Press release

Cryptocurrency Exchange Platform Market Size will grow 11.8% by 2032

The Cryptocurrency Exchange Platform Market has experienced significant growth in recent years, fueled by the rising adoption of cryptocurrencies and increased demand for secure, user-friendly platforms for buying, selling, and trading digital assets. Valued at USD 4.89 billion in 2022, the market is projected to grow from USD 5.47 billion in 2023 to USD 14.92 billion by 2032, at a robust compound annual growth rate (CAGR) of 11.8% during the forecast period of 2024-2032.Key Companies in the Cryptocurrency Exchange Platform Market Include

Binance, KuCoin, Huobi Global, Kraken, Crypto.com, Gate.io, OKX, Phemex, Coinbase, Bitfinex, Gemini, Bybit, Bittrex, FTX

Get a FREE Sample Report PDF Here: https://www.marketresearchfuture.com/sample_request/22319

Market Overview

Cryptocurrency exchanges facilitate the trading of digital currencies and assets, providing a vital infrastructure that connects buyers and sellers in the decentralized financial landscape. These platforms enable individuals and institutions to participate in cryptocurrency markets by offering wallet services, trading tools, and secure transactions. As the popularity of cryptocurrencies like Bitcoin, Ethereum, and emerging digital assets rises, so does the demand for sophisticated, secure, and efficient exchange platforms.

Key Market Drivers

Rising Popularity of Cryptocurrencies

The adoption of cryptocurrencies continues to grow globally as consumers and businesses seek decentralized alternatives to traditional financial systems. Increased use of blockchain technology and digital assets has driven demand for reliable platforms to facilitate seamless cryptocurrency transactions.

Advancements in Blockchain Technology

Blockchain innovation is driving cryptocurrency platform advancements, with improvements in security, transaction speeds, and decentralization enhancing user trust and experience. This technological progress not only attracts more retail investors but also garners interest from institutional investors, which in turn fuels demand for advanced trading platforms.

Growing Institutional Investment

Institutional investors are increasingly participating in cryptocurrency markets, seeking to diversify their portfolios. The entry of banks, hedge funds, and major corporations into the cryptocurrency space has spurred demand for exchanges that provide advanced trading features, regulatory compliance, and enhanced liquidity.

Demand for Decentralized Finance (DeFi) Solutions

The DeFi movement aims to create open-source, permissionless, and decentralized alternatives to traditional financial services, such as lending, borrowing, and trading. Cryptocurrency exchanges play a critical role in DeFi by providing access to digital assets and enabling users to participate in decentralized applications, adding another layer of growth to the market.

Regional Insights

North America: North America is one of the leading markets for cryptocurrency exchanges, driven by high adoption rates in the United States and Canada. The presence of major cryptocurrency exchanges and supportive regulatory efforts in the region contribute to market growth.

Asia-Pacific: Asia-Pacific is expected to see substantial growth in the cryptocurrency exchange market. Countries such as Japan, South Korea, and Singapore are fostering cryptocurrency adoption through supportive regulations and innovative blockchain projects, making the region a hub for digital assets.

Europe: Europe has a growing market for cryptocurrency exchanges, with countries like Germany and Switzerland at the forefront of cryptocurrency adoption and regulation. Europe's financial sector is embracing digital assets as part of broader digital transformation efforts, driving demand for robust cryptocurrency platforms.

Market Segmentation

By Type

Centralized Exchanges (CEXs)

Decentralized Exchanges (DEXs)

Centralized exchanges dominate the market due to their user-friendly interfaces, high liquidity, and robust security features. However, decentralized exchanges are gaining traction, especially among users seeking greater privacy and control over their assets.

By End-User

Retail Investors

Institutional Investors

Retail investors form the largest segment due to increasing interest from individuals looking to diversify their investments. However, institutional investors are becoming a growing segment as they seek secure platforms that offer advanced trading tools and compliance features.

By Application

Mobile Applications

Desktop Applications

Mobile applications are increasingly popular, especially in regions with high mobile penetration rates. Mobile platforms provide accessibility and convenience, allowing users to manage their cryptocurrency portfolios from anywhere.

Know More about the Cryptocurrency Exchange Market Report: https://www.marketresearchfuture.com/reports/cryptocurrency-exchange-platform-market-22319

Competitive Landscape

The cryptocurrency exchange market is competitive, with major players including Coinbase, Binance, Kraken, Huobi Global, and Gemini. These companies focus on product development, regulatory compliance, and expanding their offerings to attract a diverse user base. Additionally, the market is witnessing a wave of new entrants and innovation from decentralized exchanges.

