Press release

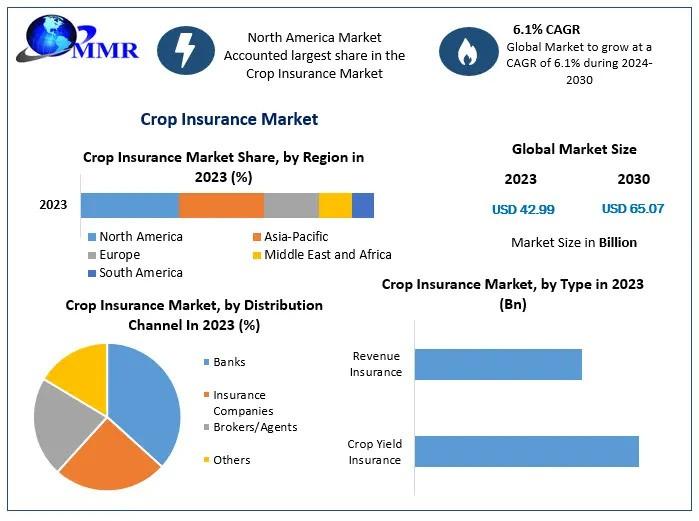

Crop Insurance Market Demand Will Reach a Value of US$ 65.07 Bn by the Year 2030, At a CAGR of 6.1%

𝐀𝐧𝐭𝐢𝐜𝐢𝐩𝐚𝐭𝐞𝐝 𝐆𝐫𝐨𝐰𝐭𝐡 𝐢𝐧 𝐑𝐞𝐯𝐞𝐧𝐮𝐞:The 𝐂𝐫𝐨𝐩 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 was valued at US$ 42.99 Bn in 2023 and is expected to reach US$ 65.07 Bn by 2030, at a CAGR of 6.1% during the forecast period.

𝐂𝐫𝐨𝐩 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

The global crop insurance market is experiencing robust growth due to rising interest in insurance products, technological advancements, and supportive government initiatives. Offering financial protection against crop losses caused by natural disasters or market price fluctuations, crop insurance is increasingly accessible through innovative products and distribution platforms. Growing internet adoption and offshoring insurance services have further fueled the demand for crop insurance worldwide, making it an essential safeguard for agricultural producers facing unpredictable risks.

𝐖𝐚𝐧𝐭 𝐭𝐨 𝐒𝐞𝐞 𝐭𝐡𝐞 𝐓𝐫𝐞𝐧𝐝𝐬? 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐓𝐨𝐝𝐚𝐲 :https://www.maximizemarketresearch.com/request-sample/148613/

𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐂𝐫𝐨𝐩 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

Key drivers of the crop insurance market include favorable government policies, increasing awareness about risk management in agriculture, and technological advancements. Governments worldwide are implementing supportive programs such as tax incentives and premium subsidies to protect farmers from financial losses caused by yield variability, price instability, and climate change impacts. Moreover, private and public partnerships in the sector, coupled with the adoption of innovative technologies like AI, remote sensing, and drones, are enhancing operational efficiency and driving market expansion.

𝐂𝐫𝐨𝐩 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬:

Emerging trends in the crop insurance market highlight the integration of advanced technologies such as artificial intelligence, satellite imagery, and drones to improve claim accuracy and streamline processes. Additionally, the development of customized insurance policies, including Multi-Peril Crop Insurance (MPCI), is gaining traction, offering tailored solutions to diverse agricultural needs. Increased focus on climate-smart practices and data-driven decision-making is also shaping the market, with stakeholders leveraging predictive analytics and ecological insights for better risk management and policy design.

𝐓𝐡𝐞 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐒𝐭𝐚𝐤𝐞𝐡𝐨𝐥𝐝𝐞𝐫𝐬 𝐜𝐚𝐧 𝐄𝐧𝐪𝐮𝐢𝐫𝐞 𝐟𝐨𝐫 𝐭𝐡𝐞 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 :https://www.maximizemarketresearch.com/inquiry-before-buying/148613/

𝐌𝐞𝐫𝐠𝐞𝐫𝐬 𝐚𝐧𝐝 𝐀𝐜𝐪𝐮𝐢𝐬𝐢𝐭𝐢𝐨𝐧𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐂𝐫𝐨𝐩 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭:

𝐕𝐢𝐞𝐭𝐧𝐚𝐦:

In Southeast Asia, FarmGuard Insurance has joined forces with local entities to increase insurance access for smallholder farmers. This merger allows the company to leverage advanced technology to improve crop protection and risk management.

𝐓𝐡𝐚𝐢𝐥𝐚𝐧𝐝:

In Thailand, a merger between local mining company Thai Lithium Co. and a prominent global energy firm has enabled them to increase production capacity. This strategic alliance focuses on tapping into the growing demand for lithium batteries for electric vehicles (EVs).

