Press release

Blockchain Insurance Market Size Growth Rate by Type, Application, Sales Estimates 2030

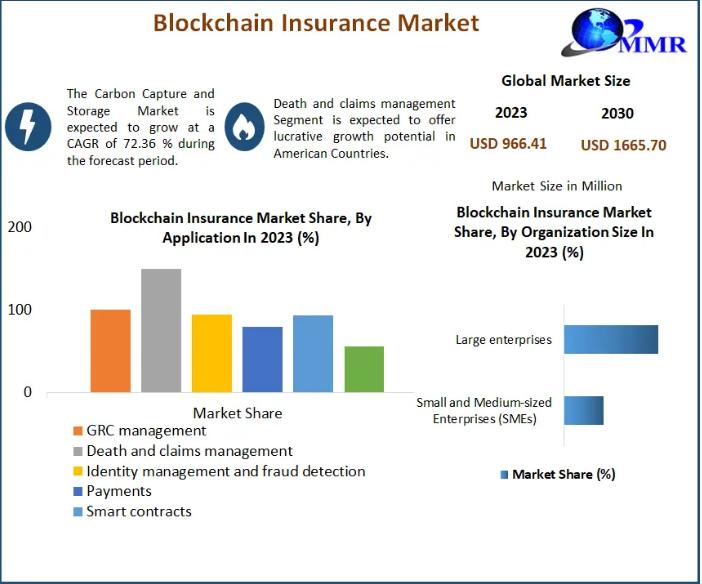

The Blockchain Insurance Market size was valued at USD 966.41 Million in 2023 and the total Blockchain Insurance revenue is expected to grow at a CAGR of 72.36 % from 2024 to 2030, reaching nearly USD 1665.70 Million by 2030.𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 Overview:

The blockchain insurance market represents a transformative shift in the insurance industry, leveraging blockchain technology to enhance transparency, efficiency, and trust. By enabling secure and immutable record-keeping, blockchain facilitates seamless claim processing, fraud detection, and policy management. This innovative approach eliminates intermediaries, reduces operational costs, and provides customers with a more streamlined and trustworthy experience. As digital transformation accelerates across industries, the integration of blockchain technology in insurance is gaining significant traction.

𝐆𝐞𝐭 𝐘𝐨𝐮𝐫 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐭𝐡𝐞 𝐋𝐚𝐭𝐞𝐬𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐬𝐢𝐠𝐡𝐭: https://www.maximizemarketresearch.com/request-sample/11489/

Drivers in the 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 :

The blockchain insurance market is primarily driven by the need for enhanced security and transparency in insurance operations. Increasing instances of fraud in traditional systems have pushed insurers to adopt blockchain to ensure data integrity and reduce risks. Furthermore, the growing demand for cost-efficient claim management processes and the rising focus on customer-centric solutions have fueled the adoption of blockchain. The technology's ability to automate processes through smart contracts has also emerged as a critical driver, enabling faster claim settlements and minimizing human errors.

𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 Trends:

Key trends in the blockchain insurance market include the growing adoption of decentralized finance (DeFi) models and smart contracts, which automate and streamline processes. Insurtech startups are increasingly leveraging blockchain to disrupt conventional models, providing innovative solutions for policy underwriting and claim settlements. Additionally, partnerships between insurance companies and blockchain technology providers are becoming prevalent, driving collaborative innovation. The rise of parametric insurance, which uses blockchain for instantaneous payouts based on predefined triggers, is also gaining attention.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐓𝐨𝐝𝐚𝐲 𝐟𝐨𝐫 𝐂𝐮𝐬𝐭𝐨𝐦 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬: https://www.maximizemarketresearch.com/inquiry-before-buying/11489/

𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 Opportunities:

The blockchain insurance market presents substantial opportunities for insurers to improve operational efficiency and customer satisfaction. Emerging markets, where insurance penetration remains low, offer untapped potential for blockchain-based microinsurance solutions. Additionally, the integration of blockchain with technologies like artificial intelligence and the Internet of Things (IoT) can further revolutionize risk assessment and personalized policies. As regulatory frameworks evolve to support blockchain adoption, insurers have the opportunity to expand their offerings and enter new markets.

What is 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 Regional Insight?

Regionally, North America leads the blockchain insurance market due to its advanced technological infrastructure and early adoption of blockchain across industries. Europe follows closely, with robust regulatory frameworks and a high focus on innovation in the financial services sector. The Asia-Pacific region is witnessing rapid growth, driven by the increasing digitization of insurance processes and the rising popularity of blockchain technology in countries like China, India, and Japan. Meanwhile, emerging economies in Latin America and the Middle East are exploring blockchain solutions to enhance insurance accessibility and efficiency.

