Press release

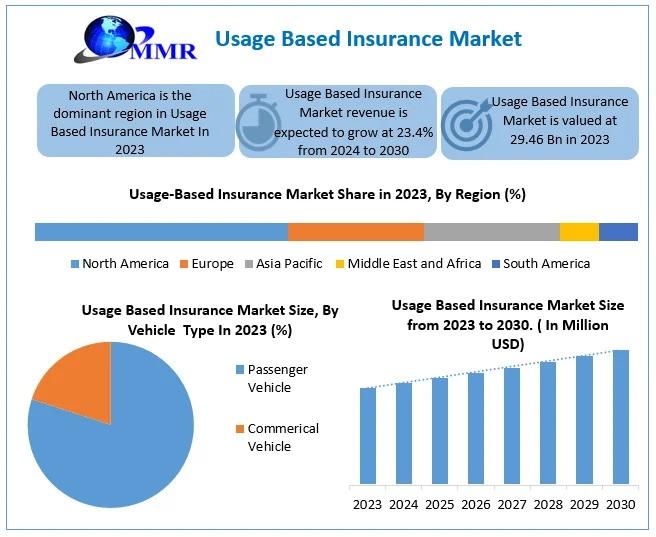

Usage Based Insurance Market Demand will reach a value of USD 128.36 Billion by the year 2030 at a CAGR of 23.4 Percentage

𝐔𝐬𝐚𝐠𝐞 𝐁𝐚𝐬𝐞𝐝 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 size was valued at USD 29.46 Billion in 2023 and the total Usage Based Insurance Market revenue is expected to grow at a CAGR of 23.4% from 2024 to 2030, reaching nearly USD 128.36 Billion by 2030.𝐔𝐬𝐚𝐠𝐞 𝐁𝐚𝐬𝐞𝐝 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

The Usage-Based Insurance (UBI) market is transforming the traditional insurance model by tailoring premiums based on individual driving behavior, such as speed, braking patterns, and mileage, instead of static factors like age and location. Through telematics devices or mobile apps, insurers can collect real-time driving data, allowing them to offer personalized premiums that reward safer driving. This approach fosters more responsible driving while offering consumers potential cost savings. Key drivers of the UBI market include advancements in telematics technology, the growing demand for cost-effective insurance solutions, the rise of connected vehicles, and regulatory support for more transparent pricing, paving the way for widespread adoption.

𝐖𝐚𝐧𝐭 𝐭𝐨 𝐒𝐞𝐞 𝐭𝐡𝐞 𝐓𝐫𝐞𝐧𝐝𝐬? 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐓𝐨𝐝𝐚𝐲 :https://www.maximizemarketresearch.com/request-sample/14665/

𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐔𝐬𝐚𝐠𝐞 𝐁𝐚𝐬𝐞𝐝 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭:

The growth of the Usage-Based Insurance market is propelled by several factors, notably advancements in telematics and IoT technologies, which enable real-time tracking of driving behavior. These innovations allow for more precise risk assessments, leading to customized and competitive pricing models. The increasing consumer demand for cost-effective insurance and the rise of connected and autonomous vehicles further stimulate market growth. Additionally, regulatory backing for transparent pricing models and the increasing emphasis on data security are playing significant roles in driving the adoption of UBI, making it an attractive alternative to traditional insurance schemes.

𝐌𝐞𝐫𝐠𝐞𝐫𝐬 𝐚𝐧𝐝 𝐀𝐜𝐪𝐮𝐢𝐬𝐢𝐭𝐢𝐨𝐧𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐔𝐬𝐚𝐠𝐞 𝐁𝐚𝐬𝐞𝐝 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭: 𝐆𝐥𝐨𝐛𝐚𝐥 𝐔𝐩𝐝𝐚𝐭𝐞𝐬

𝐔𝐬𝐚𝐠𝐞-𝐁𝐚𝐬𝐞𝐝 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐆𝐫𝐨𝐰𝐭𝐡 𝐢𝐧 𝐕𝐢𝐞𝐭𝐧𝐚𝐦

Vietnam's UBI market is witnessing significant expansion, primarily due to increasing internet penetration and a rising demand for personalized insurance solutions. The country's growing middle class and rapid adoption of smartphones and connected devices are creating favorable conditions for the uptake of UBI policies.