𝐒𝐢𝐧𝐠𝐚𝐩𝐨𝐫𝐞:

In Singapore, AgriShield Insurance has acquired AgriTech Solutions, enhancing its portfolio of crop insurance products for farmers in Southeast Asia. This acquisition aims to introduce innovative risk assessment technologies and precision agriculture tools.

𝐉𝐚𝐩𝐚𝐧:

In Japan, Sumitomo Life Insurance has acquired Kagome Crop Insurance, reinforcing its presence in the Asian market. This merger enhances its capacity to cover diverse agricultural products and manage climate-related risks.

𝐒𝐨𝐮𝐭𝐡 𝐊𝐨𝐫𝐞𝐚:

Hanwha Insurance in South Korea recently announced a strategic acquisition of GreenField Risk Management, expanding its reach into organic farming insurance. The deal is expected to strengthen South Korea's resilience against natural disasters affecting agriculture.

𝐄𝐮𝐫𝐨𝐩𝐞𝐚𝐧 𝐂𝐨𝐮𝐧𝐭𝐫𝐢𝐞𝐬:

In Europe, Aegon Insurance has partnered with FarmNet, merging their expertise to create specialized insurance solutions for precision farming. The European market has seen an influx of technology-driven innovations following this acquisition.

𝐔𝐧𝐢𝐭𝐞𝐝 𝐒𝐭𝐚𝐭𝐞𝐬:

In the USA, Farmers Insurance Group recently acquired AgriProtect USA, significantly broadening its coverage to include more sustainable farming techniques. The company plans to integrate AI and machine learning technologies to offer predictive crop insurance.

𝐊𝐞𝐲 𝐃𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭𝐬 𝐛𝐲 𝐋𝐞𝐚𝐝𝐢𝐧𝐠 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬

𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐒𝐨𝐥𝐮𝐭𝐢𝐨𝐧𝐬:

Companies like AgriTech Global have been working on enhancing their digital platforms, making it easier for farmers to access crop insurance and manage claims.

𝐒𝐮𝐬𝐭𝐚𝐢𝐧𝐚𝐛𝐢𝐥𝐢𝐭𝐲 𝐈𝐧𝐢𝐭𝐢𝐚𝐭𝐢𝐯𝐞𝐬:

Leading insurers are increasingly focusing on eco-friendly practices. For example, Cigna has announced a partnership with EcoFarming Insurance to promote sustainable agriculture through specialized green insurance policies.

𝐒𝐦𝐚𝐫𝐭 𝐃𝐚𝐭𝐚 𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐢𝐨𝐧:

Insurers are incorporating satellite and drone technologies to assess crop health and predict risks more accurately. This move is transforming how policies are designed and claims are processed.

𝐀𝐫𝐭𝐢𝐟𝐢𝐜𝐢𝐚𝐥 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞 𝐚𝐧𝐝 𝐀𝐮𝐭𝐨𝐦𝐚𝐭𝐢𝐨𝐧:

Key players, such as Allianz and Munich Re, are utilizing AI-powered systems to improve underwriting and risk assessment in crop insurance, setting new industry standards for efficiency.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐮𝐥𝐥 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 @:https://www.maximizemarketresearch.com/request-sample/148613/

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐂𝐫𝐨𝐩 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧?

by Coverage Type

Multi-peril Crop Insurance (MPCI)

Crop-hail Insurance

by Distribution Channel

Banks

Insurance Companies

Brokers/Agents

Others

by Type

Crop Yield Insurance

Revenue Insurance

𝐒𝐨𝐦𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐜𝐮𝐫𝐫𝐞𝐧𝐭 𝐩𝐥𝐚𝐲𝐞𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐂𝐫𝐨𝐩 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐚𝐫𝐞:

North America

1. American Finlands Group Inc

2. American International Group Inc

3. AmTrust Financial Services Inc

4. VANE (Insurance)

5. Duck Creek Technologies

Europe

6. axa insurance

7. Chubb Ltd

8. groupama assurances mutuelles

9. Zurich Insurance Co. Ltd

10. The Co-operators

APAC

11. Agriculture Insurance Co. of India Ltd.

12. ICICI Bank Ltd.

13. Indian Farmers Fertiliser Cooperative Ltd. (IFFCO)

14. QBE Insurance Group Ltd

15. Sompo Holdings In

16. The New India Assurance Co. Ltd.

17. Tokio Marine Holdings Inc.

18. Zking Insurance

19. SBI

20. QBE Insurance Group

ME

21. Santam Ltd.

22. Royal Exchange General Insurance

23. Farmcrowdy

𝐅𝐨𝐫 𝐦𝐨𝐫𝐞 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐚𝐛𝐨𝐮𝐭 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭 𝐯𝐢𝐬𝐢𝐭:https://www.maximizemarketresearch.com/market-report/crop-insurance-market/148613/

