Press release

Global Trade Finance Market is Forecast to Grow at a CAGR of 3.0% from 2024-2031

The Trade Finance Market report by DataM Intelligence provides insights into the latest trends and developments in the market. This report identifies the key growth opportunities in the market and provides recommendations for market participants to capitalize on these opportunities. Overall, the Trade Finance market report is an essential resource for market participants who are looking to gain a comprehensive understanding of the market and identify opportunities for growth.Download a Free sample PDF (Use Corporate email ID to Get Higher Priority) at: https://datamintelligence.com/download-sample/trade-finance-market

The Global Trade Finance Market reached US$ 4.1 billion in 2022 and is expected to reach US$ 5.2 billion by 2031, growing with a CAGR of 3.0% during the forecast period 2024-2031.

Trade Finance refers to the financial instruments and services that facilitate international and domestic trade transactions. It bridges the gap between exporters and importers by addressing payment risks, ensuring that exporters receive payment and importers receive goods. Common trade finance products include letters of credit, trade credit insurance, factoring, and supply chain financing. By providing liquidity, mitigating risks, and improving cash flow, trade finance plays a crucial role in enabling global commerce and supporting businesses of all sizes in managing their trade-related financial needs effectively.

Competitive Landscape

The section also contains information related to the new product launches, mergers, acquisitions, collaborations, etc., to give a clear understanding about the competitive landscape prevailing in the global market. With an emphasis on strategies there have been several primary developments done by major companies such as:

Oracle, Finastra, Surecomp, China Systems, Intellect Design Arena, iGTB (Intellect Global Transaction Banking), MITech, Innover Systems, CGI Trade360 and Cognizant.

Key Developments:

❁ In August 2023, Emirates Development Bank (EDB) partnered with Trade Capital Partners to launch supply chain finance and working capital solutions for Small and Medium-sized Enterprises (SMEs) in the UAE. This collaboration combines EDB's expertise with Trade Capital Partners' platform to extend financing solutions to a wider range of businesses, supporting the UAE's focus on SME growth and innovation. The partnership aims to provide vital trade finance alternatives to help SMEs expand.

❁ In July 2023, ABN AMRO Bank implemented a trade finance automation solution from Commercial Banking Applications, adopting the latest version of CBA's IBAS GTF (Global Trade Finance Factory). The integration of this solution into its global trade finance operations aims to improve efficiency, enhance automation, and elevate customer experience.

❁ In April 2023, Accelerated Payments, a global leader in working capital solutions, introduced its innovative AP Trade Finance (APTF) product. This new trade finance offering provides unmatched flexibility and control, making it an ideal solution for businesses engaged in international trade.

Get Customization in the report as per your requirements + Exclusive Bundle & Multi-User Discounts: https://datamintelligence.com/customize/trade-finance-market

Market Segments

The detailed segmentation offered in the report will help customers get a clear idea about the market segments and the factors that will drive segmental growth. The Trade Finance market has been segmented

By Product: Letters of Credit , Export Factoring, Insurance, Bill of Lading, Guarantees, Others

By Finance: Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance

By Service Provider: Banks, Trade Finance Houses, Others

By End-User: Large Enterprises, Small & Medium Enterprises

Research Process

Both primary and secondary data sources have been used in the global Trade Finance Market research report. During the research process, a wide range of industry-affecting factors are examined, including governmental regulations, market conditions, competitive levels, historical data, market situation, technological advancements, upcoming developments, in related businesses, as well as market volatility, prospects, potential barriers, and challenges.

Regional Analysis for Trade Finance Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

**The full version of the report includes an in-depth analysis of emerging players and startups, which will provide valuable insights into the evolving market landscape and key strategies being adopted**

This Report Covers:

✔ Go-to-market Strategy.

✔ Neutral perspective on the market performance.

✔Development trends, competitive landscape analysis, supply side analysis, demand side analysis, year-on-year growth, competitive benchmarking, vendor identification, and other significant analysis, as well as development status.

✔Customized regional/country reports as per request and country level analysis.

