Press release

Whole Life Insurance Market Size, Outlook And Demand Report 2024

The Business Research Company recently released a comprehensive report on the Global Whole Life Insurance Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.According to The Business Research Company's, The whole life insurance market size has grown steadily in recent years. It will grow from $175.67 billion in 2023 to $180.58 billion in 2024 at a compound annual growth rate (CAGR) of 2.8%. The growth in the historic period can be attributed to policy stability and guarantees, long-term financial security, legacy and estate planning, inflation hedge, conservative investment option.

The whole life insurance market size is expected to see steadily grown in the next few years. It will grow to $205.16 billion in 2028 at a compound annual growth rate (CAGR) of 3.2%. The growth in the forecast period can be attributed to personalized solutions, increased longevity concerns, wealth transfer and estate planning, health and wellness incentives, shift in consumer preferences. Major trends in the forecast period include customization and personalization, innovative product offerings, tech integration in underwriting, evolving customer preferences, wealth transfer and estate planning.

Get The Complete Scope Of The Report @

https://www.thebusinessresearchcompany.com/report/whole-life-insurance-global-market-report

Market Drivers and Trends:

The rising aging population is expected to propel the whole life insurance market. The aging population refers to a demographic shift characterized by a rising proportion or increase in the number of individuals within a society who are in the later stages of life, typically aged 65 and older. Whole life insurance serves as a financial planning tool for the aging population, offering lifetime coverage, cash value accumulation, and potential estate planning benefits. For instance, in October 2022, according to the World Health Organization, a Switzerland-based Intergovernmental organization, projected that by 2030, one out of every six individuals globally would be 60 years old or older. During this period, the proportion of the population aged 60 and over is expected to rise from 1 billion in 2020 to 1.4 billion. Furthermore, by the year 2050, the global population of individuals aged 60 and older is anticipated to double, reaching 2.1 billion. Therefore, the rising aging population is driving the growth of the whole life insurance market.

Major companies operating in whole life insurance are focusing on incorporating advanced technologies for simplified operations and strengthening their market position. For instance, in December 2022, Modern Life Insurance Group Inc., a US-based insurance group, announced the launch of its latest technology platform, where life insurance advisors can take advantage of a variety of cutting-edge tools and solutions from the new stack. These include the ability to manage all client and brokerage needs in one location, enhanced customer involvement, entirely digital applications, and comparison and pricing capabilities.

Key Benefits for Stakeholders:

• Comprehensive Market Insights: Stakeholders gain access to detailed market statistics, trends, and analyses that help them understand the current and future landscape of their industry.

• Informed Decision-Making: The reports provide crucial data that support strategic decisions, reducing risks and enhancing business planning.

• Competitive Advantage: With in-depth competitor analysis and market share information, stakeholders can identify opportunities to outperform their competition.

• Tailored Solutions: The Business Research Company offers customized reports that address specific needs, ensuring stakeholders receive relevant and actionable insights.

• Global Perspective: The reports cover various regions and markets, providing a broad view that helps stakeholders expand and operate successfully on a global scale.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of Our Research Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=2596&type=smp

Major Key Players of the Market:

China Life Insurance Company Limited; MetLife Inc.; Ping An Insurance Company of China Ltd.; Allianz Life Insurance; Axa SA; Generali Group; Munich Re Group; Zurich Insurance Group Ltd.; Nippon Life Insurance Company; Japan Post Holdings Company Ltd.; Berkshire Hathaway Inc.; Manulife Financial Corporation; China Pacific Insurance Co. Ltd.; Chubb Corp.; American International Group; Aviva Plc.; Allstate Corporation; Swiss Reinsurance Company Ltd.; Prudential Financial Inc.; New York Life Insurance Company; Massachusetts Mutual Life Insurance Company; Guardian Life Insurance Company of America; Penn Mutual Life Insurance Company; Ohio National Life Insurance Company; State Farm Mutual Automobile Insurance Company; Pacific Life Insurance Company; John Hancock Financial Services; Principal Financial Group Inc.; Nationwide Mutual Insurance Company; Thrivent Financial for Lutherans

Whole Life Insurance Market 2024 Key Insights:

• The whole life insurance market size will grow to $205.16 billion in 2028 at a compound annual growth rate (CAGR) of 3.2%.

