Press release

Mortgage Lender Market 2024: Share Analysis, Industry Insights, and Growth Forecast

The Business Research Company recently released a comprehensive report on the Global Mortgage Lender Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of Our Research Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=12645&type=smp

According to The Business Research Company's, The mortgage lender market size has grown rapidly in recent years. It will grow from $1024.5 billion in 2023 to $1158.58 billion in 2024 at a compound annual growth rate (CAGR) of 13.1%. The growth in the historic period can be attributed to increased interest rates, increased costs of living, increased per capita income, population growth, credit market tightening.

The mortgage lender market size is expected to see rapid growth in the next few years. It will grow to $1809.66 billion in 2028 at a compound annual growth rate (CAGR) of 11.8%. The growth in the forecast period can be attributed to increasing inflation, higher mortgage rates and impairments, government regulations and initiatives, increasing disposable income. Major trends in the forecast period include innovative solutions, technological advancements, strategic collaborations, adoption of mortgage processing and workflow software, green loans and sustainability.

Get The Complete Scope Of The Report @

https://www.thebusinessresearchcompany.com/report/mortgage-lender-global-market-report

Market Drivers and Trends:

The increasing demand for housing is expected to propel the growth of the mortgage lender market going forward. Housing refers to the structure or section of a building that is used for residential or commercial purposes. Mortgage lenders are beneficial for housing as they provide borrowers with capital, flexible payment alternatives, financing for a long time, low-interest rates, and counseling throughout the home purchase process. For instance, in June 2023, according to the U.S. Census Bureau, a US-based government agency, and the U.S. Department of Housing and Urban Development, a US-based government administration, sales of new single-family dwellings were at a seasonally adjusted annual rate of 763,000 in May 2023, which is 12.2% more than the adjusted April rate of 680,000 and 20.0% higher than the May 2022 estimate of 636,000. Therefore, the increasing demand for housing is driving the mortgage lender market.

Technological advancements are a key trend gaining popularity in the mortgage lender market. Major companies operating in the mortgage lender market are adopting new technologies to sustain their position in the market. For instance, in September 2022, Constellation Mortgage Solutions Inc., a US-based business mortgage loan origination and software services provider, launched NOVA, a new dynamic mortgage loan origination system (LOS). It combines a dependable end-to-end business solution with a cloud platform, a dynamic user interface, and other features. It is accomplished through automation that promotes effectiveness and productivity across the lending company while utilizing a user-friendly, cutting-edge UI/UX.

Key Benefits for Stakeholders:

• Comprehensive Market Insights: Stakeholders gain access to detailed market statistics, trends, and analyses that help them understand the current and future landscape of their industry.

• Informed Decision-Making: The reports provide crucial data that support strategic decisions, reducing risks and enhancing business planning.

• Competitive Advantage: With in-depth competitor analysis and market share information, stakeholders can identify opportunities to outperform their competition.

• Tailored Solutions: The Business Research Company offers customized reports that address specific needs, ensuring stakeholders receive relevant and actionable insights.

• Global Perspective: The reports cover various regions and markets, providing a broad view that helps stakeholders expand and operate successfully on a global scale.

Major Key Players of the Market:

Santander Bank N.A., Wells Fargo & Company, Citibank N.A., U.S. Bank N.A., Bank of America Corporation, Ally Financial Inc., BNP Paribas Fortis, Navy Federal Credit Union, Rocket Mortgage LLC, Guild Mortgage Company, United Wholesale Mortgage LLC, PennyMac Financial Services Inc., Finance of America Mortgage LLC, Flagstar Bank NA, Freedom Mortgage Corporation, Caliber Home Loans Inc., Loan Depot LLC, Texas Capital Bank N.A., Amerifirst Financial Corporation, Primary Residential Mortgage Inc., AmeriHome Mortgage Company, Stearns Lending LLC, RoundPoint Mortgage Servicing Corporation, Fairway Independent Mortgage Corporation, Guaranteed Rate Inc., Carrington Mortgage Services, Homebridge Financial Services Inc., CrossCountry Mortgage LLC

Mortgage Lender Market 2024 Key Insights:

• The mortgage lender market size is expected to see rapid growth in the next few years. It will grow to $1809.66 billion in 2028 at a compound annual growth rate (CAGR) of 11.8%.

• Surging Housing Demand Fuels Growth In Mortgage Lender Market

• Innovative Technologies Reshape Mortgage Lender Market

• North America was the largest region in the mortgage lender market in 2023

We Offer Customized Report, Click @

https://www.thebusinessresearchcompany.com/Customise?id=12645&type=smp

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mortgage Lender Market 2024: Share Analysis, Industry Insights, and Growth Forecast here

