Press release

Insurtech Market Size Worth USD 121.7 Billion by 2033 | IMARC Group

Global Insurtech Industry: Key Statistics and Insights in 2025-2033Summary:

● The global Insurtech market size reached USD 7.6 Billion in 2024.

● The market is expected to reach USD 121.7 Billion by 2033, exhibiting a growth rate (CAGR) of 35% during 2025-2033.

● North America leads the market, accounting for the largest Insurtech market share.

● Based on the type, the market has been categorized into auto, business, health, home, specialty, travel, and others.

● On the basis of the service, the market has been divided into consulting, support and maintenance, and managed services.

● Cloud computing holds the largest share in the Insurtech industry.

● The increasing popularity of blockchain technology is a primary driver of the Insurtech market.

● The integration of artificial intelligence (AI) and machine learning (ML) and the rise peer-to-peer (P2P) insurance models are reshaping the Insurtech market.

Request PDF Sample for more detailed market insights: https://www.imarcgroup.com/insurtech-market/requestsample

Industry Trends and Drivers:

● Growing popularity of blockchain technology:

Insurance technology (Insurtech) firms are adopting blockchain technology to enhance transparency, security, and efficiency in various insurance processes. By providing a decentralized ledger system, blockchain allows for secure, real-time verification of transactions, notably reducing the risk of fraud and errors in claims processing and policy administration. Smart contracts, enabled by blockchain, are particularly transformative as they can automate policy execution and claims payouts, eliminating the need for intermediaries and manual intervention. This not only speeds up processes but also reduces operational costs for insurers. Additionally, blockchain technology enhances client trust by providing an immutable and transparent record of all transactions, improving the overall individual experience.

● Integration of artificial intelligence (AI) and machine learning (ML):

The use of artificial intelligence (AI) and machine learning (ML) is enabling more accurate risk assessments, fraud detection, and client service automation. AI-powered algorithms analyze vast amounts of data to identify patterns and predict future risks, allowing insurers to price premiums more accurately and tailor policies to individual needs. ML models continuously improve over time, enhancing the precision of underwriting decisions and claims processing. Additionally, AI-driven chatbots and virtual assistants are being employed to provide around-the-clock client support, handling routine inquiries and claims efficiently, thus improving user satisfaction. The ability of AI and ML to streamline operations, reduce human error, and deliver personalized services is making these technologies indispensable.

● Rise of peer-to-peer (P2P) insurance models:

Peer-to-peer (P2P) insurance is gaining traction as an innovative business model within Insurtech, offering an alternative to traditional insurance structures. P2P insurance allows individuals to pool their resources and share risk among a group of peers, often resulting in lower premiums and more transparent policies. This model operates on the premise of trust and community, where any unused premiums at the end of the policy term can be refunded or rolled over to the next cycle. Insurtech companies are developing platforms that facilitate these P2P networks, offering users greater control over their insurance and fostering a sense of community ownership. By leveraging technology to minimize administrative costs and increase transparency, P2P insurance is appealing to a growing number of individuals who are dissatisfied with conventional insurance models.

Buy Full Report: https://www.imarcgroup.com/checkout?id=3636&method=502

Insurtech Market Report Segmentation:

Breakup By Type:

● Auto

● Business

● Health

● Home

● Specialty

● Travel

● Others

Based on the type, the market has been categorized into auto, business, health, home, specialty, travel, and others.

Breakup By Service:

● Consulting

● Support and Maintenance

● Managed Services

On the basis of the service, the market has been divided into consulting, support and maintenance, and managed services.

Breakup By Technology:

● Blockchain

● Cloud Computing

● IoT

● Machine Learning

● Robo Advisory

● Others

Cloud computing exhibits a clear dominance in the Insurtech market attributed to its scalability, cost-efficiency, and ability to streamline insurance operations.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America dominates the market owing to its advanced technological infrastructure and high adoption rates of digital insurance solutions.

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=3636&flag=C

Top Insurtech Market Leaders:

The Insurtech market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

● Claver Health LLC

● Damco Group

● DXC Technology Company

● Insurance Technology Services

● Majesco (Aurum PropTech Limited)

● Oscar Insurance Corporation

● Quantemplate

● Shift Technology

● Travelers Companies, Inc.

