Press release

Debt Security Market Expected to Grow USD 142,735.78 Billion By 2032

The debt security market, a critical component of the global financial system, encompasses a broad range of fixed-income instruments, such as government bonds, corporate bonds, and mortgage-backed securities. In 2022, the debt security market was estimated at USD 137,616.45 billion and is projected to grow from USD 142,735.78 billion in 2023 to USD 198,345 billion by 2032, with an expected compound annual growth rate (CAGR) of approximately 3.72% over the forecast period (2024-2032).Key Companies in the Debt Security Market Include:

BlackRock, HSBC, UBS, Bank of America, Deutsche Bank, Goldman Sachs, Citigroup, Barclays, Mizuho Financial Group, Credit Suisse, JPMorgan Chase, The Vanguard Group, Wells Fargo, BNP Paribas, Morgan Stanley

Get a FREE Sample Report PDF Here: https://www.marketresearchfuture.com/sample_request/22786

Key Market Drivers

Global Economic Growth and Recovery

Economic growth, particularly post-pandemic recovery efforts, has driven the issuance and demand for debt securities. Governments and corporations alike have relied on debt instruments to fund development projects, infrastructure, and expansion efforts, which supports ongoing market growth.

Rising Demand for Fixed-Income Investments

As global economic uncertainties persist, especially with inflation and interest rate fluctuations, investors have shown a preference for stable, income-generating assets. Debt securities offer predictable interest payments, making them attractive options for risk-averse investors seeking stability and regular returns. This trend is anticipated to continue, further fueling the growth of the debt security market.

Increased Government Borrowing

Government debt is a major segment within the debt security market, with countries issuing bonds to finance budget deficits, infrastructure projects, and social programs. With increasing global expenditure on defense, healthcare, and green initiatives, government borrowing is expected to remain strong, driving demand for debt securities in the public sector.

Corporate Debt Issuance and Expanding Business Investments

Corporate bonds form a significant portion of the debt security market. As companies expand or pursue strategic acquisitions, they often turn to debt financing to meet their capital needs. The corporate debt market is expected to see sustained growth as companies seek to capitalize on strategic opportunities and lower borrowing costs when possible.

The Growth of Emerging Markets

Emerging markets have increasingly accessed global debt markets to fund their growing infrastructure needs and social development goals. The rise of these economies as active players in the debt security market is expected to provide considerable growth opportunities, contributing to the overall expansion of the market.

Market Challenges

Interest Rate Fluctuations

The debt security market is highly sensitive to changes in interest rates. Rising interest rates can make existing fixed-rate debt securities less attractive to investors, who may seek higher returns elsewhere. Additionally, borrowers may face higher costs when issuing new debt, which can impact corporate debt issuance and, by extension, market growth.

Inflationary Pressures

Persistent inflationary pressures pose a risk to the debt security market. Inflation erodes the purchasing power of fixed income returns, making inflation-linked securities more attractive than traditional debt securities. Investors may shift preferences, impacting demand dynamics within the market.

Credit Risk and Default Concerns

The risk of default, especially in high-yield bonds or corporate debt from companies with lower credit ratings, is a constant concern. Economic downturns or crises could trigger an increase in defaults, which may impact investor confidence in the debt security market.

Regional Insights

North America

North America, particularly the U.S., represents one of the largest segments of the debt security market. The strong presence of government, municipal, and corporate debt issuance has made the U.S. a global leader in debt securities, and demand for these instruments is expected to remain high. With increased spending on infrastructure and defense, government borrowing is anticipated to grow, adding to the market's strength.

Europe

Europe's debt security market is influenced by both public and private debt issuance, as well as ongoing initiatives such as the European Green Deal, which drives sustainable bond issuances. The region's commitment to sustainable finance and the green bond market is expected to contribute positively to debt security market growth.

Asia-Pacific

The Asia-Pacific region is projected to experience notable growth in the debt security market. This expansion is driven by rapid economic growth in emerging economies like China and India, coupled with increasing infrastructure investments and growing interest in sustainable finance.

