Press release

Ambulatory Surgical Center Market to Hit $183.1 Billion by 2034

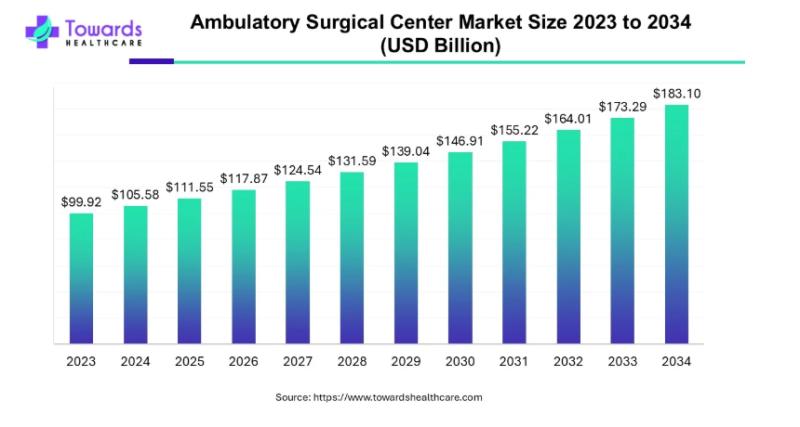

Ambulatory Surgical Center Market Size, Trends and Regional AnalysisThe ambulatory surgical centers market accounted for USD 105.58 billion in 2024 and is predicted to increase to USD 183.1 billion by 2034 and is poised to grow at a CAGR of 5.66% from 2025 to 2034. The increasing number of surgeries, growing demand for outpatient settings, and technological advancements drive the market.

Download Statistical Data: https://www.towardshealthcare.com/download-statistics/5021

The Growth and Impact of Ambulatory Surgical Centers: A Revolution in Outpatient Care

Ambulatory Surgical Centers (ASCs) have reshaped the landscape of healthcare, providing an efficient and cost-effective alternative to traditional hospital settings. ASCs offer specialized outpatient services, enabling patients to undergo surgery and return home the same day, avoiding long stays in hospital rooms. This shift in the healthcare paradigm, which began in the 1970s, has rapidly gained traction due to its numerous advantages, such as flexible scheduling, reduced costs, and enhanced comfort for patients. As more individuals seek elective procedures with fewer hospital constraints, ASCs have emerged as a popular solution to meet the growing demand for outpatient surgeries.

North America Leads the Charge in ASC Market Growth

The Ambulatory Surgical Center market was dominated by North America in 2023, driven by the high prevalence of chronic diseases, an aging population, and an established healthcare infrastructure. The market's future is promising, with Asia-Pacific poised to experience the fastest growth in the coming years. This regional shift indicates the increasing acceptance and adoption of ASCs in countries across Asia, where growing healthcare access and technological advancements are making outpatient surgical services more accessible.

Single-Specialty and Multi-Specialty Centers: The Growing Segments

In 2023, single-specialty centers held a dominant presence in the ASC market, catering to specific types of surgeries like orthopedics, ophthalmology, and dermatology. These centers are designed to provide specialized services with a streamlined approach, which ensures high-quality care and efficiency. However, the multi-specialty segment is predicted to experience substantial growth during the forecast period. Multi-specialty ASCs cater to a variety of medical disciplines, including gastroenterology, urology, and general surgery, making them versatile and attractive to a broader patient demographic.

Physician-Owned vs. Hospital-Owned ASCs: Shifting Ownership Trends

When considering ownership structure, the physician-owned segment had the largest share of the ASC market in 2023. These centers allow physicians to maintain a greater degree of autonomy and control over their practices, which can improve patient outcomes and operational efficiency. However, hospital-owned ASCs are expected to gain significant market share as the healthcare landscape evolves. Hospitals recognize the value of providing outpatient services through ASCs, allowing them to extend their reach while offering affordable care in outpatient settings.

Gastroenterology: Leading the Charge in ASC Applications

Among various medical applications, gastroenterology emerged as the leading application in ASCs in 2023. As the demand for gastrointestinal procedures such as colonoscopies, endoscopies, and other diagnostic treatments increases, gastroenterology has become a key driver of the ASC market. The high demand for these procedures is linked to the rising incidence of gastrointestinal diseases, making it a vital specialty for ASCs to cater to. This trend is expected to continue as healthcare systems focus on preventive care and minimally invasive techniques.

