Press release

Panel Level Packaging Market Outlook (2024 - 2032)

The global panel level packaging market is projected to grow from USD 0.43 billion in 2023 to USD 11.13 billion by 2033, representing a strong compound annual growth rate (CAGR) of 38.60% between 2024 and 2033.Panel-Level Packaging Market: A Growing Trend in Semiconductor and Electronics Manufacturing

The panel-level packaging (PLP) market is poised for remarkable growth in the coming years, driven by advancements in consumer electronics, telecommunications, and the automotive sector. This innovative packaging method, where semiconductor components are processed on a large square or rectangular panel, is becoming a key enabler of next-generation electronic devices. With its ability to offer high-quality features at competitive prices, PLP is rapidly transforming the landscape of semiconductor packaging.

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5246

What is Panel-Level Packaging?

Panel-level packaging refers to a technique where semiconductor components are processed on a large panel, as opposed to the traditional wafer-level approach. The process includes a series of advanced steps such as molding, bumping, die attachment, and redistribution line fabrication, all performed on a flat surface. This approach supports the creation of fine feature substrates that are critical for modern electronics, including the formation of microvias and structural features like lines.

Panel-level packaging is particularly beneficial for producing complex, high-performance packages. It leverages various manufacturing infrastructures, including silicon (BEOL), printed circuit boards (PCBs), liquid crystal displays (LCDs), and photovoltaics. This approach surpasses the limitations of conventional PCB/laminate infrastructures, offering a more scalable and cost-effective solution for the growing demands of the electronics industry.

Driving Forces Behind Market Growth

Several factors are contributing to the robust growth of the panel-level packaging market. One of the most significant drivers is the increasing demand for miniaturized electronic devices. Consumers and businesses alike are pushing for smaller, more powerful devices, and PLP is uniquely positioned to meet these demands. Smartphones, wearables, and IoT devices, in particular, require packaging solutions that are compact yet capable of delivering high performance. Panel-level packaging enables manufacturers to achieve the miniaturization required while maintaining the integrity and functionality of the components.

Another major factor influencing the growth of the PLP market is the ongoing advancements in key technological sectors such as artificial intelligence (AI), 5G, and automotive technologies. These fields are evolving rapidly, and the integration of different chip types into a single package-a trend known as heterogeneous integration-is gaining momentum. By combining multiple chips within one package, PLP provides the flexibility and performance required for next-generation AI and 5G devices, as well as the advanced electronics in autonomous vehicles.

The automotive sector, in particular, is witnessing an increased adoption of panel-level packaging. The rise of advanced driver-assistance systems (ADAS) and electric vehicles (EVs) has spurred the demand for smaller, more efficient semiconductors that can be incorporated into these technologies. As automotive manufacturers push for greater integration and performance, PLP is proving to be an ideal solution.

Key Trends Shaping the Industry

A few key trends are particularly important as the panel-level packaging market continues to evolve. The introduction of SEMI Standard 3D20 in 2019 marked a significant milestone for the industry. This standardization of panel sizes has allowed equipment manufacturers to invest in developing specialized tools to facilitate the PLP process. Standardization helps reduce manufacturing complexities, ultimately improving the overall cost-effectiveness and scalability of the process.

In addition to standardization, there is a growing interest in using glass

substrates in semiconductor packaging. Glass offers excellent electrical properties, making it highly suitable for high-frequency applications. Companies with extensive experience in producing glass wafers and panels are poised to play a crucial role in this shift. The growing interest in glass substrates signals a potential leap forward in the evolution of PLP, offering greater versatility and performance for a wide range of applications.

As the demand for smaller, faster, and more capable electronic devices

continues to grow, manufacturers face the challenge of meeting stringent performance standards. The advancements in 5G, IoT, virtual and augmented reality, and autonomous driving technologies are driving the need for semiconductors that offer superior speed, memory, and processing power. Panel-level packaging provides the means to meet these needs, ensuring that semiconductors can withstand the rigorous demands of emerging applications.

Thermal Control and Efficiency

As integration and miniaturization continue to advance, the importance of thermal control in semiconductor packaging is becoming increasingly critical. The shrinking size of electronic components means that heat dissipation is more difficult, and efficient thermal management is essential for maintaining the performance and longevity of devices. In panel-level packaging, thermal resistance must be minimized, and the heat transfer path must be as small as possible. Improving conductivity, increasing surface area for heat transfer, and optimizing the heat dissipation process are crucial factors for the success of PLP in high-performance applications.

