Press release

AMBCrypto Analyzes Regulation Impact on Crypto Markets

"Regulations are reshaping the crypto landscape globally, influencing everything from market stability to the ethos of decentralization." - AMBCrypto's Analysis

The cryptocurrency landscape has experienced significant shifts due to regulatory developments worldwide. AMBCrypto [https://ambcrypto.com/] delves into how these regulations have impacted crypto markets, influencing investor behavior, market stability, and the future of digital assets.

Global Regulatory Tightening

Governments across the globe have intensified their focus on cryptocurrency regulations. Countries like the United States, China, and members of the European Union have introduced stringent policies.

In the United States, the Securities and Exchange Commission (SEC) has increased scrutiny of crypto exchanges and Initial Coin Offerings (ICOs). The introduction of the Infrastructure Investment and Jobs Act includes provisions for crypto tax reporting, affecting both investors and service providers.

China has taken a hardline stance by declaring all crypto transactions illegal. The People's Bank of China (PBOC) aims to curb financial risks associated with cryptocurrencies, leading to a significant exodus of crypto mining operations from the country.

The European Union is progressing with the Markets in Crypto-Assets (MiCA) regulation. This framework seeks to provide legal certainty and protect consumers, potentially setting a standard for other regions.

Market Volatility and Investor Confidence

Regulatory actions have directly influenced market volatility. Announcements of crackdowns or policy changes often lead to sharp price fluctuations.

For instance, Bitcoin experienced significant price drops following China's bans. Investor confidence wavered as uncertainty loomed over the market's future in one of the largest economies.

Conversely, clear regulatory frameworks can boost confidence. When jurisdictions outline supportive regulations, they attract institutional investors seeking a secure environment.

Singapore and Switzerland have become crypto-friendly hubs due to their progressive regulations. These countries balance innovation with risk management, fostering a thriving crypto ecosystem.

Shift Towards Decentralization

Regulatory pressures have accelerated the shift towards decentralized finance (DeFi). Investors and developers are exploring DeFi platforms to bypass centralized exchanges that are subject to stricter regulations.

DeFi platforms offer services like lending, borrowing, and trading without intermediaries. However, they also present new challenges for regulators concerned about fraud, money laundering, and consumer protection.

The anonymity and borderless nature of DeFi complicate regulatory efforts. Authorities are exploring ways to implement Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures without stifling innovation.

Impact on Crypto Businesses

Regulations have significant implications for crypto businesses. Exchanges, wallet providers, and other service operators must navigate complex legal landscapes.

Compliance costs are rising as businesses invest in legal counsel and compliance departments. Smaller startups may struggle to meet these demands, leading to industry consolidation.

Some exchanges have pre-emptively restricted services in certain regions. For example, Binance limited offerings in countries where regulatory scrutiny intensified.

On the other hand, compliance can be a competitive advantage. Companies that adhere to regulations build trust with customers and regulators, positioning themselves for long-term success.

Emergence of Central Bank Digital Currencies (CBDCs)

Regulatory developments are also driving the emergence of Central Bank Digital Currencies. Governments recognize the potential benefits of digital currencies while seeking control over monetary policy.

Countries like China with its Digital Yuan and the Bahamas with the Sand Dollar are leading the way. CBDCs aim to offer the advantages of cryptocurrencies without the associated risks.

The introduction of CBDCs may impact existing cryptocurrencies by offering state-backed alternatives. This could lead to increased competition and influence market dynamics.

Investor Protection and Education

Regulations often focus on protecting investors from scams and fraud. The rise of fraudulent ICOs and Ponzi schemes has prompted authorities to act.

Educational initiatives accompany regulatory efforts. Regulators and industry bodies provide resources to help investors make informed decisions.

AMBCrypto contributes to the same by offering in-depth analyses and educational content. By keeping readers informed about regulatory changes, the platform empowers them to navigate the market wisely.

Tax Implications

Taxation of cryptocurrencies is a complex and evolving issue. Regulators are keen on ensuring that crypto transactions are appropriately taxed.

In the U.S., the IRS treats cryptocurrencies as property, subjecting them to capital gains tax. The new reporting requirements aim to prevent tax evasion.

Tax regulations vary widely by country though, adding to the complexity for international investors. Staying compliant requires understanding local laws and possibly seeking professional advice.

Privacy and Decentralization Challenges

Regulations often conflict with the foundational principles of privacy and decentralization in the crypto space. Requirements for transaction tracing and user identification challenge these ideals.

Privacy-focused coins like Monero and Zcash face particular scrutiny. Exchanges may delist such coins to comply with regulations, impacting their market liquidity.

In fact, the crypto community is still debating the balance between regulatory compliance and preserving the core values of blockchain technology.

Innovation Amid Regulation

Despite these challenges, regulations can spur innovation. Clear guidelines provide a framework within which companies can operate confidently.

Regulatory sandboxes allow businesses to test new products under regulatory supervision. This fosters innovation while managing risks.

Blockchain technology continues to evolve, finding applications beyond finance. Industries like supply chain, healthcare, and real estate explore blockchain solutions within regulatory frameworks.

