Press release

Neo and Challenger Bank Market Analysis and Forecast to 2033: Market Opportunities, Trends, and Pricing Analysis

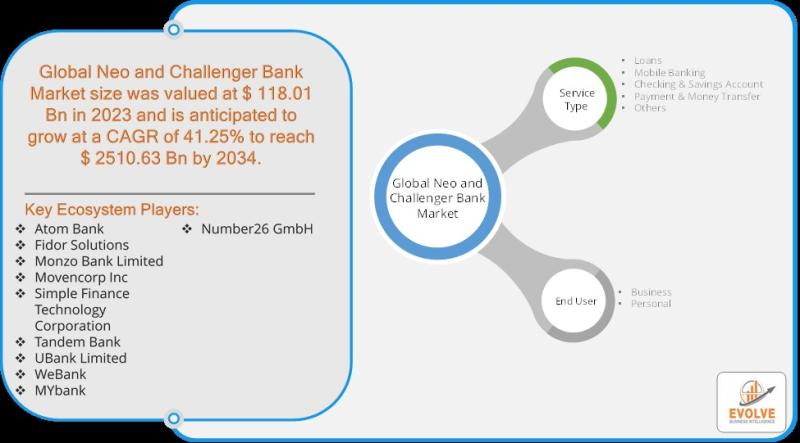

Neo and Challenger Bank Market By Service Type (Loans, Mobile Banking, Checking & Savings Account, Payment & Money Transfer, Others), By End User (Business, Personal), and By Geography-COVID-19 Impact Analysis, Post COVID Analysis, Opportunities, Trends, and Forecast from 2023 to 2033The Neo and Challenger Bank Market is experiencing rapid growth, with the market size projected to reach US$ 118.01 billion in 2023 and expected to expand at a robust CAGR of 41.25% from 2023 to 2033. This surge is primarily driven by technological advancements that enable innovative, user-friendly banking solutions, allowing these digital-first banks to provide a seamless and efficient experience. Neo and challenger banks, which operate exclusively online or with minimal physical branches, are capitalizing on the growing demand for digital banking services and offering more personalized, cost-effective services compared to traditional banks. However, the growth of these digital banks is tempered by concerns over cybersecurity and fraud risks, which continue to hinder wider adoption among some customers who are wary of entrusting their financial data to digital-only institutions. Despite these challenges, opportunities abound, particularly in the expansion of digital banking services to underserved populations and businesses, as well as the increasing acceptance of alternative financial services. As the market matures, these banks are likely to benefit from enhanced security technologies and customer trust, further accelerating their growth in the coming years.

For More Information: https://evolvebi.com/report/global-neo-and-challenger-bank-market-analysis/

The report includes 10 key players in the Neo and Challenger Bank market ecosystem that have been strategically profiled, along with the market ranking/share for major players. The key players profiled in the report are:

• Atom Bank

• Fidor Solutions

• Monzo Bank Limited

• Movencorp Inc

• Simple Finance Technology Corporation

• Tandem Bank

• UBank Limited

• WeBank

• MYbank

• Number26 GmbH

The competitive landscape of the Neo and Challenger Bank Market is dynamic, with numerous innovative players disrupting the traditional banking sector. Leading companies like Atom Bank, Monzo Bank Limited, and Tandem Bank have gained significant traction by offering fully digital banking services, including user-friendly apps, low fees, and tailored financial products. Fidor Solutions and Movencorp Inc are also at the forefront, providing digital banking platforms with advanced features such as personalized savings goals and real-time financial advice. Other notable competitors like Simple Finance Technology Corporation and UBank Limited emphasize customer-centric experiences and financial wellness tools. In China, WeBank and MYbank are leading the charge in digital banking, benefiting from their integration with larger tech ecosystems. Meanwhile, Number26 GmbH (now rebranded as N26) has expanded its operations globally, offering flexible banking solutions to millennials and digitally savvy customers. These challenger banks are capitalizing on the increasing shift towards digital and mobile banking, with a strong focus on innovation, personalization, and cost efficiency. The market is expected to remain competitive, with continued emphasis on enhanced customer experiences, technological advancements, and partnerships to expand service offerings. However, maintaining robust cybersecurity measures and gaining customer trust will remain critical for sustained growth in this highly competitive environment.

