Press release

Life and Health Reinsurance Market Trends 2024-2033 | Key Players Swiss Re Ltd., Munich Reinsurance Company, SCOR S.E., China Reinsurance (Group) Corporation.

"The Business Research Company recently released a comprehensive report on the Global Life And Health Reinsurance Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of Our Research Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=3675&type=smp

According to The Business Research Company's, The life & health reinsurance market size has grown strongly in recent years. It will grow from $173.74 billion in 2023 to $184.15 billion in 2024 at a compound annual growth rate (CAGR) of 6.0%. The growth in the historic period can be attributed to strong economic growth in emerging markets, government-led insurance reforms, rising healthcare costs and an increase in natural disasters.

The life & health reinsurance market size is expected to see strong growth in the next few years. It will grow to $225.7 billion in 2028 at a compound annual growth rate (CAGR) of 5.2%. The growth in the forecast period can be attributed to an increase in chronic diseases and disabilities, impact of covid-19, growing middle-class population in emerging markets and a rise in claims in the life insurance sector. Major trends in the forecast period include adoption of automated reinsurance platforms, increasing applications of artificial intelligence, use of blockchain technology and increasing number of mergers and acquisitions.

Get The Complete Scope Of The Report @

https://www.thebusinessresearchcompany.com/report/life-and-health-reinsurance-global-market-report

Market Drivers and Trends:

The rise in the demand for life and health insurance policies is expected to drive the life and health reinsurance industry during the forecast period. The COVID-19 outbreak has raised the importance and demand for life insurance in the minds of the people. The uncertainty of getting diagnosed with COVID-19 and its high treatment cost in private hospitals is the main reason behind the surge in demand for life and health insurance policies. For instance, in the fiscal year 2021-2022, Life Insurance Corporation (LIC), India's largest life insurer, sold around 2.17 crore policies. Therefore, increased demand for life and health insurance policies is expected to impact the growth of life and health reinsurance market positively.

The increasing demand for artificial intelligence in life and health reinsurance is an emerging trend in the life and health reinsurance market. According to Reinsurance News, Swiss Re is partnering with Tencent's WeBank to research artificial intelligence use in reinsurance. Swiss Re and WeBank will work collaboratively to explore the technology involved in addressing the challenges imposed by data silos. Swiss Re is expecting the partnership to build a foundation for a new business supported by federated learning and will also encourage the reinsurance industry to adopt a new framework to improve technological capabilities.

Key Benefits for Stakeholders:

• Comprehensive Market Insights: Stakeholders gain access to detailed market statistics, trends, and analyses that help them understand the current and future landscape of their industry.

• Informed Decision-Making: The reports provide crucial data that support strategic decisions, reducing risks and enhancing business planning.

• Competitive Advantage: With in-depth competitor analysis and market share information, stakeholders can identify opportunities to outperform their competition.

• Tailored Solutions: The Business Research Company offers customized reports that address specific needs, ensuring stakeholders receive relevant and actionable insights.

• Global Perspective: The reports cover various regions and markets, providing a broad view that helps stakeholders expand and operate successfully on a global scale.

Major Key Players of the Market:

Volkswagen leasing GmbH, Enterprise Holdings Inc., Mc Donald's Corporation, Daimler, United Rentals Inc., 7 - Eleven, LeasePlan Corporation N.V., Ashtead Group, Deutsche Leasing AG, Tokyo Century, Quippo Infrastructure Limited, GMMCO, Hami Ximeng Trade Co Ltd, Toyota Rentacar, Orix Rentacar, Anji Leasing, China Auto Rental Holdings Inc, EHi Auto Services Co. Ltd, Shenzhen City Extreme Car Rental Co. Ltd, Shouqi Car Rental Co. Ltd, Europcar, Hertz, Avis Budget, Van Anda Aviation, BNP Paribas Leasing Solutions, Oak Leasing, Renault Eurodrive, Sixt, Business Lease Group, KAMAZ Leasing Company, Volvo Finance Service Vostok, VTB Leasing, ALD Automotive, Interleasing Ltd., VEB-leasing, Trust Capital, Wells Fargo Financial Equipment Leasing, Hitachi Capital America Corp, TCF Equipment Finance, Advantage Rent a Car, Aercap Holdings N.V., McDonald's Corporation, Ryder, National Leasing, Canadian Leasing Company, Localiza, Locamerica-Unidas, Best Fleet (Unidas), Ouro Verde, Movida, Safra Leasing S.A., BB Leasing, Leasing Bolívar S.A, HALA Equipment Trading LLC, Perfect Machinery & Equipment Trading & Hire LLC, Arabian Machinery and Heavy Equipment Company, Al Badie Group (ABG), Paramount Leasing & Car Rental LLC, Budget, Barloworld South Africa (PTY) Ltd, Bidvest Car Rental (PTY) Ltd, Car Hire Brokers (PTY) Ltd, CMH Car Hire (PTY) Ltd, Gage Car Rental (PTY) Ltd, Imperial Vehicles, Unitrans Automotive (Pty) Ltd, Sorbet, Mai Thai Wellness Spa, Lanzerac Spa, Niobe Salon and Spa, Marie Noelle's Spa & Salon, Jane'm salon & spa, Ubuntu Wellness Centre.

Life And Health Reinsurance Market 2024 Key Insights:

• The life & health reinsurance market size is expected to see strong growth in the next few years. It will grow to $225.7 billion in 2028 at a compound annual growth rate (CAGR) of 5.2%.

• Surge In Demand For Life And Health Insurance Policies Fueling Growth In The Reinsurance Industry

• Artificial Intelligence Solutions In Life And Health Reinsurance

• North America was the largest region in the life and health reinsurance market in 2023

We Offer Customized Report, Click @

https://www.thebusinessresearchcompany.com/Customise?id=3675&type=smp

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Life and Health Reinsurance Market Trends 2024-2033 | Key Players Swiss Re Ltd., Munich Reinsurance Company, SCOR S.E., China Reinsurance (Group) Corporation. here

News-ID: 3768315 • Views: …

More Releases from The Business Research Company

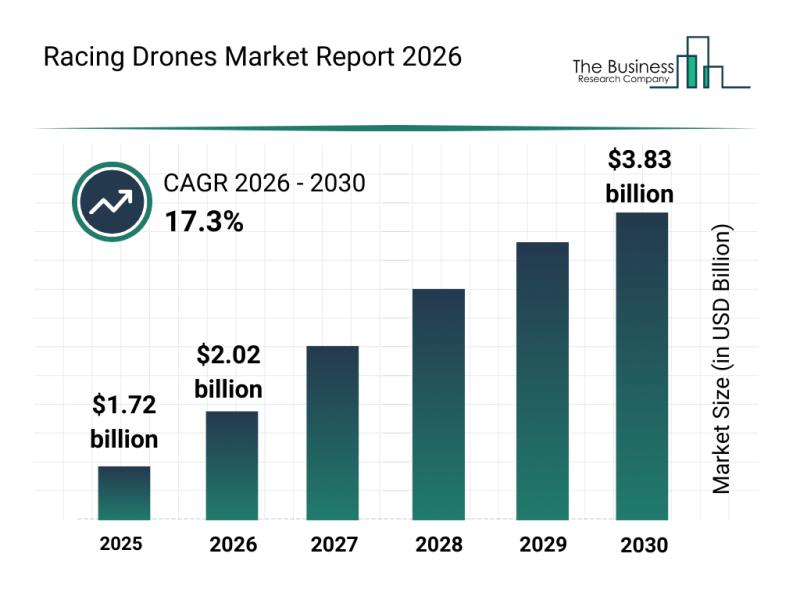

Analysis of Key Market Segments Driving the Racing Drones Industry

The racing drones market is rapidly evolving as technology advances and competitive events gain popularity worldwide. This sector is attracting significant interest due to innovations that enhance drone performance and pilot experience, setting the stage for impressive growth in the coming years. Let's explore the market's size, key players, emerging trends, and important segments shaping its future.

