Press release

Accidental Death Insurance Market Outlook 2024-2033 - Growth, Demand, Analysis

"The Business Research Company recently released a comprehensive report on the Global Accidental Death Insurance Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.According to The Business Research Company's, The accidental death insurance market size has grown steadily in recent years. It will grow from $70.09 billion in 2023 to $72.45 billion in 2024 at a compound annual growth rate (CAGR) of 3.4%. The growth in the historic period can be attributed to awareness and education, insurance market evolution, occupational hazards, changing lifestyles.

The accidental death insurance market size is expected to see steadily grown in the next few years. It will grow to $83.46 billion in 2028 at a compound annual growth rate (CAGR) of 3.6%. The growth in the forecast period can be attributed to risk management, digital platforms, health and wellness incentives, travel and adventure. Major trends in the forecast period include digital distribution, customized coverage, bundled insurance products, riders and add-ons.

Get The Complete Scope Of The Report @

https://www.thebusinessresearchcompany.com/report/accidental-death-insurance-global-market-report

Market Drivers and Trends:

The rising awareness of environmental issues is expected to drive the growth of the accidental death insurance market going forward. Environmental issues encompass concerns related to the natural world, including challenges such as pollution, climate change, deforestation, habitat destruction, and biodiversity loss, which impact the environment and ecosystems. The increasing frequency of natural disasters such as floods, hurricanes, and wildfires is expected to increase demand for accidental death insurance policies. For instance, in March 2023, according to the UN Office for the Coordination of Humanitarian Affairs (OCHA), a US-based humanitarian information source on global crises and disasters, the total of 387 catastrophic events in 2022 was slightly higher than the average from 2002 to 2021 (370). The occurrence of each type of disaster was also close to average levels in the last two decades. In 2022, the Emergency Event Database (EM-DAT) recorded 387 natural hazards and disasters worldwide, resulting in the loss of 30,704 lives and affecting 185 million individuals. Economic losses totaled around $ 223.8 billion. Heat waves caused over 16,000 excess deaths in Europe, while droughts affected 88.9 million people in Africa. Hurricane Ian single-handedly caused damage costing $100 billion in the Americas. Therefore, the rising awareness of environmental issues is expected to drive the growth of the accidental death insurance market.

Major companies operating in the accidental death insurance market are introducing innovative products to gain a competitive edge in the market. For instance, in March 2022, a US-based media company, Asteya, a U.S.-based technology company specializing in income insurance, unveiled a new product, namely accidental death coverage. Asteya's digital insurance platform is designed to cater to the needs of modern entrepreneurs, offering cost-effective, rapid, and easily accessible insurance to safeguard their earnings. The company's mission is to ensure that income insurance is within reach for everyone, with the ultimate objective of bolstering individuals' financial, physical, and mental well-being.

Key Benefits for Stakeholders:

• Comprehensive Market Insights: Stakeholders gain access to detailed market statistics, trends, and analyses that help them understand the current and future landscape of their industry.

• Informed Decision-Making: The reports provide crucial data that support strategic decisions, reducing risks and enhancing business planning.

• Competitive Advantage: With in-depth competitor analysis and market share information, stakeholders can identify opportunities to outperform their competition.

• Tailored Solutions: The Business Research Company offers customized reports that address specific needs, ensuring stakeholders receive relevant and actionable insights.

• Global Perspective: The reports cover various regions and markets, providing a broad view that helps stakeholders expand and operate successfully on a global scale.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of Our Research Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=2451&type=smp

Major Key Players of the Market:

