Press release

Bancassurance Market Size, Share and Industry Analysis, Report 2024-2032

The latest report by IMARC Group, titled" Bancassurance Market Report by Product Type (Life Bancassurance, Non-Life Bancassurance), Model Type (Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture), and Region 2024-2032", offers a comprehensive analysis of the industry, which comprises insights on the market. The global bancassurance market size reached USD 1,428 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 2,255 Billion by 2032, exhibiting a growth rate (CAGR) of 5.5% during 2024-2032.Factors Affecting the Growth of the Bancassurance Industry:

• Integration of Digital Technologies:

The integration of digital technologies is a significant driver in the global bancassurance market. Digital transformation within banking and insurance sectors has revolutionized how these services are delivered, creating a seamless and efficient consumer experience. Advanced digital tools such as artificial intelligence (AI), big data analytics, and consumer relationship management (CRM) systems enable banks and insurance companies to analyze vast amounts of consumer data. This analysis helps in crafting personalized insurance products that cater to the specific needs of individual consumers, thereby increasing consumer satisfaction and loyalty. Moreover, the advent of mobile banking and digital platforms has made it easier for consumers to access bancassurance products. Consumers can now compare different insurance policies, receive quotes, and purchase insurance products online, all within a few clicks. This convenience attracts a broader consumer base and also reduces the operational costs for banks and insurance companies.

• Regulatory Support and Financial Inclusion Initiatives:

Regulatory support and financial inclusion initiatives by governments and financial authorities play a crucial role in the expansion of the global bancassurance market. Many countries are actively promoting bancassurance as part of their financial inclusion strategies to increase the penetration of insurance products among the underserved and unbanked populations. Governments recognize the potential of bancassurance to reach a wider audience through the extensive branch networks of banks. Regulatory frameworks have been adapted to support the seamless collaboration between banks and insurance companies. For instance, in many regions, regulators have eased the licensing processes and compliance requirements, making it easier for banks to offer insurance products. This regulatory facilitation encourages more banks to enter the bancassurance market, thereby increasing competition and innovation. Furthermore, financial literacy programs aimed at educating the public about the benefits of insurance and how bancassurance works are also contributing to market growth.

• Expanding Middle-Class and Rising Disposable Incomes:

The expanding middle-class population and rising disposable incomes globally are significant factors driving the demand for bancassurance products. As economies grow and individuals' purchasing power increases, there is a corresponding rise in the demand for financial security and investment products. The middle class, in particular, seeks comprehensive financial planning solutions that include both banking and insurance services. This demographic shift is particularly evident in emerging markets such as China, India, and Southeast Asia, where rapid economic growth has led to the emergence of a substantial middle-class population. These individuals are increasingly looking for ways to protect their newfound wealth and ensure financial stability for their families. Bancassurance offers a convenient and trusted solution, leveraging the existing relationship consumers have with their banks. Banks, in turn, can cross-sell insurance products to their existing consumer base, tapping into the growing demand for life insurance, health insurance, and investment-linked insurance products.

For an in-depth analysis, you can request a sample copy of the report: https://www.imarcgroup.com/bancassurance-market/requestsample

Leading Companies Operating in the Global Bancassurance Market

• ABN AMRO Bank N.V.

• The Australia and New Zealand Banking Group Limited

• Banco Bradesco SA

• The American Express Company

• Banco Santander, S.A.

• BNP Paribas S.A.

• The ING Group

• Wells Fargo & Company

• Barclays plc

• Intesa Sanpaolo S.p.A.

• Lloyds Banking Group plc

• Citigroup Inc.

• Crédit Agricole S.A.

• HSBC Holdings plc

• NongHyup Financial Group

• Société Générale

• Nordea Group

Bancassurance Market Report Segmentation:

By Product Type:

• Life Bancassurance

• Non-Life Bancassurance

Life bancassurance holds the maximum number of shares due to its essential role in providing financial security and long-term savings solutions to individuals, which aligns closely with the primary financial services offered by banks.

By Model Type:

• Pure Distributor

• Exclusive Partnership

• Financial Holding

• Joint Venture

Pure distributor dominates the market as it allows banks to focus on leveraging their extensive consumer networks to distribute a wide range of insurance products without the complexities of underwriting.

Regional Insights:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

Asia Pacific's dominance in the bancassurance market is attributed to its rapidly growing middle-class population, increasing urbanization, and rising disposable incomes.