Regional Market Insights

Geographically, Asia-Pacific is expected to experience the fastest growth in the panel-level packaging market, with a compound annual growth rate (CAGR) of 40.89% during the forecast period. This rapid growth can be attributed to the region's expanding consumer electronics and IoT applications, as well as significant investments in semiconductor manufacturing. Asia-Pacific is home to several key players in the electronics and semiconductor industries, and the region is at the forefront of innovations in these fields.

North America, on the other hand, held a significant market share of 30.82% in 2023, owing to the region's advanced technological developments and high demand for cutting-edge electronics. The region's robust investments in research and development (R&D), especially in industries such as automotive, aerospace, and consumer electronics, further bolster its position in the market. As these industries continue to grow, the demand for high-performance packaging solutions like PLP is expected to remain strong.

Exploring the Future of Panel-Level Packaging: Drivers, Challenges, and Opportunities

The electronics industry has long been at the forefront of technological

innovation, with constant strides toward miniaturization, enhanced functionality, and greater efficiency. Among the many advancements driving the market forward, panel-level packaging (PLP) has emerged as a key player in the evolution of modern electronic devices. From shrinking the size of components to improving signal integrity, PLP technology is set to play a pivotal role in meeting the demands of an increasingly digital and connected world. However, despite its promising potential, PLP also faces significant challenges that must be overcome to fully unlock its benefits.

The Growing Demand for Miniaturization

One of the most powerful forces shaping the future of electronics is the demand for miniaturization. As consumer electronics, medical devices, and industrial systems continue to shrink in size, the need for packaging solutions that accommodate smaller, more powerful components has never been greater. The miniaturization trend is not only about making devices smaller but also about enabling higher performance.

Electronic packaging is a critical process that ties together semiconductor

devices and circuit technology, creating the foundation for compact yet highly effective systems. As more electronics incorporate features like larger batteries, miniaturization ensures that these advancements do not lead to bulkier products. For example, miniaturized electronic subdivisions allow for the integration of larger batteries without increasing the device's overall size, making them more appealing to end-users across various industries.

From a design standpoint, smaller modules provide greater creative freedom for engineers and product developers. On the technological front, reducing the size of components results in shorter signal paths with less stray capacitance and inductance, which directly contributes to improved signal integrity and faster operational speeds. A prime example of miniaturization success is the KalamSathas satellite, the world's smallest and lightest satellite. Weighing less than a smartphone, this compact satellite is a testament to the potential of miniaturization in pushing the boundaries of what is possible in space technology.

The need for miniaturization also drives the demand for more advanced

substrate technologies. Modern electronic devices require complex multi-chip packaging systems that integrate memory, power management, and computational components into a single, highly efficient package. Panel-level packaging (PLP), which enables the embedding of thin semiconductor dies onto large substrates, helps achieve these objectives while reducing manufacturing costs. With its ability to process multiple chips at once, PLP technology maximizes material usage and allows for the creation of increasingly sophisticated circuitry in a smaller footprint.

As consumer electronics become more powerful, with faster processing speeds, better networking capabilities, and precise sensors, the PLP approach provides the necessary infrastructure to support these features. The potential for downsizing and heterogeneous integration within PLP allows manufacturers to meet the growing demands for high-performance systems that don't sacrifice space or power.

Challenges in Lithography for Panel-Level Packaging

While the benefits of panel-level packaging are clear, the technology faces several hurdles that could slow its widespread adoption. One of the most significant challenges is related to lithography-the process used to etch fine patterns onto semiconductor wafers. Traditional lithography systems, designed for smaller substrates, struggle to provide the necessary precision when working with larger panels, which are essential for PLP.

The exposure fields of current lithography systems are typically limited to 60mm x 60mm or less. While smaller-field systems can pattern larger substrates by taking multiple exposures, this method reduces both yield and productivity. Each exposure involves different reticles, and the stitching process between these exposures can lead to inaccuracies and defects. These challenges in lithography reduce the overall efficiency of panel-level packaging processes, making it harder for manufacturers to meet the high standards required for modern semiconductor applications.

Another issue facing PLP technology is the warpage and distortion of panels.

When working with large substrates, it is common for panels to warp during the manufacturing process. This warpage can cause alignment problems, affecting critical dimensions and uniformity, and leading to defects such as misalignment, broken components, or delamination. As a result, warpage represents a significant barrier to the adoption of panel-level packaging, as it complicates wafer singulation, ball placement, and redistribution layer (RDL) processes. Advanced techniques are required to mitigate warpage and ensure that the high-quality standards expected by the industry are met.

