Press release

India Video Surveillance Market (2016-2022) Report-6Wresearch

India Video Surveillance Market (2016-2022)Market Forecast By Surveillance Type (Analog & IP Surveillance), Software (Video Management Software, Video Analytics and Others), By Components (Cameras (Analog and IP)), DVR/NVR, Encoders/Decoders, By Verticals (Government and Transportation, Banking & Financial, Retail, Industrial & Manufacturing, Commercial Offices, Residential, Hospitality & Healthcare and Education Institutions) and Regions (North India, South India, East India, West India and Central India)

Report Description

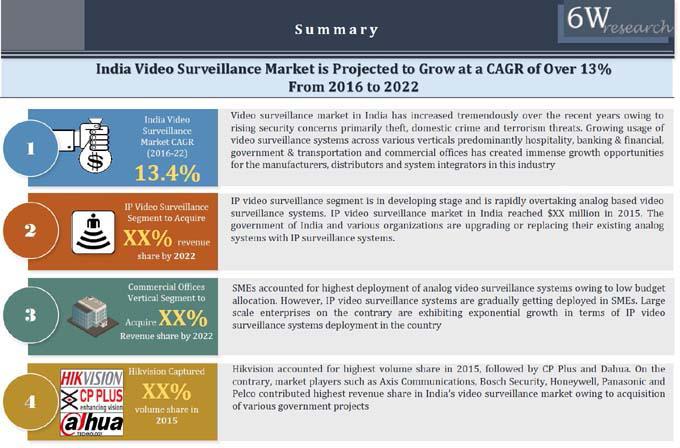

Need for intelligent security systems, increasing terrorist threats, growing public and private infrastructures coupled with rising crime rates have resulted the demand for video surveillance systems in India. Advantages of surveillance systems over physical security such as ability to allow remote and continuous monitoring has resulted for their wide deployment across India. Traditionally controlled by analog based surveillance systems, Indian market is now shifting towards IP based surveillance systems. India is registering positive growth in various vertical markets primarily across the government & transportation, banking & financial and commercial offices.

According to 6Wresearch, India’s video surveillance market is projected to grow at a CAGR of over 13% from 2016 to 2022. Although analog based surveillance systems have accounted for majority of the market revenues; however, growing awareness along with declining prices are likely to proliferate IP based surveillance systems market in the coming years.

In 2015, the government & transportation, commercial offices and banking & financial verticals accounted for the highest share in terms of market revenues, however, other verticals such as retail, residential, and industrial are considered as key growth verticals.

The report thoroughly covers video surveillance market types, components, verticals and regions. The report provides an unbiased and detailed analysis of the on-going trends, opportunities/ high growth areas, market drivers which would help the stakeholders to decide and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report

• Historical data of Global Video Surveillance Market for the Period 2010-2015

• Market Size & Forecast of Global Video Surveillance Market until 2022

• Historical data of India Video Surveillance Market for the Period 2009-2015

• Market Size & Forecast of India Video Surveillance Market until 2022

• Historical data of India Analog Video Surveillance Market for the Period 2009-2015

• Market Size & Forecast of India Analog Video Surveillance Market until 2022

• Historical data of India IP Video Surveillance Market for the Period 2009-2015

• Market Size & Forecast of India IP Video Surveillance Market until 2022

• Historical data of India Video Surveillance Vertical Market for the Period 2009-2015

• Market Size & Forecast of India Video Surveillance Vertical Market until 2022

• Market Revenue & Volume Share, By Specification (2014 & 2015)

• Historical data of India Video Surveillance Regional Market for the Period 2009-2015

• Market Size & Forecast of India Video Surveillance Regional Market until 2022

• Market Drivers and Restraints

• Market Trends

• Industry Life Cycle

• Value Chain Analysis

• Porter’s Five Forces Analysis

• Players Volume Market Share, By Video Surveillance Types

• Company Profiles

• Key Strategic Pointers

Markets Covered

The report provides the detailed analysis of the following market segments:

