Press release

Supply Chain Finance Market is Expected to Grow at a CAGR of 13.0% Over the Forecast Period (2024-2031) | Citibank, J.P. Morgan Chase, HSBC, Standard Chartered

𝐓𝐡𝐞 𝐆𝐥𝐨𝐛𝐚𝐥 𝐒𝐮𝐩𝐩𝐥𝐲 𝐂𝐡𝐚𝐢𝐧 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐫𝐞𝐚𝐜𝐡𝐞𝐝 𝐔𝐒𝐃 𝟏.𝟓 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐢𝐧 𝟐𝟎𝟐𝟐 𝐚𝐧𝐝 𝐢𝐬 𝐞𝐱𝐩𝐞𝐜𝐭𝐞𝐝 𝐭𝐨 𝐫𝐞𝐚𝐜𝐡 𝐔𝐒𝐃 𝟒.𝟎 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐛𝐲 𝟐𝟎𝟑𝟏, 𝐠𝐫𝐨𝐰𝐢𝐧𝐠 𝐰𝐢𝐭𝐡 𝐚 𝐂𝐀𝐆𝐑 𝐨𝐟 𝟏𝟑.𝟎% 𝐝𝐮𝐫𝐢𝐧𝐠 𝐭𝐡𝐞 𝐟𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐩𝐞𝐫𝐢𝐨𝐝 𝟐𝟎𝟐𝟒-𝟐𝟎𝟑𝟏.Supply chain finance (SCF) refers to a collection of technology-driven solutions designed to reduce financing expenses and enhance operational efficiency for buyers and sellers involved in a sales transaction. SCF methodologies function by automating transactions and monitoring the processes of invoice approval and settlement, from commencement to conclusion.

Get Detailed Free Sample PDF (Use Corporate mail-id for preference): https://www.datamintelligence.com/download-sample/supply-chain-finance-market

The supply chain finance market is expanding with advanced and innovative solutions, effecting significant shifts that change corporate operations within supply chains. The future will see an increase in technology-driven supply chain finance solutions, allowing companies to obtain flexible financing alternatives and optimize payment procedures throughout fragmented supply chains.

The combination of rapid expansion, evolving regulations, and new reporting obligations for SCF renders it unsurprising that sector participants prefer collaboration. A burgeoning trend of collaboration is emerging within the business, especially between banks and fintech companies. This connection has not consistently been harmonious, since competition rather than collaboration characterized its inception.

Market Drivers:

The Increasing Digitalization of Commerce and Trade Finance

In recent years, digital technologies like blockchain have garnered attention for their capacity to revolutionize global trade. Nonetheless, the trade finance sector first encountered difficulties in embracing completely new innovations, opting instead to digitize pre-existing paperwork. This hesitance was exacerbated by the existing legal system, wherein certain documents essential to international trade, such as bills of lading and bills of exchange, remained regulated by the notion of physical ownership. As a result, digital trade documents lacked legal recognition, hindering their extensive adoption.

The recent enactment of the UK's Electronic Trade Document Bill, which received royal assent in July 2023, signifies a crucial advancement in addressing these difficulties. This legislation, grounded in the UN's Model Law on Electronic Transferable Records (MLETR), grants electronic trade documents equivalent legal status to paper-based paperwork in the realms of international trade and trade finance.

McKinsey forecasts that the use of electronic bills of lading may save direct expenses by US$6.5 billion and facilitate an additional US$40 billion in global trade. The recent legal acknowledgment of digital trade documents is expected to yield substantial efficiencies in global supply chains, decreasing operational expenses and improving transaction velocity.

The global ramifications of this legislative alteration transcend the UK, given that the majority of trade agreements, encompassing 80% of bills of lading, are regulated by UK law. This extensive impact is anticipated to result in a significant rise in the volume of commerce financed by both banking and non-banking financial institutions.

Supply Chain Finance Market is segmented by Provider, Offering, Application, End-User and by region.