Opportunities in the Semiconductor Industry

Despite these challenges, the semiconductor industry presents significant growth opportunities for panel-level packaging. The rapid expansion of technologies such as 5G, artificial intelligence (AI), autonomous vehicles, and the Internet of Things (IoT) is driving the demand for more powerful, efficient, and compact semiconductor devices. As a result, semiconductor manufacturers are investing heavily in research, development, and new manufacturing capabilities, further propelling the growth of PLP technology.

In May 2024, the Semiconductor Industry Association (SIA) reported a staggering $49.1 billion in global semiconductor industry sales, a year-on-year increase of 19.3%. This growth is particularly evident in the Americas, where the market saw a 43.6% sales increase. With the surge in demand for semiconductors, manufacturers are keen on exploring innovative packaging solutions, such as PLP, that can deliver high performance at reduced size and cost.

Governments are also getting involved, with major investments aimed at bolstering the semiconductor industry's capabilities. In China, for example, the third phase of the National Integrated Circuit Industry Investment Fund raised 344 billion Yuan (around $47.5 billion) to support the domestic chip industry.

This fund is part of China's broader efforts to achieve self-sufficiency in semiconductor manufacturing amid ongoing trade tensions with the United States. These investments present a golden opportunity for PLP, which aligns perfectly with the industry's need for cutting-edge packaging solutions that can meet the requirements of next-generation semiconductor devices.

As semiconductor companies and governments invest billions in new production facilities, manufacturing equipment, and R&D, the adoption of panel-level packaging is set to accelerate. This growth is further supported by the increasing demand for devices that are smaller, faster, and more efficient-an area where PLP can provide significant advantages.

Panel-Level Packaging Market: Growth, Trends, and Key Insights for 2023-2033

The panel-level packaging (PLP) market is experiencing remarkable growth, driven by the increasing demand for advanced electronics and semiconductors. As digitalization accelerates and new technologies emerge, PLP solutions are poised to play a critical role in the production of high-performance devices. In this article, we explore the key segments of the market, regional insights, and recent developments by leading players in the industry.

Key Segment Analysis: Consumer Electronics Leads the Market

The consumer electronics segment holds the largest market share, with an impressive 47.24% in 2023. This dominance is primarily fueled by the ongoing trend toward digitalization and the integration of smart technologies into everyday life. Devices such as smartphones, tablets, smartwatches, and home automation systems continue to gain popularity, driving the demand for innovative packaging solutions.

Several factors are further accelerating the growth of this segment. The rise of remote work and online education has expanded the need for electronic devices, while the rollout of 5G networks is enhancing connectivity and supporting the development of smarter products. Moreover, consumers are increasingly seeking multifunctional, high-performance devices, which is creating a steady demand for efficient and reliable panel-level packaging.

As technology continues to evolve, the consumer electronics sector will remain at the forefront of the PLP market, offering significant growth opportunities for manufacturers and suppliers alike.

Regional Insights: Asia Pacific Leads in Growth

Asia Pacific (APAC) is expected to grow at the fastest compound annual growth rate (CAGR) of 40.89% during the forecast period. This growth is driven by the region's well-established semiconductor fabrication infrastructure and the presence of major electronics manufacturing hubs in countries like China, South Korea, Taiwan, and Japan.

A key factor contributing to the region's rapid expansion is the growing investment in semiconductor production. For instance, the South Korean government announced a $19 billion initiative in May 2024 to support the country's semiconductor industry. The strategy includes financial support, the development of semiconductor parks, and significant investments in research and development. This initiative will likely strengthen South Korea's position as a global leader in semiconductor manufacturing.

Furthermore, the increasing demand for consumer electronics such as smartphones, tablets, and wearables will continue to fuel market growth in APAC. As more consumers adopt connected devices, the need for advanced packaging solutions like PLP will be critical to meet the evolving requirements of the electronics industry.

North America: A Strong Player in the Panel-Level Packaging Market

North America accounted for 30.82% of the panel-level packaging market share in 2023, driven by the presence of leading semiconductor companies and research institutions. Major players like Intel Corporation, Qualcomm Incorporated, NVIDIA Corporation, and Texas Instruments dominate the region, contributing to the market's significant share.

The demand for high-performance computing (HPC) is another factor propelling market growth in North America. With the rise of data centers, artificial intelligence (AI), and machine learning applications, the need for powerful semiconductor devices is increasing. These trends are expected to continue driving the demand for panel-level packaging solutions, as they provide the necessary infrastructure for next-generation technology.

