Press release

Market Trends in Health Insurance 2024

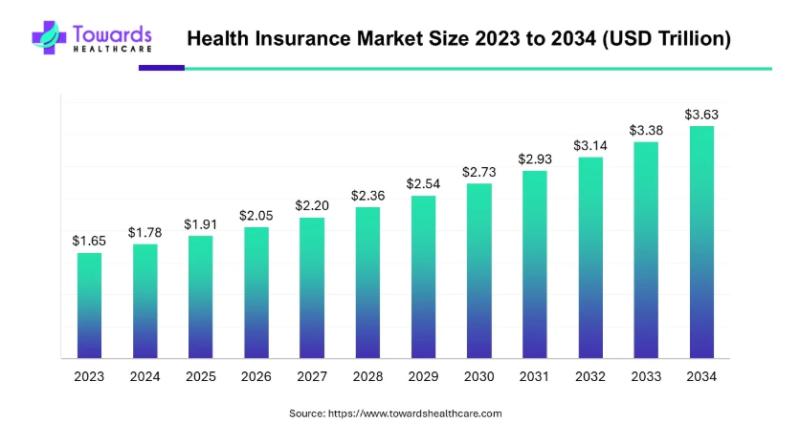

The global health insurance market is valued at USD 1.78 trillion in 2024 and is projected to grow to USD 3.63 trillion by 2034, with a compound annual growth rate (CAGR) of 7.4% over the next decade. This growth is driven by increasing healthcare costs and the expanding benefits of insurance coverage for a wide range of medical conditions.The Rising Influence of Healthcare Insurance: A Catalyst for Innovation and Access

The escalating cost of medical services has long been a pressing concern worldwide. As healthcare expenses continue to soar, individuals and governments alike are turning to healthcare insurance as an essential tool to manage costs. This growing demand for insurance is not only reshaping the healthcare landscape but is also playing a crucial role in the expansion of the healthcare insurance market globally. In 2022, global health insurance premiums reached a staggering USD 1.54 trillion, underscoring the importance of this sector.

Download Statistical Data: https://www.towardshealthcare.com/download-statistics/5085

While healthcare insurance provides a critical safety net, its growth faces several challenges. One of the most significant barriers is the limited awareness surrounding healthcare insurance, which impedes many individuals from accessing these vital services. However, as awareness campaigns and education efforts expand, the demand for healthcare insurance is expected to rise, ensuring that more people can benefit from financial protection against high medical costs.

Opportunities and Challenges: Innovation in Healthcare Insurance

The increasing focus on technological advancement and innovation in the healthcare insurance market is creating new opportunities for both providers and consumers. Funding for cutting-edge technologies is driving innovation in the sector, helping insurance companies develop more efficient, cost-effective plans while improving the quality of care. These advancements not only enhance the customer experience but also open doors for new business models, especially in the realm of digital health and telemedicine.

Medical insurance, in particular, is showing substantial growth within the healthcare insurance market. It is becoming one of the most widely adopted forms of coverage, reflecting a growing awareness of the need for protection against both routine medical expenses and unexpected health crises. This expansion of medical insurance highlights the increasing role of health insurers in addressing the rising demand for comprehensive healthcare.

The Role of Health Insurance in Advancing Pharmaceutical Innovation

Health insurance does more than just provide financial coverage-it plays a pivotal role in shaping the pharmaceutical industry. By promoting access to essential medicines and healthcare services, health insurance systems are directly contributing to the advancement of pharmaceutical research and development. Pharmaceutical innovation, which encompasses the discovery and development of new medicines, is critical in improving healthcare outcomes and addressing emerging global health challenges.

Understanding disease molecular pathways, identifying therapeutic targets, and developing new chemical entities capable of treating a wide range of diseases are central to the pharmaceutical innovation process. Health insurance facilitates this progress by ensuring that patients have access to cutting-edge treatments and therapies, thus reducing financial barriers to life-saving drugs. This in turn incentivizes pharmaceutical companies to invest in research and development, fostering a cycle of innovation that benefits both the healthcare system and the broader population.

The Interplay Between Health Insurance and Pharmaceutical Advancements

The relationship between health insurance and pharmaceutical innovation is symbiotic. Health insurance programs encourage the use of new, more effective medications, which in turn boosts the demand for these treatments and supports further innovation. As health insurers make treatment more accessible and affordable, they also create a dynamic market that encourages the continued advancement of medical science.

In particular, the ability to provide safer, more effective treatment options ensures that healthcare systems can offer personalized care that is both cost-efficient and high-quality. By bridging the gap between affordability and medical discovery, health insurance is helping to drive improvements in public health outcomes, providing individuals with access to the best possible care and treatment options.

