Press release

AI In The Credit-Scoring Market Key Players Analysis - FICO (Fair Isaac Corporation), Experian, Equifax, TransUnion.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global AI In The Credit-Scoring Market - (By Component (Software and Service), By Application (Personal Credit Scoring and Corporate Credit Scoring), By Industry Vertical (BFSI (Banking, Financial Services, Insurance), Retail, Healthcare, Telecommunications, Utilities, and Real Estate)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."According to the latest research by InsightAce Analytic, the Global AI In The Credit-Scoring Market is expected to grow with a CAGR of 25.9% during the forecast period of 2024-2031.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2578

The unification of artificial intelligence (AI) and machine learning (ML) in credit scoring is ongoing. Still, the process of aligning these advancements with a nation's developmental goals is just beginning. Across the board, banks and startups are delving into these technologies, intuitively grasping their capacity to amplify financial inclusion and propel economic expansion. Leading this innovation are alternative data sources, AI, and ML algorithms, along with agile cloud platforms. These technologies are being used to create credit scores for under-banked communities, allowing banks to offer improved financial solutions and expand access to individuals as well as communities that have traditionally been excluded from formal financial institutions.

While AI holds considerable promise, its implementation is accompanied by notable caveats. The global AI in the credit scoring market is powered by advancements in machine learning algorithms and the increasing availability of big data. AI-powered credit scoring systems use massive volumes of data, involving non-traditional data sources like social media activity, internet behaviour, and transaction history, to better assess the creditworthiness of individuals and businesses than traditional techniques. This novel approach not only improves the precision of credit ratings but also allows financial institutions to give credit to a broader spectrum of consumers, including individuals with limited credit history.

List of Prominent Market Players in the AI credit scoring market:

• FICO (Fair Isaac Corporation)

• Experian

• Equifax

• TransUnion

• Zest AI

• LenddoEFL

• Kreditech

• CreditVidya

• CreditXpert

• Upstart

• Pagaya

• Underwrite.ai

• Kensho Technologies

• Scienaptic

• DataRobot

• Deserve

• ClearScore

• ScoreData

• CredoLab

• Trust Science

• Other Prominent Players

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2024-02

Market Dynamics:

Drivers-

Several key factors drive the global AI in the credit scoring market. AI models analyze vast amounts of data with high precision, identifying patterns and trends that traditional methods might miss, leading to more accurate credit scores. AI processes data at a much faster rate than manual systems, enabling real-time credit scoring, which is essential for quick decision-making in financial services. Automation of credit scoring reduces the need for extensive manual processes, thereby lowering operational costs for financial institutions. AI can evaluate alternative data sources, making credit accessible to individuals with limited credit history, thereby expanding the customer base. AI models enhance risk assessment capabilities, predicting potential defaults more accurately and helping in mitigating financial risks. AI can ensure adherence to regulatory requirements through consistent and unbiased credit evaluations, reducing the risk of non-compliance penalties.

Challenges:

One challenge faced by AI in the credit scoring market is the potential for bias in algorithms, leading to discriminatory outcomes. Another challenge comes with the need for high-quality data to train AI models efficiently. Data privacy, including security concerns, also poses significant obstacles, as handling sensitive financial information requires strict compliance with regulations. Additionally, the interpretability of AI models in credit scoring is essential for building trust with consumers and regulatory bodies, highlighting the importance of explainable AI approaches.

Regional Trends:

North America is expected to hold the largest market share over the forecast period. This dominance is primarily driven by the advanced technological infrastructure, significant investments in AI and big data analytics, and the presence of leading financial institutions and fintech companies in the region. In North America, particularly the United States, banks and financial services firms are extensively adopting AI to enhance their credit scoring models, reduce default rates, and offer more personalized financial products. Besides, Europe had a good share of the market fueled by the increasing digitalization of financial services, a large unbanked population, and the proactive adoption of AI technologies by emerging economies.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2578

Recent Developments:

• In Jan 2024, Intuit Inc., the worldwide financial technology platform responsible for Intuit TurboTax, Credit Karma, QuickBooks, and Mailchimp, has declared that Credit Karma members and QuickBooks Online customers now have the ability to complete and submit their 2023 tax returns using TurboTax directly within the Credit Karma and QuickBooks Online product interfaces.

