Press release

Commercial Insurance Market Strategies, Drivers, Top Players, Segmentation Forecast To 2033

The Business Research Company recently released a comprehensive report on the Global Commercial Insurance Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.According to The Business Research Company's, The commercial insurance market size has grown strongly in recent years. It will grow from $717.04 billion in 2023 to $779.91 billion in 2024 at a compound annual growth rate (CAGR) of 8.8%. The growth in the historic period can be attributed to economic growth, globalization of businesses, risk management practices, increased cyber threats, emerging liability risks, employee benefits..

The commercial insurance market size is expected to see strong growth in the next few years. It will grow to $1115.75 billion in 2028 at a compound annual growth rate (CAGR) of 9.4%. The growth in the forecast period can be attributed to supply chain disruptions, remote work challenges, climate change impact, regulation and compliance, political instability, innovation in coverage, data privacy concerns.. Major trends in the forecast period include digitization and insurtech integration, parametric insurance, sustainability and climate risk managemen, data analytics for risk modeling, product customization and flexibility, regulatory compliance and changes..

Get The Complete Scope Of The Report @

https://www.thebusinessresearchcompany.com/report/commercial-insurance-global-market-report

Market Drivers and Trends:

The rising number of commercial insurance providers is driving the commercial insurance market going forward. Insurance providers are businesses that provide insurance services. The variety of business coverage grows as the number of insurance providers grows. This provides more options for businesses to choose from. It also lowers premium costs, which makes insurance more affordable for small businesses that avoid it due to high costs. For instance, in 2023, according to Ibisworld, a US-based industry data provider, there were about 420056 insurance brokers and agencies in the US, which was an increase of 0.3% from 2022. Additionally, in 2020, according to the Insurance Information Institute, a US-based trade association working to improve the understanding of insurance, the insurance industry employed about 2,853,000 individuals, compared to 2,802,300 individuals in 2019. As a result, the increasing number of commercial insurance providers is driving the commercial insurance market.

The adoption of advanced technologies is a key trend gaining popularity in the commercial insurance market. Major companies in the market are adopting technologies such as artificial intelligence and the Internet of Things (IoT) to sustain their positions in the market. For instance, in September 2022, NeuralMetrics, a US-based InsurTech company, launched MarketEdge, a proprietary solution based on artificial intelligence and natural language processing (NLP) technology that helps insurance companies research and filter US-based businesses that can be perceived as potential customers for their commercial insurance offerings. The new offering uses databases such as OSHA, the Centers for Medicare and Medicaid Services, the Environmental Protection Agency, paycheck protection recipients, licenses, permits, inspections, and other databases to find leads.

Key Benefits for Stakeholders:

• Comprehensive Market Insights: Stakeholders gain access to detailed market statistics, trends, and analyses that help them understand the current and future landscape of their industry.

• Informed Decision-Making: The reports provide crucial data that support strategic decisions, reducing risks and enhancing business planning.

• Competitive Advantage: With in-depth competitor analysis and market share information, stakeholders can identify opportunities to outperform their competition.

• Tailored Solutions: The Business Research Company offers customized reports that address specific needs, ensuring stakeholders receive relevant and actionable insights.

• Global Perspective: The reports cover various regions and markets, providing a broad view that helps stakeholders expand and operate successfully on a global scale.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of Our Research Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=9206&type=smp

Major Key Players of the Market:

Aon plc; Marsh LLC; Willis Towers Watson Public Limited Company; Direct Line Insurance Group plc; American International Group Inc.; Chubb Limited; Zurich Insurance Group Ltd.; Travelers Companies Inc.; Berkshire Hathaway Inc.; CNA Financial Corporation; The Hanover Insurance Group Inc.; The Progressive Corporation; Hiscox Ltd.; Markel Corporation; QBE Insurance Group Limited; Nationwide Mutual Insurance Company; Farmers Insurance Group Co. Inc.; Erie Insurance Group; The Cincinnati Insurance Company; American Family Mutual Insurance Company S.I.; Aflac Inc.; Allstate Corporation; American National Insurance Company; Assurant Inc.; AXA S.A.; Beazley plc; Cigna Corporation; Crum & Forster Holdings Corp.; Everest Re Group Ltd.; Factory Mutual Insurance Company; Assicurazioni Generali S.p.A.; The Hartford Financial Services Group Inc.; Liberty Mutual Group Inc.; Lloyd's Corp.; Munich Reinsurance Company; New York Life Insurance Company; Pacific Life Insurance Company; The Penn Mutual Life Insurance Company; Principal Financial Group Inc.; Prudential Financial Inc.; Sompo International Holdings Ltd.; State Farm Mutual Automobile Insurance Company; Swiss Re Ltd.; Tokio Marine Holdings Inc.; Transamerica Corporation; XL Catlin Inc.

Commercial Insurance Market 2024 Key Insights:

• The commercial insurance market will grow to $1115.75 billion in 2028 at a compound annual growth rate (CAGR) of 9.4%.

