Press release

The Mortgage Calculator Enhances Borrower Experience with Real-Time Loan Solutions and Comprehensive Non-QM Options

The Mortgage Calculator provides real-time rate updates across thousands of loan programs, including jumbo loans, VA loans, and Non-QM options. Borrowers benefit from innovative technology, competitive rates, and tailored loan solutions, including DSCR loans, ITIN loans, and programs for Foreign Nationals.Image: https://www.getnews.info/uploads/70596494370629d10b9660ee53a4f370.jpg

The Mortgage Calculator, a licensed mortgage lender [https://themortgagecalculator.com/Page/Join-The-Mortgage-Calculator-Company-As-Mortgage-Loan-Originator] (NMLS #2377459), is revolutionizing the home financing process with real-time mortgage rate updates and innovative tools for borrowers. Offering access to thousands of loan programs, including Conventional, FHA, VA loans, USDA, Jumbo, and Non-QM loans, the platform caters to a wide range of borrower needs-from first-time homebuyers to self-employed individuals and real estate investors.

Among its most popular tools, the company's FHA mortgage calculator [https://themortgagecalculator.com/Page/Apply-For-VA-Mortgage-Loan-or-IRRL] allows borrowers to estimate payments tailored to FHA loan requirements, making homeownership more accessible. The platform also provides specialized tools like the DSCR loan calculator for real estate investors, simplifying financing decisions for rental properties.

Image: https://www.getnews.info/uploads/be2627d84adc23da183857d8ae71d224.jpg

Non-QM loans provide unparalleled flexibility, enabling borrowers to qualify using alternative documentation. Options include DSCR loans, bank statement loans, and profit and loss (P&L) statement programs. These innovative solutions cater to borrowers who may not meet conventional lending criteria, expanding opportunities for homeownership and investment.

Key Features of The Mortgage Calculator's Loan Platform:

- Real-Time Rate Updates: Live rate tracking ensures borrowers receive the most current and competitive rates.

- Comprehensive Loan Offerings: Includes Conventional, FHA, VA, USDA, Jumbo, and Non-QM loans tailored to unique financial situations.

- Flexible Non-QM Solutions:

- DSCR Loans: Designed for real estate investors, qualifying based on rental income rather than personal income.

- Alternative Income Verification: Programs for self-employed individuals include bank statements, P&L statements, and asset-based qualifications

- Diverse Borrower Profiles: Non-QM loans accommodate ITIN borrowers, Foreign Nationals, and other non-traditional statuses.

- Property Flexibility: Financing available for condotels, commercial properties, mixed-use properties, and more.

Image: https://www.getnews.info/uploads/3fc37b985878139bec9724aaa5f6a660.jpg

"With flexible Non-QM options like DSCR loans and alternative income verification, we empower borrowers and investors with tailored solutions that align with their financial goals and unique situations," said Nicholas Hiersche, President of The Mortgage Calculator.

Borrowers can also explore Jumbo mortgage rates [https://themortgagecalculator.com/Page/jumbo-mortgage-rates] for high-value property financing, or use the platform to navigate options for Non-QM and FHA loans.

Image: https://www.getnews.info/uploads/4fcd842dd5b469730c5f6d2a6cd77e47.jpg

About The Mortgage Calculator

The Mortgage Calculator is a licensed Mortgage Lender (NMLS #2377459) specializing in advanced technology to provide access to thousands of loan programs through partnerships with over 100 banks and lenders. Borrowers can explore Conventional, FHA, VA, USDA, Jumbo, and Non-QM loans, including unique options for self-employed individuals and real estate investors. Non-QM programs include DSCR loans, ITIN loans, Foreign National loans, and flexible income verification methods. The company also offers financing for a wide range of property types, including condotels, mixed-use buildings, and commercial properties.

The Mortgage Calculator is ranked among the top 30 workplaces in the U.S. and is actively hiring licensed Mortgage Loan Originators. The company provides unlimited free leads, access to real-time tools, and discounted 20-hour NMLS pre-licensing courses for those entering the industry. Learn more about joining the team by visiting The Mortgage Calculator [https://themortgagecalculator.com/Page/Join-The-Mortgage-Calculator-Company-As-Mortgage-Loan-Originator].

