems.

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5221

Asia Pacific: The Global Leader in Semiconductor Packaging

Asia Pacific has firmly established itself as the dominant player in the global semiconductor packaging market, holding a commanding market share of 54% in 2023. The region's supremacy can be attributed to the robust electronics manufacturing base in countries like China, Japan, Taiwan, and South Korea. These countries not only have a large presence of semiconductor production but also lead the world in packaging innovation, driving global trends.

Rising Stars: North America's Growth Potential

While Asia Pacific holds the lion's share, North America is set to experience significant growth during the forecast period. Driven by strategic investments and regulatory support, the U.S. is poised to bolster its semiconductor packaging capabilities, providing a competitive edge in the global market. This region's growth potential lies in its ability to capitalize on emerging technologies, policy initiatives, and an increased focus on domestic semiconductor production.

Material and Technology Trends: Shaping the Future of Packaging

In 2023, the organic substrate segment led the way in semiconductor packaging materials, accounting for over 42% of the market share. This growth can be attributed to the organic substrates' ability to support high-density interconnects and their cost-effectiveness. As the demand for smaller, more efficient, and more powerful semiconductors rises, organic substrates remain a key material driving market expansion.

Regarding technology, traditional semiconductor packaging technologies

dominated in 2023. Despite advancements in newer packaging methods like 3D IC and System-in-Package (SiP), the traditional packaging segment remains the most widely used. These technologies continue to offer cost-effective solutions for a range of applications, from consumer electronics to automotive systems.

Consumer Electronics: The Largest End-User Market

Among the various end-user sectors, consumer electronics continued to dominate the semiconductor packaging market in 2023. With the relentless growth of smartphones, wearables, and other smart devices, the demand for advanced semiconductor packaging has skyrocketed. As technologies like 5G and soon-to-come 6G continue to evolve, consumer electronics will remain the largest driver of growth in the semiconductor packaging space.

The Shift to Advanced Packaging Technologies

As the world accelerates into the digital age, semiconductor packaging technologies are evolving rapidly. The global packaging market, valued at $1.20 trillion in 2022, is expected to grow at a compound annual growth rate (CAGR) of 3.16%, reaching an estimated $1.58 trillion by 2032. This growth is fueled by advancements in 3D integration, heterogeneous integration, and wafer-level packaging, which promise to deliver smaller, faster, and more efficient chips.

A prime example of this evolution is System-in-Package (SiP) integration, which combines two or more chips on a single substrate to create more compact, multifunctional modules. This technology is already being widely used in consumer goods such as smartphones, wearables, and smart home devices.

Additionally, 2.5D and 3D IC integration, which utilize advanced interposers and fine metal layers, are pushing the boundaries of what's possible in terms of chip performance and miniaturization.

Key Growth Drivers: The Forces Behind Market Expansion

Several key factors are expected to drive the growth of the semiconductor packaging market over the coming years:

• Emerging Markets: As demand for semiconductor devices rises in regions like Latin America and Africa, semiconductor packaging companies are exploring new opportunities for growth.

• Regulatory Support: Governments worldwide are offering incentives to semiconductor manufacturers to invest in packaging technologies and reduce reliance on foreign suppliers, particularly in Asia. The U.S. government's $1.6 billion investment to advance semiconductor packaging technologies is a prime example of such initiatives.

• Cost Efficiency and Production Innovation: Manufacturers are increasingly focusing on cost reduction and improved production efficiency, which will drive innovation in packaging technologies. This is particularly evident in the ongoing development of packaging films designed to support next-generation semiconductor devices.

• Technological Advancements: The continued evolution of packaging technologies, including improvements in heat management, power delivery, and connector technology, will play a significant role in driving market growth. The development of chiplets, which are modular components used to create larger chips, is also expected to drive significant advancements in packaging.

The U.S. Push: A Strategic Move to Regain Semiconductor Leadership

A critical development in the semiconductor packaging landscape is the U.S.

government's recent investment in advancing next-gen semiconductor packaging technologies. Through the 2022 CHIPS and Science Act, the U.S. has pledged $1.6 billion to foster innovation in semiconductor packaging, with the goal of reducing reliance on foreign suppliers and boosting domestic production. This funding will be used to improve critical areas like data transfer speeds, heat management, and the development of high-performance chips for AI applications.