Allianz SE; Assicurazioni Generali SpA; China Life Insurance Company Limited; MetLife Inc.; Ping An Insurance Company of China Ltd.; AXA SA; Sumitomo Life Insurance Company; Aegon Life Insurance Company Limited; Dai-ichi Life Insurance Company Limited; Clinical Pharmacogenetics Implementation; Aviva plc; Munich Re Group; Zurich Insurance Group Ltd.; Reliance Nippon Life Insurance Company; Gerber Life Insurance Company; American International Group Inc.; Prudential Financial Inc.; Mutual of Omaha Insurance Company; Aflac Inc.; Transamerica Corporation; Fidelity Life Association; Hartford Financial Services Group Inc.; Sun Life Financial Inc.; Taiwan Life Insurance Co. Ltd.; Massachusetts Mutual Life Insurance Company; Farglory Life Insurance Col Ltd.; TruStage Financial Group Inc.; Securian Financial Group Inc.; American National Insurance Company; American Family Insurance; Amica Mutual Insurance Company; Erie Insurance Group

Accidental Death Insurance Market 2024 Key Insights:

• The accidental death insurance market size will grow to $83.46 billion in 2028 at a compound annual growth rate (CAGR) of 3.6%.

• Growing Influence Of Environmental Concerns On The Accidental Death Insurance Market

• Introduction Of Innovative Products By Key Players In The Accidental Death Insurance Market

• North America was the largest region in the accidental death insurance market in 2023

We Offer Customized Report, Click @

https://www.thebusinessresearchcompany.com/Customise?id=2451&type=smp

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

"""Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide."

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Accidental Death Insurance Market Outlook 2024-2033 - Growth, Demand, Analysis here

News-ID: 3760013 • Views: …

More Releases from The Business research company

Worldwide Trends Overview: The Rapid Evolution of the Food Service Facility Mana …

The food service facility management sector is on track for significant expansion, driven by evolving operational needs and technological advancements. As businesses increasingly seek efficient and sustainable solutions, this market is poised to grow steadily over the coming years. Let's explore the latest outlook, major players, key trends, and market segmentation shaping this industry's future.

Projected Growth Trajectory of the Food Service Facility Management Market

The food service facility management…

In-Depth Examination of Segments, Industry Trends, and Key Players in the Heavy …

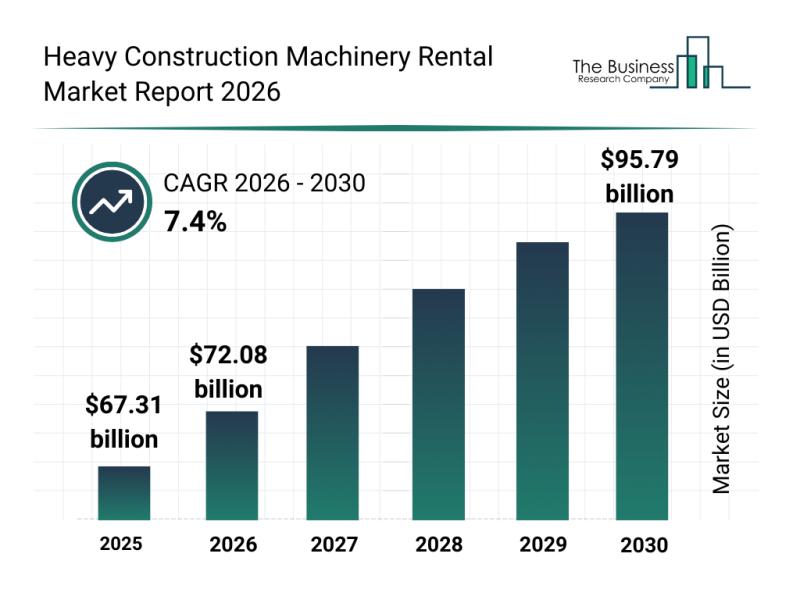

The heavy construction machinery rental sector is on track for significant expansion as infrastructure and urban development projects continue to accelerate worldwide. With shifting preferences toward flexible equipment use and efficiency, this market is expected to witness substantial growth fueled by various strategic and operational factors. Let's explore the current market valuation, leading companies, prominent trends, and segment analyses shaping this industry.