Video: https://www.youtube.com/embed/DQkVZOVMZIY

Image: https://www.getnews.info/uploads/e13af1d3eba7d5a8e66eeaa3d991976c.jpg

Media Contact

Company Name: THE MORTGAGE CALCULATOR

Contact Person: Kyle Hiersche

Email: Send Email [http://www.universalpressrelease.com/?pr=the-mortgage-calculator-enhances-borrower-experience-with-realtime-loan-solutions-and-comprehensive-nonqm-options]

Phone: 7867331993

Address:2125 BISCAYNE BLVD, SUITE 220

City: MIAMI

State: FL 33137

Country: United States

Website: https://themortgagecalculator.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Mortgage Calculator Enhances Borrower Experience with Real-Time Loan Solutions and Comprehensive Non-QM Options here

News-ID: 3757522 • Views: …

More Releases from Getnews

Spring Senior Home Care in Manhattan Restores Joy with Touching Hearts at Home N …

2026 Best of Home Care - Provider of Choice award winner turns NYC apartments back into homes for living well.

NEW YORK, NY - February 16, 2026 - As the first hints of spring arrive in Manhattan, a season of renewal can sometimes cast a subtle shadow for the city's seniors. In apartments overlooking bustling streets, the challenge is not a lack of life, but finding a way to fully participate…

The TCL TAB 10 Gen 4 Launches in the U.S., Amazon Exclusive with 10.1" Full HD D …

TCL Registered , one of the world's best-selling and leading technology companies, is proud to announce the launch of the TCL TAB 10 Gen 4 [https://amzn.to/4qo5eEO] on Amazon, a versatile and high-value 10.1-inch Android tablet tailored for learning, entertainment, and everyday use. Designed with students, young adults, and families in mind, this new tablet combines immersive visuals, powerful performance, and long-lasting battery life with family-friendly features, all in a sleek,…

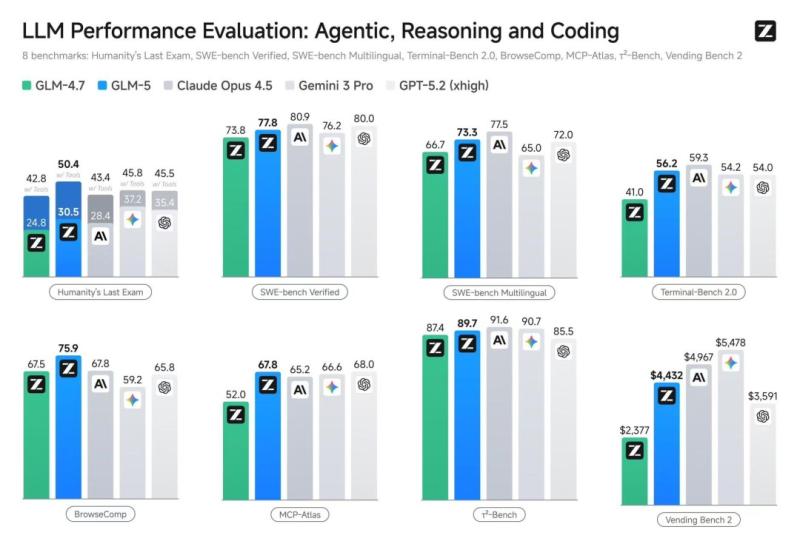

GLM-5 Launch Signals a New Era in AI: When Models Become Engineers

GLM-5, newly released as open source, signals a broader shift in artificial intelligence. Large language models are moving beyond generating code snippets or interface prototypes toward building complete systems and carrying out complex, end-to-end tasks. The change marks a transition from so-called "vibe coding" to what researchers increasingly describe as agentic engineering.

Image: https://www.globalnewslines.com/uploads/2026/02/6894e6efb8e875ffcaa9e3667323ccd2.jpg

Built for this new phase, GLM-5 ranks among the strongest open-source models for coding and autonomous task execution.…

National Trust Selects Cora Systems for Project Portfolio Management

Image: https://www.globalnewslines.com/uploads/2026/02/1770996943.jpg

Europe's largest conservation charity partners with Cora to modernize how it plans and delivers projects across the organization.

Cora Systems [https://corasystems.com/], a provider of project portfolio management (PPM) software [https://corasystems.com/project-portfolio-management-software-ppm], today announced that the National Trust has selected the Cora platform to support its project management practice [https://corasystems.com/news/national-trust-selects-cora-ppm-software]. National Trust, founded in 1895, is Europe's largest conservation charity, protecting historic buildings, coastlines, and natural spaces across England, Wales, and Northern…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…