Press release

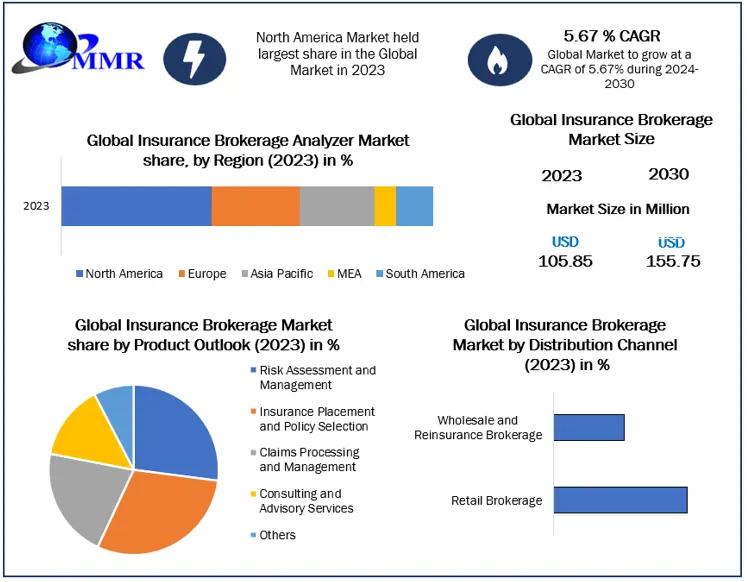

Insurance Brokerage Market: Projected to Reach USD 155.75 Billion by 2030, Growing at a 5.67% CAGR

𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐁𝐫𝐨𝐤𝐞𝐫𝐚𝐠𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰Maximize Market Research is a Business Consultancy Firm that has published a detailed analysis of the "Insurance Brokerage Market". The report includes key business insights, demand analysis, pricing analysis, and competitive landscape. The analysis in the report provides an in-depth aspect at the current status of the Insurance Brokerage market, with forecasts outspreading to the year 2030.

𝐂𝐮𝐫𝐢𝐨𝐮𝐬 𝐭𝐨 𝐩𝐞𝐞𝐤 𝐢𝐧𝐬𝐢𝐝𝐞? 𝐆𝐫𝐚𝐛 𝐲𝐨𝐮𝐫 𝐬𝐚𝐦𝐩𝐥𝐞 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭 𝐧𝐨𝐰:https://www.maximizemarketresearch.com/request-sample/215727/

𝐄𝐬𝐭𝐢𝐦𝐚𝐭𝐞𝐝 𝐆𝐫𝐨𝐰𝐭𝐡 𝐑𝐚𝐭𝐞 𝐟𝐨𝐫 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐁𝐫𝐨𝐤𝐞𝐫𝐚𝐠𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

Insurance Brokerage market was valued at USD 105.85 Bn in 2023 and is expected to reach USD 155.75 Bn by 2030, at a CAGR of 5.67 % during the forecast period.

𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐁𝐫𝐨𝐤𝐞𝐫𝐚𝐠𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐜𝐨𝐩𝐞 𝐚𝐧𝐝 𝐌𝐞𝐭𝐡𝐨𝐝𝐨𝐥𝐨𝐠𝐲:

The method used in the report to give investors relevant information is a combination of descriptive analysis and SWOT analysis. Presenting a comprehensive image of the Insurance Brokerage market is the study's main objective. The data collection process makes use of a variety of methods, such as questionnaires and surveys. Mathematical, statistical, and numerical techniques are then used to evaluate the data. Compiling and arranging data is crucial since identifying Insurance Brokerage market trends requires the application of both qualitative and quantitative research techniques.

By carefully examining the buyer-direct scenario, R&D projects, innovative forms of development, cutting-edge industry practices, and market consolidations and acquisitions, the research evaluates the potential futures of the market. The research includes charts, organizational portfolios, methods, and a critical evaluation of well-known corporate CEOs. Insurance Brokerage To determine market trends and provide microeconomic variables, the market conducted a thorough SWOT and PESTLE analysis.