Latin America and the Middle East

Emerging markets in Latin America and the Middle East are increasingly accessing debt markets to fund growth and development projects. These regions provide an emerging opportunity for growth within the global debt security market as they continue to improve their credit profiles and attract foreign investment.

Know More about the Debt Security Market Report: https://www.marketresearchfuture.com/reports/debt-security-market-22786

Market Outlook: Future Trends and Innovations

Sustainable and Green Bonds

Sustainable finance, particularly green bonds, is becoming a defining feature of the debt security market. Governments and corporations alike are issuing green bonds to finance environmentally friendly projects. As ESG (Environmental, Social, Governance) criteria continue to influence investment strategies, the demand for sustainable debt securities is expected to grow rapidly.

Digitalization and Blockchain

The adoption of blockchain and digital ledger technologies (DLT) has the potential to transform the debt security market. Blockchain can improve transparency, reduce transaction times, and lower costs associated with issuing and trading debt securities. Major financial institutions and governments are exploring blockchain-based bond issuance, which could drive the market's future innovation and efficiency.

Growth of High-Yield Debt Markets

With investors searching for higher returns in a low-interest-rate environment, high-yield bonds have gained attention. While high-yield debt carries more risk, its potential for higher returns remains attractive. The high-yield segment of the debt market is likely to grow as investors continue to diversify their portfolios.

Increasing Demand for Inflation-Protected Securities

Inflation-linked bonds, which adjust returns based on inflation rates, are becoming more popular in light of global inflation concerns. These securities protect purchasing power for investors, making them appealing options amid rising prices. This trend is likely to positively impact the debt security market over the forecast period.

Competitive Landscape

The debt security market is highly competitive and fragmented, with both public and private sector entities as prominent players. Key issuers include:

Governments: National and local governments are major players, issuing various bonds to fund public expenditures.

Corporations: Companies from diverse sectors issue debt to finance growth initiatives, acquisitions, and other strategic investments.

Financial Institutions: Banks and other financial entities issue bonds and securitize loans, adding to the diversity of available debt securities.

Key players also include central banks and regulatory authorities that shape the market through interest rate policies and regulatory frameworks.

Top Trending Research Report:

Home Insurance Market https://www.marketresearchfuture.com/reports/home-insurance-market-24090

Usage Based Insurance (Ubi) Market https://www.marketresearchfuture.com/reports/usage-based-insurance-market-24122

Fintech Market https://www.marketresearchfuture.com/reports/fintech-market-24173

Alternative Lending Market https://www.marketresearchfuture.com/reports/alternative-lending-market-24319

Commercial Lending Market https://www.marketresearchfuture.com/reports/commercial-lending-market-24325

Credit Scoring Market https://www.marketresearchfuture.com/reports/credit-scoring-market-24354

Digital Lending Market https://www.marketresearchfuture.com/reports/digital-lending-market-24416

Esg Finance Market https://www.marketresearchfuture.com/reports/esg-finance-market-24428

Telematics Based Auto Insurance Market https://www.marketresearchfuture.com/reports/telematics-based-auto-insurance-market-24409

Financial Accounting Advisory Services Market https://www.marketresearchfuture.com/reports/financial-accounting-advisory-services-market-24491

About Market Research Future:

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact Us:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Debt Security Market Expected to Grow USD 142,735.78 Billion By 2032 here

News-ID: 3732668 • Views: …

More Releases from MRFR ( Market Research Future Report)

Marine Electronics Market Size to Reach USD 10.37 Billion by 2035, Growing at a …

The marine electronics market is embarking on a period of steady expansion driven by technological innovation, heightened safety standards, and the growing complexity of global maritime operations. Marine electronics - including navigational systems, communication devices, automation solutions, and safety instruments - are increasingly integral for commercial shipping, naval fleets, fishing vessels, and recreational boats. According to Market Research Future (MRFR), the global marine electronics market was valued at approximately USD…