Case Study: Employer-Sponsored Health Insurance in the United States

A compelling example of the role of health insurance in promoting access to care is the prevalence of employer-sponsored health insurance in the United States. In 2020, more than 163 million Americans-nearly half of the U.S. population-were covered by health insurance provided through their employer or as dependents. With nearly 60% of businesses offering health insurance to their employees, employer-sponsored insurance covers a significant portion of the population, spanning various age groups from young children to retirees.

Employer-sponsored insurance is the most widespread form of health coverage in the United States, reflecting its broad appeal and the critical role it plays in ensuring that millions of Americans have access to necessary healthcare services. This type of insurance is particularly important in a country where the cost of medical treatment is high, and without adequate coverage, many individuals would face significant financial barriers to accessing care.

The Evolving U.S. Healthcare Insurance Landscape

Changes in the healthcare insurance market are not just affecting consumers-they are also having a profound impact on healthcare providers and insurers. As the concentration of health insurance continues to grow, patients and payers are facing fewer choices in terms of health plans, with premiums rising as a result. For healthcare providers, these changes can erode bargaining power in reimbursement negotiations, further complicating the economic landscape of healthcare delivery.

To understand how these dynamics are influencing the healthcare sector, it's crucial to examine the broader market trends. A recent study revealed that 57% of U.S. metropolitan statistical areas are experiencing significant shifts in their healthcare markets. These shifts highlight the importance of ongoing research and analysis to better understand how market pressures are shaping the future of healthcare insurance.

The Path Forward: A Call for Comprehensive Research

The complexity of the evolving healthcare insurance landscape necessitates a deeper understanding of market forces, insurer dynamics, and regulatory changes. Policymakers have recognized the need for more comprehensive studies to provide insights into how these factors are influencing the healthcare system and shaping the future of health insurance. As the sector continues to grow, ongoing research will be critical in ensuring that healthcare insurance remains a force for positive change, providing access to essential services while supporting innovation in both healthcare and pharmaceuticals.

In conclusion, the healthcare insurance market is at a crossroads, with significant growth opportunities driven by technological innovation, increased awareness, and evolving market dynamics. As health insurance becomes more entrenched in healthcare systems globally, its role in supporting pharmaceutical advancements and improving public health outcomes will continue to be of paramount importance. By fostering greater access to essential medicines and treatments, health insurance is not only securing better health outcomes for individuals but also driving the future of medical innovation.

The Transformative Trends Shaping the Health Insurance Market

In recent years, the health insurance market has undergone significant transformation, driven by various socio-economic factors and the rapid adoption of technology. These shifts reflect broader trends in global healthcare, with the rising cost of medical services, an aging population, and increased consumer demand for more personalized and efficient insurance solutions.

Here, we explore key trends influencing the evolution of health insurance, including the rise of artificial intelligence (AI), changing consumer expectations, and the financial pressures created by escalating healthcare costs.

1. Growing Healthcare Expenditure: A Market Driver

The healthcare expenditure burden is becoming more pronounced, particularly with the global rise in the elderly population and the prevalence of chronic conditions. These factors significantly strain healthcare systems worldwide, prompting a greater reliance on health insurance. As more individuals face the financial burden of medical expenses, health insurance becomes a crucial safety net to help manage these costs.

In many countries, especially those with aging demographics, healthcare

spending is increasingly allocated to managing long-term care and the treatment of chronic diseases. This ongoing trend has made health insurance an essential financial product for individuals looking to secure protection against unpredictable medical costs. The push toward comprehensive health insurance coverage is not only a response to rising healthcare expenditures but also a reflection of growing consumer awareness and desire for better healthcare coverage.

2. The Impact of the COVID-19 Pandemic on Health Insurance Demand

The COVID-19 pandemic played a pivotal role in shaping the health insurance

market in ways that will have lasting effects. The crisis underscored the critical need for health coverage in a world increasingly susceptible to global health threats. As the pandemic led to mass layoffs, economic uncertainty, and disrupted healthcare systems, it also heightened the public's awareness of the importance of health insurance.

Individuals around the world were forced to reconsider their health insurance needs, with many seeking more comprehensive policies that could provide greater protection against health emergencies. Insurers responded to this surge in demand by offering flexible plans that incorporated COVID-19 coverage, reflecting the market's shifting priorities. The pandemic also sparked a broader conversation about the importance of having health insurance in an unpredictable world, fostering greater consumer interest and encouraging more people to invest in policies to safeguard against future health crises.