𝐊𝐞𝐲 𝐎𝐟𝐟𝐞𝐫𝐢𝐧𝐠𝐬:

Past Market Size and Competitive Landscape

Crop Insurance Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Crop Insurance Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

𝐅𝐨𝐫 𝐚𝐝𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐫𝐞𝐩𝐨𝐫𝐭𝐬 𝐨𝐧 𝐫𝐞𝐥𝐚𝐭𝐞𝐝 𝐭𝐨𝐩𝐢𝐜𝐬, 𝐯𝐢𝐬𝐢𝐭 𝐨𝐮𝐫 𝐰𝐞𝐛𝐬𝐢𝐭𝐞:

♦ Indian Online Grocery Market : https://www.maximizemarketresearch.com/market-report/indian-online-grocery-market/29537/

♦ India Cement Market : https://www.maximizemarketresearch.com/market-report/india-cement-market/20105/

♦ Hydrogen Fuel Cell Vehicle Market : https://www.maximizemarketresearch.com/market-report/hydrogen-fuel-cell-vehicle-market/184548/

♦ level sensors market : https://www.maximizemarketresearch.com/market-report/level-sensor-market/2838/

♦ India Lighting Market : https://www.maximizemarketresearch.com/market-report/india-lighting-market/127659/

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crop Insurance Market Demand Will Reach a Value of US$ 65.07 Bn by the Year 2030, At a CAGR of 6.1% here

News-ID: 3772408 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

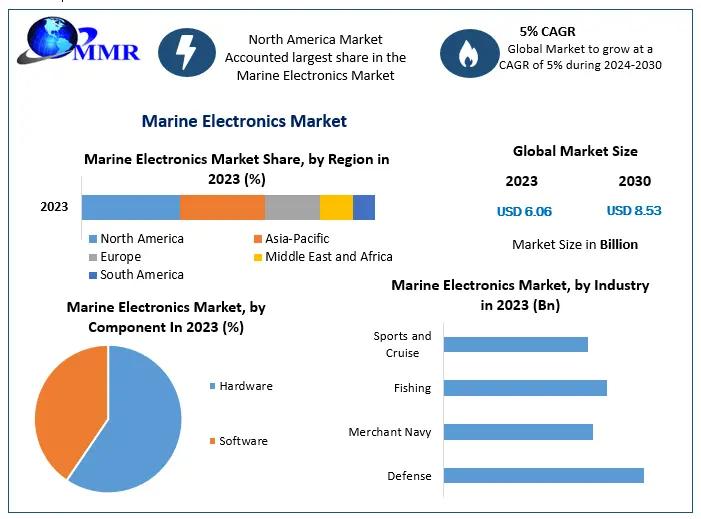

Marine Electronics Market Expected to Reach USD 8.53 Bn by 2030 - Growth Forecas …

Marine Electronics Market Size: According to Maximize Market Research, the Global Marine Electronics Market was valued at US$ 6.06 billion in 2023 and is expected to reach US$ 8.53 billion by 2030, growing at a CAGR of around 5% during 2024-2030.

Market Overview

The Global Marine Electronics Market encompasses electronic devices and systems designed specifically for marine environments. These include navigation systems, communication devices, safety equipment, sonar & radar, vessel management systems,…

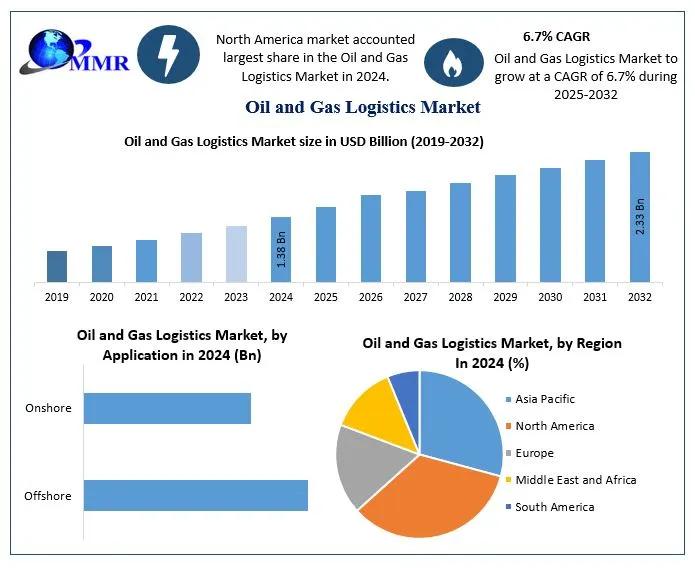

Oil and Gas Logistics Market to Reach USD 2.33 Billion by 2032 | Growth, Trends, …

The Oil and Gas Logistics Market was valued at USD 1.38 Billion in 2024 and is forecasted to grow to USD 2.33 Billion by 2032, exhibiting a CAGR of 6.7% during 2025 to 2032, driven by rising global energy demand, technological innovation, and expanding upstream and downstream supply chain activities.