The Role of ASCs in Healthcare Delivery

Ambulatory Surgery Centers have proven their value by offering high-quality care at a fraction of the cost of traditional hospital-based treatments. Over 80% of surgeries are now conducted in outpatient settings, thanks to the significant innovations in technology and surgical techniques championed by ASCs. These centers have transformed how surgery is performed, ensuring quicker recovery times, lower infection rates, and reduced hospital stays.

A particularly critical factor contributing to the rise of ASCs is the aging population, especially in regions like North America. In the United States, more than 49 million people-approximately 15% of the population-are aged 65 or older, with this number expected to rise to 24% by 2060. This demographic shift is driving up the demand for healthcare services, particularly those provided by ASCs, which can handle a high volume of elective and minor surgical procedures. ASCs also help reduce healthcare expenses, saving Medicare $4.2 billion annually and cutting overall healthcare costs by $42.2 billion.

Artificial Intelligence (AI): Transforming ASCs with Technology

The integration of Artificial Intelligence (AI) in Ambulatory Surgery Centers is driving innovation and growth in the sector. AI technologies, such as machine learning and predictive analytics, are being utilized to enhance diagnostic accuracy, optimize surgical scheduling, and improve patient outcomes. AI algorithms can process vast amounts of medical data, helping doctors make more informed decisions and develop personalized treatment plans tailored to individual patients.

Robotic-assisted surgeries, powered by AI, have become a major trend in ASCs, offering highly precise, minimally invasive procedures that reduce recovery time and enhance the overall patient experience. As AI technologies continue to advance, ASCs are expected to further evolve, offering cutting-edge care that meets the increasing demand for high-quality surgical services.

Factors Driving ASC Market Expansion

Several factors are influencing the growth of Ambulatory Surgical Centers, with the most prominent being the shift from hospital-based to outpatient surgery. Over the past decade, the number of surgeries performed in ASCs has steadily increased, reflecting the benefits these centers offer, such as shorter stays, innovative technologies, and lower infection risks. ASCs are designed to provide lower-risk procedures in a more convenient and comfortable environment, allowing for faster recoveries and minimal disruption to patients' lives.

According to data from the Medicare Payment Advisory Commission, ASCs performed nearly 60% of outpatient procedures in 2019, compared to just 48% in 2010. This growth reflects broader industry trends toward outpatient treatment, as healthcare systems work to manage rising costs while maintaining high standards of patient care. The shift to outpatient care is being facilitated by changes in reimbursement policies, with payers incentivizing the use of ASCs over hospital settings.

Government Investments and Aging Populations: Key Growth Drivers

The continued growth of the ASC market is being bolstered by increased government investments. Governments are allocating funds to the development of new ambulatory settings and are incentivizing ASCs to adopt the latest technologies to improve patient care. This push is especially important in light of the aging population, which is more vulnerable to chronic diseases and medical conditions. With a growing number of elderly individuals requiring surgical interventions, ASCs are well-positioned to offer specialized care to this demographic.

The Expanding Ambulatory Surgical Center (ASC) Market: Drivers, Restraints, Opportunities, and Regional Insights

The global Ambulatory Surgical Center (ASC) market is experiencing significant growth, driven by an increasing number of surgeries, technological advancements, and evolving healthcare policies. This article delves into the key factors propelling the market, the challenges it faces, and the opportunities it presents, with a particular focus on the industry's future outlook and regional dynamics.

The Driving Forces Behind ASC Market Growth

One of the primary drivers of the ASC market is the increasing number of surgeries performed globally. An estimated 300 million surgical procedures are carried out annually, addressing a wide range of conditions such as chronic and acute disorders, road accidents, and surgical interventions for life-threatening diseases. Among the most common surgeries are cesarean sections (C-sections), cataract surgeries, hernia repairs, and aesthetic procedures. This growing volume of surgical procedures is pushing the demand for ASCs, which are increasingly seen as a cost-effective and convenient alternative to hospital-based surgeries.

