Press release

Closed End Funds Market is Booming Worldwide | BlackRock,Invesco,Nuveen

The Latest published market study on Global Closed End Funds Market provides an overview of the current market dynamics in the Closed End Funds, as well as what our survey respondents all outsourcing decision-makers predict the market will look like in 2032. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some of the players that are in coverage of the study are BlackRock, Invesco, Eaton Vance, Nuveen, T. Rowe Price, Aberdeen Standard Investments, Cohen & Steers, Franklin Templeton, Morgan Stanley, Wells Fargo Asset Management, Janus Henderson Investors, AllianceBernstein, Neuberger Berman, Legg Mason, Virtus Investment Partners, The Blackstone Group, VanEck, Royce & Associates, Guggenheim Investments, Columbia Threadneedle Investments. etc.Get ready to identify the pros and cons of the regulatory framework, local reforms, and its impact on the industry. Know how Leaders in Closed End Funds are keeping themselves one step forward with our latest survey analysis

Click to get Global Closed End Funds Market Research Sample PDF Copy Here 👉https://www.htfmarketreport.com/sample-report/3564744-worldwide-closed-end-funds-market?utm_source=Tina_OpenPR&utm_id=Tina

According to HTF Market Intelligence, the Global Closed End Funds market size was valued at USD 180 Billion in 2024 and is projected to reach USD 250 Billion by 2032, growing at a CAGR of 6%.

Definition:

Closed-end funds (CEFs) are investment funds that raise capital through an initial public offering (IPO) and then trade on the secondary market like stocks. Unlike open-end mutual funds, which continuously issue and redeem shares, closed-end funds have a fixed number of shares available. After the IPO, these funds are listed on an exchange and their shares can be bought and sold by investors in the market. The value of a closed-end fund's shares is determined by market demand, which may cause its price to trade at a premium or discount to its net asset value (NAV). CEFs can invest in a wide range of assets, including stocks, bonds, or real estate, and they typically distribute income through dividends or interest payments to investors. The fixed number of shares can make these funds less liquid compared to other forms of investment, but they often offer higher yields or unique investment strategies. Investors in closed-end funds are generally looking for income generation and diversification.

Dominating Region:

• North America

Fastest-Growing Region:

• Europe

Major highlights from the Study along with most frequently asked questions:

1) What so unique about this Global Closed End Funds Assessment?

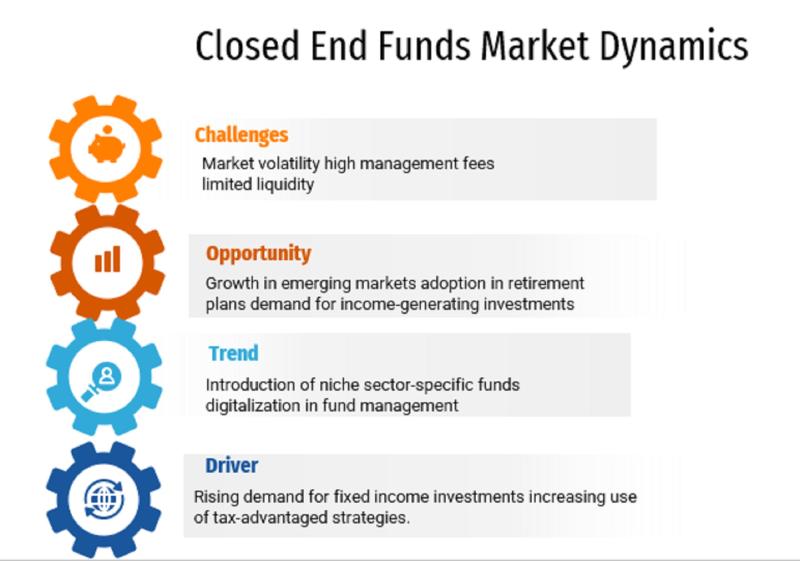

Market Factor Analysis: In this economic slowdown, the impact on various industries is huge. Moreover, the increase in demand & supply gap as a result of the sluggish supply chain and the production line has made the market worth observing. It also discusses technological, regulatory, and economic trends that are affecting the market. It also explains the major drivers and regional dynamics of the global market and current trends within the industry.