For sample report pages - https://evolvebi.com/report/global-neo-and-challenger-bank-market-analysis/

Market Segment By Service Type with focus on market share, consumption trend, and growth rate of Neo and Challenger Bank Market:

o Loans

o Mobile Banking

o Checking & Savings Account

o Payment & Money Transfer

o Others

Market Segment By end-user with focus on market share, consumption trend, and growth rate of Neo and Challenger Bank Market:

o Business

o Personal

Global Neo and Challenger Bank Geographic Coverage:

• North America

o US

o Canada

o Mexico

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Benelux

o Nordic

o Rest of Europe

• Asia Pacific

o China

o Japan

o South Korea

o Indonesia

o Austalia

o Malaysia

o India

o Rest of Asia Pacific

• South America

o Brazil

o Argentina

o Rest of South America

• Middle East & Africa

o Saudi Arabia

o UAE

o Egypt

o South Africa

o Rest of the Middle East & Africa

For any customization, contact us through - https://evolvebi.com/report/global-neo-and-challenger-bank-market-analysis/

Key Matrix for Latest Report Update

• Base Year: 2023

• Estimated Year: 2024

• CAGR: 2024 to 2034

Address

Evolve Business Intelligence

C-218, 2nd floor, M-Cube

Gujarat 396191

India

Contact: +91 635 396 3987

Email: sales@evolvebi.com

Website: https://evolvebi.com/

About EvolveBI

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing innovative solutions to challenging pain points of a business. Our market research reports include data useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate data through our in-house AI-modelled data analysis and forecast tool - EvolveBI. This tool tracks real-time data including, quarter performance, annual performance, and recent developments from fortune's global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neo and Challenger Bank Market Analysis and Forecast to 2033: Market Opportunities, Trends, and Pricing Analysis here

News-ID: 3748161 • Views: …

More Releases from Evolve Business Intelligence

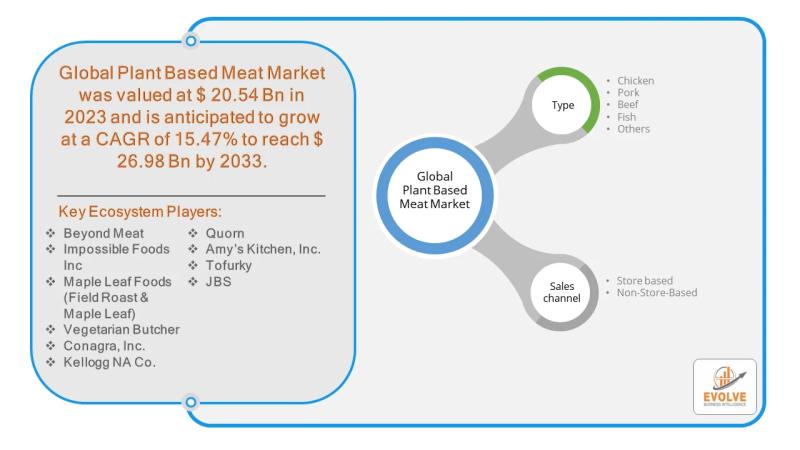

Plant-Based Meat Market Forecast to Reach USD 26.98 Billion by 2033

The plant-based meat market is at a pivotal point, marked by strong growth in the past decade but now facing headwinds. While traditional retail channels have seen recent slowdowns, the non-store-based segment, which includes direct-to-consumer (D2C) e-commerce, meal kits, and food service, presents a significant and largely untapped opportunity. This channel allows brands to bypass the challenges of traditional retail, such as intense competition for shelf space and high listing…