Global Bancassurance Market Trends:

One of the critical factors driving the global bancassurance market is the need for banks to diversify their revenue streams. Traditional banking activities, such as lending and deposit-taking, are often subject to market fluctuations and regulatory pressures. By incorporating insurance products into their portfolio, banks can create a more stable and diversified revenue base. The sale of insurance products through bancassurance provides banks with additional fee-based income, which can help to offset the cyclical nature of traditional banking revenues. This diversification is particularly appealing in times of economic uncertainty, as it offers banks a steady stream of income from insurance commissions and premiums.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Bancassurance Market Size, Share and Industry Analysis, Report 2024-2032 here

News-ID: 3796822 • Views: …

More Releases from IMARC Group

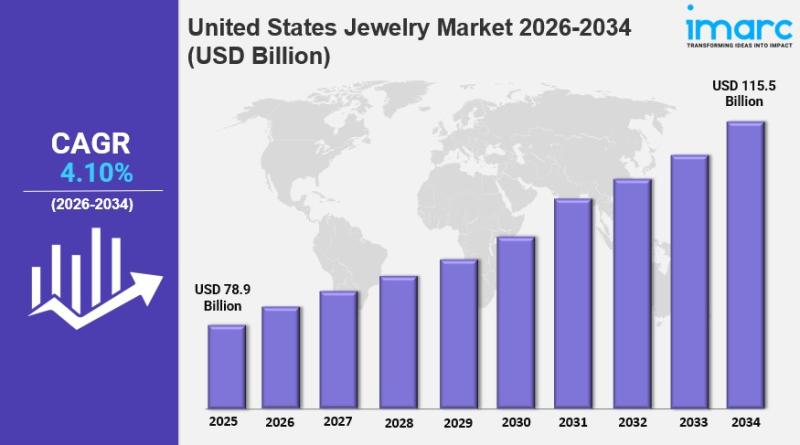

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

More Releases for Bancassurance

Investment Outlook: Analyzing Europe Bancassurance Market Trajectory by 2033

Market Overview

The Europe bancassurance market was valued at USD 646.79 Billion in 2024 and is forecast to reach USD 971.75 Billion by 2033, growing at a CAGR of 4.40% during 2025-2033. Digital transformation and enhanced financial literacy are primary growth drivers. Partnerships between banks and insurers create integrated service offerings, expanding customer access to insurance.

Download a sample copy of the report: https://www.imarcgroup.com/europe-bancassurance-market/requestsample

Study Assumption Years

Base Year: 2024

Historical Years: 2019-2024

Forecast Period: 2025-2033

Europe…

Bancassurance Market: An Extensive Analysis Predicts Significant Future Growth

According to USD Analytics the Global Bancassurance Market is projected to register a high CAGR from 2025 to 2034.

The latest study released on the Global Bancassurance Market by USD Analytics Market evaluates market size, trend, and forecast to 2034. The Bancassurance market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study…

Bancassurance Products Market 2025: A Decade of Phenomenal Growth Ahead

The Bancassurance Products Market 2025-2033 report provides a comprehensive analysis of Types (Life Insurance, Non-life Insurance), Application (Aldult, Child, Others), Analysis of Industry Trends, Growth, and Opportunities, R&D landscape, Data security and privacy concerns Risk Analysis, Pipeline Products, Assumptions, Research Timelines, Secondary Research and Primary Research, Key Insights from Industry Experts, Regional Outlook and Forecast, 2025-2033.

Major Players of Bancassurance Products Market are:

ABN AMRO Bank, ANZ, Banco Bradesco, American Express, Banco Santander,…

GCC Bancassurance Market 2024: Trends, Growth Drivers, and Opportunities

The Business Research Company recently released a comprehensive report on the Global Food Inclusions Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

According to The Business Research Company's, The food inclusions market size…

Bancassurance Market Growth, Size, Trends,Share Analysis 2024-2033

"The Business Research Company recently released a comprehensive report on the Global Bancassurance Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Global Bancassurance Market Professional 2027-

Global Bancassurance Market Size Is Projected To Reach US$ 2291.7 Million By 2027, From US$ 2008.8 Million In 2020, At A CAGR Of 1.9% During 2021-2027

QY Research recently published a research report titled, "Global Bancassurance Market Report, History and Forecast , Breakdown Data by Manufacturers, Key Regions, Types and Application". The research report attempts to give a holistic overview of the Bancassurance market by keeping the information simple, relevant, accurate,…