Press release

Automobile Insurance Carriers Market 2024 - Top Manufactures, Growth Rate, Revenue And Forecast To 2033

The Business Research Company recently released a comprehensive report on the Global Automobile Insurance Carriers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.According to The Business Research Company's, The automobile insurance carriers market size has grown rapidly in recent years. It will grow from $847.06 billion in 2023 to $933.3 billion in 2024 at a compound annual growth rate (CAGR) of 10.2%. The growth in the historic period can be attributed to motorization and vehicle ownership growth, legal requirements and regulatory compliance, population and urbanization trends, rise in traffic accidents and collisions, economic growth and affordability..

The automobile insurance carriers market size is expected to see rapid growth in the next few years. It will grow to $1430.69 billion in 2028 at a compound annual growth rate (CAGR) of 11.3%. The growth in the forecast period can be attributed to continued vehicle ownership growth, evolution of legal and regulatory landscape, urban mobility challenges, changing consumer behavior and preferences, economic trends and affordability factors.. Major trends in the forecast period include focus on cybersecurity, climate change impact and catastrophe modeling, customer-centric services, regulatory compliance and changes, integration of big data analytics..

Get The Complete Scope Of The Report @

https://www.thebusinessresearchcompany.com/report/automobile-insurance-carriers-global-market-report

Market Drivers and Trends:

The rising number of accidents is expected to propel the growth of the automotive insurance carrier market going forward. A traffic or road accident is defined as an unpleasant event that can causes injury, damage, or death unexpectedly. Automotive insurance companies, through their insurance policies, safeguard customers financially when their automobiles get damaged in an accident or a mishap by paying compensation. Therefore, the rise in the number of accidents is driving the growth of the automotive insurance carrier market. For instance, in December 2022, according to the Ministry of Road Transport and Highways, a ministry of the Government of India, the number of traffic accidents in India increased by 12.6%, from 366,138 in 2020 to 412,432 in 2021. Furthermore, in May 2022, according to the National Highway Traffic Safety Administration, a transportation agency of the U.S. federal government, around 42,915 people died in accidents in 2021, a 10.5% increase from 38,824 fatalities in 2020. Therefore, the rise in the number of accidents is driving the demand for the automotive insurance carriers market.

Product innovations are the key trends gaining popularity in the automotive insurance carriers market. Companies operating in the automotive insurance carriers market are adopting innovations to strengthen their position in the market. For instance, in January 2023, New India Assurance (NIA), an India-based general insurance company, launched the Pay as You Drive (PAYD) policy. PAYD policy has the provision of saving money through discounts on renewal premiums, provided the vehicle runs within the specified kilometers. In addition, if the vehicle has been driven beyond the threshold limit, the coverage will continue for the policy's remaining duration.

Key Benefits for Stakeholders:

• Comprehensive Market Insights: Stakeholders gain access to detailed market statistics, trends, and analyses that help them understand the current and future landscape of their industry.

• Informed Decision-Making: The reports provide crucial data that support strategic decisions, reducing risks and enhancing business planning.

• Competitive Advantage: With in-depth competitor analysis and market share information, stakeholders can identify opportunities to outperform their competition.

• Tailored Solutions: The Business Research Company offers customized reports that address specific needs, ensuring stakeholders receive relevant and actionable insights.

• Global Perspective: The reports cover various regions and markets, providing a broad view that helps stakeholders expand and operate successfully on a global scale.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of Our Research Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=9742&type=smp

Major Key Players of the Market:

State Farm Mutual Automobile Insurance Company; Government Employees Insurance Company; The Allstate Corporation; People's Insurance Company Of China; China Pacific Insurance Co.; Universal Sompo General Insurance Company Limited; Ping An Insurance (Group) Company of China Ltd.; Berkshire Hathaway Inc.; Admiral Group plc; Tokio Marine Group; Allianz SE; Progressive Casualty Insurance Company; Zurich Insurance Group plc; Farmers Insurance Group; Liberty Mutual Holding Company Inc.; RAC Motoring Services Ltd.; Clements & Company and later Clements International; National Farmers' Union Mutual Insurance Society Limited (NFU Mutual); United Services Automobile Association; RSA Insurance Group Ltd.; American International Group Inc.; Assicurazioni Generali S.p.A.; AXA Cooperative Insurance Company; Bajaj Allianz General Insurance Company Limited; Mitsui Sumitomo Insurance Co. Ltd.; Reliance General Insurance Company Limited; The Hanover Insurance Group Inc.; American Family Mutual Insurance Company; AmTrust North America Inc.; Automobile Club MI Group; Auto-Owners Insurance Co.; CSAA Insurance; Erie Insurance Co.; Mapfre SA; Mercury General Corp.; Nationwide Mutual Insurance Company; Security National Insurance Company; Sentry Insurance Group; Technology Insurance Company; Hartford Financial Services Group Inc.; Travelers Companies Inc.