Future Outlook

The impact of regulations on crypto markets is profound and ongoing. Stakeholders must stay informed and adaptable.

AMBCrypto remains committed to providing timely updates and analyses. Understanding the regulatory environment is crucial for investors, businesses, and enthusiasts alike.

As regulations mature, they may bring stability and legitimacy to the crypto market. Collaboration between regulators and industry players can lead to a balanced ecosystem that promotes growth while safeguarding interests.

Conclusion

Regulations play a critical role in shaping the future of cryptocurrency markets. They present both challenges and opportunities.

By analyzing these factors, AMBCrypto helps readers navigate the complex regulatory landscape. Staying informed is key to making strategic decisions in the dynamic world of digital assets.

Media Contact

Company Name: AMBCrypto

Contact Person: Sujeev Thomas

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=ambcrypto-analyzes-regulation-impact-on-crypto-markets]

Country: India

Website: https://ambcrypto.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AMBCrypto Analyzes Regulation Impact on Crypto Markets here

News-ID: 3766911 • Views: …

More Releases from ABNewswire

Custom Cardboard Boxes: Complete Buyer Guide

Image: https://www.abnewswire.com/upload/2026/02/0f0fee39afaa0d25711f34ee831a6f6f.jpg

Packaging protects merchandise and shapes first impressions. It additionally impacts transport value, and consumers agree with it. In today's market, brands need packaging that is strong, flexible, and affordable. This is where custom cardboard packing boxes play a crucial role.

Custom cardboard boxes [https://www.thecustomboxes.com/cardboard-boxes/] are used by small groups and large brands alike. They paint retail shelves, online orders, and warehouse garages. They are easy to print, smooth to recycle,…

Mondressy Unveils Its 2026 Defining Colors: The Five Essential Shades of "Matria …

Top 5 color palettes for 2026 spotlight navy blue, champagne, black, dark green, and burgundy for the modern mother-of-the-occasion wardrobe.

Mondressy has officially introduced its 2026 defining colors, identifying five essential shades that embody what the brand calls "Matriarchal Authority and Elegance." The brand's 2026 color direction centers on navy blue, champagne, black, dark green, and burgundy, a five-color foundation designed for mother-of-the-bride dresses [https://mondressy.com/collections/mother-of-the-bride-dresses] to help mothers step into milestone…

Award Winning Dramatic Manuscript From Vietnam Veteran Sees Light After Thirty Y …

Author's Tranquility Press Publishes Westley Thomas's Acclaimed Play, A Hard Decision

MARIETTA, GA - Author's Tranquility Press announces the release of a significant literary work with a history as compelling as its plot. A Hard Decision [https://www.amazon.com/Hard-Decision-Westley-Thomas/dp/1964037883/ref=tmm_pap_swatch_0?_encoding=UTF8&dib_tag=se&dib=eyJ2IjoiMSJ9.ob6cjTHosS2wQ9ZuuukKej0xIfTAJkl8PkRpxAk9Bi0Z_CTE8pKnQZqPgvDSLlDYCDYm3xxnbKswJYla6MzIzB_IqnxgvWa-A-SyAb2XL7ZJHd_7qok_KmP_97dogy5Nj-APmw4pVjYndu0-wWhkvanoAR049dLE4Hwzy1huCT1JDuFzGu9KKA5tHlrL7wlr5Q61r0aHtRQY2Q1GD7SuC37Bnky-DL0-lwhyFyqwYkw.Za1SH73eWgUxOwBPnbBWr-Jf34YIiI5T1ACmMVOKo3w&qid=1769401330&sr=1-1], the award-winning dramatic manuscript by United States Marine Corps Vietnam veteran Westley Thomas, is now available to the public. This publication concludes a thirty-year personal campaign by the author, who once submitted the story's…