𝐓𝐡𝐞 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐒𝐭𝐚𝐤𝐞𝐡𝐨𝐥𝐝𝐞𝐫𝐬 𝐜𝐚𝐧 𝐄𝐧𝐪𝐮𝐢𝐫𝐞 𝐟𝐨𝐫 𝐭𝐡𝐞 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 :https://www.maximizemarketresearch.com/inquiry-before-buying/14665/

𝐓𝐡𝐚𝐢𝐥𝐚𝐧𝐝: 𝐔𝐁𝐈 𝐆𝐫𝐨𝐰𝐭𝐡 𝐢𝐧 𝐓𝐡𝐚𝐢𝐥𝐚𝐧𝐝

Thailand's insurance market is rapidly adopting UBI, largely due to the increased penetration of connected devices and rising urbanization. With a growing preference for smart, usage-based insurance models, Thai Life Insurance has implemented telematics-based policies for car insurance, offering personalized premiums based on driving behavior. Moreover, the Thai government's push towards smart cities and digital transformation will further fuel the growth of UBI in the country.

𝐉𝐚𝐩𝐚𝐧: 𝐔𝐁𝐈 𝐓𝐫𝐞𝐧𝐝𝐬 𝐢𝐧 𝐉𝐚𝐩𝐚𝐧

Japan, with its high technological advancements, is emerging as a leader in UBI in the Asia-Pacific region. Companies like Mitsui Sumitomo Insurance and Sompo Japan Nipponkoa Insurance are investing heavily in telematics to provide personalized auto insurance solutions. UBI is expected to grow rapidly as Japan focuses on enhancing customer experience and reducing accident rates through data-driven insights.

𝐒𝐨𝐮𝐭𝐡 𝐊𝐨𝐫𝐞𝐚: 𝐔𝐁𝐈 𝐂𝐨𝐧𝐬𝐨𝐥𝐢𝐝𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐒𝐨𝐮𝐭𝐡 𝐊𝐨𝐫𝐞𝐚

In South Korea, the UBI market is consolidating as established insurance players look to expand their digital offerings. Companies such as Samsung Life Insurance and Hanwha Life have embraced telematics to offer innovative solutions to South Korean consumers. This consolidation trend is driven by the government's support for digital transformation and smart cities, which will further push UBI penetration across the country.

𝐒𝐢𝐧𝐠𝐚𝐩𝐨𝐫𝐞: 𝐔𝐁𝐈 𝐔𝐩𝐝𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐒𝐢𝐧𝐠𝐚𝐩𝐨𝐫𝐞

Singapore's UBI market is undergoing significant updates, with leading insurers like AXA Singapore integrating advanced telematics to offer more dynamic pricing models. The regulatory environment in Singapore is conducive to innovation, allowing companies to experiment with different UBI pricing strategies. The government's smart nation initiative is also playing a crucial role in supporting the adoption of UBI as more consumers look for flexible and personalized insurance plans.

𝐔𝐧𝐢𝐭𝐞𝐝 𝐒𝐭𝐚𝐭𝐞𝐬: 𝐔𝐁𝐈 𝐆𝐫𝐨𝐰𝐭𝐡 𝐢𝐧 𝐭𝐡𝐞 𝐔.𝐒.

The United States remains the largest market for Usage-Based Insurance, with a valuation of over USD 20 billion in 2023. UBI's growth in the U.S. is primarily driven by the increasing demand for personalized auto insurance, with major players like Progressive Insurance, State Farm, and Allstate offering pay-per-mile and pay-as-you-drive models. The industry is witnessing increasing partnerships with tech companies to enhance telematics capabilities, further driving the market's expansion.

𝐄𝐮𝐫𝐨𝐩𝐞: 𝐔𝐁𝐈 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 𝐢𝐧 𝐄𝐮𝐫𝐨𝐩𝐞

Europe is experiencing rapid growth in the UBI market, with countries like the UK, Germany, and France leading the way in adoption. The trend toward usage-based policies is gaining traction, as consumers seek more tailored insurance solutions. Zurich Insurance and Allianz are among the leading players offering telematics-based products in the region. Mergers and acquisitions are also on the rise, as companies like AXA acquire smaller tech startups to enhance their telematics offerings.