✔ Potential & niche segments and regions exhibiting promising growth covered.

✔ Analysis of Market Size (historical and forecast), Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM), Market Growth, Technological Trends, Market Share, Market Dynamics, Competitive Landscape and Major Players (Innovators, Start-ups, Laggard, and Pioneer).

Chapter Outline

⏩ Market Overview: It contains five chapters, as well as information about the research scope, major manufacturers covered, market segments, Trade Finance market segments, study objectives, and years considered.

⏩ Market Landscape: The competition in the Global Trade Finance Market is evaluated here in terms of value, turnover, revenues, and market share by organization, as well as market rate, competitive landscape, and recent developments, transaction, growth, sale, and market shares of top companies.

⏩ Companies Profiles: The global Trade Finance market's leading players are studied based on sales, main products, gross profit margin, revenue, price, and growth production.

⏩ Market Outlook by Region: The report goes through gross margin, sales, income, supply, market share, CAGR, and market size by region in this segment. North America, Europe, Asia Pacific, Middle East & Africa, and South America are among the regions and countries studied in depth in this study.

⏩ Market Segments: It contains the deep research study which interprets how different end-user/application/type segments contribute to the Trade Finance Market.

⏩ Market Forecast: Production Side: In this part of the report, the authors have focused on production and production value forecast, key producers forecast, and production and production value forecast by type.

⏩ Research Findings: This section of the report showcases the findings and analysis of the report.

⏩ Conclusion: This portion of the report is the last section of the report where the conclusion of the research study is provided.

Unlock Year-End Savings! Get Up to 30% Off: https://www.datamintelligence.com/buy-now-page?report=trade-finance-market

Frequently asked questions:

➠ What is the global sales value, production value, consumption value, import and export of Trade Finance market?

➠ Who are the global key manufacturers of the Trade Finance Industry? How is their operating situation (capacity, production, sales, price, cost, gross, and revenue)?

➠ What are the Trade Finance market opportunities and threats faced by the vendors in the global Trade Finance Industry?

➠ Which application/end-user or product type may seek incremental growth prospects? What is the market share of each type and application?

➠ What focused approach and constraints are holding the Trade Finance market?

➠ What are the different sales, marketing, and distribution channels in the global industry?

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Trade Finance Market is Forecast to Grow at a CAGR of 3.0% from 2024-2031 here