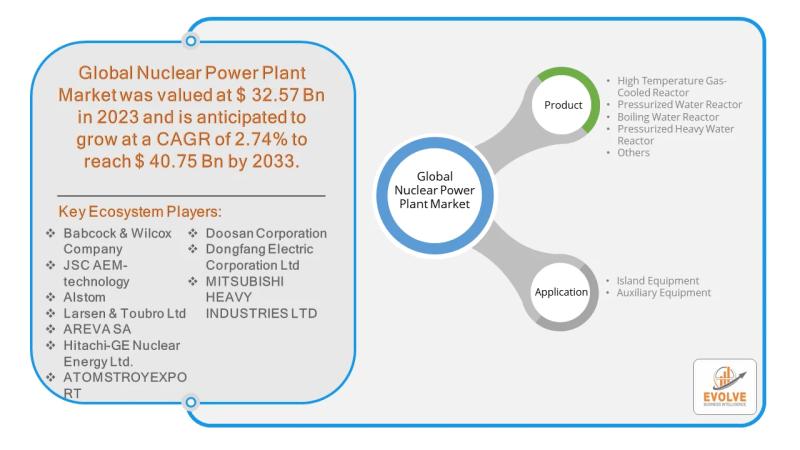

Nuclear Power Plant Market Forecast to Reach USD 40.75 Billion by 2033

As the world seeks a clean, reliable, and sustainable energy future, High Temperature Gas-Cooled Reactors (HTGRs) are emerging as a prime candidate to lead the next generation of nuclear power. This advanced reactor technology, which uses a graphite-moderated core and inert helium coolant, offers a unique blend of inherent safety and versatility that extends well beyond traditional electricity generation. While challenges remain, the opportunity for HTGRs to transform the nuclear…

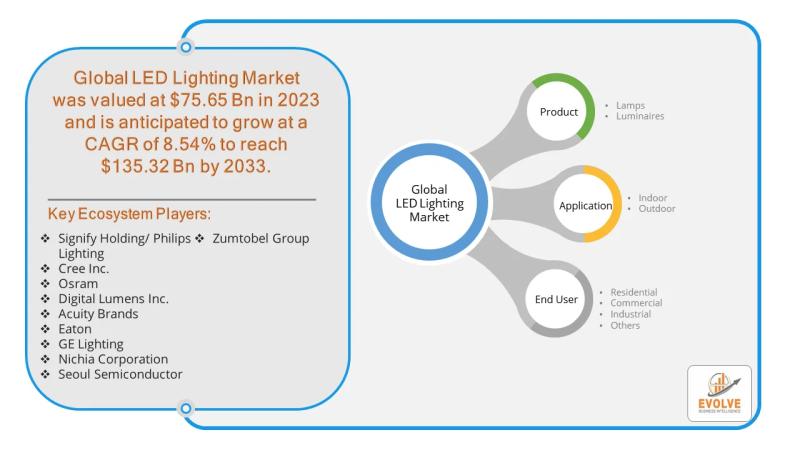

LED Lighting Market Forecast to Reach USD 255.92 Billion by 2035

The global LED lighting market is on a trajectory of significant expansion, fueled by the rising demand for energy-efficient and sustainable lighting solutions. While the market for LED lamps remains strong, luminaires-complete lighting fixtures with integrated LEDs-are emerging as the primary driver of future growth. Valued at an estimated USD 71.59 billion in 2023, the market is projected to surge to over USD 255.92 billion by 2035, with a compound…

Sensor Market Forecast to Reach USD 457.26 Billion by 2032

The global sensor market is at a pivotal point, poised for remarkable growth driven by the proliferation of smart devices, industrial automation, and the Internet of Things (IoT). The market, valued at an estimated USD 241.06 billion in 2024, is projected to expand significantly to approximately USD 457.26 billion by 2032, demonstrating a robust Compound Annual Growth Rate (CAGR) of about 8.5%. Within this dynamic landscape, a key player is…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…