The U.S. government has incentivized semiconductor companies like Intel, SK Hynix, and Amkor Technology to establish chip packaging plants on American soil, positioning the country as a competitive force in global semiconductor manufacturing. This move aims to strengthen the U.S.'s position in the semiconductor value chain, ensuring that the nation remains at the forefront of technology and innovation.

A Bright Future Ahead for Semiconductor Packaging

The semiconductor packaging market is poised for significant growth, driven by technological innovations, regional expansions, and increased demand for smaller, more efficient chips. With advancements in packaging materials and technologies, the market is set to evolve, enabling the creation of even more powerful and efficient semiconductor devices. As consumer electronics continue to expand and new industries like automotive and AI emerge, semiconductor packaging will remain a critical component in the next wave of technological innovation.

In conclusion, as countries like the U.S. ramp up investments in domestic

semiconductor capabilities and key regions like Asia Pacific continue to lead the charge, the semiconductor packaging market is primed for exciting growth. With the right strategic investments and technological advancements, the next decade promises to be a transformative period for the semiconductor packaging industry.

Semiconductor Packaging Market Dynamics: Trends, Challenges, and Opportunities

The semiconductor packaging market is undergoing transformative shifts, driven by technological advancements, rising demand for compact and efficient electronics, and the need for enhanced performance. These changes have created both exciting opportunities and significant challenges for industry players. As a crucial element of the semiconductor industry, packaging solutions are evolving to meet the diverse needs of modern electronics. This article explores the key drivers, restraints, and opportunities shaping the semiconductor packaging landscape.

Drivers of Market Growth: The Push for Miniaturization and Densification

One of the primary drivers of growth in the semiconductor packaging market is the increasing trend of miniaturization and densification in the electronics sector. As devices shrink, their functionality and performance need to be preserved or enhanced. This trend is especially visible in consumer electronics such as smartphones, wearables, and Internet of Things (IoT) devices, where users demand sleek designs without compromising on performance.

Manufacturers face the challenge of fitting increasingly complex functions into smaller and more compact spaces. To address these challenges, semiconductor companies are pushing the limits of integration, packing more functions into fewer components. This has led to innovations in packaging solutions that support higher levels of integration while ensuring that performance, reliability, and thermal management remain at optimal levels.

The miniaturization of consumer electronics is driving the need for advanced packaging materials that can support these intricate chip designs. Integrated circuit (IC) packaging materials, which provide mechanical support, electrical insulation, signal integrity, and heat dissipation, have become indispensable in meeting the stringent demands of compact devices. Materials such as organic substrates, leadframes, encapsulation resins, and thermal interface materials are increasingly being used to deliver small, yet highly effective, packaging options.

Furthermore, the growing trend of component densification-the practice of cramming more functionality into limited space-has spurred the demand for packaging materials that can support more complicated interconnections and higher pin densities. The need for reliable, robust, and thermally efficient packaging materials is becoming more critical as the electronics industry pushes towards these goals. As a result, the semiconductor and IC packaging markets are seeing continuous innovation to keep pace with the evolving requirements of the electronics sector.

Restraints: The High Cost of Advanced Materials

While the growth prospects in the semiconductor packaging market are strong, the industry faces significant challenges, primarily related to the high cost of advanced materials. The rising cost of raw materials, driven by factors such as increased urbanization and supply chain issues, poses a threat to market expansion. Moreover, there is a shortage of trained professionals and skilled labor in the semiconductor packaging field, which further hampers the development of advanced packaging solutions.

Advanced packaging materials, which offer enhanced functionality, performance, and reliability, often require specialized production techniques and substantial investments in research and development (R&D). These expenses contribute to higher manufacturing costs, which ultimately impact the pricing of these materials. As a result, semiconductor manufacturers may pass on these costs to consumers, diminishing the cost-effectiveness of advanced packaging solutions in comparison to traditional packaging options.