ASCs are healthcare facilities that meet rigorous state and federal regulations to ensure patient safety and quality of care. In the United States, over 80% of surgeries are now performed in outpatient settings, reflecting a significant shift in patient preferences towards these centers. Government policies that encourage outpatient care, coupled with advancements in medical technologies, have contributed to the rise of ASCs. These facilities are designed to handle various procedures efficiently, reducing hospital congestion and offering patients quicker recovery times in a more comfortable, private setting.

Restraints Impacting the Growth of ASCs

Despite the promising growth prospects, the ASC industry faces several challenges. One of the major impediments is the high cost associated with acquiring and maintaining advanced medical devices. ASCs require sophisticated equipment for complex surgical procedures, such as those needed in neurosurgery, cardiovascular surgery, and orthopedic interventions. The costs of these devices-ranging from portable X-ray units priced over $100,000 to basic surgical tables costing upwards of $50,000-are prohibitively high for smaller healthcare facilities.

Additionally, the lack of overnight accommodations in ASCs can deter some patients, as certain surgeries may require post-operative monitoring that can't be adequately provided in outpatient settings. This limitation increases the possibility that patients might have to be transferred to hospitals in the event of complications. Studies have shown that complications, including pain, nausea, infections, and poor recovery, can occur during surgical procedures at ASCs. For instance, a 2017 report by the National Center for Biotechnology Information (NCBI) revealed that complications from orthopedic procedures performed in ASCs ranged from 0.05% to 20%. Such concerns about patient safety and potential crises could undermine the market's growth, as some patients prefer the security of hospital settings for their surgeries.

Opportunities in the ASC Industry

Despite these challenges, there are abundant opportunities for growth within the ASC industry. One of the key growth drivers is favorable reimbursement policies, particularly from government bodies like the Centers for Medicare & Medicaid Services (CMS). The expansion of the list of surgical procedures eligible for reimbursement in ASCs is a significant boost for the industry. As CMS continues to review and approve a wider range of procedures for outpatient settings, more physicians are encouraged to perform surgeries in these centers, leading to an increase in the overall number of procedures conducted.

In particular, CMS has focused on reviewing complex surgeries, such as spine and spinal fusion procedures, to determine their feasibility in ambulatory settings. For example, in 2018, CMS reviewed 38 procedures, including lumbar and cervical spinal fusions, to assess whether they could be safely performed in ASCs. The continued focus on ensuring patient safety and minimizing complications in these facilities is expected to attract a larger patient base, further propelling market growth.

Segmental Insights: Type, Ownership, and Application

The ASC market can be segmented based on the type of center, ownership model, and the type of procedures performed.

Type of Center

ASCs are typically categorized into single-specialty and multispecialty centers. Single-specialty centers, which focus on one specific medical field, currently dominate the market. This is particularly evident in ophthalmology, where a high incidence of eye-related conditions drives demand for specialized surgical care. However, multispecialty centers, which offer a broader range of surgical services, are expected to grow significantly in the coming years. The rise in demand for procedures in fields like gastroenterology, pain management, and orthopedics is anticipated to boost revenue in these centers.

Ownership

Ownership models in the ASC market include physician-owned, hospital-owned, and corporate-owned centers. Physician-owned centers hold the largest market share and are projected to expand rapidly due to the flexibility they offer in scheduling surgeries. These centers are often owned and operated by the physicians themselves, who enjoy the autonomy and operational control. Hospital-owned ASCs also represent a significant portion of the market, with many hospitals acquiring independent practices to expand their outpatient services. However, corporate-owned ASCs are expected to grow at the fastest rate. This trend is fueled by increasing partnerships between corporate entities and physicians, as well as the development of joint ventures, which are helping corporate-owned centers gain traction in the market.

Application

In terms of application, the ASC market is largely dominated by

gastroenterology, which accounted for 35% of total revenue in 2022. The growing global burden of digestive diseases and the rising demand for endoscopic procedures have fueled the expansion of gastroenterology services in ASCs. Plastic surgery, however, is expected to experience the fastest growth rate in the coming years. As patients increasingly prefer minimally invasive and non-surgical procedures, the demand for plastic surgery services in ASCs is expected to rise substantially.