𝐂𝐮𝐫𝐢𝐨𝐮𝐬 𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬? 𝐆𝐫𝐚𝐛 𝐘𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐓𝐨𝐝𝐚𝐲: https://www.maximizemarketresearch.com/request-sample/11489/

Segmentation Analysis of the 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 :

by Provider

Application and solution provider

Middleware provider

Infrastructure and protocols provider

by Application

GRC management

Death and claims management

Identity management and fraud detection

Payments

Smart contracts

Others (content storage management and customer communication)

Who is the largest manufacturers of 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 worldwide?

North America:

1. Lemonade

2. MetLife

3. AXA XL

4. State Farm

5. Liberty Mutual

Europe:

1. B3i (Blockchain Insurance Industry Initiative)

2. Allianz

3. Generali

4. Mapfre

5. Swiss Re

Asia-Pacific:

1. Ping An Insurance

2. Bajaj Allianz General Insurance

3. Sompo Japan Nipponkoa Insurance

4. Tokio Marine & Nichido Fire Insurance

5. QBE Insurance

𝐊𝐧𝐨𝐰 𝐌𝐨𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐓𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.maximizemarketresearch.com/market-report/blockchain-insurance-market/11489/

Key Offerings:

Past Market Size and Competitive Landscape

𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Explore More: Visit Our Website for Additional Reports:

♦ Helicopter Market https://www.maximizemarketresearch.com/market-report/global-helicopter-market/15356/

♦ Xylitol Market https://www.maximizemarketresearch.com/market-report/xylitol-market/13398/

♦ Caustic Soda Market https://www.maximizemarketresearch.com/market-report/global-caustic-soda-market/31611/

♦ Biostimulants Market https://www.maximizemarketresearch.com/market-report/biostimulants-market/604/

♦ Air Purifier Market https://www.maximizemarketresearch.com/market-report/global-air-purifier-market/102643/

♦ Ethanol Market https://www.maximizemarketresearch.com/market-report/global-ethanol-market/25241/

♦ Baby & Pregnancy Skincare Products Market https://www.maximizemarketresearch.com/market-report/baby-pregnancy-skincare-products-market/122817/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Blockchain Insurance Market Size Growth Rate by Type, Application, Sales Estimates 2030 here

News-ID: 3743284 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Morocco Cosmetics Market Poised for Robust Growth, Projected to Reach USD 3.59 B …

Global Morocco Cosmetics Market Overview

The Global Morocco Cosmetics Market is witnessing significant expansion, driven by rising consumer awareness regarding personal grooming, skincare, and wellness. Valued at USD 1.82 billion in 2024, the market is projected to grow at a strong compound annual growth rate (CAGR) of 7.92% from 2024 to 2032, reaching nearly USD 3.59 billion by the end of the forecast period. This steady growth reflects increasing demand for…

Virtual Fitting Room Market to Reach US$ 19.32 Billion by 2030, Driven by Rapid …

The Global Virtual Fitting Room Market is witnessing remarkable growth, fueled by the rapid digital transformation of the fashion and retail industry. Valued at US$ 5.20 billion in 2023, the market is projected to expand at a robust compound annual growth rate (CAGR) of 20.6% from 2024 to 2030, reaching nearly US$ 19.32 billion by 2030. This strong growth trajectory reflects increasing investments in immersive technologies, rising e-commerce penetration, and…

Car Care Products Market to Reach USD 18.02 Billion by 2032, Growing at a CAGR o …

The global car care products market is witnessing steady expansion, driven by rising vehicle ownership, increasing consumer awareness about vehicle maintenance, and rapid technological innovations. According to recent industry analysis, the market was valued at USD 13.96 billion in 2024 and is projected to reach USD 18.02 billion by 2032, registering a compound annual growth rate (CAGR) of 4.2% during the forecast period. This growth reflects the increasing importance of…

Car Care Products Market to Reach USD 18.02 Billion by 2032, Growing at a CAGR o …

The global car care products market is witnessing steady expansion, driven by rising vehicle ownership, increasing consumer awareness about vehicle maintenance, and rapid technological innovations. According to recent industry analysis, the market was valued at USD 13.96 billion in 2024 and is projected to reach USD 18.02 billion by 2032, registering a compound annual growth rate (CAGR) of 4.2% during the forecast period. This growth reflects the increasing importance of…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…