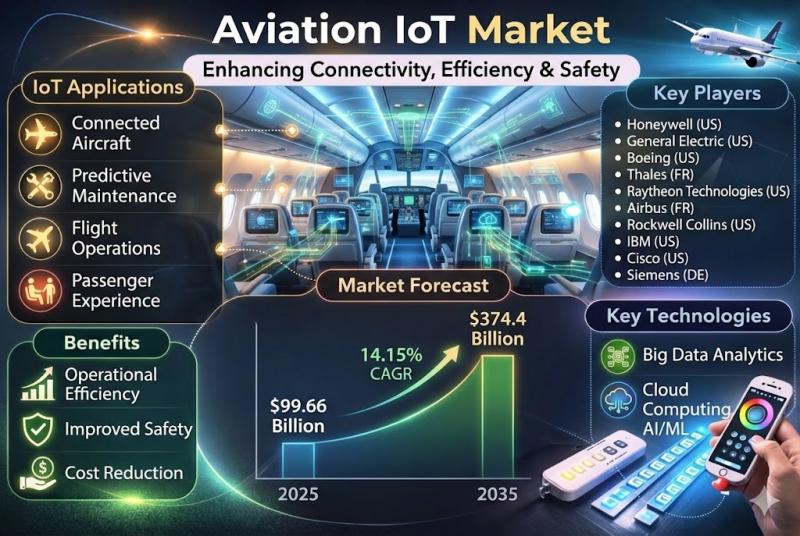

Aviation IoT Market Size to Reach USD 374.4 Billion by 2035, Growing at a CAGR o …

The Aviation IoT (Internet of Things) Market is underway in a period of rapid digital expansion as airlines, airports, and air traffic management systems increasingly adopt IoT technologies to enhance operational efficiency, safety, and passenger experience. According to Market Research Future, the Aviation IoT Market was estimated at USD 87.3 billion in 2024 and is projected to grow to USD 99.66 billion in 2025. Over the long term, the market…

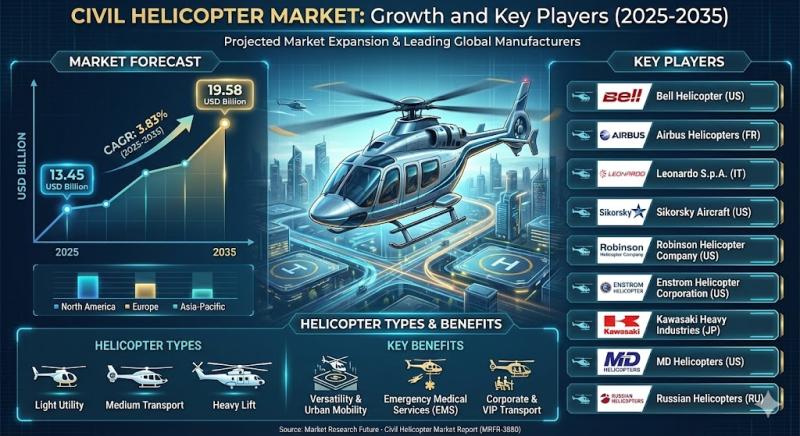

Civil Helicopter Market Size to Reach USD 19.58 Billion by 2035, Growing at a CA …

The Civil Helicopter Market is experiencing consistent growth as demand rises across emergency services, law enforcement, transportation, tourism, and industrial applications. According to Market Research Future (MRFR), the civil helicopter market was valued at approximately USD 12.95 billion in 2024 and is projected to increase to USD 13.45 billion in 2025. Over the long term, the market is expected to expand to around USD 19.58 billion by 2035, exhibiting a…

