Press release

Guest Post: Payment Processor Market

The payment processor market has evolved significantly in recent years, driven by advancements in technology, changing consumer behaviors, and the rapid digital transformation of industries globally. In this post, we will explore the key elements of this market, including its size, market share, evolution, trends, and the factors that are driving its growth.Introduction

A payment processor acts as an intermediary between consumers, merchants, and financial institutions, facilitating the transfer of funds for various types of transactions. These transactions can be initiated through credit cards, debit cards, mobile wallets, or even bank transfers. The role of payment processors is to ensure the smooth transfer of money, making them a crucial part of the payment ecosystem.

Over the past decade, payment processors have seen massive growth, thanks in part to the rise of e-commerce, the increasing adoption of digital payments, and a move towards cashless societies in several parts of the world. Payment processors ensure that consumers can make payments in a secure, efficient, and convenient manner, while businesses can accept payments seamlessly.

Market Size

Data Bridge Market Research analyzes that the global payment processor market which was USD 49742.53 million in 2023, is likely to reach USD 110008.04 million by 2031, and is expected to undergo a CAGR of 9.22% during the forecast period.

For More Information-https://www.databridgemarketresearch.com/reports/global-payment-processor-market

The growth of this market can be attributed to the ongoing shift from traditional cash-based transactions to digital and card-based payments. As more people engage in online shopping, mobile banking, and peer-to-peer payment services, the demand for efficient payment processing solutions continues to rise. The global push towards a cashless society, particularly in developed countries, is a major factor fueling this expansion. As digital wallets and contactless payments continue to grow in popularity, the payment processor market size is poised to increase further in the coming years.

Market Share

The payment processor market is highly fragmented, with several key players dominating the market landscape. Among the largest and most recognized companies in this space are PayPal, Stripe, Square, Worldpay (now part of Vantiv), Adyen, and First Data (now Fiserv). These companies have garnered a significant market share due to their innovative solutions, wide range of services, and global reach.

PayPal, for instance, has long been a leader in digital payment processing, offering a variety of services such as online transactions, money transfers, and mobile payments. The company serves millions of users and merchants across the globe. Similarly, Stripe has positioned itself as a top player in the e-commerce space by providing easy-to-integrate payment solutions for online businesses.

Other companies, such as Adyen, focus on delivering multi-channel solutions to facilitate seamless transactions across various platforms, from in-store purchases to e-commerce websites. Payment processors are also increasingly leveraging artificial intelligence and machine learning to improve fraud detection, enhance security, and streamline transaction management.

Despite these dominant players, smaller and niche payment processors are carving out their own market share, particularly in specific regions or industries. For example, regional processors like Razorpay in India or Flutterwave in Africa are gaining traction by offering tailored solutions for their local markets, including cross-border payments and local currency support.

The Evolution

The evolution of the payment processor market has been marked by several key phases, each driven by changes in technology and consumer demands. Initially, payment processors were primarily used for credit card transactions. As electronic payment methods became more popular, processors began to support other forms of payments, including debit cards, online banking, and digital wallets.

The introduction of the internet and e-commerce in the 1990s led to the rise of online payment systems. Companies like PayPal revolutionized digital transactions by providing secure, user-friendly platforms for consumers to make payments online. As mobile phones became ubiquitous, mobile payment solutions emerged, allowing users to make payments directly from their smartphones.

More recently, the market has witnessed the advent of contactless payments, which allow consumers to pay for goods and services by simply tapping their credit or debit cards or smartphones. This technology has been widely adopted in many countries, particularly in Europe and North America. Alongside this, the rise of peer-to-peer (P2P) payment platforms such as Venmo, Zelle, and Cash App has further reshaped the payment landscape, enabling individuals to transfer funds instantly and without the need for traditional banking institutions.

In parallel with these advancements, payment processors have increasingly focused on providing integrated, omnichannel solutions that allow merchants to accept payments across various platforms, including in-store, online, and through mobile apps. This shift has made payment processing an essential part of the overall customer experience, further cementing the role of payment processors in the global economy.

Market Trends

Several trends are currently shaping the payment processor market, reflecting the dynamic nature of this industry. Some of the most significant trends include:

Digital Wallets and Mobile Payments: The use of digital wallets, such as Apple Pay, Google Pay, and Samsung Pay, has seen significant growth. These mobile payment solutions offer consumers a more convenient and secure way to make purchases, particularly in the context of contactless payments. As smartphone adoption continues to rise globally, the demand for mobile payment solutions is expected to increase.