Automobile Insurance Carriers Market 2024 Key Insights:

• The automobile insurance carriers market will grow to $1430.69 billion in 2028 at a compound annual growth rate (CAGR) of 11.3%.

• Surge In Accidents Fuels Growth Of Automotive Insurance Carrier Market

• Innovations Reshaping The Automotive Insurance Carriers Market

• North America was the largest region in the automobile insurance carriers' market in 2023

We Offer Customized Report, Click @

https://www.thebusinessresearchcompany.com/Customise?id=9742&type=smp

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automobile Insurance Carriers Market 2024 - Top Manufactures, Growth Rate, Revenue And Forecast To 2033 here

News-ID: 3748089 • Views: …

More Releases from The Business research company

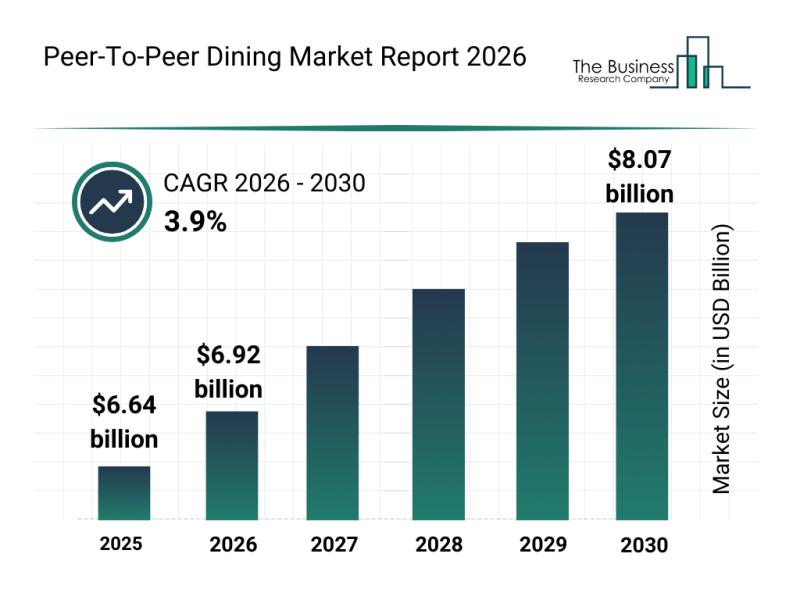

Peer-to-Peer Dining Market Overview: Major Segments, Strategic Developments, and …

The peer-to-peer dining market is on track for steady expansion in the coming years, driven by shifting consumer preferences and technological advancements. This sector is becoming increasingly popular as people seek unique culinary experiences that go beyond traditional restaurant dining. Let's explore the market's size, key players, emerging trends, and detailed segmentation to understand its future trajectory.

Projected Market Value and Growth Outlook for the Peer-To-Peer Dining Market

The peer-to-peer…

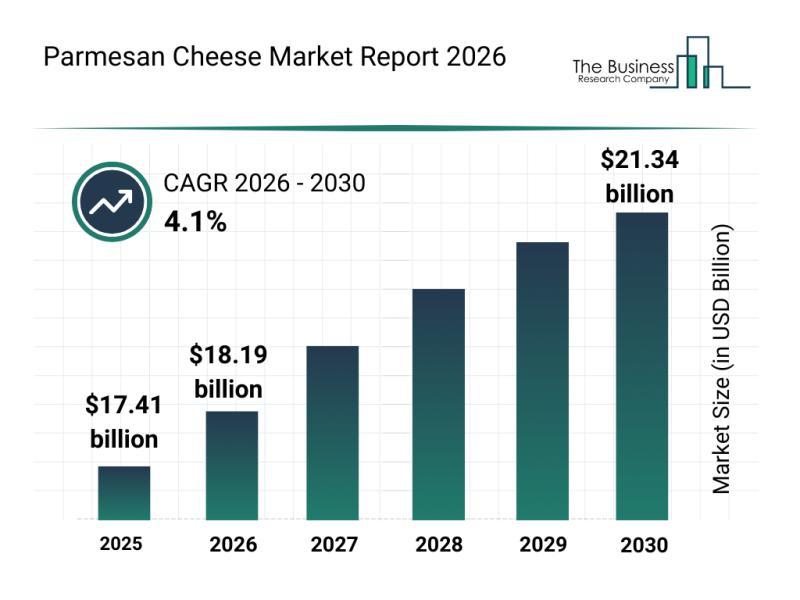

Emerging Sub-Segments Transforming the Parmesan Cheese Market Landscape

The parmesan cheese market is set for steady expansion over the coming years, driven by evolving consumer preferences and innovations within the dairy sector. This overview highlights the market's expected growth, key players, emerging trends, and major segments shaping the future of parmesan cheese worldwide.