Additionally, the deployment of 5G networks and the rise of electric vehicles (EVs) and autonomous vehicles are expected to further support the growth of the PLP market in North America. The region's strong technological base and focus on innovation position it as a key player in the global panel-level packaging market.

Recent Developments by Key Market Players

The panel-level packaging market has seen several exciting developments in recent months, signaling the industry's ongoing transformation. One notable example is Silicon Box, a leading player in semiconductor packaging. In March 2024, the company announced plans to invest up to $3.6 billion (€3.2 billion) in Northern Italy to build a cutting-edge semiconductor assembly and testing facility. This new facility will replicate Silicon Box's flagship foundry in Singapore and is expected to support the growing demand for next-generation packaging technologies, including 3D integration and testing.

In October 2023, Onto Innovation Inc. took a significant step by establishing an Applications Center of Excellence focused on panel-level packaging. The center will serve as a hub for tool demonstration, photoresist qualification, process integration, and research and development, specifically targeting the chiplet market. TechSearch International forecasts the chiplet package market to grow at an annual average pace of 103% over the next three years, underscoring the importance of advanced packaging solutions like PLP.

Conclusion: A Thriving Market with Immense Potential

The panel-level packaging market is set for substantial growth over the next decade, driven by the increasing demand for consumer electronics, advancements in semiconductor technologies, and regional investments in manufacturing infrastructure. With Asia Pacific leading in growth and North America maintaining a strong presence, the market is well-positioned for innovation and expansion.

As key players continue to invest in advanced packaging technologies and infrastructure, the PLP market will play a critical role in meeting the needs of the rapidly evolving electronics and semiconductor industries. With its capacity to support next-generation technologies, panel-level packaging is poised to be at the heart of the digital revolution, offering promising opportunities for businesses and consumers alike.

Key Market Players

• Samsung Electronics Co., Ltd.

• TSMC (Taiwan Semiconductor Manufacturing Company)

• Onto Innovation Inc.

• Intel Corporation

• JCET Group

• Silicon Box, Ltd.

• AT&S (Austria Technologie & Systemtechnik AG)

• Amkor Technology

• Deca Technologies

• Unimicron Technology Corp.

Source: https://www.towardspackaging.com/insights/panel-level-packaging-market-sizing

Baner

Buy Premium Global Insight: https://www.towardspackaging.com/table-of-content/panel-level-packaging-market-sizing

Review the Full TOC for the Panel Level Packaging Market Report:

Get the latest insights on packaging industry segmentation with our Annual Membership - https://www.towardspackaging.com/get-an-annual-membership

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

Towards Healthcare: https://www.towardshealthcare.com

Towards Automotive: https://www.towardsautomotive.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Panel Level Packaging Market Outlook (2024 - 2032) here

News-ID: 3803750 • Views: …

More Releases from Towards Packaging

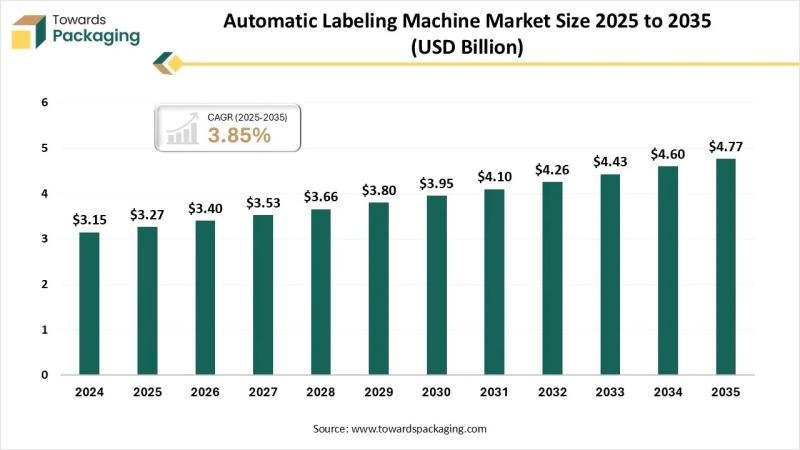

Automatic Labeling Machine Market Set for Strong Growth Through 2035

The global automatic labeling machine market is poised for steady expansion, rising from USD 3.4 billion in 2026 to USD 4.77 billion by 2035 at a CAGR of 3.85%. Demand is being driven by rapid automation in packaging lines, stringent labeling regulations, and the shift toward high-speed, error-free production across industries.