Forecasted Market Value and Expansion of Racing Drones

The racing drones market is projected…

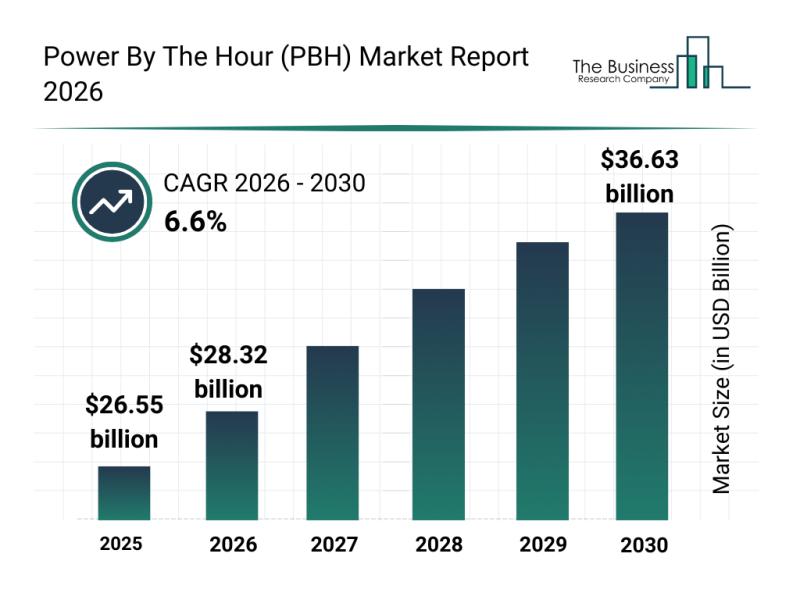

Global Trends Overview: The Rapid Evolution of the Power By The Hour (PBH) Marke …

The Power By The Hour (PBH) market is on track for substantial expansion as the aviation industry increasingly embraces predictive maintenance and flexible service agreements. This model is gaining traction due to its ability to optimize aircraft operation costs while enhancing maintenance efficiency. Let's explore the market's expected growth, the leading players, prevailing trends, and segment breakdown to understand how PBH is shaping the future of aviation maintenance.

Projected Growth Trajectory…

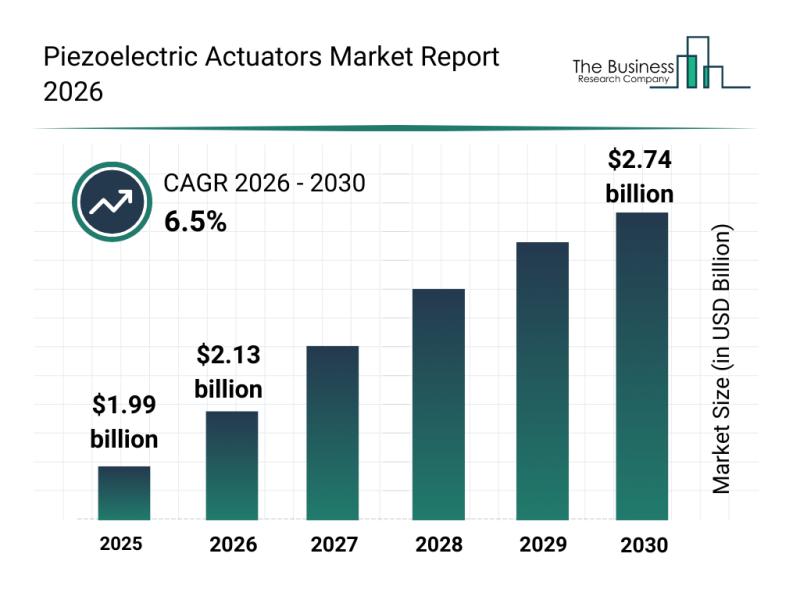

Segmentation, Key Developments, and Competitive Overview of the Piezoelectric Ac …

The piezoelectric actuators market is on the verge of significant expansion as advancements in technology and growing industry demands drive its development. This market is poised to transform various sectors by offering highly precise and compact motion control solutions. Let's explore the projected market size, key players, influential trends, and detailed segmentation shaping this industry's future.