3. Evolving Consumer Expectations:

The Demand for Customization and Enhanced Services As consumer expectations evolve, insurance providers are increasingly focused on offering products that cater to individual needs. Today's health insurance buyers are not just looking for basic coverage; they are seeking policies that provide more personalized care, better claim services, and a seamless experience. In response, insurers are stepping up efforts to enhance their offerings, with many developing customized policies designed to address the unique health and financial needs of their clients.

Favorable policies from insurance companies have played a significant role in attracting customers. By offering tailored products, flexible payment plans, and enhanced claim services, insurers are creating more consumer-centric solutions that aim to improve the overall user experience. These improvements have not only contributed to the growth of the health insurance market but have also fostered greater competition among providers, driving innovation and expanding coverage options.

4. Artificial Intelligence: The Future of Health Insurance

One of the most exciting advancements in the health insurance sector is the integration of Artificial Intelligence (AI). AI is revolutionizing the industry by improving efficiency, reducing operational costs, and enhancing customer experiences. Machine learning and natural language processing are being harnessed to develop smarter solutions that can automate routine tasks, predict health trends, and provide personalized customer service.

For instance, AI-powered chatbots and virtual assistants are now common in many health insurance companies, offering customers quick and accurate responses to queries. These systems can handle everything from providing policy details to assisting with claims processing, drastically reducing the need for human intervention and speeding up operations. As AI continues to evolve, it is expected to play a crucial role in streamlining the customer journey, from purchasing insurance to submitting and managing claims.

Moreover, AI's ability to analyze vast amounts of data is enabling insurers to assess risk more accurately and set premiums that reflect individual health profiles and lifestyles. Predictive analytics also allows insurers to anticipate future healthcare needs, improving care management and providing more proactive services to policyholders. With AI also excelling in fraud detection, insurers can identify and address suspicious claims more effectively, ensuring that the system remains fair and efficient.

5. Rising Medical Costs and the Growing Demand for Health Insurance

Perhaps the most significant force driving the expansion of the health insurance market is the escalating cost of medical services. The price of surgeries, hospital stays, doctor's visits, and diagnostic tests is rising at an alarming rate, placing a heavy financial burden on individuals and families. Health insurance has become an essential tool for protecting against these ever-increasing costs, offering critical financial support in the event of serious illness or injury.

In the United States, for example, healthcare spending has been steadily climbing. According to the World Health Organization, Americans now spend an average of approximately $13,000 annually on healthcare. The Centers for Medicare and Medicaid Services projected that healthcare spending would rise by 5.1% in 2023, reaching a total of $4.2 trillion. Meanwhile, the Commonwealth Fund reported that healthcare costs as a percentage of GDP in the U.S. surged from 8.2% in 1980 to a staggering 17.8% in 2021. These figures highlight the mounting pressures on both individuals and healthcare systems, underscoring the growing need for robust health insurance plans that can mitigate the financial impact of medical treatment.

As healthcare costs continue to rise globally, health insurance remains a critical investment for individuals looking to protect themselves and their families from the financial hardships associated with medical care. The expansion of health insurance coverage has become not just a personal need but also a societal imperative to ensure access to care in an increasingly complex and expensive healthcare landscape.

Understanding the Dynamics of the Health Insurance Market: Trends, Providers, and Geographical Insights

The health insurance market is witnessing a transformative shift driven by multiple factors, including technological advancements, changing consumer behavior, and evolving healthcare needs. In 2023, the global health insurance landscape showed clear trends in provider segmentation, coverage options, network preferences, and geographical growth. This article delves into these crucial dynamics, offering insights into current trends and the anticipated market trajectory.

Provider Segmentation: Public vs. Private Health Insurance

In 2023, the public health insurance segment held a dominant position in the market. Public providers, usually government-run systems, offer universal health coverage that is funded through taxation. In low-income countries, it is estimated that governments spent an average of $8 per person on health insurance. The growth of this segment is largely attributed to the increasing trust in government-led policies and the establishment of supportive regulatory frameworks.

On the other hand, the private health insurance segment is expected to grow at the fastest rate in the coming years. Private providers have gained traction due to their ability to offer enhanced services, the integration of technological innovations, and the flexibility of customized plans. The demand for private insurance is expected to rise as consumers seek more personalized options with better coverage and advanced medical care.

Coverage Options: Lifetime vs. Term Insurance

When examining coverage options, lifetime coverage emerged as the dominant choice in 2023. Lifetime policies offer the significant advantage of uninterrupted insurance coverage throughout an individual's life, regardless of age or health conditions. This reduces the administrative hassle of renewing or reapplying for new policies, making it highly preferred for those seeking long-term financial security and continuous access to healthcare services.