𝐄𝐚𝐠𝐞𝐫 𝐭𝐨 𝐝𝐢𝐬𝐜𝐨𝐯𝐞𝐫 𝐰𝐡𝐚𝐭'𝐬 𝐰𝐢𝐭𝐡𝐢𝐧? 𝐒𝐞𝐜𝐮𝐫𝐞 𝐲𝐨𝐮𝐫 𝐬𝐚𝐦𝐩𝐥𝐞 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 𝐭𝐨𝐝𝐚𝐲:https://www.maximizemarketresearch.com/request-sample/215727/

𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐁𝐫𝐨𝐤𝐞𝐫𝐚𝐠𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬

The evaluation of the market's prospective futures involves a thorough examination of various factors, including the buyer-direct scenario, R&D initiatives, creative forms of development, cutting-edge industry practices, and market consolidations and acquisitions. The study includes methods, organizational charts, portfolios, and a critical assessment of prominent business executives. Insurance Brokerage Market conducted a comprehensive SWOT and PESTLE analysis to identify market trends and offer microeconomic variables.

𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐁𝐫𝐨𝐤𝐞𝐫𝐚𝐠𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧

𝐛𝐲 𝐏𝐫𝐨𝐝𝐮𝐜𝐭

Property and Casualty Insurance

Life and Health Insurance

Specialty Insurance

Others

The insurance brokerage market is divided into various segments based on product, including specialty insurance, life and health insurance, and property and casualty insurance. Commercial property, general liability insurance, and services pertaining to liability and property damage risks are all included in property and casualty insurance. Medical needs such as disability, health, and life insurance are covered by life and health insurance policies. Specialty insurance, such as professional indemnity insurance and cyber insurance, is insurance that is associated with certain markets and risks. With a 2023 valuation of USD 46929.17 million, Property and Casualty Insurance maintained its leading position in the insurance brokerage industry. Over the course of the projection period, the property and casualty insurance segment is anticipated to expand at a CAGR of 5.59%.

𝐛𝐲 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬

Risk Assessment and Management

Insurance Placement and Policy Selection

Claims Processing and Management

Consulting and Advisory Services

Others

𝐛𝐲 𝐃𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧 𝐂𝐡𝐚𝐧𝐧𝐞𝐥

Retail Brokerage

Wholesale and Reinsurance Brokerage

The insurance brokerage market is divided into retail, wholesale, and reinsurance brokerages based on the distribution channel. With a 2023 valuation of USD 73699.44 million, the retail brokerage held the largest market share in the insurance brokerage industry. It has direct interaction with small business and individual clients, which fosters loyalty and personal ties. It is anticipated that the retail brokerage service will provide a selection of insurance products that will help meet the needs of its clients. Due to the large number of individual and small company clients, they have a high volume of transactions.

𝐛𝐲 𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫𝐬

Individuals and Families

Small and Medium-sized Enterprises (SMEs)

Large Corporations and Institutions

The insurance brokerage market is divided into three customer segments: small and medium-sized businesses (SMEs), major corporations and institutions, and individuals and families. With a 2023 valuation of USD 41440.98 million, the small and medium-sized business segment dominated the insurance brokerage market. It is anticipated that the proliferation of small and medium-sized businesses will propel the use of insurance brokerage. Numerous small and medium-sized businesses need a range of insurance coverages, including specialized insurance, life and health insurance, and property and casualty insurance.

𝐛𝐲 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐕𝐞𝐫𝐭𝐢𝐜𝐚𝐥𝐬

Healthcare

Manufacturing

Construction

Automotive

Others

𝐓𝐚𝐛𝐥𝐞 𝐨𝐟 𝐂𝐨𝐧𝐭𝐞𝐧𝐭: 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐁𝐫𝐨𝐤𝐞𝐫𝐚𝐠𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

Part 01: Executive Summary

Part 02: Scope of the Insurance Brokerage Market Report

Part 03: Global Insurance Brokerage Market Landscape

Part 04: Global Insurance Brokerage Market Sizing

Part 05: Global Insurance Brokerage Market Segmentation by Type

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

𝐈𝐧𝐭𝐫𝐢𝐠𝐮𝐞𝐝 𝐭𝐨 𝐞𝐱𝐩𝐥𝐨𝐫𝐞 𝐭𝐡𝐞 𝐜𝐨𝐧𝐭𝐞𝐧𝐭𝐬? 𝐒𝐞𝐜𝐮𝐫𝐞 𝐲𝐨𝐮𝐫 𝐡𝐚𝐧𝐝𝐬-𝐨𝐧 𝐬𝐚𝐦𝐩𝐥𝐞 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐞 𝐫𝐞𝐩𝐨𝐫𝐭:https://www.maximizemarketresearch.com/request-sample/215727/

𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐁𝐫𝐨𝐤𝐞𝐫𝐚𝐠𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬

1. Aon plc (United States)

2. Marsh & McLennan Companies, Inc. (United States)

3. Willis Towers Watson (United States)

4. Arthur J. Gallagher & Co. (United States)

5. Hub International Ltd. (United States)

6. Brown & Brown, Inc (United States)

7. Lockton Companies, LLC (United States)

8. Gallagher Bassett Services, Inc. (United States)

9. Integro Insurance Brokers (United States)

10. USI Insurance Services LLC (United States)

11. The Hylant Group (United States)

12. AssuredPartners, Inc. (United States)

13. Oswald Companies (United States)

14. Jardine Lloyd Thompson Group Ltd. (United Kingdom)

15. Ed Broking Group Ltd. (United Kingdom)

16. BMS Group Ltd. (United Kingdom)

17. JLT Specialty Limited (United Kingdom)

18. Bluefin Insurance Services Limited (United Kingdom)

19. Al Futtaim Willis (UAE)

20. Howden Insurance Brokers (South Africa)

21. Alexander Forbes Group Holdings Limited (South Africa)

𝐅𝐨𝐫 𝐝𝐞𝐞𝐩𝐞𝐫 𝐦𝐚𝐫𝐤𝐞𝐭 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐩𝐞𝐫𝐮𝐬𝐞 𝐭𝐡𝐞 𝐬𝐮𝐦𝐦𝐚𝐫𝐲 𝐨𝐟 𝐭𝐡𝐞 𝐫𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐫𝐞𝐩𝐨𝐫𝐭:https://www.maximizemarketresearch.com/market-report/insurance-brokerage-market/215727/

𝐊𝐞𝐲 𝐪𝐮𝐞𝐬𝐭𝐢𝐨𝐧𝐬 𝐚𝐧𝐬𝐰𝐞𝐫𝐞𝐝 𝐢𝐧 𝐭𝐡𝐞 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐁𝐫𝐨𝐤𝐞𝐫𝐚𝐠𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐚𝐫𝐞:

What is Insurance Brokerage ?

What is the growth rate of the Insurance Brokerage Market?

What was the Insurance Brokerage Market size in 2023?

What are the upcoming opportunities and trends for the Insurance Brokerage Market?

What are the different segments of the Insurance Brokerage Market?

What are the recent industry trends that can be implemented to generate additional revenue streams for the Insurance Brokerage Market?

What segments are covered in the Insurance Brokerage Market?

Which are the factors expected to drive the Insurance Brokerage Market growth?

What growth strategies are the players considering to increase their presence in Insurance Brokerage ?

Who are the leading companies and what are their portfolios in Insurance Brokerage Market?

Who are the key players in the Insurance Brokerage market?

What is the CAGR at which the Insurance Brokerage market will grow during the forecast period?

𝐊𝐞𝐲 𝐎𝐟𝐟𝐞𝐫𝐢𝐧𝐠𝐬:

Past Market Size and Competitive Landscape (2018 to 2023)

Past Pricing and price curve by region (2018 to 2023)

Market Size, Share, Size & Forecast by different segment | 2024-2030

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by Region

Market Segmentation - A detailed analysis by segment with their sub-segments and Region

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of Business by Region

Lucrative business opportunities with SWOT analysis

Recommendations

𝐋𝐚𝐭𝐞𝐬𝐭 𝐜𝐮𝐭𝐭𝐢𝐧𝐠-𝐞𝐝𝐠𝐞 𝐫𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐟𝐫𝐨𝐦 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐢𝐬 𝐧𝐨𝐰 𝐭𝐫𝐞𝐧𝐝𝐢𝐧𝐠:

Global Corrosion Protection Rubber Coating Market https://www.maximizemarketresearch.com/market-report/global-corrosion-protection-rubber-coating-market/88120/

Global Realtime Flood Monitoring and Warning System Market https://www.maximizemarketresearch.com/market-report/global-real-time-flood-monitoring-and-warning-system-market/41068/

Air Motor Market https://www.maximizemarketresearch.com/market-report/global-air-motor-market/94462/

Ethernet Cable Market https://www.maximizemarketresearch.com/market-report/global-ethernet-cable-market/66964/

Zirconia Market https://www.maximizemarketresearch.com/market-report/global-zirconia-market/21638/

