Press release

High Net Worth (HNW) Offshore Investment Market Will Grow 4.01% By 2032

The high net worth (HNW) offshore investment market, catering to affluent individuals with substantial financial assets, has witnessed steady growth over recent years. Valued at approximately USD 15.19 billion in 2022, the market is anticipated to expand from USD 15.8 billion in 2023 to around USD 22.5 billion by 2032, achieving a compound annual growth rate (CAGR) of approximately 4.01% during the forecast period of 2024-2032. This growth is driven by evolving wealth management needs, tax efficiency strategies, and diversified investment portfolios that leverage offshore opportunities.Key Companies in the High Net Worth Hnw Offshore Investment Market Include:

Commerzbank Wealth Management, Morgan Stanley Private Wealth Management, BNP Paribas Wealth Management, Deutsche Bank Wealth Management, JPMorgan Private Bank, RBC Wealth Management, Scotiabank Private Banking, Citi Private Bank, UBS, HSBC Private Banking, Credit Suisse, Goldman Sachs Private Wealth Management, UBS Wealth Management Americas, Bank of America Private Bank, Wells Fargo Private Bank

Get a FREE Sample Report PDF Here: https://www.marketresearchfuture.com/sample_request/22960

Key Market Drivers

Desire for Portfolio Diversification

HNW individuals often seek to spread their wealth across a diverse range of assets and geographies, reducing the risk associated with domestic market fluctuations. Offshore investments provide unique options, such as foreign real estate, international equities, and alternative assets that can offer attractive returns and growth potential.

Tax Optimization and Wealth Preservation

Offshore investments are frequently structured to offer tax-efficient solutions, which is a significant incentive for HNW individuals looking to maximize wealth preservation. Jurisdictions offering tax-neutral policies attract a substantial share of HNW investments, allowing individuals to legally reduce tax liabilities, optimize their wealth management, and improve post-tax returns.

Growth of Globalized Financial Services

The globalization of financial services has made offshore investments more accessible, with financial institutions and wealth management firms offering customized offshore solutions. This enables HNW individuals to manage cross-border assets seamlessly, providing access to international markets, varied financial instruments, and specialized advisory services.

Increased Demand for Confidentiality and Asset Protection

Offshore investments can provide enhanced confidentiality and protection for assets, a priority for many HNW investors who value discretion in managing their wealth. By investing in jurisdictions with robust privacy laws, HNW individuals can reduce exposure to legal risks and potential liabilities in their home countries.

Rising Interest in ESG and Impact Investments

Many HNW individuals are increasingly interested in aligning their investments with personal values, particularly through Environmental, Social, and Governance (ESG) criteria and impact investing. Offshore markets offer access to global ESG investments, allowing investors to participate in green bonds, renewable energy projects, and social enterprises that align with these values.

Market Challenges

Although the HNW offshore investment market shows strong growth prospects, there are some challenges that could impact its trajectory:

Regulatory Scrutiny and Compliance Requirements

Heightened scrutiny from regulatory bodies, particularly in regions like the European Union and the United States, has led to more stringent compliance requirements for offshore investments. Transparency initiatives such as the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA) have increased the obligations for disclosure, reducing some of the historical appeal of offshore investments.

Currency Exchange Risks

Offshore investments involve exposure to multiple currencies, which can lead to exchange rate risks. Currency fluctuations can impact the value of investments, and managing these risks is crucial for maximizing returns and ensuring stability in an offshore portfolio.

Geopolitical and Economic Uncertainty

Geopolitical tensions and economic instability in certain offshore investment hubs can influence market sentiment and investor confidence. Instability in a region with a significant presence of offshore investments may lead HNW individuals to reconsider their investment choices or look for alternatives in more stable jurisdictions.

Regional Insights

Europe

Europe remains a significant market for HNW offshore investments, especially with access to well-established hubs like Switzerland, Luxembourg, and the Channel Islands. These jurisdictions offer stability, a robust legal framework, and extensive wealth management services, making them highly attractive to European HNW individuals.

Asia-Pacific

Asia-Pacific's HNW offshore investment market is growing rapidly due to the rising wealth in countries like China, Singapore, and Hong Kong. Many HNW individuals in this region seek offshore opportunities to diversify assets outside domestic markets, benefiting from the financial centers' strong regulatory standards and global access.

North America

In North America, the Cayman Islands, Bermuda, and the Bahamas continue to attract HNW investments, with U.S. and Canadian investors seeking tax-efficient and diversified solutions. The growth in technology-driven financial services in this region has made offshore investment management more streamlined, supporting market growth.