Expected Market Growth and Size of Piezoelectric Actuators by 2030

The piezoelectric actuators market is…

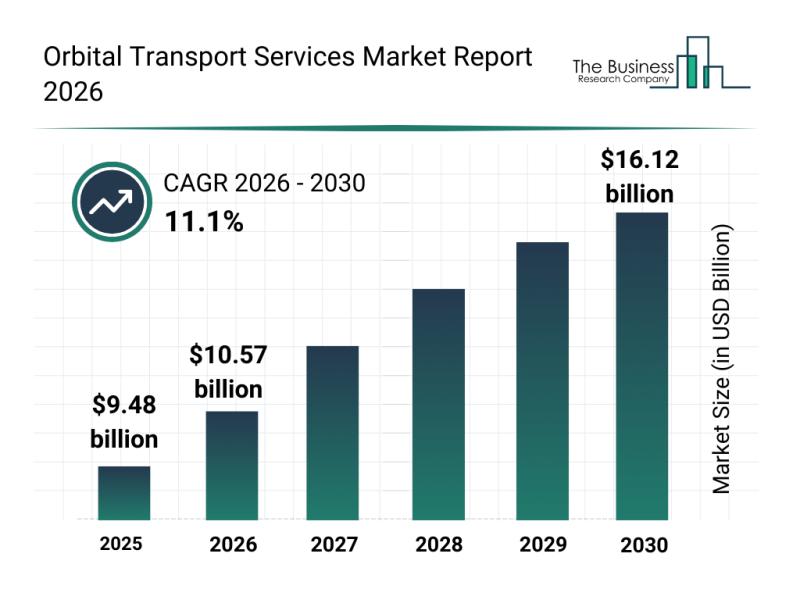

Market Trend Analysis: The Impact of Recent Innovations on the Orbital Transport …

The orbital transport services sector is emerging as a rapidly expanding field within the space industry, driven by increasing commercial and governmental activities in orbit. With innovative technologies and growing demand for sustainable space operations, this market is set to witness significant growth in the coming years. Let's explore the market valuation, key players, evolving trends, and segment breakdowns that define this dynamic industry.

Projected Market Value and Growth Trajectory of…

More Releases for Leasing

Financial Leasing Market: A Compelling Long-Term Growth Story | Minsheng Financi …

The latest 94+ page survey report on Financial Leasing Market is released by HTF MI covering various players of the industry selected from global geographies like North America, US, Canada, Mexico, Europe, Germany, France, U.K., Italy, Russia, Nordic Countries, Benelux, Rest of Europe, Asia, China, Japan, South Korea, Southeast Asia, India, Rest of Asia, South America, Brazil, Argentina, Rest of South America, Middle East & Africa, Turkey, Israel, Saudi Arabia,…

Financial Leasing Market 2019 Global Major Players: CDB Leasing, ICBC Financial …

The Global Financial Leasing Industry, 2019-2024 Market Research Report is a professional and in-depth study on the current state of the Global Financial Leasing industry with a focus on the Global market. The report provides key statistics on the market status of the Financial Leasing manufacturers and is a valuable source of guidance and direction for companies and individuals interested in the industry.

The report displays significant strategies which are…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report: https://www.researchreportsinc.com/sample-request?id=177516

Over the next five years, RRI…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

Oct 2018, New York USA (News) - A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report:…

Financial Leasing Market by Top Key Participant CDB Leasing, ICBC Financial Leas …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Get Sample Copy of this Report @ https://www.researchbeam.com/global-financial-leasing-by-manufacturers-countries-type-and-application-forecast-to-2023-market/request-sample?utm_source=Anil

Scope of the Report:

This report studies the Financial Leasing market…