• The Rising Aging Population Is Anticipated To Fuel The Whole Life Insurance Market

• Technology Platform For The Whole Life Insurance Market

• North America was the largest region in the whole life insurance market in 2023

We Offer Customized Report, Click @

https://www.thebusinessresearchcompany.com/Customise?id=2596&type=smp

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Whole Life Insurance Market Size, Outlook And Demand Report 2024 here

News-ID: 3769367 • Views: …

More Releases from The Business research company

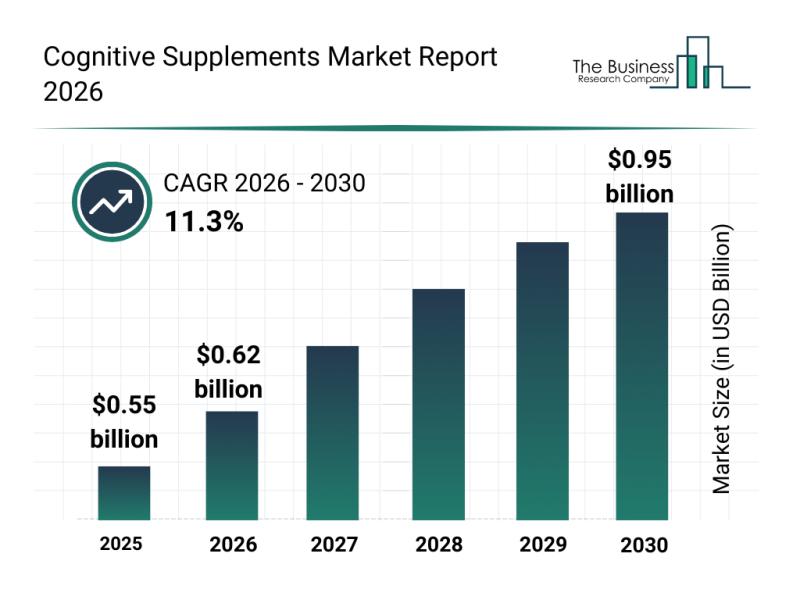

Analysis of Segments and Major Growth Areas in the Cognitive Supplements Market

The cognitive supplements sector is positioned for significant expansion over the coming years, driven by evolving health and wellness priorities. As more consumers seek tailored brain health solutions, the market is responding with innovative products and growing accessibility. Let's explore the anticipated market growth, key players shaping the landscape, emerging trends, and the segmentation defining this dynamic industry.

Forecasted Expansion of the Cognitive Supplements Market to 2030

The cognitive supplements…

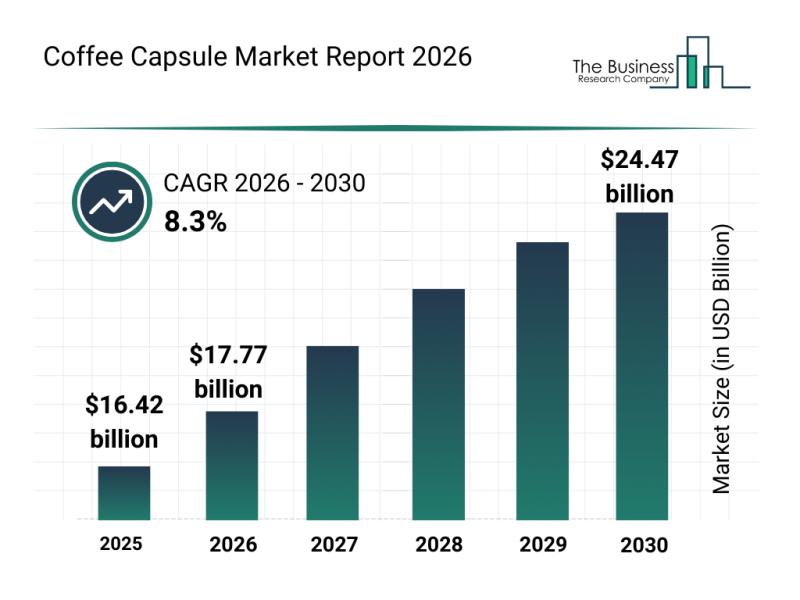

Emerging Growth Trends Driving Expansion in the Coffee Capsule Market

The coffee capsule industry is on track for notable expansion in the coming years, driven by shifting consumer preferences and sustainability efforts. As more people seek convenient yet high-quality coffee experiences, innovation and eco-friendly solutions are becoming key factors shaping this market's future. Here's a detailed overview of the market's size, the major players involved, emerging trends, and segment breakdowns.