In a competitive and cost-sensitive industry like semiconductors, companies are continually seeking ways to reduce costs and improve profit margins. The high initial costs associated with adopting new materials could deter some businesses-particularly smaller players-from investing in advanced packaging technologies. This could slow the adoption of cutting-edge packaging materials, affecting the overall growth of the market.

Opportunities: The Rise of Inorganic Growth Strategies

The growing adoption of emerging technologies such as autonomous systems, 5G connectivity, machine learning (ML), artificial intelligence (AI), and IoT is creating a surge in demand for high-performance semiconductor components. These technologies require packaging solutions that meet rigorous performance, reliability, and thermal management standards. As the demand for high-speed data transmission, low-latency communication, and enhanced connectivity grows, the need for advanced semiconductor packaging materials becomes increasingly critical.

For example, AI and ML applications require chips with high processing power and effective heat dissipation capabilities, which in turn demands innovative packaging materials. Similarly, the rollout of 5G networks and the proliferation of IoT devices necessitate semiconductor packages that can support rapid data transmission and ensure reliable connectivity among devices.

This demand for sophisticated packaging solutions presents significant growth

opportunities for businesses that specialize in semiconductor packaging materials. To meet this rising demand, key players in the market are increasingly focusing on inorganic growth strategies, such as strategic partnerships and collaborations. By joining forces with other industry leaders, companies can pool resources, share expertise, and accelerate the development of advanced packaging technologies.

One notable example of inorganic growth in the semiconductor packaging space is the formation of the "US-JOINT" research and development consortium in July 2024. Led by Resonac Corporation, this collaboration includes ten prominent semiconductor companies from Japan and the U.S., including Moses Lake Industries, Towa, Kulicke and Soffa Industries, and KLA. The US-JOINT consortium aims to advance semiconductor back-end processes through collective research and development efforts. A new R&D center in the U.S. will serve as the hub for these activities, showcasing the growing trend of collaborative innovation in the semiconductor packaging industry.

The Importance of Semiconductor Packaging: A Critical Pillar in Modern Technology

Semiconductors, the core components of integrated circuits, are indispensable in the functioning of modern technology. Their role has expanded across virtually all technological sectors, from mobile phones and laptops to advanced AI systems and autonomous vehicles. However, these intricate semiconductor wafers need more than just functional efficiency-they require robust protection and strategic connections to the external environment. This is where semiconductor packaging comes into play.

Semiconductor packaging serves a critical role in safeguarding delicate

semiconductor wafers from contamination, environmental factors such as light and heat, and mechanical damage. Packaging not only provides physical protection but also ensures that the semiconductor is connected to its surrounding system-enabling efficient signal transmission, thermal management, and electrical connections. Despite its importance, semiconductor packaging was historically undervalued, with reliance on outdated packaging methods and outsourced testing to low-cost OSATs (Outsourced Semiconductor Assembly and Test companies).

A Shift Toward Advanced Packaging: Paving the Way for Future Technologies

Around the year 2000, the semiconductor industry began transitioning toward more advanced packaging methods, marking a pivotal shift in the way these critical components were protected and integrated into devices. As Moore's Law, which historically predicted the doubling of transistors on a chip, starts to slow down, the need for more efficient, high-performance packaging solutions has gained prominence. Emerging technologies such as 5G, autonomous vehicles, the Internet of Things (IoT), and virtual and augmented reality (VR/AR) have further accelerated the demand for innovative packaging that enables smaller, faster, and more energy-efficient semiconductors.

Advanced packaging has thus become essential to the ongoing innovation in the semiconductor industry. With traditional approaches reaching their limits, advanced packaging offers the promise of overcoming challenges tied to power consumption, size constraints, and performance requirements.

Key Advanced Packaging Technologies: Shaping the Future of Semiconductors

The semiconductor industry has witnessed the emergence of several advanced packaging technologies that are currently transforming the market. These innovations are not only reshaping the physical structure of chips but are also optimizing their overall performance and functionality.

• 2.5-D Packaging: This method involves placing multiple chips side by side on a shared interposer. The interposer acts as a bridge, facilitating communication between the chips. This approach optimizes performance by minimizing the physical space between chips while maintaining their integrity.