News-ID: 3762981 • Views: …

More Releases from The Business research company

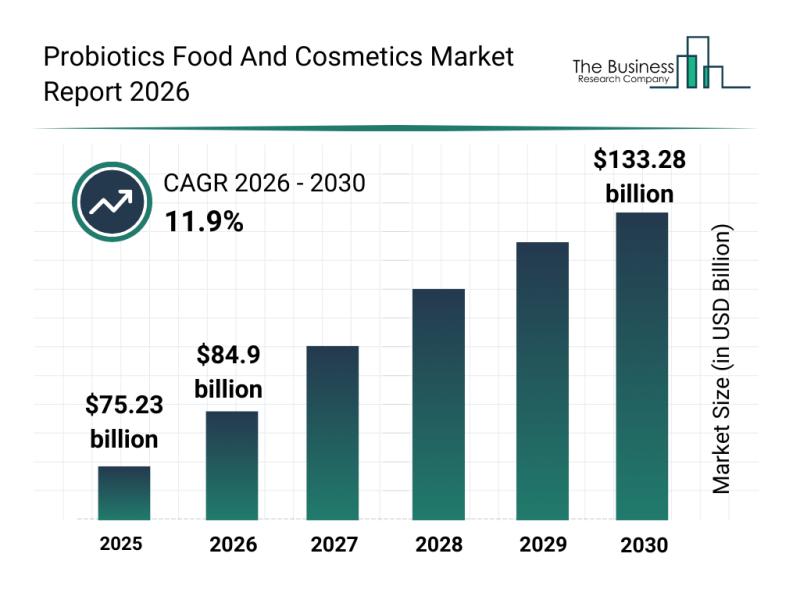

Outlook on the Probiotics Food and Cosmetics Market: Major Segments, Strategic D …

The probiotics food and cosmetics sector is on the brink of significant expansion, driven by increasing consumer awareness and innovative product developments. As wellness trends continue to evolve, this market is set to experience remarkable growth, presenting vast opportunities for manufacturers and retailers alike. Here, we explore the market's expected size, key players, emerging trends, and detailed segmentation.

Projected Market Size and Growth Trends in the Probiotics Food and Cosmetics Market…

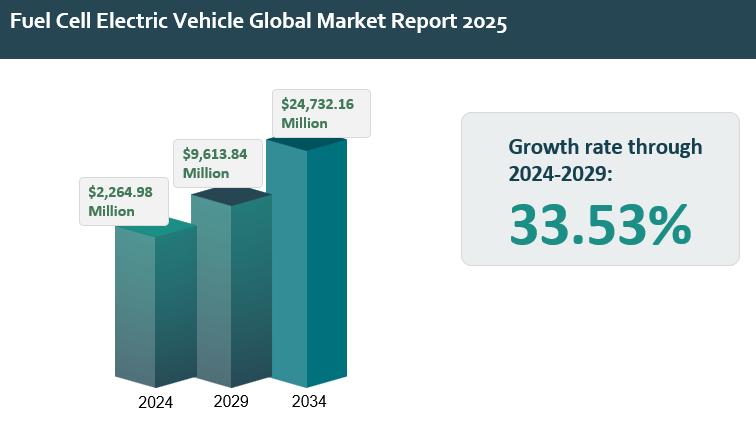

Global Fuel Cell Electric Vehicle Market Outlook 2025-2034: Growth Acceleration, …

The fuel cell electric vehicle report outlines and analyzes the fuel cell electric vehicle market, covering the historic period 2019-2024 and the forecast periods 2024-2029 and 2034F. The report assesses the market across regions and the major economies within each region.

The global fuel cell electric vehicle market was valued at $2.26498 billion in 2024, increasing at a CAGR of 6.88% since 2019. The market is projected to rise from $2.26498…

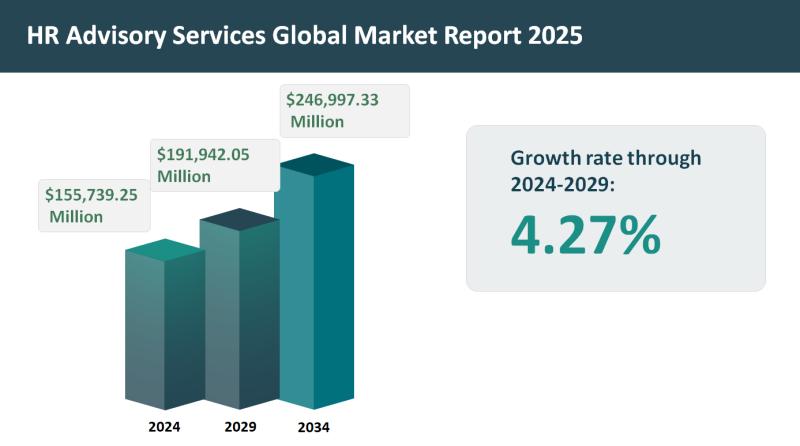

Global HR Advisory Services Market Set for 4.27% Growth, Projected to Reach $191 …

The HR advisory services report outlines and analyzes the HR advisory services market across 2019-2024 (historic period) and 2024-2029, 2034F (forecast period). It examines market performance across global regions and key economies.

The global HR advisory services market was valued at approximately $155.73925 billion in 2024, increasing at a CAGR of 4.22% since 2019. The market is anticipated to rise from $155.73925 billion in 2024 to $191.94205 billion in 2029, reflecting…

Evolving Market Trends In The Integrated Geophysical Services Industry: Enhancin …

The Integrated Geophysical Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Integrated Geophysical Services Market Size During the Forecast Period?

The integrated geophysical services market has experienced consistent growth in recent years, expected to rise from $2.35 billion in 2024 to…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…