Dedicated Server Hosting Market https://www.maximizemarketresearch.com/market-report/global-dedicated-server-hosting-market/109734/

Claw Machine Market https://www.maximizemarketresearch.com/market-report/claw-machine-market/77400/

India Motorcycle Helmets Market https://www.maximizemarketresearch.com/market-report/india-motorcycle-helmets-market/44869/

Air Leak Testing Market https://www.maximizemarketresearch.com/market-report/air-leak-testing-market/146744/

Global Indoor Positioning and Indoor Navigation Market https://www.maximizemarketresearch.com/market-report/global-indoor-positioning-and-indoor-navigation-market/25418/

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Brokerage Market: Projected to Reach USD 155.75 Billion by 2030, Growing at a 5.67% CAGR here

News-ID: 3773416 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

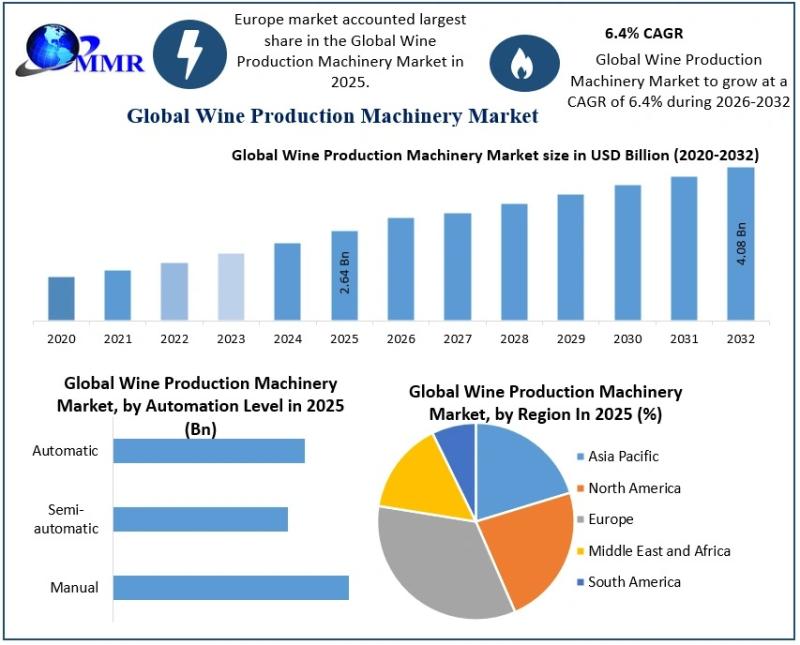

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

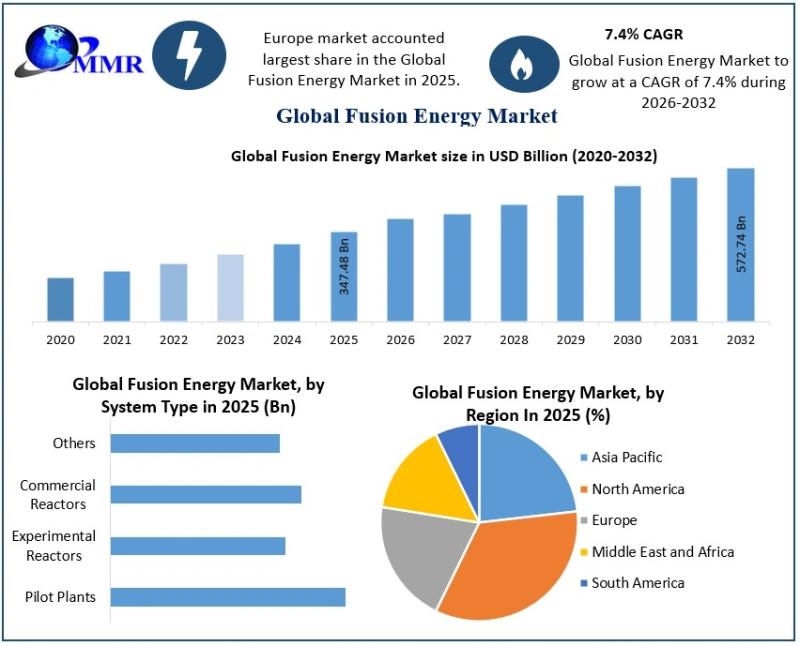

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…