Press release

New Jersey Student Loan Attorney Daniel Straffi Releases Article on Relief Options for Borrowers

New Jersey student loan attorney Daniel Straffi (https://www.straffilaw.com/new-jersey-student-loan-attorney/), of Straffi & Straffi Attorneys at Law, has highlighted critical issues and solutions for managing the mounting student debt crisis affecting the state. With New Jersey ranking as the sixth-highest in student loan debt among college graduates, according to a report by The Institute for College Access & Success, Straffi underscores the pressing need for borrowers to be informed about their rights and available relief measures."Student loans are intended to open doors to higher education but can also lead to significant financial stress," explains New Jersey student loan attorney Daniel Straffi. This financial pressure has far-reaching consequences, including impacting credit scores, purchasing power, and retirement planning. In New Jersey, where educational costs are significantly high, many borrowers find themselves caught in a cycle of overwhelming debt.

Student debt in New Jersey has reached a staggering $45.3 billion, with over 1.2 million residents carrying an average loan of $37,201, according to EducationData.org. While federal loans account for a significant share of this debt, private student loans also contribute considerably. The New Jersey student loan attorney notes that these private loans often come with higher interest rates and fewer consumer protections, placing additional strain on borrowers.

Approximately 15% of New Jersey graduates rely on private loans, with an average debt of $38,870. Coupled with the state's high cost of living, this creates a challenging repayment landscape for borrowers. Younger residents, particularly those under the age of 35, are disproportionately impacted, making up 56.2% of student borrowers in the state.

Managing federal and private student loans requires careful consideration of their differing features. Federal loans often offer fixed interest rates, flexible repayment plans, and borrower protections such as deferment, forbearance, and forgiveness programs like the Public Service Loan Forgiveness (PSLF). Private loans, on the other hand, tend to have variable interest rates, fewer protections, and less flexible repayment options.

Daniel Straffi advises borrowers to understand these distinctions and their long-term implications. Mismanagement of loans or falling victim to deceptive loan servicing practices can exacerbate financial struggles. With legal guidance, borrowers can explore their options, including repayment plan adjustments, consolidation, and defense against unfair repayment claims.

New Jersey has implemented state-specific regulations to safeguard student loan borrowers. A notable 2019 law requires student loan servicers to be licensed and adhere to fair practices. It also established a student loan ombudsman to assist borrowers and mandated timely responses to complaints. These measures aim to prevent deceptive practices, such as misrepresenting loan terms or misapplying payments.

"Legal strategies for managing student debt can provide a lifeline for those feeling overwhelmed," says Straffi. The firm can offer services to negotiate repayment terms, address disputes with loan servicers, and represent borrowers in legal proceedings.

For borrowers facing persistent financial challenges, relief may come through federal and state loan forgiveness programs. Federal initiatives such as PSLF benefit public service employees, while New Jersey offers targeted forgiveness programs for residents in critical sectors. Additionally, the Total and Permanent Disability (TPD) discharge program can release eligible borrowers from their repayment obligations.

In extreme cases, borrowers may consider bankruptcy, although student loans are notoriously difficult to discharge. Courts typically require demonstrating "undue hardship" through the stringent Brunner test. Straffi & Straffi Attorneys at Law can assist clients in evaluating this option and managing the complex aspects of Chapter 7 and Chapter 13 bankruptcy filings.

The student loan crisis in New Jersey underscores the need for informed decision-making and proactive legal support. Borrowers struggling with debt should not delay seeking assistance. Daniel Straffi emphasizes the importance of addressing issues early, whether by negotiating repayment terms, exploring forgiveness options, or defending against unfair practices.

For borrowers in New Jersey seeking guidance on their student loans, consulting with a knowledgeable attorney such as Daniel Straffi can be the first step toward financial recovery. Legal support can provide clarity and confidence in pursuing options that align with individual circumstances and long-term goals.