In contrast, the term insurance segment is anticipated to witness the highest compound annual growth rate (CAGR) in the coming years. Term insurance policies offer affordable premiums and provide substantial coverage, particularly in the event of the policyholder's death. These plans also often include additional benefits such as critical illness cover or accidental death benefits, further driving their appeal.

Network Providers: PPO vs. POS

In 2023, the Preferred Provider Organization (PPO) dominated the health insurance market. PPOs offer consumers access to a wide range of healthcare providers at lower costs due to negotiated fee agreements. Policyholders enjoy flexibility, as they can choose medical services from any provider within the network, making PPOs a popular choice for those seeking both cost efficiency and provider choice.

However, the Point of Sale (POS) network provider is expected to experience robust growth. POS plans strike a balance between affordability and flexibility, offering lower premiums compared to PPOs while still providing a broad range of benefits. These plans encourage policyholders to use in-network providers but allow some coverage for out-of-network services. As healthcare consumers look for cost-effective alternatives to PPOs, POS plans are likely to gain traction in the market.

Geographical Landscape: North America vs. Asia-Pacific Growth

North America was the dominant player in the health insurance market in 2022, driven by its high insurance penetration and substantial healthcare expenditures. The high cost of healthcare in the region, particularly in the United States, means that a significant portion of the population depends on health insurance for medical treatments. In fact, approximately 60% of Americans suffer from one or more chronic conditions, further driving the demand for insurance coverage. North America's well-established healthcare infrastructure, coupled with increased public awareness about the benefits of health insurance, is expected to continue fueling market growth.

Meanwhile, the Asia-Pacific region is poised for the fastest growth in the global health insurance market. The region is home to the world's largest population, and the rising prevalence of chronic diseases, largely due to lifestyle changes and poor dietary habits, is increasing the demand for health insurance. Growing disposable incomes, widespread internet access, and higher literacy rates are contributing to the adoption of health insurance. Additionally, investments in state-of-the-art healthcare infrastructure and increasing public awareness are driving the growth of the market in this region.

One notable example of market expansion is the Life Insurance Corporation of India (LIC), which made headlines in 2022 with its historic IPO, one of the largest in India's history. This move underscores the increasing interest in health insurance in the Asia-Pacific market.

Competitive Landscape: Innovations and Collaborations

The competitive landscape of the health insurance market is undergoing a transformation as companies explore new avenues to stay ahead of the curve. Technological innovations such as data analytics, telemedicine integration, and personalized coverage options are gaining traction. These advancements are reshaping the industry by enhancing the customer experience and improving the overall efficiency of insurance operations.

Strategic partnerships and regulatory compliance also play a significant role in shaping market dynamics. Collaborations between tech firms and healthcare providers are becoming more common, as companies aim to leverage cutting-edge technologies to offer better products and services. This trend is expected to continue as both startups and established players race to gain a competitive edge.

Recent Developments in the Health Insurance Market

In recent months, several major developments have impacted the health insurance market:

• November 2024: The Life Insurance Corporation of India (LIC) announced its acquisition of an independent health insurance firm, signaling its entry into the health insurance sector by 2025.

• November 2024: MyBenefits, a health insurance platform, entered into a partnership with Metropolitan Life to provide direct access to health insurance packages for employees.

• May 2024: In Canada, two million seniors were approved to receive insurance coverage under the Canadian Dental Care Plan just one month after its release.

Health Insurance Market Leaders

Several key players dominate the global health insurance landscape, driving innovation and setting industry standards. These include:

• Cigna Corporation

• CVS Health Corporation

• Allianz

• Centene Corporation

• United Healthcare Services, Inc.

• National Insurance Company Limited

• Bupa Global

• Humana, Inc.

• AIA Group Limited

Source: https://www.towardshealthcare.com/insights/health-insurance-market-size

Baner

Buy Premium Global Insight: https://www.towardshealthcare.com/price/5085

Review the Full TOC for the Health Insurance Market Report: https://www.towardshealthcare.com/table-of-content/health-insurance-market-size

Get the latest insights on industry segmentation with our Annual Membership: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations. We are a global strategy consulting firm that assists business leaders in gaining a competitive edge and accelerating growth. We are a provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations.