• Video Surveillance Type

o Analog Video Surveillance

o IP/ Network Video Surveillance

o Video Surveillance Software

• Applications

o Banking & Financial Institutions

o Government & Transportation

o Retail

o Commercial Offices

o Industrial & Manufacturing

o Residential

o Hospitality & Healthcare

o Educational Institutions

• Regions

o Northern India

o Eastern India

o Southern India

o Western India

o Central India

Table of Contents

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Assumptions & Methodology

3 Global Video Surveillance Market Overview

3.1 Global Video Surveillance Market Revenues (2009-2022F)

3.2 Global Video Surveillance Market Volume (2009-2022F)

3.3 Global Video Surveillance Market Revenue Share, By Region (2015 & 2022F)

4 India Video Surveillance Market Overview

4.1 India Video Surveillance Market Revenues (2009-2022F)

4.2 India Video Surveillance Market Volume (2009-2022F)

4.3 India Video Surveillance Industry Life Cycle

4.4 India Video Surveillance Market Opportunistic Matrix

4.5 India Video Surveillance Market Value Chain Analysis

4.6 India Video Surveillance Market Porter’s Five Forces Model

4.7 India Video Surveillance Market Revenue Share, By Surveillance Types (2015 & 2022F)

4.8 India Video Surveillance Market Revenue Share, By Verticals (2015 & 2022F)

4.9 India Video Surveillance Market Revenue Share, By Region (2015 & 2022F)

5 India Video Surveillance Market Dynamics

5.1 Impact Analysis

5.2 Market Drivers

5.3 Market Restraints

5.4 Market Opportunity

6 India Video Surveillance Market Trends

6.1 High Definition Cameras to Propel Video Surveillance

6.2 Cloud-based Video Surveillance

6.3 HD over Coax: The New Face of Analog Technology

6.4 Wireless Surveillance Systems

6.5 Increasing Penetration of Surveillance Equipment in SME Sector

7 India Analog Video Surveillance Market Overview

7.1 India Analog Video Surveillance Market Revenues (2009-2022F)

7.1.1 India Analog Video Surveillance Market Revenues, By Components (2009-2022F)

7.2 India Analog Video Surveillance Market Volume (2009-2022F)

7.2.1 India Analog Video Surveillance Market Volume, By Components (2009-2022F)

7.3 India Analog Video Surveillance Market Revenue Share, By Verticals (2015 & 2022F)

7.3.1 India Analog Video Surveillance Market Revenues, By Verticals (2009-2022F)

7.4 India Analog Video Surveillance Market Price Trend (2009-2022F)

8 India IP/ Network Video Surveillance Market Overview

8.1 India IP/ Network Video Surveillance Market Revenues (2009-2022F)

8.1.1 India IP/ Network Video Surveillance Market Revenues, By Components (2009-2022F)

8.2 India IP/ Network Video Surveillance Market Volume (2009-2022F)

8.2.1 India IP/ Network Video Surveillance Market Volume, By Components (2009-2022F)

8.3 India IP/ Network Video Surveillance Market Revenue Share, By Verticals (2015 & 2022F)

8.3.1 India IP/ Network Video Surveillance Market Revenues, By Verticals (2009-2022F)

8.4 India IP/ Network Video Surveillance Market Price Trend (2009-2022F)

9 India Video Surveillance Software Market Overview

9.1 India Video Surveillance Software Market Revenues (2009-2022F)

9.1.1 India Video Analytics Software Market Revenues (2009-2022F)

9.1.2 India Video Management Software Market Revenues (2009-2022F)

9.1.3 Other India Video Surveillance Software Market Revenues (2009-2022F)

9.2 India Video Surveillance Software Market Revenues, By Verticals (2009-2022F)

10 India Video Surveillance Market Overview, By Specification (Q1-Q4 Comparison)

10.1 India Video Surveillance Market Revenue Share, By Outdoor/ Indoor (2014 & 2015)

10.2 India Video Surveillance Market Volume Share, By Outdoor/ Indoor (2014 & 2015)

10.3 India Video Surveillance Market Revenue Share, By Form Factor (2014 & 2015)

10.3.1 India Video Surveillance Market Revenue Share, By Form Factor (Analog VS IP/ Network)

10.4 India Video Surveillance Market Volume Share, By Form Factor (2014 & 2015)