Segmentation of AI in credit scoring market-

By Component

• Software

• Service

By Application

• Personal Credit Scoring

• Corporate Credit Scoring

By Industry Vertical

• BFSI

o Banking,

o Financial Services,

o Insurance

• Retail,

• Healthcare,

• Telecommunications,

• Utilities,

• Real Estate

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Empower Your Decision-Making with 180 Pages Full Report @ https://www.insightaceanalytic.com/buy-report/2578

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 551 226 6109

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI In The Credit-Scoring Market Key Players Analysis - FICO (Fair Isaac Corporation), Experian, Equifax, TransUnion. here

News-ID: 3775042 • Views: …

More Releases from InsightAce Analytic Pvt. Ltd

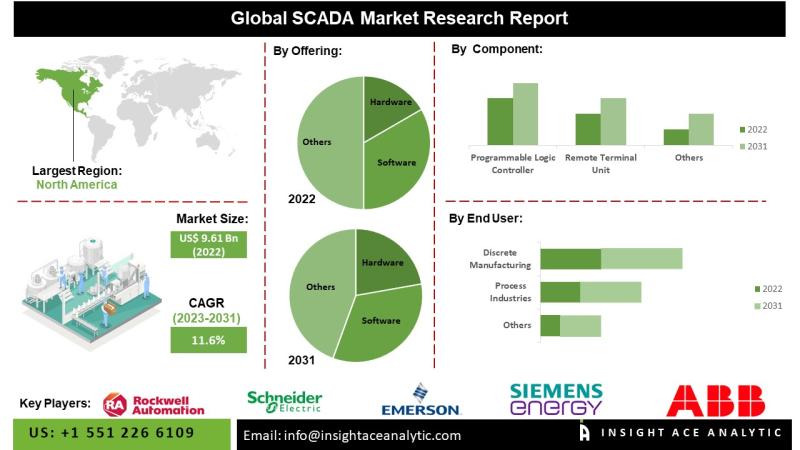

SCADA Market Insights Highlighting Technological Advancements in Wireless Sensor …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global SCADA Market Size, Share & Trends Analysis Report By Offering (Hardware, Software, Services), Component (Programmable Logic Controller, Remote Terminal Unit, Human-Machine Interface), End User (Process Industries, Discrete Manufacturing, Utilities), Region, Market Outlook And Industry Analysis 2034"

The global SCADA market is estimated to reach over USD 25.0 billion by the year 2034, exhibiting a CAGR of…

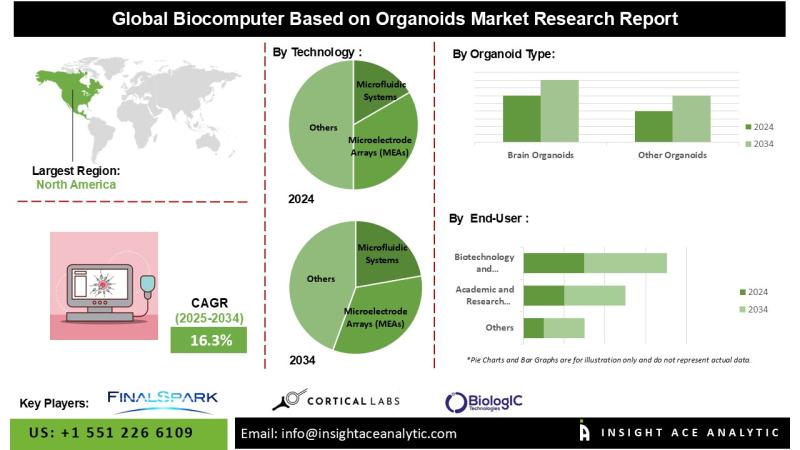

Biocomputer Based on Organoids Market Poised for 16.3% CAGR Driven by Brain Orga …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Biocomputer Based on Organoids Market Size, Share & Trends Analysis Report By Organoid Type (Brain Organoids, Other Organoids), Application (Biological Computing, Neuroscience Research, Drug Discovery and Testing, Personalized Medicine, Regenerative Medicine), Technology (Microfluidic Systems Microelectrode Arrays (MEAs), Brain-Machine Interfaces, CRISPR and Gene Editing), End-User (Academic and Research Institutes, Biotechnology and Pharmaceutical Companies, Technology Companies, Contract…