• Rising Number Of Commercial Insurance Providers Drives The Market

• Adoption Of Advanced Technologies Transforms The Market

• Asia-Pacific was the largest region in the commercial insurance market in 2023

We Offer Customized Report, Click @

https://www.thebusinessresearchcompany.com/Customise?id=9206&type=smp

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (https://www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial Insurance Market Strategies, Drivers, Top Players, Segmentation Forecast To 2033 here

News-ID: 3779825 • Views: …

More Releases from The Business research company

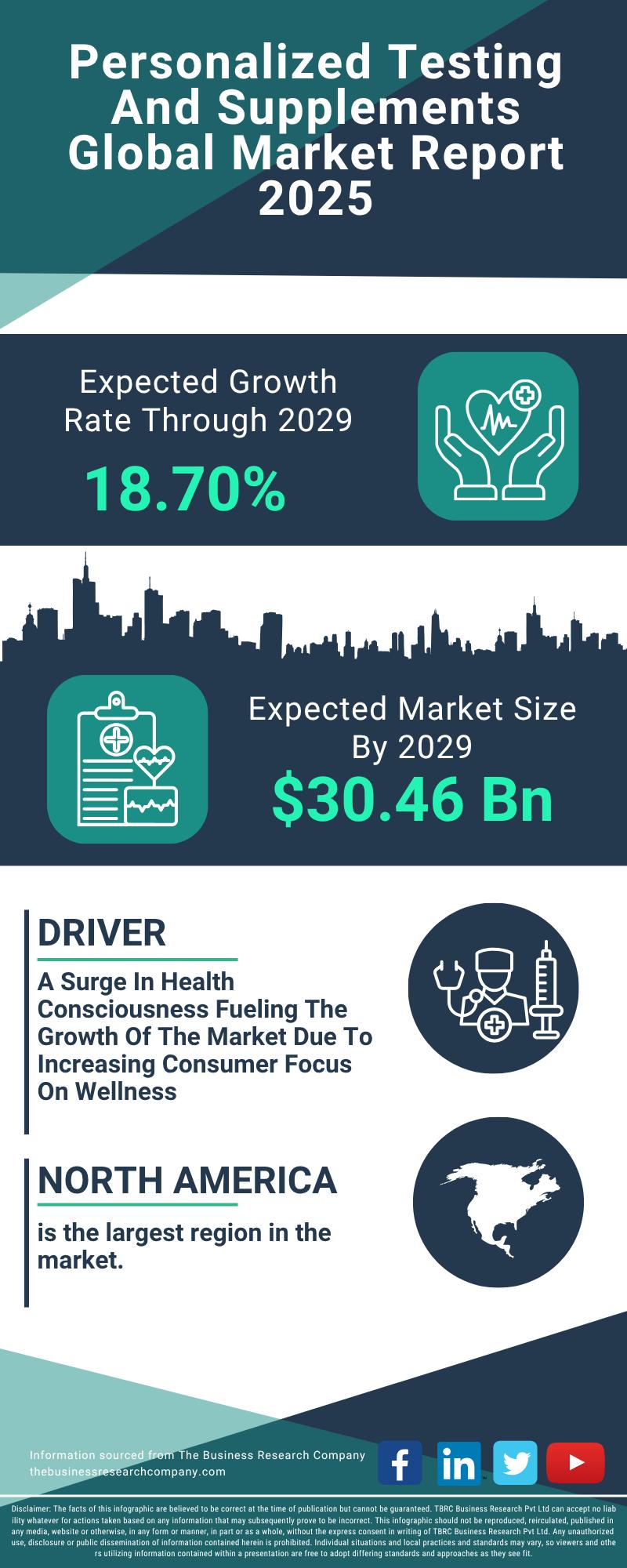

Segment Evaluation and Major Growth Areas in the Personalized Testing and Supple …

The personalized testing and supplements sector is gaining remarkable traction, driven by advancements in technology and a rising consumer focus on tailored health solutions. As more individuals seek customized wellness options, this market is set to experience substantial expansion in the coming years. Here's an in-depth look at its current valuation, key players, significant trends, and the main market segments shaping its future.

Market Valuation and Expansion Forecast for Personalized Testing…

Top Players and Market Competition in the Skin Microbiome Industry

The skin microbiome market is emerging as a significant area of interest due to growing awareness about the critical role of skin health and innovative skincare technologies. As research advances and consumer preferences shift towards more natural and science-backed products, this market is set to undergo substantial growth. Let's explore the current market size, key players, driving factors, and upcoming trends shaping the skin microbiome industry.

Projected Expansion in the Skin…

Key Strategic Developments and Emerging Changes Shaping the Upadacitinib Market …

The upadacitinib market is poised for significant expansion over the coming years, driven by advances in treatment options and increasing awareness of autoimmune diseases. This report delves into the market's current size, key drivers, major players, and the emerging trends shaping its future trajectory.

Steady Growth Expected in Upadacitinib Market Size Through 2029

The market for upadacitinib is projected to reach $2.54 billion by 2029, growing at a robust compound annual…

Analysis of Key Market Segments Driving the Alzheimer's Disease Diagnostic Marke …

The Alzheimer's disease diagnostic sector is rapidly evolving as advancements in technology and healthcare infrastructure open new possibilities for early detection and personalized treatment. With rising awareness and innovative approaches, this market is poised for significant growth in the coming years. Let's explore the current market size, key drivers, leading companies, and emerging trends that are shaping this critical healthcare field.

Projected Market Size and Growth Trends in Alzheimer's Disease Diagnostics…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…