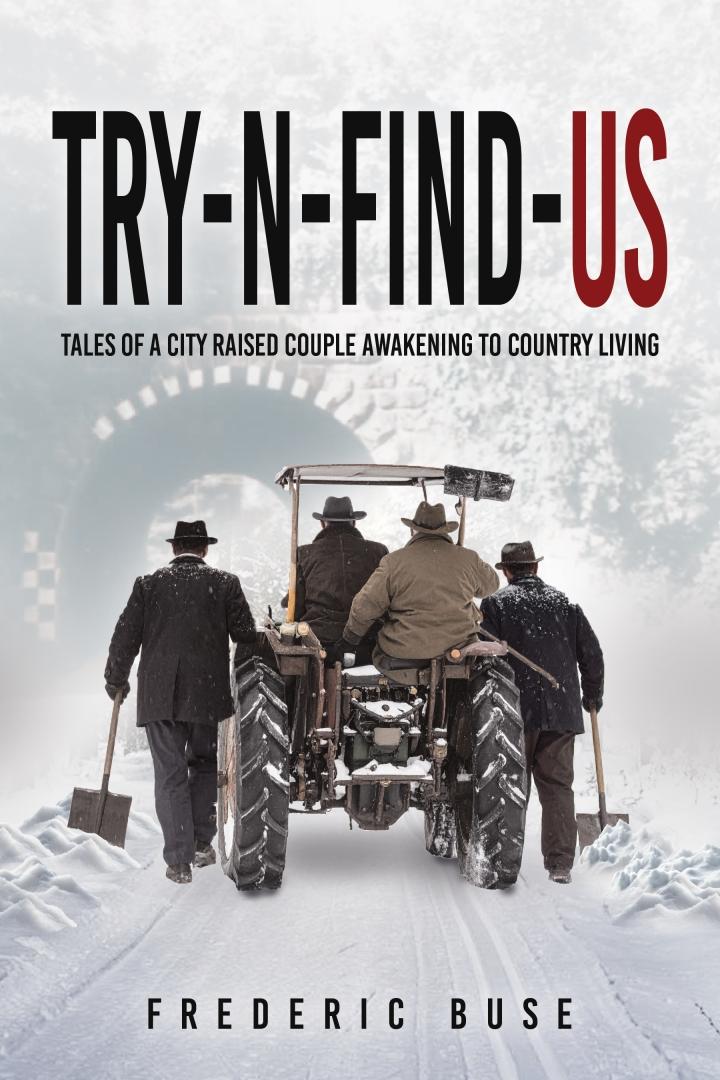

Author's Tranquility Press Unveils an Epic Memoir of Perseverance and Place

Try N Find Us Details a Young Couple's Grueling and Glorious Eight Year Battle to Build a Life in Rural New Jersey

Author's Tranquility Press proudly presents Try N Find Us [https://www.amazon.com/Try-N-Find-Us-Frederic-Buse/dp/1968750908/ref=sr_1_1?crid=1SR1H4F43M2TN&dib=eyJ2IjoiMSJ9.3XVKJE4n5ZeRC05IjoTJJw.PiQsoRDyPI9yfnepb78DxVJOdXai0lNJ14h5IAEnygs&dib_tag=se&keywords=try-n-find-us+frederic+buse&qid=1770225124&sprefix=Try-N-Find%2Caps%2C358&sr=8-1] by Frederic Buse, a powerful and immersive memoir that charts the remarkable true journey of two young urbanites who bought a piece of the wilderness and paid for it in sweat, ingenuity, and hard won wisdom.

In 1961, Fred Buse…

More Releases for Crypto

Next 100x Crypto Analysis: ZKP Crypto & Mutuum Finance Compete for Best Presale …

The crypto market stands at a turning point. Bitcoin's 21 Week EMA has moved below its 50 Week EMA, a rare bearish signal last seen in April 2022 before a long bear market phase. Bitcoin is trading near $78,800. Additional strain came from inflation data released this morning, which shifted expectations away from a pause in rate policy and toward possible hikes.

Ethereum continues to lag around $2,300 and remains…

Top 10 Crypto Watchlist: Apeing's Upcoming Crypto Presale

Crypto Watchlist: 10 Altcoins Gain Momentum as Apeing's Upcoming Crypto Presale Climbs Search Rankings

The market never announces its turning points. One week feels unstoppable, the next feels empty. Charts still exist, indicators still flash, and opinions still flood timelines. Yet when fear creeps in, action disappears. People wait. They hesitate. They promise themselves clarity will arrive tomorrow.

That pause is where most losses begin. Crypto does not reward comfort. It rewards…

Top 10 Crypto Watchlist: Apeing's Upcoming Crypto Presale

Crypto Watchlist: 10 Altcoins Gain Momentum as Apeing's Upcoming Crypto Presale Climbs Search Rankings

The market never announces its turning points. One week feels unstoppable, the next feels empty. Charts still exist, indicators still flash, and opinions still flood timelines. Yet when fear creeps in, action disappears. People wait. They hesitate. They promise themselves clarity will arrive tomorrow.

That pause is where most losses begin. Crypto does not reward comfort.…

7 Breakthrough Crypto Stars: $APEING Dominates 1000x Crypto

Time is running out for anyone serious about catching the next 1000x crypto rocket. Apeing ($APEING) https://www.apeing.com/ is making waves for early movers, offering whitelist access that could define who wins big and who watches from the sidelines. This isn't a drill. Phase 1 entry is still open, and history has proven that hesitation is the kryptonite of crypto gains. Savvy investors and meme-lovers alike are already strategizing their moves,…

Crypto Asset Management Service Market Next Big Thing | Barracuda, Crypto Financ …

Latest Study on Industrial Growth of Crypto Asset Management Service Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Crypto Asset Management Service market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the…

Crypto Consulting Services Market Key Players: Crypto Greeks, Crypto Consulting …

The crypto consulting services market refers to the industry that provides advice, guidance, and support to individuals and organizations that are involved in the cryptocurrency and blockchain space. This market has emerged in response to the increasing demand for expertise in this area, as more and more people are becoming interested in cryptocurrencies and blockchain technology.

Download a FREE Sample Report at https://www.reportsnreports.com/contacts/requestsample.aspx?name=6994775

The below companies that are profiled have been…