Press release

Car insurance market will grow at 4.42% CAGR by 2032

The global car insurance market is on a growth trajectory, fueled by an increasing number of vehicles, rising accident rates, and regulatory mandates for vehicle insurance in many countries. The market was valued at USD 2.08 billion in 2022 and is projected to grow from USD 2.17 billion in 2023 to USD 3.21 billion by 2032, representing a compound annual growth rate (CAGR) of approximately 4.42% from 2024 to 2032. This growth is expected to be driven by evolving consumer needs, advancements in technology, and a rise in demand for personalized insurance offerings.Key Companies in the Car Insurance Market Include

State Farm Insurance, Zurich Insurance Group, Allstate, Geico, MS Insurance Group, AXA, Farmers Insurance Group, MetLife, Allianz, Liberty Mutual Insurance, Generali, Berkshire Hathaway, CHUBB, Travelers Insurance, Progressive Corporation

Get a FREE Sample Report PDF Here: https://www.marketresearchfuture.com/sample_request/22576

Market Overview

Car insurance is a critical aspect of vehicle ownership, providing financial protection against losses arising from traffic accidents, theft, natural disasters, and other unexpected events. The market is highly competitive and influenced by factors like regional insurance regulations, technological advancements in data analytics and telematics, and consumer preferences for customized policies. As insurance companies continue to innovate with digital solutions and personalized packages, the market's growth potential is becoming increasingly significant.

Key Market Drivers

Increasing Vehicle Ownership and Road Traffic

The rise in disposable income and urbanization has led to increased vehicle ownership globally, boosting demand for car insurance. More vehicles on the road mean a greater need for insurance coverage, particularly as accident rates climb in high-traffic regions.

Regulatory Requirements

Many countries mandate car insurance, making it a non-optional purchase for vehicle owners. Stringent insurance regulations, especially in developed markets, ensure that every car on the road has adequate coverage, which in turn bolsters the market.

Advancements in Telematics and Data Analytics

The integration of telematics devices, which track driving behavior and mileage, enables insurers to offer usage-based insurance (UBI). UBI policies allow customers to pay premiums based on their driving habits, creating incentives for safer driving and appealing to customers looking for tailored policies.

Digital Transformation and Ease of Access

The rise of digital platforms has made it easier for customers to compare, purchase, and manage insurance policies online. Many insurers now offer end-to-end digital solutions, simplifying the claims process and improving customer experience, which attracts new customers and retains existing ones.

Market Segmentation

By Type of Coverage

Third-Party Liability: Covers legal liabilities in case of damage to another person's property or injury.

Comprehensive Coverage: Provides broader protection, covering both third-party liabilities and damages to the insured vehicle.

Comprehensive coverage is gaining popularity due to its all-inclusive nature, providing customers with greater peace of mind.

By Distribution Channel

Direct Sales: Policies purchased directly from insurance providers through digital platforms or branch offices.

Agents and Brokers: Third-party intermediaries offering car insurance policies on behalf of insurers.

The direct sales channel is expanding rapidly due to the convenience of online platforms and mobile applications that enable customers to make informed decisions.

By Vehicle Type

Passenger Vehicles: The dominant segment due to the sheer volume of personal vehicles on the road.

Commercial Vehicles: Includes trucks, buses, and other vehicles used for business purposes, requiring specialized insurance policies.

Passenger vehicles account for the largest share of the market, but commercial vehicle insurance is also seeing growth due to the rise in transportation and logistics services.

Regional Insights

North America: North America leads the global car insurance market, with a mature insurance landscape and stringent vehicle insurance regulations. The United States and Canada both have high car ownership rates and well-established insurance infrastructures.

Europe: In Europe, car insurance is growing steadily, supported by a strong regulatory environment. Countries like the United Kingdom, Germany, and France have high vehicle density, and governments actively enforce mandatory insurance policies.