𝐊𝐞𝐲 𝐑𝐞𝐜𝐞𝐧𝐭 𝐃𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭𝐬

𝐏𝐚𝐫𝐭𝐧𝐞𝐫𝐬𝐡𝐢𝐩𝐬 𝐚𝐧𝐝 𝐂𝐨𝐥𝐥𝐚𝐛𝐨𝐫𝐚𝐭𝐢𝐨𝐧𝐬:

Progressive Insurance (U.S.) has teamed up with Verizon to enhance its UBI offerings, integrating real-time driving data to offer more personalized pricing.

Sompo Japan Nipponkoa (Japan) has signed a partnership with Toyota to integrate telematics into its UBI products, enhancing data accuracy and reducing risk assessment errors.

𝐀𝐜𝐪𝐮𝐢𝐬𝐢𝐭𝐢𝐨𝐧𝐬:

AXA (France) acquired Bdeo, a tech startup specializing in AI-based claims management, enhancing its UBI capabilities in the European market.

Zurich Insurance (Switzerland) has acquired Bright Box, an automotive technology company, to improve its telematics solutions for UBI.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐮𝐥𝐥 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 @https://www.maximizemarketresearch.com/request-sample/14665/

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐔𝐬𝐚𝐠𝐞 𝐁𝐚𝐬𝐞𝐝 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭:

by Type

Pay-As-You-Drive (PAYD)

Pay-How-You-Drive (PHYD)

Manage-How-You-Drive (MHYD)

by Technology Type

OBD-II

Smartphone

Hybrid

Black Box

Others

by Vehicle Type

Passenger Vehicle

Commercial Vehicle

by Vehicle Age

New Vehicles

Used Vehicles

𝐅𝐨𝐫 𝐦𝐨𝐫𝐞 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐚𝐛𝐨𝐮𝐭 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭 𝐯𝐢𝐬𝐢𝐭:https://www.maximizemarketresearch.com/market-report/usage-based-insurance-market/14665/

𝐖𝐡𝐨 𝐢𝐬 𝐭𝐡𝐞 𝐥𝐚𝐫𝐠𝐞𝐬𝐭 𝐦𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐞𝐫𝐬 𝐨𝐟 𝐔𝐬𝐚𝐠𝐞 𝐁𝐚𝐬𝐞𝐝 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐰𝐨𝐫𝐥𝐝𝐰𝐢𝐝𝐞?

1. Octo Telematics S.p.A.

2. Intelligent Mechatronic Systems

3. Allianz SE

4. Insure the Box Ltd

5. Progressive Corporation

6. Allstate Corporation

7. Desjardins Insurance

8. Generali Group

9. Mapfre S.A.

10. Metromile

11. Aviva plc

12. Watchstone Group

13. Sierra Wireless

14. Mechatronic Systems Inc.

15. TrueMotion

16. Cambridge Mobile Telematics

17. Modus Group, LLC

18. Inseego Corp

19. The Floow Limited

20. Vodafone

21. TomTom International

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐛𝐲 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 :

♦ Veterinary CT Scanner Market : https://www.maximizemarketresearch.com/market-report/veterinary-ct-scanner-market/14612/

♦ Global Antiseptics and Disinfectants Market : https://www.maximizemarketresearch.com/market-report/global-antiseptics-and-disinfectants-market/39163/

♦ Global Electric Shavers Market : https://www.maximizemarketresearch.com/market-report/global-electric-shavers-market/29577/

♦ Global Preparative and Process Chromatography Market : https://www.maximizemarketresearch.com/market-report/global-preparative-and-process-chromatography-market/16874/

♦ Global NGS Sample Preparation Market : https://www.maximizemarketresearch.com/market-report/global-ngs-sample-preparation-market/33020/

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

𝐌𝐀𝐗𝐈𝐌𝐈𝐙𝐄 𝐌𝐀𝐑𝐊𝐄𝐓 𝐑𝐄𝐒𝐄𝐀𝐑𝐂𝐇 𝐏𝐕𝐓. 𝐋𝐓𝐃.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Usage Based Insurance Market Demand will reach a value of USD 128.36 Billion by the year 2030 at a CAGR of 23.4 Percentage here