• 3-D Stacking: As the name suggests, this technique stacks chips vertically, creating a compact and efficient solution. Chips may be stacked with or without an interposer, and this technology is ideal for applications requiring high-density, low-latency components.

• Fan-Out and Fan-In Wafer-Level Packaging: These packaging methods focus on improving the arrangement of electrical connections and solder balls, enhancing performance and reducing the overall size. They are particularly effective in reducing signal loss and heat buildup.

Though traditional packaging methods, like wire-bonding, continue to be used in certain environments, they face challenges in high-temperature settings. Flip-chip packaging is increasingly favored for its compact design, improved performance, and superior signal propagation.

The Market Dynamics: Trends, Growth, and Market Leadership

In recent years, wafer-level packaging has gained significant traction, particularly within mobile and network applications. Among the various advanced packaging technologies, Fan-Out Packaging currently dominates the market, driven largely by the rising demand for mobile devices and high-performance computing (HPC). The need for faster data transmission and lower power consumption in devices such as smartphones, tablets, and laptops continues to propel this trend.

As cloud computing, artificial intelligence (AI), and data center infrastructures expand, 2.5-D Stacking is poised to experience significant growth, especially in HPC applications. Meanwhile, 3-D Packaging is rapidly gaining ground in memory applications, particularly within data centers and graphics accelerators.

Leading companies like TSMC, Intel, and Apple are playing a pivotal role in driving advancements in these technologies. Their continued focus on innovation is setting the tone for the future of semiconductor packaging.

Market Strategies: Collaboration and Overcoming Barriers

Successfully navigating the competitive advanced packaging market requires manufacturers to engage in close collaboration with their fabless customers-those who design the chips but outsource the manufacturing process. This collaboration is particularly crucial during the chip design and development stages to ensure seamless integration of the packaging with the chip's functional requirements.

The semiconductor packaging industry faces significant challenges. High technology and investment barriers make it difficult for new entrants to compete with established market leaders. To overcome this, joint development agreements are essential for fostering innovation and creating premium packaging solutions. Such partnerships help companies stay ahead in a market that demands constant technological advancement.

Moreover, semiconductor packaging is entering a new phase of innovation, with new materials being explored. For instance, glass is emerging as a potential alternative material for interposers, offering enhanced performance. While it is still in the experimental phase, this technology holds promise for the future.

Material Insights: The Role of Organic Substrates and Advanced Materials

In terms of materials, organic substrates dominated the semiconductor packaging market in 2023. These materials are preferred for their cost-effectiveness and excellent electrical performance, making them the go-to choice for a wide range of applications. Organic substrates are particularly popular in consumer communication and electronics industries due to their ability to deliver high reliability while reducing the overall weight of the printed circuit board (PCB). This reduction in weight is critical for modern electronic devices, which are increasingly becoming smaller and lighter.

Recent advancements in organic substrates, such as low-loss dielectrics and high-speed laminated materials, have significantly improved thermal management and signal transmission, further solidifying their place as the material of choice for semiconductor packaging.

On the other hand, ceramic packages-known for their high thermal conductivity-are essential in applications requiring high performance in extreme environments, such as defense, aerospace, and other harsh settings. These packages are gaining traction in specialized applications where reliability and endurance are critical.

Technology Insights: Traditional vs. Advanced Packaging

While traditional packaging methods, such as wire bonding and leadframe-based techniques, continue to hold the largest share of the market, the demand for advanced packaging solutions is growing at a rapid pace. Traditional methods are still preferred in large-scale applications, such as automotive electronics, due to their cost-effectiveness and the established manufacturing processes involved.

However, advanced packaging technologies, such as embedded die, 3D/5D

packaging, System-in-Package (SiP), and Fan-in Wafer Level Packaging (FI-WLP), are witnessing a surge in demand. These methods allow for miniaturization and enhance the overall production capacity of devices. They are particularly vital for high-demand sectors like IoT and AI, where both size reduction and high performance are essential.

Additionally, advancements in packaging also include the integration of components like galvanic isolators with integrated magnets for power and signal isolation, and crystal-less MCs with integrated BAW resonators. These developments are setting new standards for IC performance, reducing system costs while enhancing functionality.