Projected Growth and Market Size of the Coffee Capsule Industry …

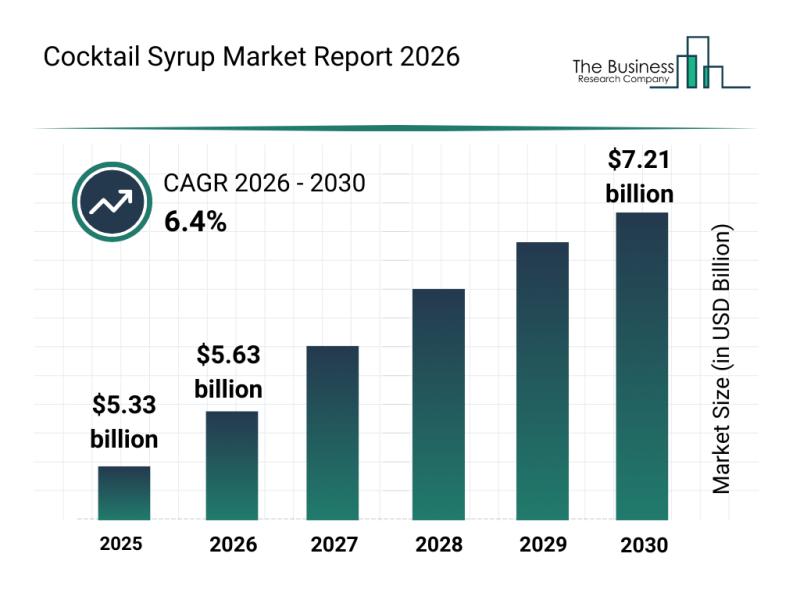

Market Segmentation, Dynamics, and Competitive Landscape in the Cocktail Syrup I …

The cocktail syrup market is gaining significant traction as consumers increasingly seek unique and premium beverage options. With evolving tastes and growing interest in non-alcoholic cocktails, this sector is set for notable expansion. Let's explore the market's size, key players, emerging trends, and segmentation to understand its future trajectory.

Projected Size and Growth Outlook for the Cocktail Syrup Market

The cocktail syrup market is anticipated to experience substantial growth, reaching…

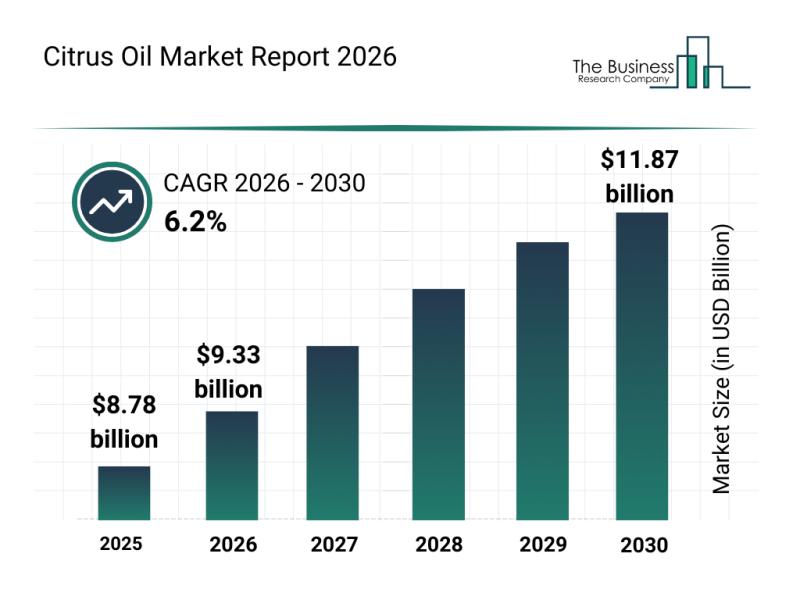

Segment Evaluation and Major Growth Areas in the Citrus Oil Market

The citrus oil industry is set to experience impressive growth in the coming years, driven by evolving consumer preferences and expanding applications across various sectors. As demand for natural and sustainable ingredients continues to rise, the market is adapting and innovating to meet new challenges and opportunities. Let's explore the current market size, key players, trends, and segments shaping the future of citrus oils.

Projected Expansion of the Citrus Oil Market…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…