Key Developments:

Product Diversification: Leading exchanges are diversifying their offerings by adding support for more cryptocurrencies, advanced trading tools, staking services, and educational resources to attract a wider audience.

Regulatory Compliance: To gain credibility and expand into new markets, major players are increasingly focused on regulatory compliance. This approach helps them attract institutional investors who prioritize security and adherence to financial regulations.

Future Prospects

As cryptocurrency adoption expands, the cryptocurrency exchange platform market is set to see steady growth. Increasing demand from both retail and institutional investors, coupled with advancements in DeFi, blockchain technology, and regulatory clarity, are expected to create substantial growth opportunities. Additionally, with the rise of stablecoins and central bank digital currencies, cryptocurrency exchanges are likely to serve as critical infrastructure, bridging traditional financial systems with the world of digital assets.

Challenges

Despite growth opportunities, the market faces challenges, including regulatory uncertainty in several countries, cybersecurity concerns, and volatility in cryptocurrency markets. Navigating these challenges will be essential for platforms to maintain user trust and continue growing.

Top Trending Research Report:

Capital Expenditure Market https://www.marketresearchfuture.com/reports/capital-expenditure-market-29115

Currency Management Market https://www.marketresearchfuture.com/reports/currency-management-market-28784

Digital Transformation In BFSI Market https://www.marketresearchfuture.com/reports/digital-transformation-in-bfsi-market-29558

Banking Encryption Software Market https://www.marketresearchfuture.com/reports/banking-encryption-software-market-29232

Art Insurance Market https://www.marketresearchfuture.com/reports/art-insurance-market-29803

Business Travel Accident Insurance Market https://www.marketresearchfuture.com/reports/business-travel-accident-insurance-market-29709

Corporate Banking Market https://www.marketresearchfuture.com/reports/corporate-banking-market-29725

CFD Trading Affiliate Programs Market https://www.marketresearchfuture.com/reports/cfd-trading-affiliate-programs-market-29947

Commercial Auto Insurance Market https://www.marketresearchfuture.com/reports/commercial-auto-insurance-market-23496

Alternative Legal Service Providers Market https://www.marketresearchfuture.com/reports/alternative-legal-service-providers-market-31274

About Market Research Future:

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact Us:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cryptocurrency Exchange Platform Market Size will grow 11.8% by 2032 here

News-ID: 3734690 • Views: …

More Releases from MRFR ( Market Research Future Report)

Commercial Aircraft Engine Market Size to Reach USD 237.64 Billion by 2035, Grow …

The Commercial Aircraft Engine Market is set for dynamic expansion over the next decade, powered by rapid growth in global air travel demand, ongoing fleet modernization, and technological leaps toward fuel efficiency and sustainability. Commercial aircraft engines - typically turbofan and turboprop powerplants - are central to airline operations, influencing fuel consumption, operating costs, and environmental compliance. According to Market Research Future (MRFR), the market was valued at about USD…

Aircraft Turbine Engine Market Size to Reach USD 75.89 Billion by 2035, Growing …

The Aircraft Turbine Engine Market is entering a sustained growth phase driven by rising global air travel, fleet modernization efforts, and advances in engine technologies that prioritize fuel efficiency and emissions reduction. Turbine engines - including turbofan, turbojet, turboprop, and turboshaft types - are essential propulsion systems for commercial, business, and military aircraft. According to Market Research Future (MRFR), the market was valued at approximately USD 43.58 billion in 2024…