Asia-Pacific: The APAC region is expected to experience the highest growth in the coming years, fueled by rising income levels, increasing car ownership, and expanding insurance awareness in emerging economies like China and India.

Latin America and the Middle East & Africa: While smaller in terms of market size, these regions are seeing growing demand for car insurance due to rising vehicle sales and regulatory initiatives to improve road safety.

Know More about the Car Insurance Market Report: https://www.marketresearchfuture.com/reports/car-insurance-market-22576

Competitive Landscape

The car insurance market is highly competitive, with key players including Allianz SE, AXA, GEICO, Progressive Corporation, and State Farm. These companies focus on offering a wide range of insurance products and are investing heavily in digital technology to streamline their services and enhance customer engagement.

Key Developments:

Product Innovations: Insurers are increasingly introducing new products tailored to specific customer segments, such as young drivers, low-mileage drivers, and fleet operators.

Mergers and Acquisitions: To expand their market presence and increase market share, leading players are merging with or acquiring smaller insurers, particularly in emerging markets.

Future Prospects and Trends

Growth in Usage-Based Insurance (UBI)

UBI policies, which calculate premiums based on driving behavior, are becoming more popular among customers seeking lower costs and flexible payment options. As telematics becomes more advanced, UBI adoption is expected to grow, providing a lucrative opportunity for insurers.

AI and Automation in Claims Processing

Insurers are increasingly leveraging artificial intelligence (AI) to automate the claims process, allowing for faster and more efficient handling of claims. Automated claims processing enhances customer satisfaction and reduces operational costs, making it a critical growth factor.

Integration of Blockchain for Data Security

Blockchain technology is being explored by some insurers to enhance data security, transparency, and efficiency in processing transactions and managing records, particularly in combating insurance fraud.

Growing Demand for Comprehensive and All-Risk Policies

With natural disasters and theft incidents on the rise, demand for comprehensive policies that offer extensive protection is increasing. Customers are more willing to pay higher premiums for policies that cover a wide range of risks.

Top Trending Research Report:

Digital Payment Healthcare Market https://www.marketresearchfuture.com/reports/digital-payment-healthcare-market-7977

Automotive Insurance Market https://www.marketresearchfuture.com/reports/automotive-insurance-market-7793

Online Payment Gateway Market https://www.marketresearchfuture.com/reports/online-payment-gateway-market-6347

BFSI Security Market https://www.marketresearchfuture.com/reports/bfsi-security-market-1810

Account Payable Market https://www.marketresearchfuture.com/reports/account-payable-market-8683

Anti Money Laundering Solutions Market https://www.marketresearchfuture.com/reports/anti-money-laundering-solutions-market-24771

Crypto Payment Gateway Market https://www.marketresearchfuture.com/reports/crypto-payment-gateway-market-24736

B2C Payment Market https://www.marketresearchfuture.com/reports/b2c-payment-market-29051

Blockchain Finance Market https://www.marketresearchfuture.com/reports/blockchain-finance-market-28798

Business Analytics In Fintech Market https://www.marketresearchfuture.com/reports/business-analytics-in-fintech-market-29077

About Market Research Future:

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact Us:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Car insurance market will grow at 4.42% CAGR by 2032 here

News-ID: 3734685 • Views: …

More Releases from MRFR ( Market Research Future Report)