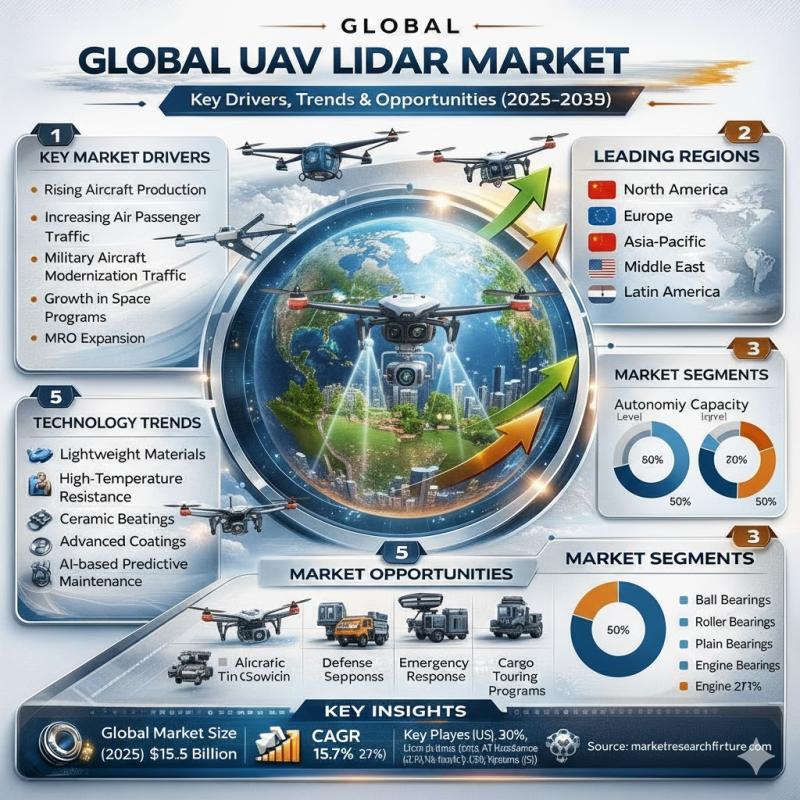

UAV LiDAR Market Size to Reach USD 15.5 Billion by 2035, Growing at a CAGR of 15 …

The UAV LiDAR Market is poised for rapid and substantial growth as drone technologies become increasingly integrated with light detection and ranging (LiDAR) systems to deliver highly accurate 3D data for surveying, mapping, agriculture, forestry, infrastructure inspection, and environmental monitoring. According to Market Research Future (MRFR), the UAV LiDAR Market was valued at approximately USD 3.113 billion in 2024 and is expected to grow to USD 3.602 billion in 2025.…

More Releases for Debt

Debt Settlement Solution Market Impressive Growth 2021-2028 | National Debt Reli …

The Insight Partners announces the research on Global Debt Settlement Solution Market [Report Page Link as it covers the key boundaries Required for your Research Need. This Global Debt Settlement Solution Market Report covers worldwide, local, and nation level market size, pieces of the overall industry, ongoing pattern, the effect of covid19 on worldwide

Market Research Report Investigations Research Methodology review comprises of Secondary Research, Primary Research, Company Share Analysis,…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market 2019 By Freedom Debt Relief National Debt Relief Rescue O …

This report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in which the debtor and creditor agree on a reduced balance that will be regarded as payment in full.

Request a Sample of this Report @ https://www.orbisresearch.com/contacts/request-sample/2575396 …

Debt Settlement Market 2018-National Debt Relief, Freedom Debt Relief, New Era D …

The report on Debt Settlement, documents a detailed study of different aspects of the ‘Debt Settlement’ market. It shows the steady growth in market in spite of the fluctuations and changing market trends. In the past four years the ‘Debt Settlement’ market has grown to a booming value of $xxx million and is expected to grow more.

Request a Sample of this Report@ http://www.orbisresearch.com/contacts/request-sample/2335800

Every market intelligence report is based on certain…

Debt Settlement Market 2018 | Global Demand, Top Companies Analysis- National De …

Global Debt Settlement Market Research Report 2018 is a professional and in-depth study on the current state of the global Debt Settlement industry with a focus on the regional market, analysis of industry share, growth factors, development trends, size, majors manufacturers and 2025 forecast. The report also analyze innovative business strategies, value added factors and business opportunities. The Debt Settlement report introduces market revenue, product & services, latest developments and…