News-ID: 3788346 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

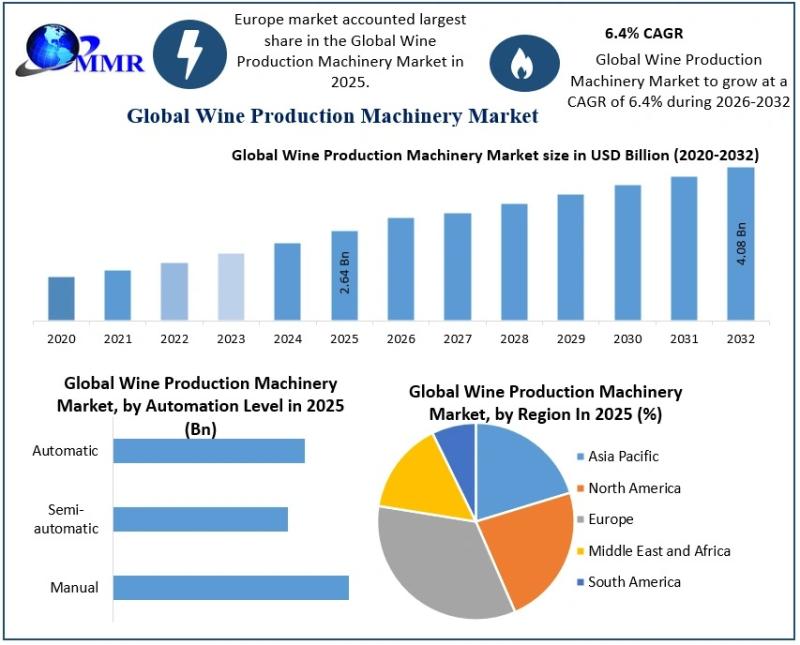

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

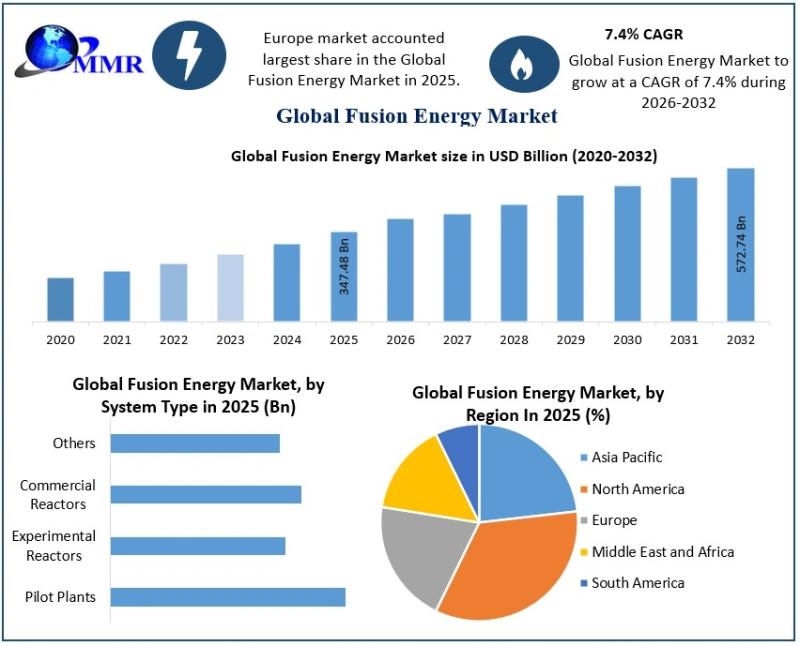

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

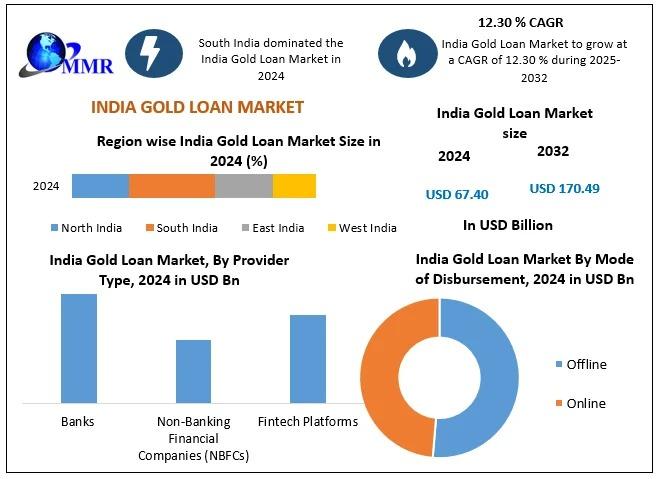

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

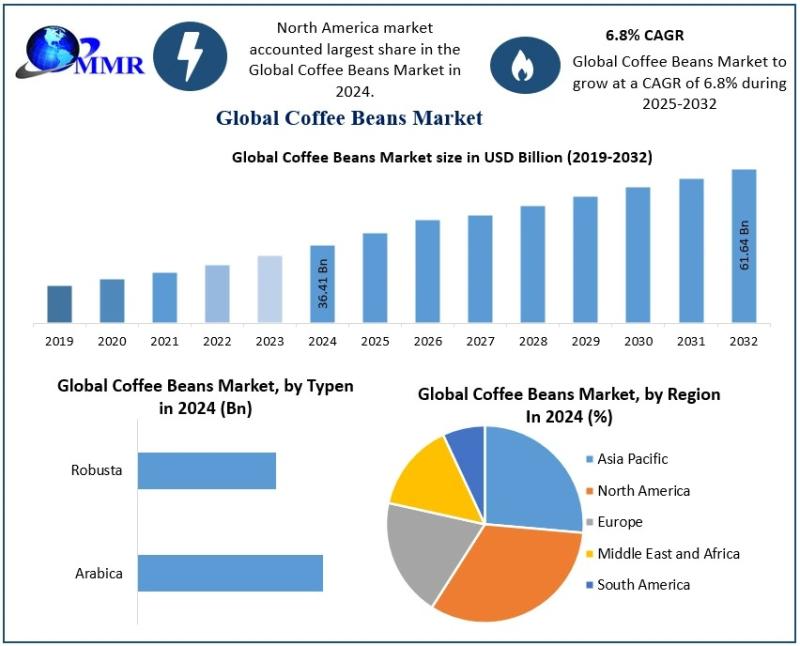

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for UBI

Usage Based Insurance (Ubi) Market: A Comprehensive Overview

The Usage-Based Insurance (UBI) Market was valued at USD 43.38 billion in 2023 and is expected to grow to approximately USD 87.0 billion by 2033, reflecting a CAGR of about 7.2% from 2024 to 2033.

Usage Based Insurance (Ubi) Market Overview

The Usage-Based Insurance (UBI) Market is experiencing significant growth, driven by advancements in telematics and the increasing adoption of connected vehicles. UBI models, such as Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD), utilize…

Usage Based Insurance (Ubi) Market Size Unlocking New Opportunities for Success

The global Usage-Based Insurance (UBI) Market was valued at approximately USD 33.27 billion in 2023 and is projected to reach around USD 232.94 billion by 2032, growing at a compound annual growth rate (CAGR) of 24.14% from 2024 to 2032.

Usage Based Insurance (Ubi) Market Overview

Usage-Based Insurance (UBI) is an innovative auto insurance model that determines premiums based on individual driving behaviors, such as distance traveled, speed, braking patterns, and time…

Usage-based Insurance (UBI) Market Revenue Sizing Outlook Appears Bright

Global Usage-based Insurance (UBI) Market Report from Market Insights Report highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions…

Usage-based Insurance (UBI) Market Will Generate Record Revenue by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-based Insurance (UBI) Market to Witness Growth Acceleration by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-Based Insurance (UBI) Market by Policy Type [Pay-As-You-Drive Insurance (P …

UBI Market Size

The global usage-based insurance market size was valued at $28.7 billion in 2019, and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.1% from 2020 to 2027. Usage-based insurance is expected to grow rapidly in the coming years. Key drivers of the usage-based insurance market include the growing adoption of telematics technology in the automotive insurance space.

Download Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-0U87/Usage_Based_Insurance

Trends Influencing the Global…