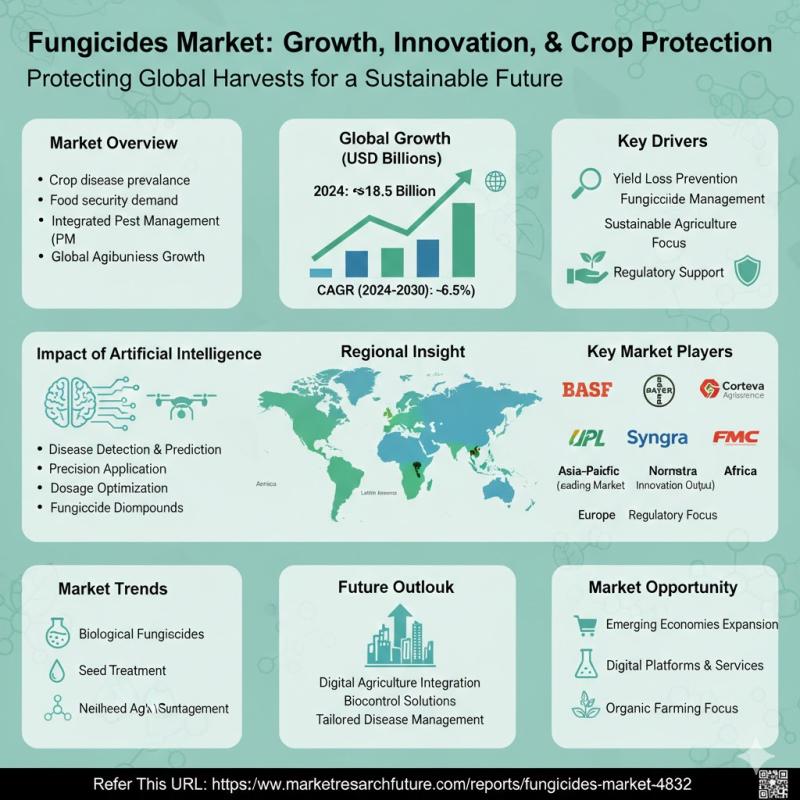

Fungicides Market Size USD 22.06 Billion in 2025, Projected to Reach USD 33.41 B …

The Fungicides Market is entering a phase of steady expansion driven by increasing demand for higher agricultural productivity, rising incidences of crop diseases, and an evolving emphasis on sustainable farming practices. As fungal pathogens continue to threaten staple and high-value crops alike, fungicides - chemical and biological agents designed to prevent or control the spread of fungi - are becoming indispensable tools in crop protection strategies worldwide. According to Market…

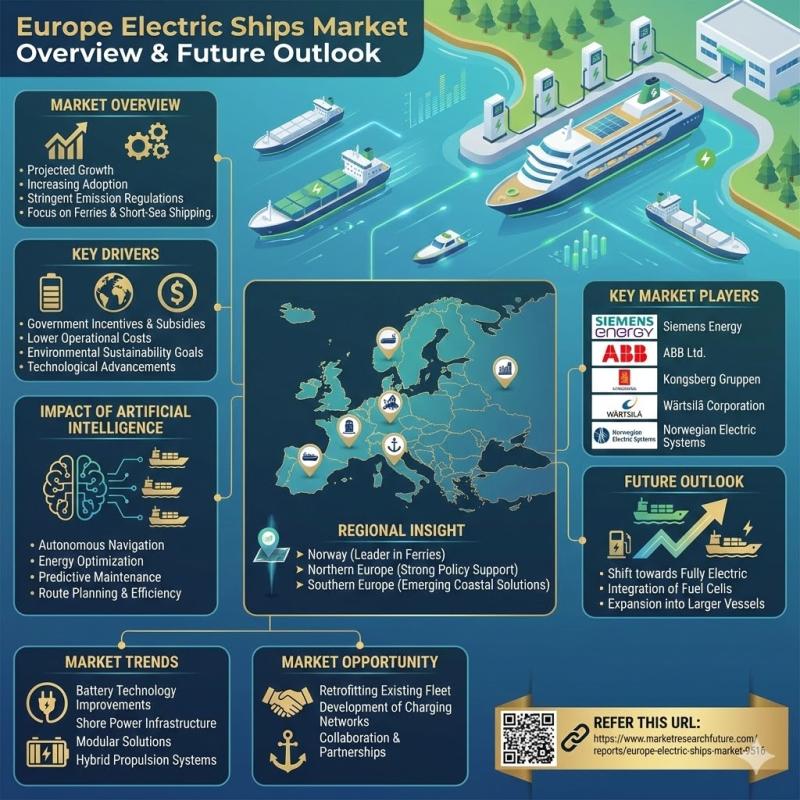

Europe Electric Ships Market Size USD 3.48 Billion in 2025, Projected to Reach U …