Regional Insights: North America and Asia-Pacific Lead the Way

In 2023, North America dominated the ASC market, driven by increased government support for outpatient care and an aging population. The U.S. currently has over 11,000 ASCs, with a significant proportion Medicare-certified, underscoring the role of government reimbursement programs in supporting the sector. The U.S. also benefits from a rapidly aging population, with 15% of the population aged 65 or older, a figure projected to rise to 24% by 2060. ASCs are seen as a more affordable and efficient alternative to hospital care, especially in managing surgeries for elderly patients.

Asia-Pacific, however, is expected to experience the fastest market growth

during the forecast period. This growth can be attributed to the increasing prevalence of chronic diseases, rising healthcare expenditure, and supportive government policies aimed at expanding ASC infrastructure. Countries such as China, Japan, and South Korea are leading the charge in developing ASCs. Additionally, the booming medical tourism industry in the region, particularly in countries like India and Thailand, is further propelling the demand for ASCs.

Competitive Landscape

The growing demand within the healthcare sector is driving significant growth in the ambulatory surgical center (ASC) industry, further supported by increased research into service offerings within mobile surgical systems. Key players in the healthcare industry are heavily investing in research and development to establish mobile surgery centers. Companies are focusing on revenue growth through acquisitions, mergers, collaborations, and enhancing product portfolios via extensive R&D. To maintain competitiveness and strengthen their position in the ASC market, leading companies are employing both inorganic and organic growth strategies.

Key Announcements from Industry Leaders

Kemal Erkan, Chairman of the Board of American Surgery Center and CEO of United Medical, emphasized that ambulatory surgery centers represent the future of cost reduction in healthcare, suggesting that hospitals should prioritize more complex cases. He also noted that surgical costs could be reduced by up to 59% if payers direct patients to ASCs instead of hospitals. Additionally, he pointed out that surgeons financially benefit from working in ASCs, as they do not incur facility fees when performing outpatient surgeries in a hospital setting.

Recent Developments in the Ambulatory Surgical Center Market

• August 2024: ChristianaCare and Atlas Healthcare Partners announced a collaboration to create an ambulatory surgical center network, improving access to affordable and high-quality surgical care in Delaware and the Mid-Atlantic region.

• April 2024: Commons Clinic made a $9.75 million investment to expand its ASC network, enhancing its capabilities with its proprietary surgical care platform, Theater.

Leading Companies in the Ambulatory Surgical Center Market

• AmSurg

• American Vision Partners

• Azura Vascular Care

• Covenant Physician Partners

• HCA Healthcare

• HST Pathways

• PE GI Solutions

• Surgery Partners

• Surgical Care Affiliates (SCA) Health

• TeamHealth Holdings, Inc.

• United Surgical Partners International

• ValueHealth

Source: https://www.towardshealthcare.com/insights/factors-influencing-the-ambulatory-surgical-center-industry

Baner

Buy Premium Global Insight: https://www.towardshealthcare.com/price/5021

Review the Full TOC for the Ambulatory Surgical Center Market Report: https://www.towardshealthcare.com/table-of-content/factors-influencing-the-ambulatory-surgical-center-industry

Get the latest insights on industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations. We are a global strategy consulting firm that assists business leaders in gaining a competitive edge and accelerating growth. We are a provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations.

We've prepared a service to support you. Please feel free to contact us at sales@towardshealthcare.com

Web: https://www.towardshealthcare.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-healthcare

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Ambulatory Surgical Center Market to Hit $183.1 Billion by 2034 here

News-ID: 3801719 • Views: …

More Releases from Towards Healthcare

Rapid Advancements in Cardiac Biomarkers Shaping the Future of Healthcare

The global cardiac biomarkers market is experiencing substantial growth, driven by a surge in the number of cardiovascular diseases (CVDs) and a rising demand for early diagnostics and preventive care. Valued at USD 21.27 billion in 2024, the market is projected to grow to USD 24.39 billion in 2025 and reach an impressive USD 83.54 billion by 2034, expanding at a compound annual growth rate (CAGR) of 14.66% during this…