10.4.1 India Video Surveillance Market Volume Share, By Form Factor (Analog VS IP/ Network)

10.5 India Video Surveillance Market Revenue Share, By PTZ (2014 & 2015)- IP/ Network

10.6 India Video Surveillance Market Volume Share, By PTZ (2014 & 2015) IP/ Network

10.7 India Video Surveillance Market Revenue Share, By Megapixel (2014 & 2015)

10.7.1 India Video Surveillance Market Revenue Share, By Megapixel (Analog VS IP/ Network)

10.8 India Video Surveillance Market Volume Share, By Megapixel (2014 & 2015)

10.8.1 India Video Surveillance Market Volume Share, By Megapixel (Analog VS IP/ Network)

10.9 India Video Surveillance Market Revenue Share, By ONVIF Compliant (2014 & 2015)- IP/ Network

10.10 India Video Surveillance Market Volume Share, By ONVIF Compliant (2014 & 2015) - IP/ Network

11 India Video Surveillance Market Overview, By Verticals

11.1 India Banking & Financial Institutions Video Surveillance Market Revenues (2009-2022F)

11.2 India Government & Transportation Video Surveillance Market Revenues (2009-2022F)

11.3 India Retail Video Surveillance Market Revenues (2009-2022F)

11.4 India Commercial Offices Video Surveillance Market Revenues (2009-2022F)

11.5 India Hospitality & Healthcare Video Surveillance Market Revenues (2009-2022F)

11.6 India Industrial & Manufacturing Video Surveillance Market Revenues (2009-2022F)

11.7 India Residential Video Surveillance Market Revenues (2009-2022F)

11 .8 India Educational Institutions Video Surveillance Market Revenues (2009-2022F)

12 India Video Surveillance Market Overview, By Regions

12.1 Northern India Video Surveillance Market Revenues (2009-2022F)

12.2 Southern India Video Surveillance Market Revenues (2009-2022F)

12.3 Eastern India Video Surveillance Market Revenues (2009-2022F)

12.4 Western India Video Surveillance Market Revenues (2009-2022F)

12.5 Central India Video Surveillance Market Revenues (2009-2022F)

13 Competitive Landscape

13.1 CCTV Manufacturers/ Assemblers in India

13.2 India Overall Video Surveillance Market Players’ Volume Share, (Q1’2015-Q4’2015 Comparison)

13.2.1 India Video Surveillance Market Players’ Volume Share, By Outdoor/ Indoor (2015)

13.2.2 India Video Surveillance Market Players’ Volume Share, By Form Factor (2015)

13.2.3 India Video Surveillance Market Players’ Volume Share, By Megapixel (2015)

13.3 India Analog Video Surveillance Market Players’ Volume Share (2015)

13.3.1 India Analog Video Surveillance Market Players’ Volume Share, By Outdoor/ Indoor (2015)

13.3.2 India Analog Video Surveillance Market Players’ Volume Share, By Form Factor (2015)

13.3.3 India Analog Video Surveillance Market Players’ Volume Share, By Megapixel (2015)

13.4 India IP/ Network Video Surveillance Market Players’ Volume Share (2015)

13.4.1 India IP/ Network Video Surveillance Market Players’ Volume Share, By Outdoor/ Indoor (2015)

13.4.2 India IP/ Network Video Surveillance Market Players’ Volume Share, By Form Factor (2015)

13.4.3 India IP/ Network Video Surveillance Market Players’ Volume Share, By PTZ Type (2015)

13.4.4 India IP/ Network Video Surveillance Market Players’ Volume Share, By Megapixel (2015)

13.4.5 India IP/ Network Video Surveillance Market Players’ Volume Share, By ONVIF Compliant (2015)

13.5 Competitive Benchmarking, By Technology

14 Company Profiles

14.1 Axis Communications AB

14.2 Bosch Security Systems, Inc.

14.3 CP PLUS INDIA PVT.LTD.

14.4 FLIR Systems, Inc. (DVTel)

14.5 Hangzhou Hikvision Digital Technology Co. Ltd.

14.6 Hanwha Techwin Co., Ltd. (Samsung Techwin)

14.7 Honeywell Automation India Limited

14.8 Panasonic India

14.9 Pelco by Schneider Electric

14.10 Sony Corporation

14.11 Zhejiang Dahua Technology Co., Ltd.

14.12 Zicom Electronic Security Systems Ltd.

15 Key Strategic Note

16 Disclaimer

List of Figures

Figure 1 Global Video Surveillance Market Revenues, 2010-2022F ($ Billion)

Figure 2 Global Video Surveillance Market Volume, 2010-2022F (Million Units)