Based on Provider segment the market is classified further as Banks, Trade Finance Houses, Others.

Based on offering segment the market is sub categorised as Letter of Credit, Export and Import Bills, Performance Bonds, Shipping Guarantees, Others.

Based on application segment the market is divided into Domestic, International

On the basis of End-User the market is sub categorized into Large Enterprises, Small and Medium-sized Enterprises. whereas the Small and medium-sized enterprises (SMEs) represent the largest segment in the supply chain finance (SCF) industry, driven by their necessity to enhance working capital, alleviate financial risks, and facilitate business expansion. Small and medium enterprises sometimes encounter substantial liquidity challenges stemming from protracted payment delays by larger creditors, with the average debtor days for Indian SMEs totaling 66.5 days. Prolonged delays necessitate that SMEs pursue alternative financing, frequently turning to expensive lending from informal lenders, thereby worsening working capital deficits, elevating borrowing expenses, and hindering profitability.

Regional Overview:

The North American supply chain financing sector is undergoing substantial expansion, propelled by technical innovations and strategic investments from prominent financial institutions. A significant advancement in the region is the worldwide use of supplier enablement portals and platforms aimed at optimizing client onboarding procedures. These portals generally examine expenditure data and offer comprehensive insight into the supplier onboarding procedure, enhancing convenience and efficiency within the SCF ecosystem. The capacity to streamline onboarding and guarantee transparency is facilitating the proliferation of SCF solutions across diverse sectors.

The Asia-Pacific region possesses the largest portion of the worldwide supply chain financing (SCF) industry, distinguished by varied economic development among nations. China dominates the regional market, exhibiting strong growth, although emerging economies like Uzbekistan, Kazakhstan, and Kyrgyzstan are experiencing the early development of supply chain financing ecosystems, propelled by government backing, industry associations, and essential infrastructure. The establishment of comprehensive standards and regulations throughout the region has markedly improved industrial performance, operational efficiency, and business results.

Market Players Overview:

As supply chain finance (SCF) continues to evolve, emerging players and startups are leveraging innovative financial solutions to enhance liquidity, streamline operations, and strengthen supplier relationships. These businesses, often facing financial constraints, are turning to SCF strategies such as invoice financing, dynamic discounting, and reverse factoring to optimize cash flow and unlock working capital. By embracing technology-driven solutions, improving creditworthiness assessments, and fostering collaborative ecosystems with suppliers, startups are not only overcoming financial challenges but also positioning themselves for long-term growth and resilience in an increasingly competitive market.

Leading Players in the market are:

Citibank, J.P. Morgan Chase, HSBC, Standard Chartered, Wells Fargo, Banco Santander, BNP Paribas, Deutsche Bank oracle and Taulia.

Get Customization in the report as per your requirements + Exclusive Bundle & Multi-User Discounts: https://www.datamintelligence.com/customize/supply-chain-finance-market

Frequently asked questions:

➠ What is the global sales value, production value, consumption value, import and export of Supply Chain Finance Market?

➠ Who are the global key manufacturers of the Supply Chain Finance Industry? How is their operating situation (capacity, production, sales, price, cost, gross, and revenue)?

➠ What are the Supply Chain Finance Market opportunities and threats faced by the vendors in the Global Supply Chain Finance Industry?

➠ Which application/end-user or product type may seek incremental growth prospects? What is the market share of each type and application?

➠ What focused approach and constraints are holding the Supply Chain Finance Market?

➠ What are the different sales, marketing, and distribution channels in the global industry?