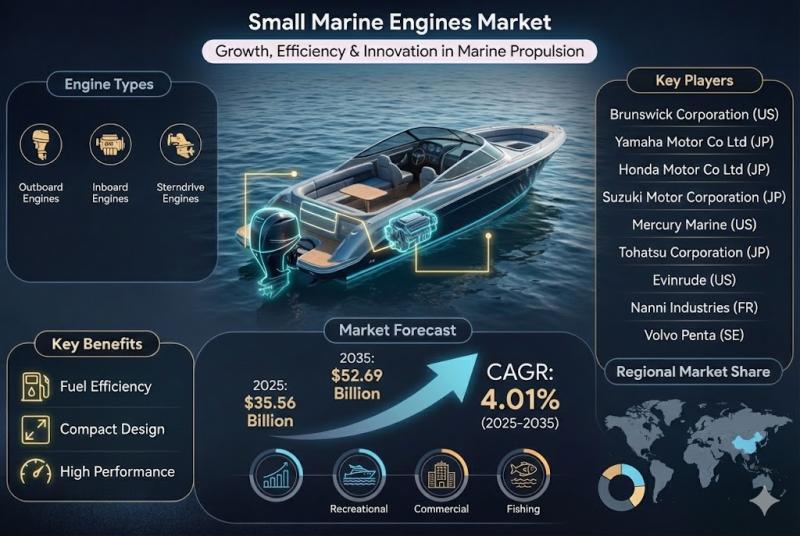

Small Marine Engines Market Size to Reach USD 52.69 Billion by 2035, Growing at …

The global Small Marine Engines Market is positioned for steady growth as demand rises for propulsion systems in recreational boats, support vessels, coastal craft, and other small-to-medium watercraft. According to Market Research Future, the small marine engines market was estimated at USD 34.19 billion in 2024 and is projected to grow to approximately USD 35.56 billion in 2025. Over the forecast period from 2025 to 2035, the market is expected…

Aviation Engine MRO Market Size to Reach USD 73.58 Billion by 2035, Growing at a …

The Aviation Engine Maintenance, Repair, and Overhaul (MRO) Market is a critical backbone of the global aviation industry, ensuring that aircraft engines - among the most complex and costly components - remain safe, efficient, and airworthy throughout their service life. As air traffic continues to rebalance and grow globally, the demand for engine MRO services has surged, driven by fleet expansions, aging aircraft, and the high operational costs associated with…

More Releases for Crypto

Next 100x Crypto Analysis: ZKP Crypto & Mutuum Finance Compete for Best Presale …

The crypto market stands at a turning point. Bitcoin's 21 Week EMA has moved below its 50 Week EMA, a rare bearish signal last seen in April 2022 before a long bear market phase. Bitcoin is trading near $78,800. Additional strain came from inflation data released this morning, which shifted expectations away from a pause in rate policy and toward possible hikes.

Ethereum continues to lag around $2,300 and remains…

Top 10 Crypto Watchlist: Apeing's Upcoming Crypto Presale

Crypto Watchlist: 10 Altcoins Gain Momentum as Apeing's Upcoming Crypto Presale Climbs Search Rankings

The market never announces its turning points. One week feels unstoppable, the next feels empty. Charts still exist, indicators still flash, and opinions still flood timelines. Yet when fear creeps in, action disappears. People wait. They hesitate. They promise themselves clarity will arrive tomorrow.

That pause is where most losses begin. Crypto does not reward comfort. It rewards…

Top 10 Crypto Watchlist: Apeing's Upcoming Crypto Presale

Crypto Watchlist: 10 Altcoins Gain Momentum as Apeing's Upcoming Crypto Presale Climbs Search Rankings

The market never announces its turning points. One week feels unstoppable, the next feels empty. Charts still exist, indicators still flash, and opinions still flood timelines. Yet when fear creeps in, action disappears. People wait. They hesitate. They promise themselves clarity will arrive tomorrow.

That pause is where most losses begin. Crypto does not reward comfort.…

7 Breakthrough Crypto Stars: $APEING Dominates 1000x Crypto

Time is running out for anyone serious about catching the next 1000x crypto rocket. Apeing ($APEING) https://www.apeing.com/ is making waves for early movers, offering whitelist access that could define who wins big and who watches from the sidelines. This isn't a drill. Phase 1 entry is still open, and history has proven that hesitation is the kryptonite of crypto gains. Savvy investors and meme-lovers alike are already strategizing their moves,…

Crypto Asset Management Service Market Next Big Thing | Barracuda, Crypto Financ …

Latest Study on Industrial Growth of Crypto Asset Management Service Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Crypto Asset Management Service market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the…

Crypto Consulting Services Market Key Players: Crypto Greeks, Crypto Consulting …

The crypto consulting services market refers to the industry that provides advice, guidance, and support to individuals and organizations that are involved in the cryptocurrency and blockchain space. This market has emerged in response to the increasing demand for expertise in this area, as more and more people are becoming interested in cryptocurrencies and blockchain technology.

Download a FREE Sample Report at https://www.reportsnreports.com/contacts/requestsample.aspx?name=6994775

The below companies that are profiled have been…