Market Concentration: Includes C4 Index, HHI, Comparative Closed End Funds Market Share Analysis (Y-o-Y), Major Companies, Emerging Players with Heat Map Analysis

Market Entropy: Randomness of the market highlighting aggressive steps that players are taking to overcome the current scenario. Development activity and steps like expansions, technological advancement, M&A, joint ventures, and launches are highlighted here.

Patent Analysis: Comparison of patents issued by each player per year.

Peer Analysis: An evaluation of players by financial metrics such as EBITDA, Net Profit, Gross Margin, Total Revenue, Segmented Market Share, Assets, etc. to understand management effectiveness, operation, and liquidity status.

2)Why only a few Companies are profiled in the report?

Industry standards like NAICS, ICB, etc. are considered to derive the most important manufacturers. More emphasis is given to SMEs that are emerging and evolving in the market with their product presence and technologically upgraded modes, current version includes players like "Closed End Funds" etc. and many more.

** Companies reported may vary subject to Name Change / Merger etc.

Complete Purchase of Latest Edition of Global Closed End Funds Market Report 👉 https://www.htfmarketreport.com/buy-now?format=1&report=3564744

3) What details will the competitive landscape provide?

A value proposition chapter to gauge Closed End Funds market. 2-Page profiles of all listed companies with 3 to 5 years of financial data to track and comparison of business overview, product specification, etc.

4) What is all regional segmentation covered? Can specific countries of interest be added?

A country that is included in the analysis is North America, Europe, Asia-Pacific etc.

** Countries of primary interest can be added if missing.

5) Is it possible to limit/customize the scope of study to applications of our interest?

Yes, the general version of the study is broad, however, if you have limited application in your scope & target, then the study can also be customized to only those applications. As of now, it covers applications & Other.

** Depending upon the requirement the deliverable time may vary.

To comprehend Global Closed End Funds market dynamics in the world mainly, the worldwide Closed End Funds market is analyzed across major global regions. A customized study by a specific region or country can be provided, usually, the client prefers below

• North America: United States of America (US), Canada, and Mexico.

• South & Central America: Argentina, Chile, Colombia, and Brazil.

• Middle East & Africa: Kingdom of Saudi Arabia, United Arab Emirates, Turkey, Israel, Egypt, and South Africa.

• Europe: the UK, France, Italy, Germany, Spain, Nordics, BALTIC Countries, Russia, Austria, and the Rest of Europe.

• Asia: India, China, Japan, South Korea, Taiwan, Southeast Asia (Singapore, Thailand, Malaysia, Indonesia, Philippines & Vietnam, etc.) & Rest

• Oceania: Australia & New Zealand

Enquire for customization in Report 👉 https://www.htfmarketreport.com/enquiry-before-buy/3564744-worldwide-closed-end-funds-market?utm_source=Tina_OpenPR&utm_id=Tina

Basic Segmentation Details:

Global Closed End Funds Product Types In-Depth: Equity Funds, Bond Funds, Hybrid Funds, Specialty Funds, Tax-Exempt Funds& Other

Global Closed End Funds Major Applications/End users: Wealth Management, Institutional Investments, Retirement Funds, Tax Management, Alternative Investments & Other

Geographical Analysis: North America, Europe, Asia-Pacific & Rest of World, etc.

Thanks for reading this article, you can also make sectional purchases or opt-in for a regional report by limiting the scope to only North America, ANZ, Europe or MENA Countries, Eastern Europe, or European Union.

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketreport.com

About Author:

HTF Market Intelligence consulting is uniquely positioned empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist in decision making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Closed End Funds Market is Booming Worldwide | BlackRock,Invesco,Nuveen here

News-ID: 3790437 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Curated Luxury Home Accents Market: Regaining Its Glory | Company A, Company B, …

Curated luxury home accents are high-end decorative items selected for their aesthetic appeal and quality, aimed at enhancing the beauty and functionality of living spaces, reflecting individual tastes and lifestyles, and increasingly sought after by consumers looking to create personalized and stylish environments in their homes.

Key Players in This Report Include: Company A, Company B, Company C, Company D, Company E, Company F, Company G, Company H, Company I, Company…

Gold Resources Market Seeking Excellent Growth | Wheaton Precious Metals, Royal …

The Gold Resources Market refers to the global industry involved in the exploration, extraction, processing, refining, trading, and investment of gold resources. It encompasses upstream mining activities, midstream refining operations, and downstream distribution across jewelry, investment, central banking, and industrial applications.