End-Use Market: Consumer Electronics Leading the Charge

The consumer electronics sector is the largest end-user of semiconductor packaging, accounting for a significant portion of the market share in 2023. The relentless evolution of electronic gadgets-particularly smartphones, tablets, laptops, and wearable devices-has driven the demand for efficient and miniaturized semiconductor packaging. The trend towards multifunctional and smaller devices continues to propel the need for advanced packaging technologies.

For example, with over 7.4 billion smartphone users worldwide, the demand for semiconductors that power these devices has skyrocketed. This growing consumer base is expected to further drive the need for high-performance semiconductor packaging, ensuring that it remains at the forefront of technological advancement.

Semiconductor Packaging Market: Recent Developments and Key Players

The semiconductor packaging industry is undergoing rapid transformation, driven by advancements in technology and increasing demand for high-performance chips. Over the past few months, several significant developments have reshaped the market landscape, with major companies making bold moves to cater to the growing demands of artificial intelligence (AI), mobile devices, automotive applications, and other sectors. This article delves into recent developments and key players in the semiconductor packaging market.

Tata Electronics Invests in Greenfield Facility in Assam

In February 2024, Tata Electronics Pvt Ltd. made a strategic investment in a greenfield facility in Assam, India, committing approximately US$ 32.28 million to the project. The new facility is set to focus on the congregation and testing of semiconductor chips. This facility will serve a broad array of applications, including artificial intelligence (AI), mobile devices, automotive systems, and other key segments. With this expansion, Tata Electronics aims to strengthen its semiconductor capabilities and meet the growing demand for cutting-edge chips across the globe.

Intel Introduces Glass Substrate for Advanced Packaging

Intel Corporation, a global leader in technology services, made headlines in September 2023 with the launch of a new glass substrate designed for next-generation semiconductor packaging. This innovative glass substrate offers superior mechanical and thermal stability, coupled with ultra-low flatness-properties that significantly enhance the interconnect density within semiconductor substrates. These improvements allow for the production of high-performance, high-density chip packages, which are essential for handling data-intensive workloads. Intel's new glass substrate is poised to revolutionize the packaging industry by improving performance while also reducing power consumption.

Taiwan Semiconductor Manufacturing Company to Expand in Japan

Another major player, Taiwan Semiconductor Manufacturing Company (TSMC), revealed plans in March 2024 to expand its advanced packaging capacity in Japan, Asia Pacific. TSMC is set to introduce its Chip-on-Wafer-on-Substrate (CoWoS) technology in the region, a technique that involves stacking semiconductor chips on top of one another to optimize space and performance. CoWoS technology helps to boost processing power and reduce power consumption, making it ideal for high-performance computing and AI applications. TSMC's move underscores the increasing importance of advanced packaging solutions in driving innovation across various industries.

Key Companies Shaping the Semiconductor Packaging Market

As the semiconductor packaging market grows, several key players are at the forefront of innovation and development. Among these are:

• HCL Technologies: A global IT services company, HCL is focusing on semiconductor solutions to provide cutting-edge packaging and assembly technologies.

• Moschip Semiconductor Technologies: Known for its semiconductor packaging solutions, Moschip continues to play a significant role in the evolving market.

• SPEL Semiconductor: SPEL specializes in the assembly and packaging of semiconductor devices, contributing to the industry's rapid growth.

• Ruttonsha International Rectifier Ltd: A prominent player in the semiconductor packaging space, Ruttonsha is involved in providing integrated solutions for various industries.

• ASE (Advanced Semiconductor Engineering): ASE is one of the largest semiconductor assembly and testing services providers, contributing to the development of advanced packaging solutions.

• Amkor Technology: A global leader in semiconductor packaging, Amkor is at the cutting edge of packaging technologies for a range of industries.

• JCET Group: A leading provider of semiconductor packaging and testing services, JCET is known for its advanced packaging technologies.

• Siliconware Precision Industries Co. Ltd.: Siliconware is renowned for its innovative semiconductor packaging and testing solutions.

• Powertech Technology Inc.: Powertech offers semiconductor packaging and testing services that cater to various sectors including consumer electronics and telecommunications.