Figure 3 Global Video Surveillance Market Revenue Share, By Region (2015)

Figure 4 India Video Surveillance Market Revenues, 2009-2022F ($ Million)

Figure 5 Video Surveillance Market Revenue Share, India Vs. Asia-Pacific, 2015

Figure 6 India Video Surveillance Market Volume, 2009-2022F (Million Units)

Figure 7 India Homeland Security Expenditure, 2010-2022F ($ Billion)

Figure 8 India IT Spending, 2013-2022F ($ Billion)

Figure 9 India Video Surveillance Industry Life Cycle (2015)

Figure 10 Value Chain Analysis of India Video Surveillance Market

Figure 11 India Video Surveillance Market Revenue Share, By Surveillance Types (2015)

Figure 12 India Video Surveillance Market Revenue Share, By Surveillance Types (2022F)

Figure 13 India Video Surveillance Market Revenue Share, By Verticals (2015)

Figure 14 India Video Surveillance Market Revenue Share, By Verticals (2022F)

Figure 15 India Video Surveillance Market Revenue Share, By Region (2015 & 2022F)

Figure 16 India Crime Incidences, 2002 – 2015E (In Million)

Figure 17 India Analog Video Surveillance Market Revenues, 2009-2015 ($ Million)

Figure 18 India Analog Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 19 India Analog Video Surveillance Market Volume, 2009-2015 (Million Units)

Figure 20 India Analog Video Surveillance Market Volume, 2016E-2022F (Million Units)

Figure 21 India Analog Video Surveillance Market Revenue Share, By Verticals (2015)

Figure 22 India Analog Video Surveillance Market Revenue Share, By Verticals (2022F)

Figure 23 India Analog Video Surveillance Camera Market Price Trend, 2009-2022F

Figure 24 India Analog Video Surveillance DVR Market Price Trend, 2009-2022F

Figure 25 India IP Video Surveillance Market Revenues, 2009-2015 ($ Million)

Figure 26 India IP Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 27 India IP Video Surveillance Market Volume, 2009-2015 (Thousand Units)

Figure 28 India IP Video Surveillance Market Volume, 2016E-2022F (Thousand Units)

Figure 29 India IP Video Surveillance Market Revenue Share, By Verticals (2015)

Figure 30 India IP Video Surveillance Market Revenue Share, By Verticals (2022F)

Figure 31 India IP Video Surveillance Camera Market Price Trend, 2009-2022F

Figure 32 India IP Video Surveillance NVR Market Price Trend, 2009-2022F

Figure 33 India IP Video Surveillance Encoder/ Decoder Market Price Trend, 2009-2022F

Figure 34 India Video Surveillance Software Market Revenues, 2009-2015 ($ Million)

Figure 35 India Video Surveillance Software Market Revenues, 2016E-2022F ($ Million)

Figure 36 India Video Analytics Software Market Revenues, 2009-2015 ($ Million)

Figure 37 India Video Analytics Software Market Revenues, 2016E-2022F ($ Million)

Figure 38 India Video Management Software Market Revenues, 2009-2015 ($ Million)

Figure 39 India Video Management Software Market Revenues, 2016E-2022F ($ Million)

Figure 40 India Other Video Surveillance Software Market Revenues, 2009-2015 ($ Million)

Figure 41 India Other Video Surveillance Software Market Revenues, 2016E-2022F ($ Million)

Figure 42 India Video Surveillance Market Revenue Share, By Indoor/ Outdoor (Quarter-wise Comparison – 2014 Vs. 2015)

Figure 43 India Video Surveillance Market Volume Share, By Indoor/ Outdoor (Quarter-wise Comparison – 2014 Vs. 2015)

Figure 44 India Video Surveillance Market Revenue Share, By Form Factor (Quarter-wise Comparison – 2014 Vs. 2015)

Figure 45 India Video Surveillance Market Revenue Share, By Form Factor, Analog Vs. IP (Quarter-wise Comparison – 2014 Vs. 2015)

Figure 46 India Video Surveillance Market Revenue Share, By Form Factor (Quarter-wise Comparison – 2014 Vs. 2015)

Figure 47 India Video Surveillance Market Revenue Share, By Form Factor, Analog Vs. IP (Quarter-wise Comparison – 2014 Vs. 2015)