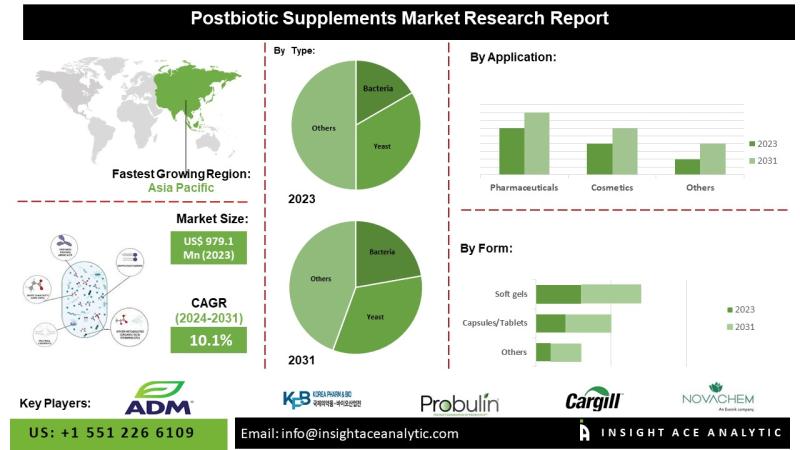

Postbiotic Supplements Market Drivers Include Functional Nutrition and Bioactive …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Postbiotic Supplements Market - (By Type (Bacteria, Yeast), By Form (Soft gels, Capsules/Tablets, Powder/ Granules, Others), By Application (Personal Care and Cosmetics, Food and Beverages, Animal Feed, Pharmaceuticals, Others)), Trends, Industry Competition Analysis, Revenue and Forecast To 2034."

According to the latest research by InsightAce Analytic, the Global Postbiotic Supplements Market is valued at USD 12.8…

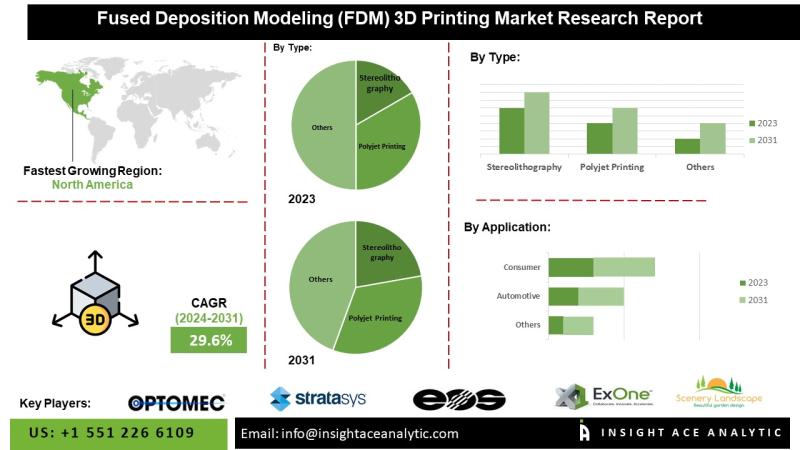

Fused Deposition Modeling 3D Printing Market Trends Highlight Increasing Use in …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Fused Deposition Modeling 3D printing Market - (By Type (Stereolithography, Polyjet Printing, MultiJet Printing, Colorjet Printing, Digital Light Processing, Selective Laser Sintering), By Application (Consumer, Automotive, Aerospace & Defence, Healthcare, Fashion & Aesthetics)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to the latest research by InsightAce Analytic, the Global Fused Deposition Modeling 3D…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…