Gold resources include both primary gold deposits (mined from underground and open-pit operations) and secondary sources (recycled gold, electronics, and industrial waste). The market is influenced by geological reserves, mining…

Tourism Digitalization Market Is Going to Boom | Major Giants Amadeus IT Group, …

The Tourism Digitalization Market refers to the global industry focused on the adoption, integration, and commercialization of digital technologies across the travel and tourism value chain to enhance operational efficiency, customer experience, marketing effectiveness, and revenue generation.

Tourism digitalization involves the use of advanced technologies such as cloud computing, artificial intelligence (AI), big data analytics, Internet of Things (IoT), blockchain, mobile applications, and digital payment systems to transform how tourism services…

Daily Newsletters Market Hits New High | Major Giants Mailchimp, Sendinblue, Get …

The Daily Newsletters Market refers to the global industry focused on the creation, distribution, monetization, and management of email-based news publications that are delivered to subscribers on a daily basis. These newsletters curate timely content such as news updates, industry insights, financial reports, marketing trends, technology developments, lifestyle topics, and opinion pieces, tailored to specific audience segments.

Key Players in This Report Include: Mailchimp (USA), Constant Contact (USA), HubSpot (USA), Sendinblue…

More Releases for Funds

Infinity Forex Funds Reviews & News: Investors Can Trace Their Lost Funds (Updat …

InvestorWarnings.com has issued a new update on the Infinity Forex Funds case.

Trace Your Lost Funds Here:

https://www.investorwarnings.com/warnings/get-expert-assistance-on-your-case/

Regulatory Warnings Against Infinity Forex Funds

Infinity Forex Funds markets itself as an online "prop-firm" / forex-funding / trading platform, offering funded accounts and trading services via its website. The firm seems to target retail traders, promising access to capital and the opportunity to trade forex or other instruments under its funding model. However…

Mutual Funds or Index Funds: Understanding the Fundamental Differences

Mutual Funds or Index Funds -

Understanding the fundamental differences between mutual funds and index funds, including how they are managed, their fees, and their investment strategies. Investing in the stock market has become an essential part of wealth creation. While there are many ways to invest in the stock market, mutual funds and index funds are two of the most popular options.

Both of these investment vehicles offer their own set…

Mutual Funds Market Next Big Thing | Major Giants- Aditya Birla, Kotak Mahindra, …

Mutual Funds Market in India 2019 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Mutual Funds Market. Some of the key players profiled in the study are HDFC Asset Management Company Limited, Reliance Nippon…

VINITO WINE FUNDS LTD LAUNCHES NEW ALTERNATIVE CROWD INVESTING FINE WINE FUNDS T …

Vinito Wine Funds , based in Georgia and Luxembourg, is a leading independent crowd investment fund manager for fine wine. They have been active in the international wine market since 2016, and they proudly manage exclusively private wine funds. In 2018 Vinito Wines has completed the 3rd closing of its new wine fund, the From Bordeaux with Love, at €250,000. The new fund is a continuation of Vinito Wine’s global…

Number Of Cryptocurrency Funds Growing

To contribute to the current crypto cycle there are two options: conventional currencies or

cryptocurrency. Here at ABPT Crypto (Asset Backed Palladium Token) we recommend using the

second option as it’s safer, faster and more profitable.

There is a constant rise of interest towards cryptocurrencies — not only on the part of

investors, but also on the part of investment funds.

The increasing amount of investment hedge funds that advise their customers to invest in

cryptocurrencies…

Opalesque Roundtable: Australian Superannuation funds start seeding hedge funds …

Opalesque has published a 24 page protocol of a hedge fund Roundtable held in March with local hedge fund managers, institutional investors and prime brokers. The Opalesque Roundtable Series highlights fundamental developments within the global hedge fund industry, a full archive with 48 Roundtable scripts can be accessed here: www.opalesque.com/index.php?act=archiveRT. The current Australia Roundtable can be downloaded here: www.opalesque.com/RT/RoundtableAustralia2011.html.

The Australian hedge fund community is a sophisticated marketplace with tremendous…