Figure 48 India Video Surveillance Market Revenue Share, By PTZ (Quarter-wise Comparison – 2014 Vs. 2015)

Figure 49 India Video Surveillance Market Volume Share, By PTZ (Quarter-wise Comparison – 2014 Vs. 2015)

Figure 50 India Video Surveillance Market Revenue Share, By Megapixel (Quarter-wise Comparison – 2014 Vs. 2015)

Figure 51 India Video Surveillance Market Revenue Share, By Megapixel, Analog Vs. IP (Quarter-wise Comparison – 2014 Vs. 2015)

Figure 52 India Video Surveillance Market Volume Share, By Megapixel (Quarter-wise Comparison – 2014 Vs. 2015)

Figure 53 India Video Surveillance Market Volume Share, By Megapixel, Analog Vs. IP (Quarter-wise Comparison – 2014 Vs. 2015)

Figure 54 India Video Surveillance Market Revenue Share, By ONVIF Complaint (Quarter-wise Comparison – 2014 Vs. 2015)

Figure 55 India Video Surveillance Market Volume Share, By ONVIF Complaint (Quarter-wise Comparison – 2014 Vs. 2015)

Figure 56 India Banking & Financial Institutions’ Video Surveillance Market Revenues, 2009-2015 ($ Million)

Figure 57 India Banking & Financial Institutions’ Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 58 India Government & Transportation Video Surveillance Market Revenues, 2009-2015 ($ Million)

Figure 59 India Government & Transportation Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 60 India Retail Video Surveillance Market Revenues, 2009-2015 ($ Million)

Figure 61 India Retail Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 62 India Retail Market Revenues, 2011-2022F ($ Billion)

Figure 63 India Commercial Offices Video Surveillance Market Revenues, 2009-2015 ($ Million)

Figure 64 India Commercial Offices Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 65 Total Number of SMEs in India, 2010-2022F (In Million)

Figure 66 India Hospitality & Healthcare Video Surveillance Market Revenues, 2009-2015 ($ Million)

Figure 67 India Hospitality & Healthcare Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 68 India Industrial & Manufacturing Video Surveillance Market Revenues, 2009-2015 ($ Million)

Figure 69 India Industrial & Manufacturing Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 70 India Construction Market, 2010-2022F ($ Billion)

Figure 71 India Oil & Gas Production, 2010-2022F (‘000 Barrels/ Day & Billion Cubic Meters)

Figure 72 India Residential Video Surveillance Market Revenues, 2009-2015 ($ Million)

Figure 73 India Residential Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 74 India Educational Institutions Video Surveillance Market Revenues, 2009-2015 ($ Million)

Figure 75 India Educational Institutions Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 76 Northern India Video Surveillance Market Revenues, 2009-2015 ($ Million)

Figure 77 Northern India Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 78 Southern India Video Surveillance Market Revenues, 2009-2015 ($ Million)

Figure 79 Southern India Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 80 Eastern India Video Surveillance Market Revenues, 2009-2015 ($ Million)

Figure 81 Eastern India Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 82 Western India Video Surveillance Market Revenues, 2009-2015 ($ Million)

Figure 83 Western India Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 84 Central India Video Surveillance Market Revenues, 2009-2015 ($ Million)

Figure 85 Central India Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 86 India Overall Video Surveillance Market Players’ Volume Share, (Q1’2015-Q4’2015 Comparison)

Figure 87 India Analog Video Surveillance Market Players’ Volume Share, (Q1’2015-Q4’2015 Comparison)

Figure 88 India IP Video Surveillance Market Players’ Volume Share, (Q1’2015-Q4’2015 Comparison)

Figure 89 Axis Communications Market Revenue Share by Segment (2013 & 2012)

Figure 90 Robert Bosch GmbH., Revenue Share by Segment (2014)

Figure 91 FLIR Systems, Inc. Revenue Share, By Segment (Q3’2015)

Figure 92 Zhejiang Dahua Technology Co. Ltd., Revenues, Gross Profit and Net Income, 2013 & 2014 ($ Million)

List of Tables

Table 1 India Analog Video Surveillance Market Revenues, By Components, 2009-2015 ($ Million)

Table 2 India Analog Video Surveillance Market Revenues, By Components, 2016E-2022F ($ Million)

Table 3 India Analog Video Surveillance Market Volume, By Components, 2009-2015 (Million Units)