The Europe Electric Ships Market is entering a transformative phase driven by mounting environmental regulations, rapid technological advancements, and an accelerated shift toward sustainable maritime transport solutions. As countries across the continent work to decarbonize their shipping industries and curb emissions from marine vessels, electric ships - powered by batteries, hybrid systems, or fully electric propulsion - are increasingly seen as essential to achieving ambitious climate goals. According to Market…

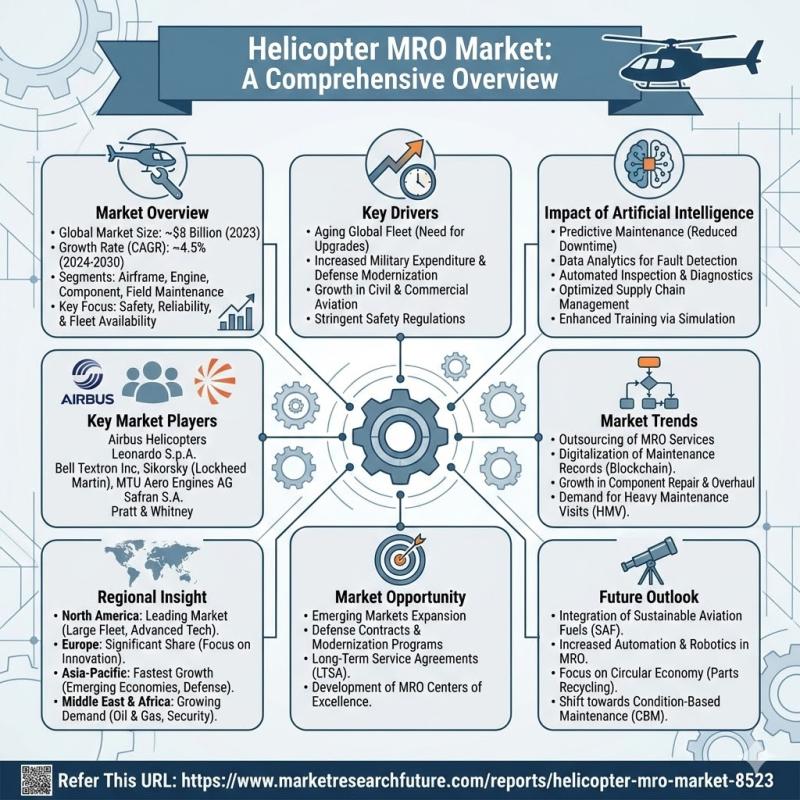

Helicopter MRO Market Size USD 104.0 Billion in 2025, Projected to Reach USD 277 …

The global Helicopter MRO (Maintenance, Repair, and Overhaul) Market is entering a period of significant growth, fueled by increasing helicopter deployments across commercial, military, and emergency service applications. Helicopters have become indispensable in sectors such as offshore oil and gas operations, law enforcement, medical emergencies, tourism, and defense, creating a pressing need for maintenance and repair services to ensure operational reliability and airworthiness. According to Market Research Future (MRFR), The…

Commercial Aircraft Lighting Market to Grow from USD 1.303 Million in 2025 to US …

The Commercial Aircraft Lighting Market is entering a phase of methodical growth, driven by expanding airline fleets, advancements in lighting technology, increased focus on energy efficiency, and a rising emphasis on passenger comfort and safety. As airlines modernize cabins and enhance operational efficiency, lighting systems - both interior and exterior - are playing an increasingly strategic role in overall aircraft design and in-flight experience. According to Market Research Future (MRFR),…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…