Market Overview

The oil and gas logistics market encompasses the transportation, storage, handling, and distribution of crude oil, refined products, natural gas,…

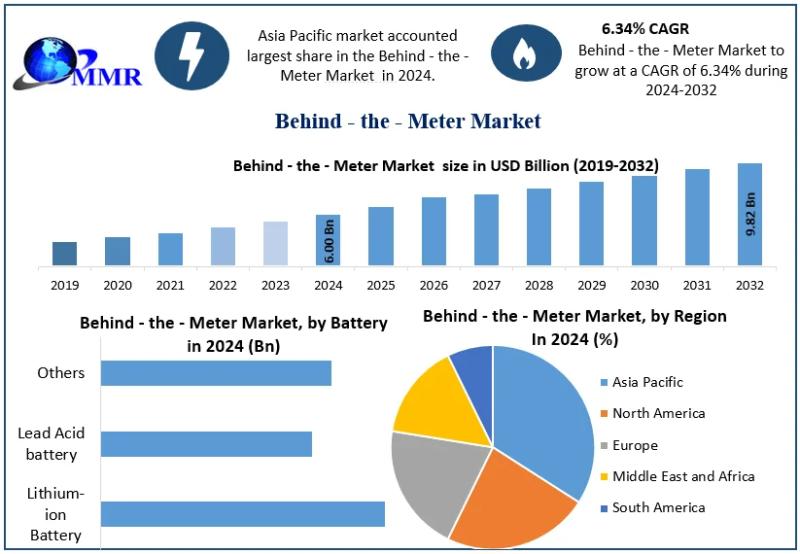

Behind the Meter Market to Surge to USD 9.82 Billion by 2032 - Unmatched Growth …

According to Maximize Market Research, the Global Behind the Meter Market was valued at USD 6.00 Billion in 2024 and is projected to reach USD 9.82 Billion by 2032 at a 6.34 % CAGR, driven by growth in residential, commercial, and industrial energy storage adoption.

Market Overview

The Behind the Meter Market consists of energy storage systems installed on the consumer side of the utility meter. These systems store electricity generated from…

Commercial Paper Market Expected to Witness Steady Growth Driven by Short-Term C …

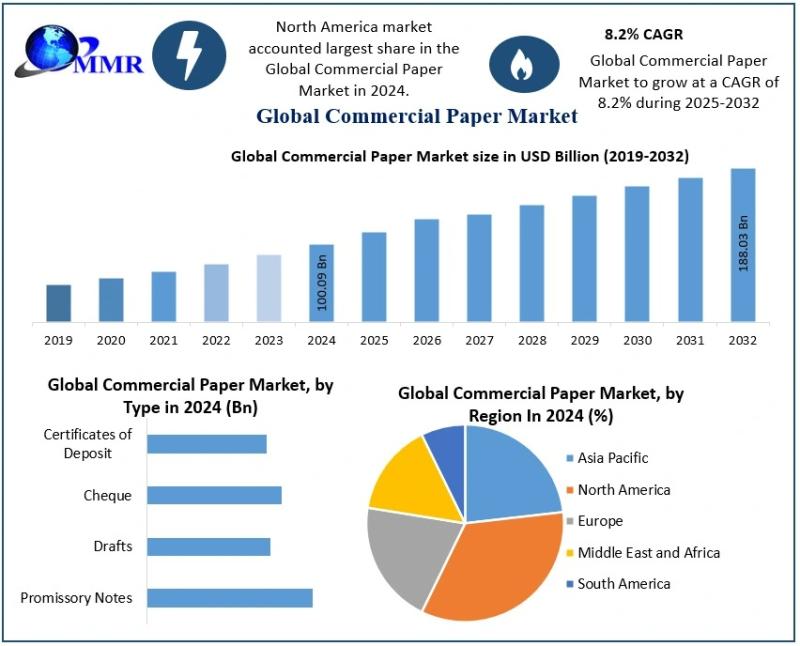

The Commercial Paper Market size was valued at USD 100.09 Billion in 2024 and the total Commercial Paper revenue is expected to grow at a CAGR of 8.2% from 2025 to 2032, reaching nearly USD 188.03 Billion.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/199690/

The Commercial Paper Market is gaining strong momentum as corporations, financial institutions, and large enterprises increasingly rely on short-term unsecured debt instruments…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…