Table 4 India Analog Video Surveillance Market Volume, By Components, 2016E-2022F (Million Units)

Table 5 India Analog Video Surveillance Market Revenues, By Verticals, 2009-2015

Table 6 India Analog Video Surveillance Market Revenues, By Verticals, 2016E-2022F

Table 7 India IP Video Surveillance Market Revenues, By Components, 2009-2015 ($ Million)

Table 8 India IP Video Surveillance Market Revenues, By Components, 2016E-2022F ($ Million)

Table 9 India IP Video Surveillance Market Volume, By Components, 2009-2015 (Thousand Units)

Table 10 India IP Video Surveillance Market Volume, By Components, 2016E-2022F (Thousand Units)

Table 11 India IP Video Surveillance Market Revenues, By Verticals, 2009-2015

Table 12 India IP Video Surveillance Market Revenues, By Verticals, 2016E-2022F

Table 13 India Video Surveillance Software Market Revenues, By Verticals, 2009-2015

Table 14 India Video Surveillance Software Market Revenues, By Verticals, 2016E-2022F

Table 15 Number of Bank Branches in India, 2009-2015E

Table 16 Number of ATMs in India (as of March 2013)

Table 17 List of Upcoming International Airports in India

Table 18 India Airport Passenger Traffic, 2008-2015, (In Million)

Table 19 CCTV Manufacturers/ Assemblers in India

Table 20 India Video Surveillance Market Players’ Volume Share, By Indoor (2015)

Table 21 India Video Surveillance Market Players Volume Share, By Outdoor (2015)

Table 22 India Video Surveillance Market Players Volume Share, By Dome Form Factor (2015)

Table 23 India Video Surveillance Market Players Volume Share, By Bullet Form Factor (2015)

Table 24 India Video Surveillance Market Players Volume Share, By Box Form Factor (2015)

Table 25 India Video Surveillance Market Players Volume Share, By Other Form Factors (2015)

Table 26 India Video Surveillance Market Players Volume Share, By 0.3-0.9 Megapixel (2015)

Table 27 India Video Surveillance Market Players Volume Share, By 1-1.4 Megapixel (2015)

Table 28 India Video Surveillance Market Players Volume Share, By 2-2.8 Megapixel (2015)

Table 29 India Video Surveillance Market Players Volume Share, By 3-3.3 Megapixel (2015)

Table 30 India Video Surveillance Market Players Volume Share, By 4 Megapixel (2015)

Table 31 India Video Surveillance Market Players Volume Share, By 5 & >5 Megapixel (2015)

Table 32 India Analog Video Surveillance Market Players Volume Share, By Indoor (2015)

Table 33 India Analog Video Surveillance Market Players Volume Share, By Outdoor (2015)

Table 34 India Analog Video Surveillance Market Players Volume Share, By Dome Form Factor (2015)

Table 35 India Analog Video Surveillance Market Players Volume Share, By Bullet Form Factor (2015)

Table 36 India Analog Video Surveillance Market Players Volume Share, By Box Form Factor (2015)

Table 37 India Analog Video Surveillance Market P0layers’ Volume Share, By Other Form Factors (2015)

Table 38 India Analog Video Surveillance Market Players Volume Share, By 0.3-0.9 Megapixel (2015)

Table 39 India Analog Video Surveillance Market Players Volume Share, By 1-1.4 Megapixel (2015)

Table 40 India Analog Video Surveillance Market Players Volume Share, By 2-2.8 Megapixel (2015)

Table 41 India Analog Video Surveillance Market Players Volume Share, By 3-3.3 Megapixel (2015)

Table 42 India IP Video Surveillance Market Players Volume Share, By Indoor (2015)

Table 43 IP Video Surveillance Market Players Volume Share, By Outdoor (2015)

Table 44 India IP Video Surveillance Market Players Volume Share, By Dome Form Factor (2015)

Table 45 India IP Video Surveillance Market Players Volume Share, By Bullet Form Factor (2015)

Table 46 India IP Video Surveillance Market Players Volume Share, By Box Form Factor (2015)

Table 47 India IP Video Surveillance Market Players’ Volume Share, By Other Form Factors (2015)

Table 48 India IP Video Surveillance Market Players Volume Share, By PTZ (2015)