● Wipro

● ZhongAn Online P&C Insurance Co. Ltd.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurtech Market Size Worth USD 121.7 Billion by 2033 | IMARC Group here

News-ID: 3773372 • Views: …

More Releases from IMARC Group

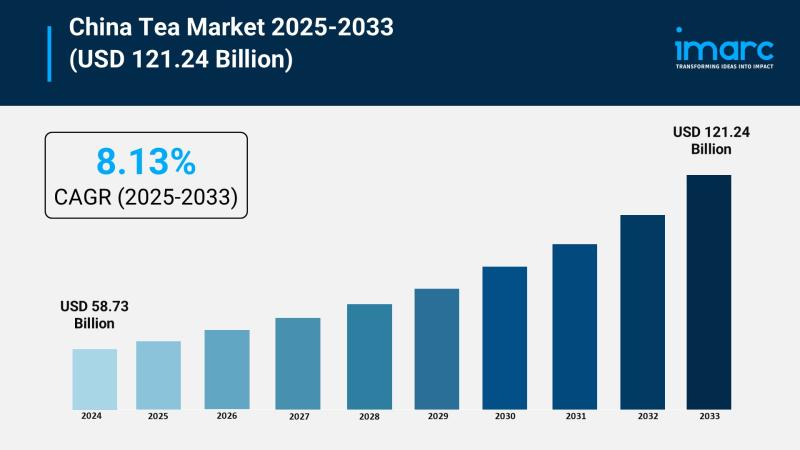

China Tea Market Forecast CAGR of 8.13%, Innovation Trends, and Strategic Insigh …

Market Overview

The China tea market was valued at USD 58.73 Billion in 2024 and is projected to reach USD 121.24 Billion by 2033, growing at a CAGR of 8.13% during 2025-2033. Growth is driven by rising health consciousness, premium product trends, government support, and expanding online retail. Innovation in flavors and packaging attracts younger consumers and global buyers, expanding the market.

Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Year/Period: 2025-2033

China Tea…

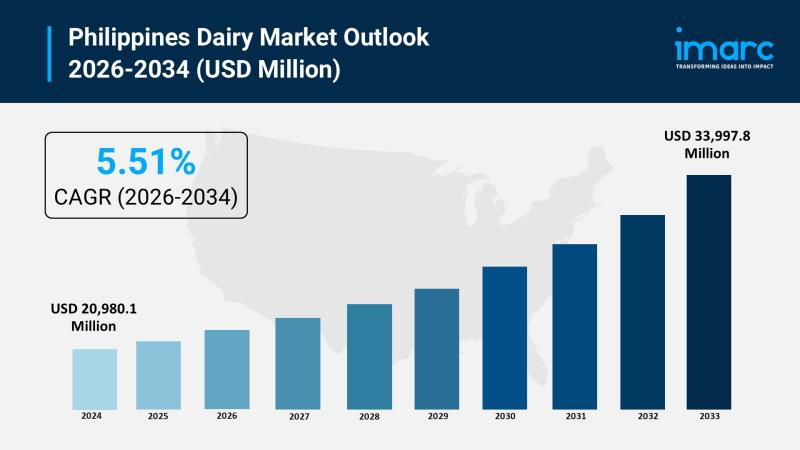

Philippines Dairy Market 2026: Expected to Reach USD 33,997.8 Million by 2034

Market Overview

The Philippines dairy market reached a size of USD 20,980.1 Million and is anticipated to grow to USD 33,997.8 Million by 2034 with a significant growth rate of 5.51%. This expansion is driven by rising demand for nutritious and diverse dairy products, rapid urbanization, increased disposable incomes, improved retail infrastructure, and strong government initiatives promoting local dairy production. Health-conscious consumers and expanding food service sectors further fuel this growth…