About Straffi & Straffi Attorneys at Law:

Straffi & Straffi Attorneys at Law is a trusted legal firm based in New Jersey, committed to assisting individuals with student loan debt. Led by Daniel Straffi, the firm can offer comprehensive services to help borrowers address complex financial and legal challenges. From negotiating repayment plans to managing disputes with loan servicers, Straffi & Straffi Attorneys at Law can provide dedicated support to protect borrowers' rights and promote financial stability.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=GgZH845iZcU

GMB: https://www.google.com/maps?cid=18340758732161592314

Email and website

Email: familyclient@straffilaw.com

Website: https://www.straffilaw.com/

Media Contact

Company Name: Straffi & Straffi Attorneys at Law

Contact Person: Daniel Straffi

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=new-jersey-student-loan-attorney-daniel-straffi-releases-article-on-relief-options-for-borrowers]

Phone: (732) 341-3800

Address:670 Commons Way

City: Toms River

State: New Jersey 08755

Country: United States

Website: https://www.straffilaw.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Jersey Student Loan Attorney Daniel Straffi Releases Article on Relief Options for Borrowers here

News-ID: 3779619 • Views: …

More Releases from ABNewswire

Child Attorney Service: Gordon Law, P.C. Queens Implements Strict Confidentialit …

Gordon Law, P.C. Queens Family and Divorce Lawyers has reinforced its commitment to ethical legal practices by implementing strict confidentiality standards for clients seeking Child Attorney service in Richmond Hill, Queens, NY. Recognizing the sensitive nature of child custody matters, the firm prioritizes safeguarding personal information while providing professional guidance and support.

Gordon Law, P.C. Queens Family and Divorce Lawyers has reinforced its commitment to ethical legal practices by implementing strict…

Dry Needling Safety Standards: Price Chiropractic and Rehabilitation Enhances Pa …

Dry needling services are available to residents of Boise, ID, providing a structured approach to addressing muscle tension, mobility limitations, and related neuromuscular conditions. Clinics offering dry needling and physical therapy services play an important role in supporting recovery, rehabilitation, and physical function.

Dry needling services are available to residents of Boise, ID, providing a structured approach to addressing muscle tension, mobility limitations, and related neuromuscular conditions. Clinics offering dry needling…

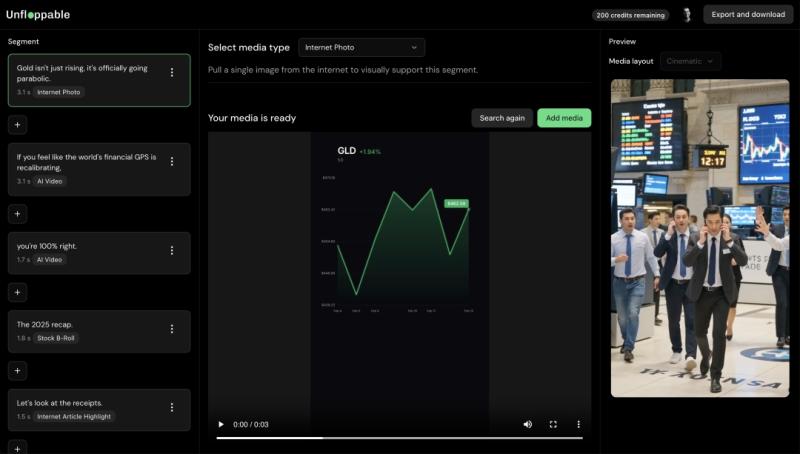

Unfloppable Launches AI Video Editor That Turns Talking-Head Recordings into Rea …

Image: https://www.abnewswire.com/upload/2026/02/feed1d8bfb1a4e150709d055f017d1ef.jpg

Singapore - February 25, 2026 - Unfloppable [http://unfloppable.com] today announced the public launch of its AI-powered video editor designed to eliminate the most time-consuming part of content creation: editing. Built for founders, experts, and builders, Unfloppable transforms a simple talking-head recording into polished, captioned, media-rich short-form videos optimized for platforms like TikTok, Instagram Reels, and YouTube Shorts.