Table 49 India IP Video Surveillance Market Players Volume Share, By Non-PTZ (2015)

Table 50 India IP Video Surveillance Market Players Volume Share, By 0.3-0.9 Megapixel (2015)

Table 51 India IP Video Surveillance Market Players Volume Share, By 1-1.4 Megapixel (2015)

Table 52 India IP Video Surveillance Market Players Volume Share, By 2-2.8 Megapixel (2015)

Table 53 India IP Video Surveillance Market Players Volume Share, By 3-3.3 Megapixel (2015)

Table 54 India IP Video Surveillance Market Players Volume Share, By 4 Megapixel (2015)

Table 55 India IP Video Surveillance Market Players Volume Share, By 5 & >5 Megapixel (2015)

Table 56 India IP Video Surveillance Market Players Volume Share, By ONVIF Complaint (2015)

Table 57 India IP Video Surveillance Market Players Volume Share, By Non-ONVIF Complaint (2015)

Table 58 Axis Communications AB Financial Statement, 2011-2014 ($ Million)

Table 59 Robert Bosch Financial Statement, 2012-2014 ($ Billion)

Table 60 Hanwha Techwin Co. Ltd. Financial Statement, 2011-2014 ($ Billion)

Table 61 Honeywell International Inc. Financial Statement, 2011-2014 ($ Billion)

Table 62 Panasonic Corporation Financial Statement, 2011-2014 ($ Billion)

Table 63 Schneider Electric SA Financial Statement, 2011-2014 ($ Billion)

Table 64 Sony Corporation Financial Statement, 2011-2014 ($ Billion)

Source Link: http://www.6wresearch.com/market-reports/india-video-surveillance-vsc-market-2016-2022-new-industry-analysis-share-players-forecasts.html

For Further details, please contact:

Email Us: sales@6wresearch.com

Call Now: +91-11-430-24-305

With over 1000 custom research projects, 6Wresearch is a global market research and consulting firm specializes in niche and emerging markets.The Company over the past few years has developed itself to be a renowned market intelligence company which led strong emphasis on competitive and strategic intelligence.

6Wresearch, through its integrated survey model, offers its client real time market and competitive intelligence and thus enable our clients to devise market entry strategies to target particular market and geography.

Delhi/NCR Office

809, 8th Floor, Pearls Best Heights - II

Netaji Subhash Place, Pitampura

New Delhi, India-110034

Phone: +911143024305

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Video Surveillance Market (2016-2022) Report-6Wresearch here

News-ID: 373401 • Views: …

More Releases from 6Wresearch- Market Intelligence Solutions

Why the Global Windows Market is Growing Steadily with Advancements in Technolog …

The global windows market has been witnessing a steady growth over the years. This growth is due to some major factors, such as construction activities are increasing and technological upgradation in window manufacturing. Furthermore, the demand for energy-efficient solutions has increased, which leads to a positive impact on the market growth. Windows are considered an important part of residential, commercial, and industrial buildings, which contribute to aesthetic appeal, ventilation, and…

Why the Global Wine Market is Growing Steadily with Innovations in Production an …

Wine is known for its antioxidant properties, especially red wine, which is considered healthy for the heart health. It has diverse ranges and flavors, which attracts wider consumer base. The global wine market has been experiencing a steady growth over the years. This growth is due to some key drivers, such as increasing wine consumption rate globally and increasing income levels of middle class population that allow consumers to spend…

Why the Global Semiconductor Market is Expanding Rapidly with Technological Adva …

The global semiconductor market is estimated to grow in the coming years as it is driven by some major factors, such as increasing demand across various industries such as consumer electronics, automotive, telecommunications, and industrial automation and e rising adoption of advanced technologies such as 5G, AI, and IoT. Other factor contributing to the market growth are a surge in demand for faster, smaller, and more energy-efficient chips, and innovations…

Why the Global Pulses Market is Growing Steadily with Advancements in Cultivatio …

Driven by the growing demand for plant-based protein and increasing recognition of the health benefits of pulses, the Global Pulses Market has been expanding. With high levels of protein, fiber, vitamins, and minerals, pulses such as lentils, chickpeas, and beans are crucial elements of a healthy eating plan. As plant-based diets gain widespread popularity and the demand for sustainable food options increases, pulse consumption is growing, especially among health-conscious and…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…