News-ID: 3785130 • Views: …

More Releases from DataM Intelligence 4 Market Research LLP

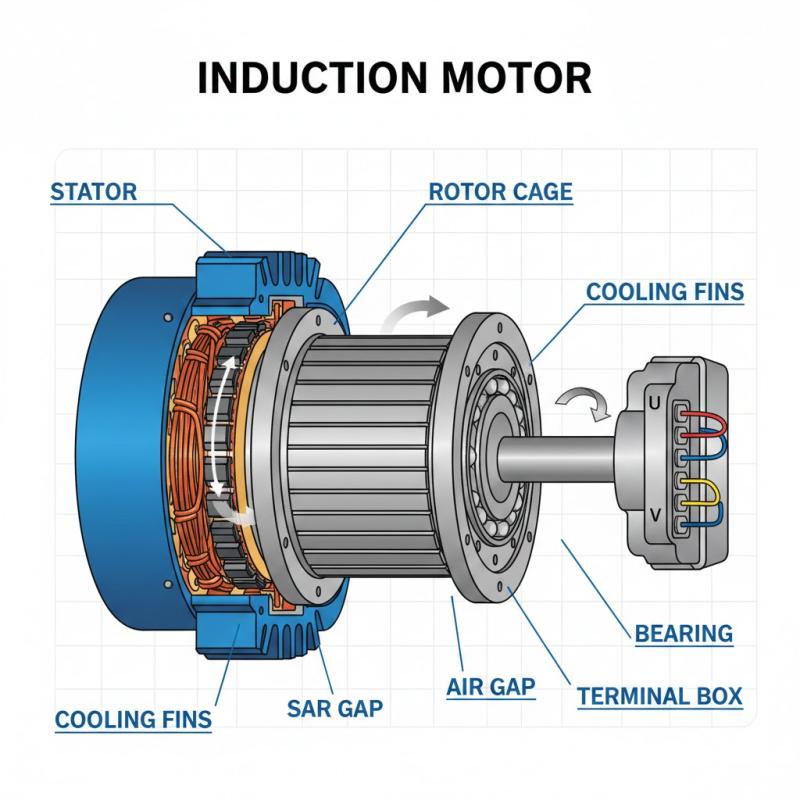

United States Induction Motor Market 2031 | Growth Drivers, Trends & Market Fore …

Induction Motor Market size was worth US$ 20.36 billion in 2023 and is estimated to reach US$ 33.66 billion by 2031, growing at a CAGR of 6.49% during the forecast period (2024-2031).

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/induction-motor-market?kb

List of Top Key Player:

ABB Ltd., Ametek, Emerson Electric, Siemens AG, Brook Crompton, Danaher Corporation, Johnson Electric Holdings, Regal Beloit, WEG Electric Corp.…

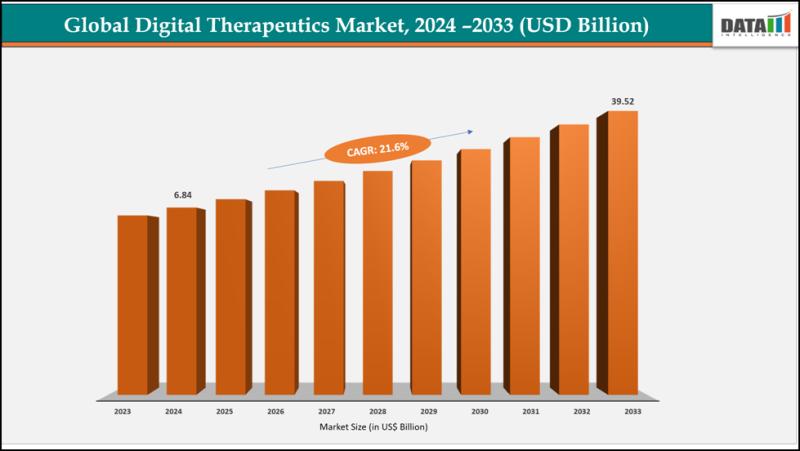

Digital Therapeutics Market Set for Explosive Growth to USD 39.52 Billion by 203 …

The Global Digital Therapeutics Market size reached USD 6.84 billion in 2024 and is expected to reach USD 39.52 billion by 2033, growing at a CAGR of 21.6% during the forecast period 2025-2033.

Market growth is driven by the rising prevalence of chronic diseases like diabetes and mental health disorders, increasing smartphone penetration, and growing patient demand for personalized, app-based interventions. Advancements in AI and machine learning for behavior change, expanding…

United States Contrast Media Injectors Market: Real-Time Market Trends & Competi …

DataM Intelligence unveils its latest report on the "Contrast Media Injectors Market Size 2025," offering an in-depth analysis of market trends, growth drivers, competitive landscape, and regional dynamics. The study covers market size in value and volume, CAGR forecasts, and emerging opportunities that can guide businesses in seizing growth potential and crafting winning strategies. Packed with data-driven insights on current developments and future trends, this report is essential for companies…

United States Real Time Location System (RTLS) Market Analysis 2026: Growth Driv …

Real Time Location System (RTLS) Market is expected to grow at a CAGR of 18% during the forecasting period (2022-2029).

Request a Premium Sample PDF of This Report (Corporate Email IDs Receive Priority Service): https://www.datamintelligence.com/download-sample/real-time-location-system-market?kb

United States: Recent Industry Developments

✅ December 2025: Major healthcare systems expanded RTLS deployments to enhance patient tracking, asset utilization, and workflow efficiency.

✅ November 2025: Leading tech providers integrated AI‐driven analytics into RTLS platforms to deliver predictive…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…