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Supply Chain Finance Market is Expected to Grow at a CAGR of 13.0% Over the Forecast Period (2024-2031) | Citibank, J.P. Morgan Chase, HSBC, Standard Chartered here

News-ID: 3785373 • Views: …

More Releases from DataM Intelligence 4 Market Research LLP

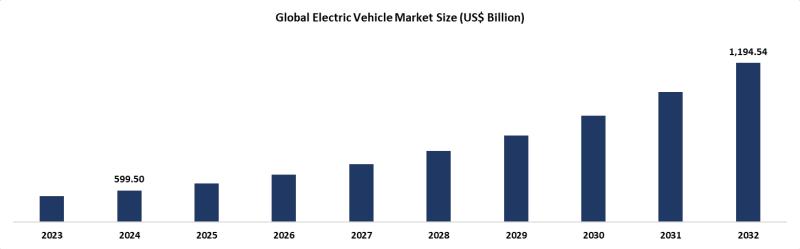

Electric Vehicle Market to Nearly Double to US$ 1,194.54 Billion by 2032, Driven …

According to DataM Intelligence, the global electric vehicle market reached US$ 599.50 billion in 2024 and is expected to reach US$ 1,194.54 billion by 2032, growing at a CAGR of 9% during the forecast period 2025-2032. Growth is propelled by rising consumer demand for sustainable mobility, favorable government policies and incentives, continuous improvements in battery technology, and expanding EV charging infrastructure worldwide.

Get a Free Sample PDF Of This…

Artificial Intelligence Market to Expand Rapidly at 29.4% CAGR Through 2031, Dri …

According to DataM Intelligence, the global artificial intelligence market is estimated to grow at a significant CAGR of approximately 29.4% during the forecast period 2024-2031. Growth is propelled by broad enterprise adoption of AI across industries such as healthcare, retail, BFSI, automotive, IT & telecom, and industrial sectors, coupled with accelerating advancements in machine learning, natural language processing, and computer vision technologies.

Get a Free Sample PDF Of This Report…

Generative AI Market to Skyrocket to US$ 1,022.41 Billion by 2032, Fueled by Ent …

According to DataM Intelligence, the generative AI market reached US$ 45.56 billion in 2024 and is expected to reach US$ 1,022.41 billion by 2032, growing at an exceptional CAGR of 47.53% during the forecast period 2025-2032. Growth is driven by accelerating enterprise adoption of generative AI across business functions, rising demand for AI chatbots and agents, advances in large language models (LLMs), and increasing integration of generative AI into internal…

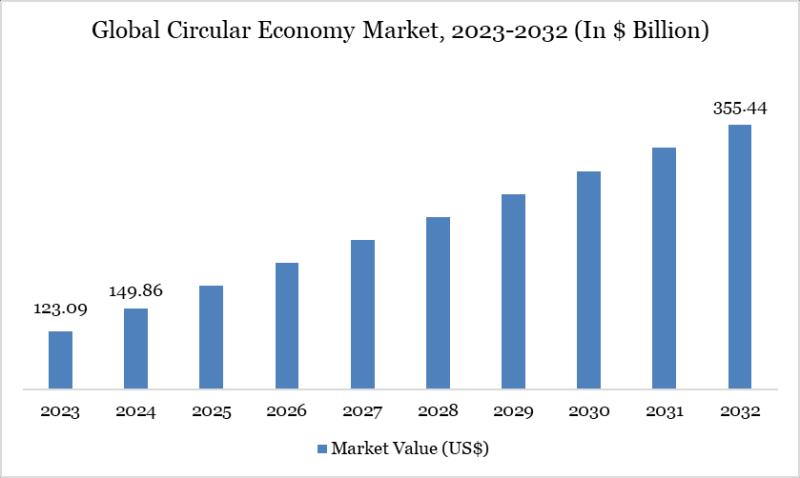

Circular Economy Market to Reach US$ 355.44 Billion by 2032, Fueled by Sustainab …

According to DataM Intelligence, the circular economy market was valued at US$ 149.86 billion in 2024 and is projected to reach US$ 355.44 billion by 2032, expanding at a robust CAGR of 11.40% from 2025 to 2032. Market growth is driven by increasing global sustainability mandates, rising adoption of advanced recycling and resource recovery technologies, and growing integration of circular business models such as Product-as-a-Service (PaaS) across consumer goods, automotive,…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…