• Tianshui Huatian Technology Co. Ltd.: Tianshui Huatian is involved in advanced semiconductor packaging, with a focus on integrating multiple semiconductor components.

• Fujitsu Semiconductor Ltd.: As a major player in the semiconductor packaging market, Fujitsu provides advanced packaging solutions for electronic components.

• UTAC: Known for its semiconductor assembly and testing capabilities, UTAC is a key player in the packaging industry.

• ChipMOS TECHNOLOGIES INC.: ChipMOS specializes in semiconductor assembly and testing, serving the global electronics market.

• CHIPBOND Technology Corporation: A significant player in the semiconductor packaging and testing industry, CHIPBOND offers innovative solutions for high-performance chips.

• Intel Corporation: A global leader in semiconductor manufacturing, Intel continues to innovate in packaging technology to meet the demands of modern computing.

• Samsung: Samsung's semiconductor division is heavily invested in advanced packaging technologies to support high-performance applications in mobile, AI, and other sectors.

• Unisem (M) Berhad: A provider of semiconductor packaging and testing solutions, Unisem is a major player in the global market.

• Camtek: Camtek specializes in providing semiconductor packaging solutions that enhance chip performance.

• LG Chem: A key supplier of materials for semiconductor packaging, LG Chem is involved in the development of advanced packaging technologies.

• MIC Electronics Ltd.: MIC Electronics plays a role in providing semiconductor packaging solutions for consumer electronics and other industries.

• Surana Telecom and Power Ltd.: Surana focuses on semiconductor packaging for the telecommunications and power sectors.

• Vedanta Ltd.: Vedanta is expanding its presence in the semiconductor packaging space, focusing on meeting the increasing demand for advanced chip packages.

Source: https://www.towardspackaging.com/insights/semiconductor-packaging-market-sizing

Baner

Buy Premium Global Insight: https://www.towardspackaging.com/price/5221

Review the Full TOC for the Semiconductor Packaging Market Report: https://www.towardspackaging.com/table-of-content/semiconductor-packaging-market-sizing

Get the latest insights on packaging industry segmentation with our Annual Membership - https://www.towardspackaging.com/get-an-annual-membership

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

Towards Healthcare: https://www.towardshealthcare.com

Towards Automotive: https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Semiconductor Packaging Market Share and Future Trends here

News-ID: 3803763 • Views: …

More Releases from Towards Packaging

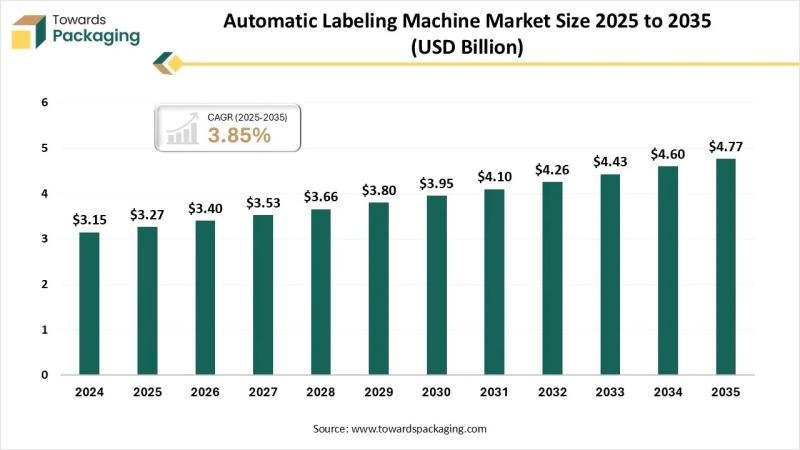

Automatic Labeling Machine Market Set for Strong Growth Through 2035

The global automatic labeling machine market is poised for steady expansion, rising from USD 3.4 billion in 2026 to USD 4.77 billion by 2035 at a CAGR of 3.85%. Demand is being driven by rapid automation in packaging lines, stringent labeling regulations, and the shift toward high-speed, error-free production across industries.