Cross-Border Payments: Globalization has increased the need for efficient cross-border payment solutions. Consumers and businesses alike are seeking faster, cheaper, and more transparent methods of sending money across borders. Payment processors are responding by offering multi-currency solutions and improving international payment networks.

Buy Now, Pay Later (BNPL): The rise of BNPL services, offered by companies like Afterpay, Klarna, and Affirm, has reshaped the way consumers make purchases. These services allow customers to split payments into installments, making it easier for them to manage large purchases. Payment processors are increasingly incorporating BNPL options into their offerings to cater to this growing demand.

Security and Fraud Prevention: As digital payments become more prevalent, the risk of fraud and cyber-attacks also increases. Payment processors are investing heavily in advanced security features, including tokenization, biometric authentication, and machine learning algorithms to detect fraudulent activity in real time. Enhancing security measures is crucial for maintaining consumer trust and ensuring the growth of the payment processing market.

Cryptocurrency and Blockchain Technology: The rise of cryptocurrency has introduced a new dimension to the payment processing market. Some payment processors have started offering support for digital currencies like Bitcoin and Ethereum, enabling businesses to accept cryptocurrency payments. Blockchain technology is also being explored for its potential to streamline payment processes and reduce transaction costs.

Factors Driving Growth

Several factors are driving the growth of the payment processor market, including technological advancements, evolving consumer preferences, and the global shift towards digital transactions. Key growth drivers include:

Increased Digitalization: As more businesses move online, the need for digital payment solutions has surged. The convenience and accessibility of online shopping, combined with the ease of making digital payments, have contributed to the growing reliance on payment processors.

Consumer Demand for Convenience: Consumers are increasingly seeking convenient, fast, and secure payment methods. Digital wallets, mobile payments, and contactless payments are meeting these demands, enabling consumers to make purchases with just a tap or a few clicks.

Government Support for Cashless Societies: Governments around the world are encouraging the adoption of cashless payment systems. This is particularly evident in countries like Sweden, where the use of cash is declining, and in India, where initiatives like the Digital India program have pushed for greater financial inclusion through digital payment methods.

Merchant Demand for Omnichannel Solutions: Businesses are increasingly seeking omnichannel payment solutions to cater to customers across different platforms. Payment processors are responding by offering integrated solutions that allow businesses to accept payments both in-store and online, improving the overall customer experience.

Browse Trending Reports:

https://rutujabhosaleblogs.blogspot.com/2024/11/severe-combined-immunodeficiency-market.html

https://rutujabhosaleblogs.blogspot.com/2024/11/refinery-process-additives-market-size.html

https://rutujabhosaleblogs.blogspot.com/2024/11/hospital-bedsheet-and-pillow-cover.html

https://rutujabhosaleblogs.blogspot.com/2024/11/payment-processor-market-size-share.html

Conclusion

The payment processor market is undergoing rapid transformation, driven by technological innovations, changing consumer preferences, and the global shift toward digital payments. As the market continues to evolve, businesses and consumers alike are benefiting from more convenient, secure, and efficient payment solutions. The future of the payment processor market looks promising, with trends like mobile payments, BNPL, and cryptocurrency likely to continue reshaping the industry for years to come.

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: corporatesales@databridgemarketresearch.com"

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Guest Post: Payment Processor Market here

News-ID: 3751118 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

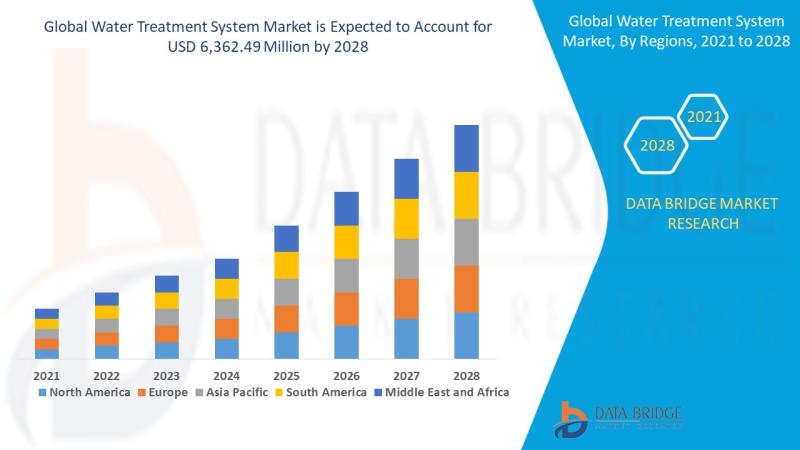

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…