We've prepared a service to support you. Please feel free to contact us at sales@towardshealthcare.com

Web: https://www.towardshealthcare.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-healthcare

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Market Trends in Health Insurance 2024 here

News-ID: 3803286 • Views: …

More Releases from Towards Healthcare

Rapid Advancements in Cardiac Biomarkers Shaping the Future of Healthcare

The global cardiac biomarkers market is experiencing substantial growth, driven by a surge in the number of cardiovascular diseases (CVDs) and a rising demand for early diagnostics and preventive care. Valued at USD 21.27 billion in 2024, the market is projected to grow to USD 24.39 billion in 2025 and reach an impressive USD 83.54 billion by 2034, expanding at a compound annual growth rate (CAGR) of 14.66% during this…

Rapid Advancements in Cardiac Biomarkers Shaping the Future of Healthcare

The global cardiac biomarkers market is experiencing substantial growth, driven by a surge in the number of cardiovascular diseases (CVDs) and a rising demand for early diagnostics and preventive care. Valued at USD 21.27 billion in 2024, the market is projected to grow to USD 24.39 billion in 2025 and reach an impressive USD 83.54 billion by 2034, expanding at a compound annual growth rate (CAGR) of 14.66% during this…

Exploring the Impact of Robotics on the Dental Industry

The field of robotic dentistry is rapidly evolving, with technological advancements and the increasing prevalence of dental diseases driving substantial growth. Valued at an estimated US$ 535 million in 2023, the robotic dentistry market is poised to reach US$ 2.58 billion by 2034, growing at an impressive compound annual growth rate (CAGR) of 15.4% from 2024 to 2034. This surge is driven by a combination of factors, including innovation in…

Revolutionizing Industries with Key Developments in the Microbial Fermentation T …

The microbial fermentation technology market is rapidly expanding, reflecting a broader shift towards sustainable and bio-based manufacturing processes. Valued at approximately USD 34.11 billion in 2023, the market is set to experience significant growth, with projections placing its value at USD 60.17 billion by 2033. This growth is anticipated at a compound annual growth rate (CAGR) of 5.84% from 2024 to 2033. The rise in demand for biologics, coupled with…

More Releases for Health

Health Coach Market Positioned for Accelerated Growth with Iora Health, Virta He …

Global health coach market is estimated to be valued at USD 18.83 Bn in 2025 and is expected to reach USD 30.65 Bn by 2032, exhibiting a compound annual growth rate (CAGR) of 7.2% from 2025 to 2032.

Latest Report on the Health Coach Market 2025-2032, focuses on a comprehensive analysis of the current and future prospects of the Health Coach Market industry. An in-depth analysis of historical trends, future trends,…

Digital Therapeutics Market Research 2025 Leading Key Players - Proteus Digital …

An exclusive Digital Therapeutics Market research report created through broad primary research (inputs from industry experts, companies, and stakeholders) and secondary research, the report aims to present the analysis of Global Digital Therapeutics Market by Type, By Application, By Region - North America, Europe, South America, Asia-Pacific, Middle East and Africa. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment evaluation. Besides, the report…

Digital Therapeutics Market Outlook 2025 : Proteus Digital Health, Omada Health, …

ReportsWeb.com has announced the addition of the “Global Digital Therapeutics Market Size, Status and Forecast 2025” The report focuses on major leading players with information such as company profiles, product picture and specification.

This report studies the global Digital Therapeutics market, analyzes and researches the Digital Therapeutics development status and forecast in United States, EU, Japan, China, India and Southeast Asia.

This report focuses on the top players in global market,…

Digital Therapeutics Market Outlook to 2025 - Propeller Health, CANARY HEALTH, N …

The global digital therapeutics market is segmented on the basis of application, distribution channel, and geography. The application segment includes, respiratory diseases, central nervous system disease, smoking cessation, medication adherence, cardiovascular diseases, musculoskeletal diseases, and other applications. Based on distribution channel, the digital therapeutics market is segmented as, B2B and B2C.

Digital therapeutics, a subset of digital health, is a health discipline and treatment option that utilizes a digital and…

Digital Therapeutics Market Analysis 2018 | Growth by Top Companies: Proteus Dig …

Global Digital Therapeutics Market to 2025

This report "Digital Therapeutics Market Analysis to 2025" provides an in-depth insight of medical device industry covering all important parameters including development trends, challenges, opportunities, key manufacturers and competitive analysis.

Digital therapeutics, a subset of digital health, is a health discipline and treatment option that utilizes a digital and often online health technologies to treat a medical or psychological condition. The treatment relies on behavioral and…

Digital Therapeutics Market Global Outlook to 2025 - Proteus Digital Health, Wel …

“Digital Therapeutics Market" covers a detailed research on the industry with financial analysis of the major players. The report provides key information and detailed study relating to the industry along with the Economic Impact and Regulatory and Market Support. The report examines the industry synopsis, strategic investments, Industry Surveys, Economic Impact, etc.

The market of digital therapeutics market is anticipated to grow with a significant rate in the coming years, owing…