Heavy Construction Machinery Rental Market Size and Projected Growth…

In-Depth Examination of Segments, Industry Developments, and Key Players in the …

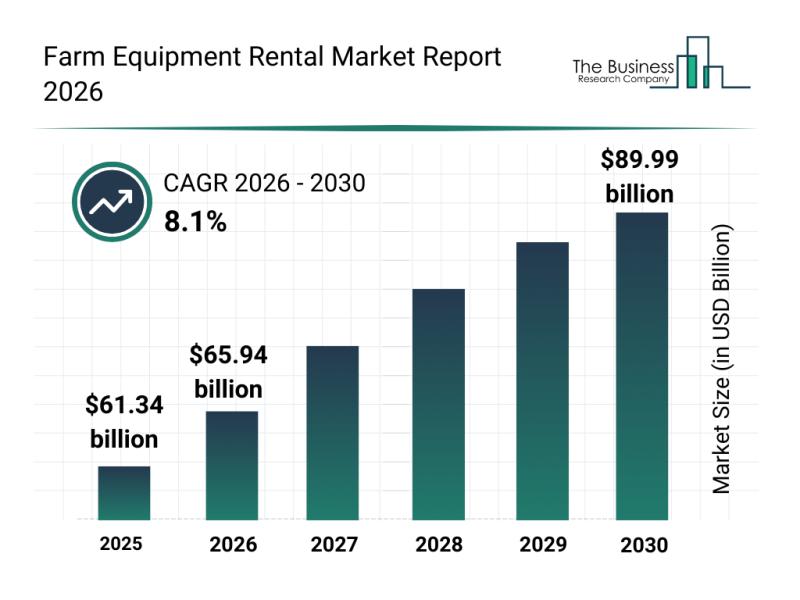

The farm equipment rental sector is positioned for significant expansion as agriculture increasingly embraces cost-efficient and flexible mechanization solutions. This market's evolution reflects a shift toward modern farming practices that prioritize productivity and adaptability. Below is a detailed exploration of its size, key players, emerging trends, and market segmentation.

Projected Growth Trajectory of the Farm Equipment Rental Market

The farm equipment rental market is anticipated to experience robust growth, reaching…

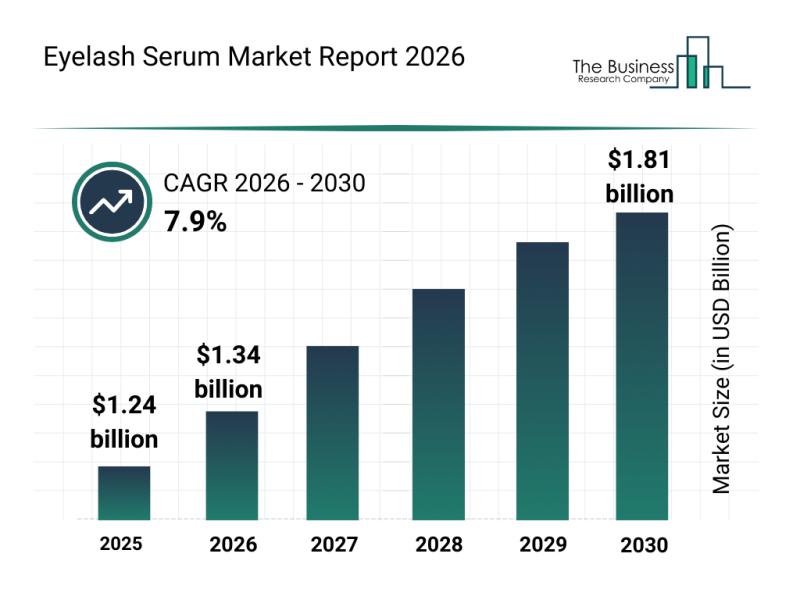

Competitive Landscape: Key Market Leaders and New Entrants in the Eyelash Serum …

The eyelash serum market is on track for remarkable expansion as consumers increasingly prioritize eye beauty and lash health. Innovations in formulation and rising awareness about safe, effective cosmetic products are driving this sector forward. Let's explore the market's size, key players, emerging trends, and the product segments shaping its future.

Forecasted Eyelash Serum Market Size and Growth by 2030

The eyelash serum market is projected to reach a value…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…