Forecasted Growth Trajectory of the Parmesan Cheese Market

By 2030, the parmesan cheese market is projected to reach a valuation of $21.34 billion, growing at…

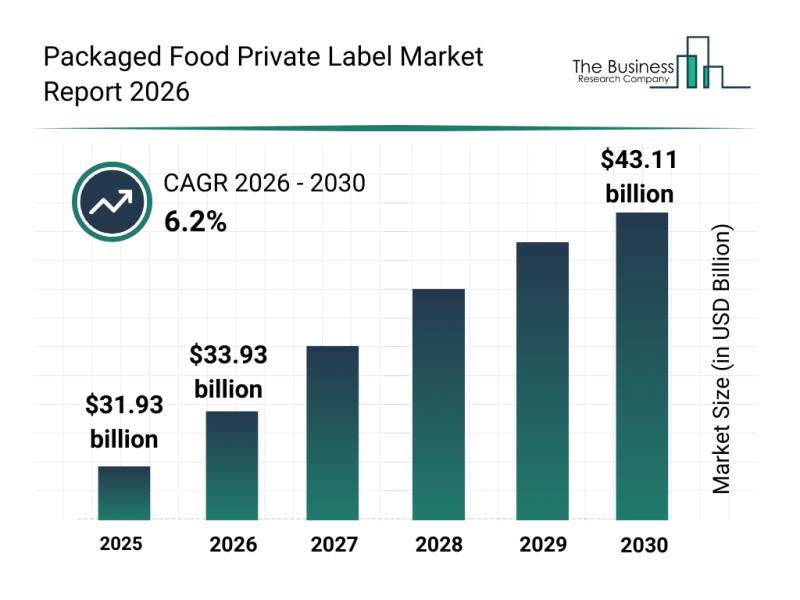

Key Players and Market Competition in the Packaged Food Private Label Sector

The packaged food private label sector is set to experience significant expansion over the coming years, driven by evolving consumer preferences and strategic innovations. As retailers focus on enhancing their brand offerings and sustainability efforts, this market is poised for remarkable growth and transformation. Below, we explore the market's size projections, leading players, and emerging trends shaping its future.

Projected Growth Trajectory of the Packaged Food Private Label Market

The…

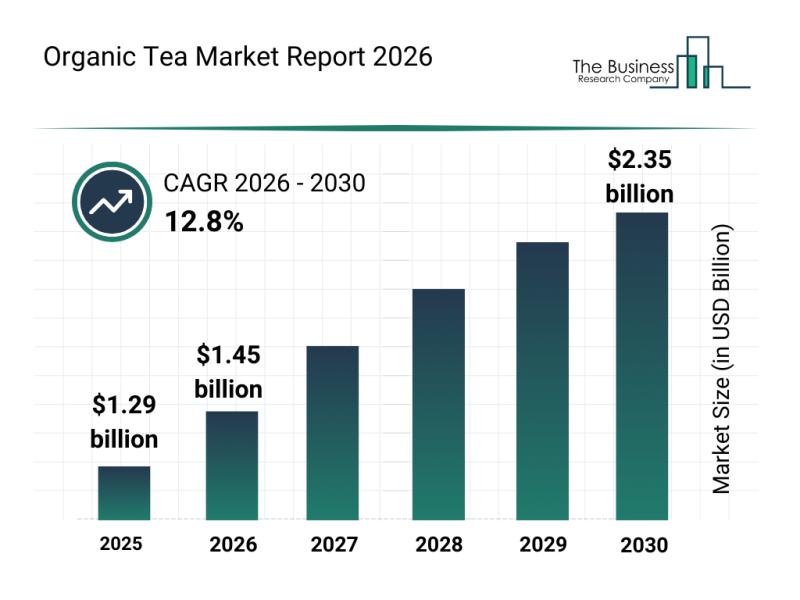

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Or …

The organic tea market is attracting significant attention as consumers increasingly turn to health-conscious and sustainable beverage options. With shifting preferences towards wellness and environmentally friendly products, this sector is set for substantial growth in the coming years. Let's explore the expected market valuation, leading players, current trends, and key segments shaping the organic tea industry.

Forecasting the Organic Tea Market Size and Growth by 2030

The organic tea market…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…