According to internal research and user feedback, up to 93% of content creators…

The AI Search Agency That Operates Like a Lab: Unique Differentiators and Innova …

In 2026, marketing stopped being a battle for clicks and became a battle for algorithmic trust. Users increasingly skip the classic list of search results. Instead, they ask a question and expect a single, confident answer. Sometimes inside Google, and more and more often inside ChatGPT, Gemini, Claude, Perplexity, and the next generation of assistants that are becoming the first screen of the internet.

That single screen changes everything. Decisions are…

More Releases for Straffi

New Jersey Bankruptcy Attorney Daniel Straffi, Jr. Explains Chapter 7 Income Lim …

TOMS RIVER, NJ - Individuals considering Chapter 7 bankruptcy in New Jersey must meet specific income requirements determined by the federal means test, which compares a six-month income average against state median income guidelines. New Jersey bankruptcy attorney Daniel Straffi, Jr. of Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/what-are-income-limits-chapter-7-bankruptcy/) explains how the income thresholds work, what counts as income in the calculation, and what options exist for those whose income…

New Jersey Bankruptcy Attorneys Straffi & Straffi Attorneys at Law Announce Guid …

Toms River, NJ - New Jersey bankruptcy attorneys at Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/how-long-after-filing-bankruptcy-can-you-buy-a-house-in-new-jersey/), led by attorney Daniel Straffi Jr., announce comprehensive guidance for residents seeking a path to homeownership after bankruptcy. The firm's new advisory explains practical timelines, loan options, and documentation standards for applicants rebuilding credit, providing clear steps for pursuing a mortgage in New Jersey following Chapter 7 or Chapter 13 proceedings.

The guidance details how…

New Jersey Emergency Bankruptcy Attorney Daniel Straffi Provides Clarity on Emer …

Understanding how to protect assets during a financial crisis is critical, particularly when swift legal action is required. New Jersey emergency bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-an-emergency-bankruptcy-filing-in-new-jersey/) explains how an emergency bankruptcy filing can provide immediate relief for those facing foreclosure, wage garnishment, or other urgent creditor actions. In a recent article published by Straffi & Straffi Attorneys at Law, Daniel Straffi outlines the essential steps and key considerations involved in…

Straffi & Straffi Attorneys at Law Publishes New Article on No Asset Bankruptcy …

New Jersey Chapter 7 bankruptcy lawyer Daniel Straffi of Straffi & Straffi Attorneys at Law has published an article discussing the concept and implications of a no asset bankruptcy New Jersey [https://www.straffilaw.com/new-jersey-chapter-7-bankruptcy-lawyer/no-asset/]. This type of bankruptcy is commonly filed by individuals who have little to no nonexempt assets available for creditors. As explained by Straffi, a no asset bankruptcy can be an effective path toward financial relief for those who…

New Jersey Bankruptcy Attorney Daniel Straffi Discusses Medical Debt Relief Thro …

Medical debt continues to be a leading cause of financial distress for many Americans, and New Jersey residents are no exception. In a detailed article titled "Can My Medical Debt Be Paid Off With Bankruptcy?", New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/can-my-medical-debt-be-paid-off-with-bankruptcy/) explains how individuals burdened with overwhelming healthcare expenses may find relief through the bankruptcy process. The article, published by Straffi & Straffi Attorneys at Law, provides a comprehensive…

New Jersey Bankruptcy Attorney Daniel Straffi Explains Debt Restructuring Soluti …

New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-debt-restructuring-in-new-jersey/) offers important insights into how individuals and businesses can regain control of their finances through debt restructuring. In a recent article titled "What is Debt Restructuring in New Jersey?", Straffi addresses the growing financial strain many face due to job loss, unexpected expenses, or business challenges, and outlines the available options for restructuring debt to avoid default. Straffi & Straffi Attorneys at Law…