Download Sample: https://www.towardspackaging.com/download-sample/5882

Self-adhesive labeling systems currently hold the largest share at 39%, supported by their versatility and cost efficiency. Meanwhile,…

Unleashing Growth in the Liquid Packaging Market with Strategic Innovations

The liquid packaging industry is experiencing remarkable growth, with projections indicating an increase from USD 397.36 billion in 2025 to USD 645.43 billion by 2034. This growth, at a compound annual growth rate (CAGR) of 5.7%, signifies the expanding demand for liquid packaging solutions across a variety of sectors. As we delve into the market dynamics, it becomes clear that the liquid packaging sector is evolving rapidly, with several key…

Advancements in Hot-Fill Food Packaging Paving the Way for a Sustainable Future

The global hot-fill food packaging market is experiencing a steady rise, with an expected market value of USD 71.26 billion by 2033, up from USD 49.85 billion in 2023. This growth is projected to follow a compound annual growth rate (CAGR) of 3.76% from 2024 to 2033, reflecting the increasing demand for innovative packaging solutions in the food and beverage sector.

Download a Brochure of Hot-fill Food Packaging Market: https://www.towardspackaging.com/download-brochure/5266

Hot-Fill…

Driving Growth and Innovation in the Plastic Bag Market

The plastic bag market is undergoing significant growth, with its value reaching an estimated US$ 25.10 billion in 2023. Projections suggest that this market could hit a substantial US$ 35.41 billion by 2033, marking a steady compound annual growth rate (CAGR) of 3.5% from 2024 to 2034. This growth is largely driven by the expanding needs of various industries for efficient and cost-effective packaging solutions.

Download a Brochure of Plastic Bag…

More Releases for Semiconductor

Semiconductor Manufacturing Market 2021 Disclosing Latest Advancements- AMI Semi …

The report studies the Global Semiconductor Manufacturing Market with many aspects of the industry like the market size, market status, market trends, and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. The report offers valuable insight into the Semiconductor Manufacturing Market progress and approaches related to the market with an analysis of each region. The report goes on to…

Semiconductor Rectifier Market 2020 Share and Projection: ABB, ASI Semiconductor …

The Semiconductor Rectifier market report is the most important research for who looks for complete information on the Semiconductor Rectifier market. The report covers all information on the global and regional markets including historic and future trends for market demand, size, trading, supply, competitors, and prices as well as global predominant vendor’s information. The forecast market information, SWOT analysis, Semiconductor Rectifier market scenario, and feasibility study are the vital aspects…

"Semiconductor Microelectronics Market, Global Semiconductor Microelectronics Ma …

The “Semiconductor Microelectronics Market Analysis to 2030” is a specialized and in-depth study of the Semiconductor Microelectronics industry with a focus on the Semiconductor Microelectronics market trend. The report aims to provide an overview of the Semiconductor Microelectronics market with detailed market segmentation by component, application, end-user, and geography. The Semiconductor Microelectronics market is expected to witness high growth during the forecast period. The report includes key statistics on the…

Semiconductor Manufacturing Market Research Report 2019-2025 | Top Key Players � …

UpMarketResearch offers a latest published report on “Global Semiconductor Manufacturing Market Analysis and Forecast 2018-2025” delivering key insights and providing a competitive advantage to clients through a detailed report. The report contains 126 pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing and profitability.

Get Exclusive FREE Sample Copy Of this Report @ https://www.upmarketresearch.com/home/requested_sample/42049

Semiconductor Manufacturing Market research report delivers a close…

Global Silicon Carbide for Semiconductor Market - Toshiba, United Silicon Carbid …

The Market Research Store report offers majority of the latest and newest industry data that covers the overall market situation along with future prospects for Silicon Carbide for Semiconductor market around the globe. The research study includes significant data and also forecasts of the global market which makes the research report a helpful resource for marketing people, analysts, industry executives, consultants, sales and product managers, and other people who are…

Global Semiconductor Foundry Market 2016: Focuses on top players GlobalFoundries …

The Semiconductor Foundry research report by QY Research represents an inclusive evaluation of the Global Semiconductor Foundry Market and comprises considerable insights, historical data, facts, and statistical and industry-validated data of the global market. Additionally, it consists of estimated data that is evaluated with the help of suitable set of methodologies and assumptions. The research report highlights informative data and in-depth analysis of Semiconductor Foundry market and its corresponding segments…