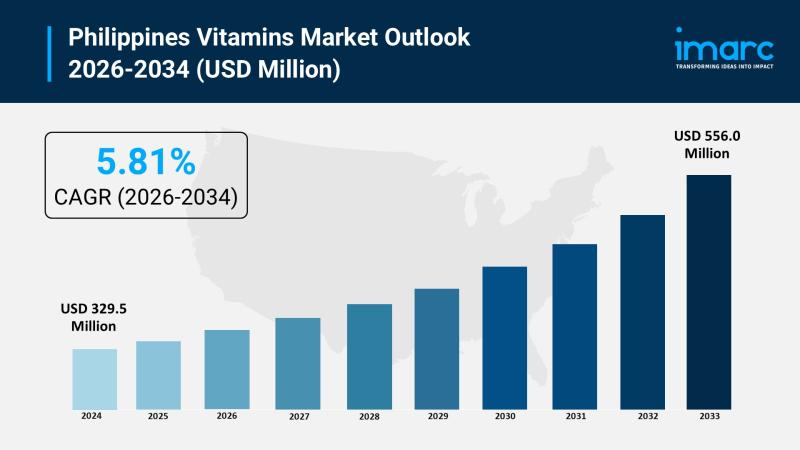

Philippines Vitamins Market 2026 | Projected to Reach USD 556.0 Million by 2034

Market Overview

The Philippines vitamins market was valued at USD 329.5 Million in 2025 and is projected to reach USD 556.0 Million by 2034, growing steadily over the forecast period. The market's growth is driven by increasing health consciousness, a rising geriatric population, and escalating demand for supplements that support immunity, energy, and overall wellness due to proactive health measures. The forecast period for this expansion is 2026-2034, with a CAGR…

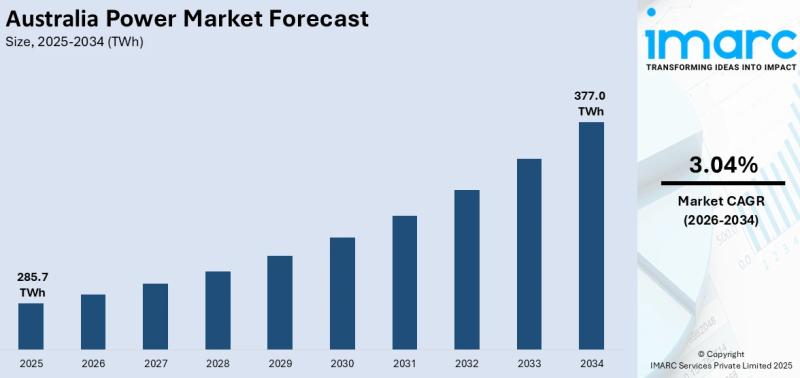

Australia Power Market Projected to Reach TWH 377 by 2034

Market Overview

The Australia power market size reached 285.7 TWh in 2025 and is projected to grow to 377.0 TWh by 2034, with a CAGR of 3.04% during the forecast period of 2026-2034. This growth is driven by rising renewable energy adoption, increased electricity demand, grid modernization, battery storage expansion, transition from coal plants, and government incentives for clean power. Key strategies such as virtual power plant integration and investments in…

More Releases for Insurtech

Insurtech Accelerators Market Hits New High | Major Giants Plug and Play, Startu …

HTF MI just released the Global Insurtech Accelerators Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Insurtech Accelerators Market are: Plug and Play,…

Insurtech Market: A Comprehensive Overview

The global insurtech market was valued at approximately USD 10.3 billion in 2024 and is projected to reach around USD 152.9 billion by 2033, growing at a compound annual growth rate (CAGR) of about 31.5% from 2025 to 2033.

Insurtech Market Overview

The global Insurtech market is undergoing explosive growth, fueled by the insurance industry's rapid digitization and rising customer demand for seamless, personalized digital experiences. Advanced technologies like artificial intelligence (AI),…

Top Trends Transforming the InsurTech (Insurance Technology) Market Landscape in …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the InsurTech (Insurance Technology) Industry Market Size Be by 2025?

The volume of the insurtech (insurance technology) market has expanded significantly in the past few years. The market, currently valued at $19.23 billion in 2024, is projected to reach $25.95 billion in 2025, demonstrating a compound annual…

Emerging Trends Influencing The Growth Of The Insurtech Market: Innovative AI-Po …

The Insurtech Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Insurtech Market Size Expected to Be by 2034?

In recent times, the insurtech market has seen substantial expansion. The projected growth indicates an increase from $17.08 billion in 2024 to $22.08 billion…

Top Factor Driving Insurtech Market Growth in 2025: Rising Tide Of Insurance Cla …

How Are the key drivers contributing to the expansion of the insurtech market?

The expected surge in insurance claims is projected to directly contribute to the expanded growth of the insurtech market. Insurtech plays a critical role in claim management, risk assessment, contract processing, and policy underwriting. The increase in hospitalizations during the COVID-19 pandemic has resulted in a steep rise in insurance claims. An illustrative example of this could be…

Insurtech, Market Dynamics, Global Opportunities, Forecast 2024

The Business Research Company recently released a comprehensive report on the Global Insurtech Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…