Rapid Advancements in Cardiac Biomarkers Shaping the Future of Healthcare

The global cardiac biomarkers market is experiencing substantial growth, driven by a surge in the number of cardiovascular diseases (CVDs) and a rising demand for early diagnostics and preventive care. Valued at USD 21.27 billion in 2024, the market is projected to grow to USD 24.39 billion in 2025 and reach an impressive USD 83.54 billion by 2034, expanding at a compound annual growth rate (CAGR) of 14.66% during this…

Exploring the Impact of Robotics on the Dental Industry

The field of robotic dentistry is rapidly evolving, with technological advancements and the increasing prevalence of dental diseases driving substantial growth. Valued at an estimated US$ 535 million in 2023, the robotic dentistry market is poised to reach US$ 2.58 billion by 2034, growing at an impressive compound annual growth rate (CAGR) of 15.4% from 2024 to 2034. This surge is driven by a combination of factors, including innovation in…

Revolutionizing Industries with Key Developments in the Microbial Fermentation T …

The microbial fermentation technology market is rapidly expanding, reflecting a broader shift towards sustainable and bio-based manufacturing processes. Valued at approximately USD 34.11 billion in 2023, the market is set to experience significant growth, with projections placing its value at USD 60.17 billion by 2033. This growth is anticipated at a compound annual growth rate (CAGR) of 5.84% from 2024 to 2033. The rise in demand for biologics, coupled with…

More Releases for ASC

MBC Sets Benchmark in ASC Billing through AI Innovation

Wilmington, DE - 17 April 2025 - As the U.S. healthcare system increasingly moves toward more efficient, outpatient-oriented models, Ambulatory Surgical Centres (ASCs) are coming to the forefront. Treating more than 23 million patients annually, ASCs provide quicker, less expensive alternatives to hospital-based procedures. As their significance in the continuum of care increases, inpatient loads are minimized, wait times are reduced, and total healthcare costs decrease.

However, whereas ASCs shine clinically,…

ASC Heating & Air Explains the Dangers of Neglected HVAC Repairs

Image: https://www.getnews.info/wp-content/uploads/2024/05/1715614537.jpeg

ASC Heating & Air is a leading air conditioning company. In a recent update, the company explained the dangers of neglected HVAC repairs.

San Antonio, TX - In a website post, ASC Heating & Air explained the dangers of neglected HVAC repairs.

The HVAC repair contractor San Antonio [https://ascheatingair.business.site/] mentioned that one of the dangers is the potential for health hazards. A malfunctioning air conditioning system can cause inadequate ventilation,…

ASC Software Market Statistics and Growth Trends Analysis Forecast 2017 - 2032

ASC Software Market size is projected to grow at a CAGR of 9.5% from 2022 to 2028.

ASC software is a computer programme used to manage and keep track of business operations. It makes it easier for businesses to manage their money, inventory, and sales. Because it enables organisations to run effectively and make wise decisions about their operations, ASC software is crucial.

Modern healthcare facilities known as ambulatory surgery centres, or…

Automatic Stacking Cranes (ASC) Market 2022 | Detailed Report

The Automatic Stacking Cranes (ASC) research report undoubtedly meets the strategic and specific needs of the businesses and companies. The report acts as a perfect window that provides an explanation of market classification, market definition, applications, market trends, and engagement. The competitive landscape is studied here in terms of product range, strategies, and prospects of the market's key players. Furthermore, the report offers insightful market data and information about the…

ASC Software Market to See Booming Growth with CureMD, eClinicalWorks, iSalus

Latest released the research study on Global ASC Software Market, offers a detailed overview of the factors influencing the global business scope. ASC Software Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the ASC Software. The study covers emerging player’s data, including: competitive…

Global Inclinometers Market Revenue 2018-2025 Agisco, Altheris sensors, ASC

Recently added detailed market study "Global Inclinometers Market" examines the performance of the Inclinometers market 2018. It encloses an in-depth Research of the Inclinometers market state and the competitive landscape globally. This report analyzes the potential of Inclinometers market in the present and the future prospects from various angles in detail.

The Global Inclinometers Market 2018 report includes Inclinometers market Revenue, market Share, Inclinometers industry volume, market Trends, Inclinometers Growth aspects.…