Download Sample: https://www.towardspackaging.com/download-sample/5882

Self-adhesive labeling systems currently hold the largest share at 39%, supported by their versatility and cost efficiency. Meanwhile,…

Unleashing Growth in the Liquid Packaging Market with Strategic Innovations

The liquid packaging industry is experiencing remarkable growth, with projections indicating an increase from USD 397.36 billion in 2025 to USD 645.43 billion by 2034. This growth, at a compound annual growth rate (CAGR) of 5.7%, signifies the expanding demand for liquid packaging solutions across a variety of sectors. As we delve into the market dynamics, it becomes clear that the liquid packaging sector is evolving rapidly, with several key…

Advancements in Hot-Fill Food Packaging Paving the Way for a Sustainable Future

The global hot-fill food packaging market is experiencing a steady rise, with an expected market value of USD 71.26 billion by 2033, up from USD 49.85 billion in 2023. This growth is projected to follow a compound annual growth rate (CAGR) of 3.76% from 2024 to 2033, reflecting the increasing demand for innovative packaging solutions in the food and beverage sector.

Download a Brochure of Hot-fill Food Packaging Market: https://www.towardspackaging.com/download-brochure/5266

Hot-Fill…

Driving Growth and Innovation in the Plastic Bag Market

The plastic bag market is undergoing significant growth, with its value reaching an estimated US$ 25.10 billion in 2023. Projections suggest that this market could hit a substantial US$ 35.41 billion by 2033, marking a steady compound annual growth rate (CAGR) of 3.5% from 2024 to 2034. This growth is largely driven by the expanding needs of various industries for efficient and cost-effective packaging solutions.

Download a Brochure of Plastic Bag…

More Releases for PLP

Helical Vibration Dampers Market Innovations and Key Players: Huaneng Electric P …

The Helical Vibration Dampers market has emerged as a pivotal segment in the landscape of industrial applications, offering essential solutions for managing and mitigating vibrations in various settings. These specialized devices play a critical role in enhancing the stability and longevity of structures, equipment, and transmission systems, making them indispensable in sectors such as energy, telecommunications, and transportation.

𝐘𝐨𝐮 𝐜𝐚𝐧 𝐚𝐜𝐜𝐞𝐬𝐬 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐫𝐞𝐩𝐨𝐫𝐭 𝐡𝐞𝐫𝐞: https://www.statsndata.org/download-sample.php?id=349830

In recent years, the Helical…

Patient Lift Pendant (PLP) Market Giants' Expenditure Will Increase with a CAGR …

The "Global Patient Lift Pendant (PLP)" intelligence report, just published by USD Analytics, covers insurers' micro-level study of important market niches, product offers, and sales channels. In order to determine market size, potential, growth trends, and competitive environment, the Global Patient Lift Pendant (PLP) provides dynamic views. Both primary and secondary sources of data were used to generate the research, which has both qualitative and quantitative depth. Several of the…

Bird Flapper Market Manufacturers, Suppliers, Vendors Sales, Revenue, Market Sha …

"Strategic Market Insights for Every Sector: Explore Our Comprehensive Bird Flapper Industry Research Report 2023-2029. Inform Your Business Decisions Today!"

The latest report provides information about the global Bird Flapper market and forecasts the growth prospects and industry trends that could emerge between 2023 and 2029. Future growth was calculated by taking the current growth rate and the entire market size into account. The Bird Flapper Market report offers in-depth qualitative…

Performed Lashing Rods Market to Show Incredible Growth and Forecast by 2029 | P …

Global Performed Lashing Rods Market Overview

The Performed Lashing Rods market is a diverse and rapidly evolving industry that encompasses a wide range of products and services. It is characterized by intense competition, changing consumer preferences, and technological advancements that continually drive innovation.

The Performed Lashing Rods market is comprised of several sub-sectors, including but not limited to: electronics, healthcare, automotive, consumer goods, and energy. Each of these sub-sectors has its unique…

Global Interphase Spacer System Market Analysis, Competitors, Growth Rate 2023 | …

Global Info Research announces the release of the report "Global Interphase Spacer System Market 2023 by Manufacturers, Regions, Type and Application, Forecast to 2029" . The report is a detailed and comprehensive analysis presented by region and country, type and application. As the market is constantly changing, the report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected…

Patient Lift Pendant (PLP) Market Booming Worldwide( Forecast Period 2023-2029) …

The global Patient Lift Pendant (PLP) market is carefully researched in the report while largely concentrating on top players and their business tactics, geographical expansion, market segments, competitive landscape, manufacturing, and pricing and cost structures. Each section of the research study is specially prepared to explore key aspects of the global Patient Lift Pendant (PLP) market. For instance, the market dynamics section digs deep into the drivers, restraints, trends, and…