Middle East and Africa

The Middle East and Africa represent emerging markets for offshore investments. Wealthy individuals in these regions are increasingly using offshore jurisdictions to diversify their wealth outside local markets, particularly in response to regional economic fluctuations and limited local investment opportunities.

Know More about the HNW offshore investment Market Report: https://www.marketresearchfuture.com/reports/high-net-worth-offshore-investment-market-22960

Forecast and Future Trends

With an estimated CAGR of 4.01% from 2024 to 2032, the HNW offshore investment market is set to reach approximately USD 22.5 billion by 2032. This growth is expected to be fueled by factors such as:

Digital Transformation in Wealth Management

The rise of digital platforms and fintech has made offshore investment management more accessible and efficient. HNW individuals can now leverage digital tools for transparent asset management, real-time monitoring, and seamless cross-border transactions, likely boosting the offshore investment market further.

Sustainable Investing and Alternative Assets

Offshore markets are increasingly offering green and sustainable investment options, catering to HNW individuals interested in impact investing. Furthermore, offshore jurisdictions are expanding their portfolio options to include alternative investments like cryptocurrency, private equity, and luxury assets, providing HNW investors with diverse investment avenues.

Evolving Tax Regulations

As global tax regulations evolve, offshore jurisdictions that adapt to transparency and compliance standards while maintaining competitive tax benefits are likely to thrive. HNW investors may favor offshore markets with streamlined tax regimes, fostering growth in jurisdictions that strike a balance between regulation and tax efficiency.

Competitive Landscape

The HNW offshore investment market is competitive, with several wealth management firms and banks catering to high-net-worth clients globally. Key players include:

UBS Group AG: Offers comprehensive wealth management services, including offshore investment solutions.

Credit Suisse Group AG: Specializes in private banking and asset management for HNW clients, providing access to international investment opportunities.

JPMorgan Chase & Co.: Leverages global presence and digital services to offer HNW clients access to diversified offshore portfolios.

Goldman Sachs Group Inc.: Known for its private wealth management solutions and expertise in offshore investments, including tax-optimized strategies.

These firms are focused on leveraging technology, expanding sustainable investment options, and developing tailored solutions to meet the complex needs of HNW clients in offshore markets.

Top Trending Research Report:

Insurance Bpo Services Industry Market https://www.marketresearchfuture.com/reports/insurance-bpo-services-industry-market-24181

Merchant Cash Advance Market https://www.marketresearchfuture.com/reports/merchant-cash-advance-market-24003

Smart Tracker Tag Market https://www.marketresearchfuture.com/reports/smart-tracker-tag-market-24127

Clearing Houses And Settlements Market https://www.marketresearchfuture.com/reports/clearing-houses-and-settlements-market-24027

Merchant Banking Services Market https://www.marketresearchfuture.com/reports/merchant-banking-services-market-23963

Pension Funds Market https://www.marketresearchfuture.com/reports/pension-funds-market-23961

Commercial Insurance Market https://www.marketresearchfuture.com/reports/commercial-insurance-market-23980

Decentralized Insurance Market https://www.marketresearchfuture.com/reports/decentralized-insurance-market-24081

Engineering Insurance Market https://www.marketresearchfuture.com/reports/engineering-insurance-market-24104

Fire Insurance Market https://www.marketresearchfuture.com/reports/fire-insurance-market-24107

About Market Research Future:

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact Us:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release High Net Worth (HNW) Offshore Investment Market Will Grow 4.01% By 2032 here

News-ID: 3732655 • Views: …

More Releases from MRFR ( Market Research Future Report)

Commercial Aircraft Engine Market Size to Reach USD 237.64 Billion by 2035, Grow …

The Commercial Aircraft Engine Market is set for dynamic expansion over the next decade, powered by rapid growth in global air travel demand, ongoing fleet modernization, and technological leaps toward fuel efficiency and sustainability. Commercial aircraft engines - typically turbofan and turboprop powerplants - are central to airline operations, influencing fuel consumption, operating costs, and environmental compliance. According to Market Research Future (MRFR), the market was valued at about USD…

Aircraft Turbine Engine Market Size to Reach USD 75.89 Billion by 2035, Growing …

The Aircraft Turbine Engine Market is entering a sustained growth phase driven by rising global air travel, fleet modernization efforts, and advances in engine technologies that prioritize fuel efficiency and emissions reduction. Turbine engines - including turbofan, turbojet, turboprop, and turboshaft types - are essential propulsion systems for commercial, business, and military aircraft. According to Market Research Future (MRFR), the market was valued at approximately USD 43.58 billion in 2024…

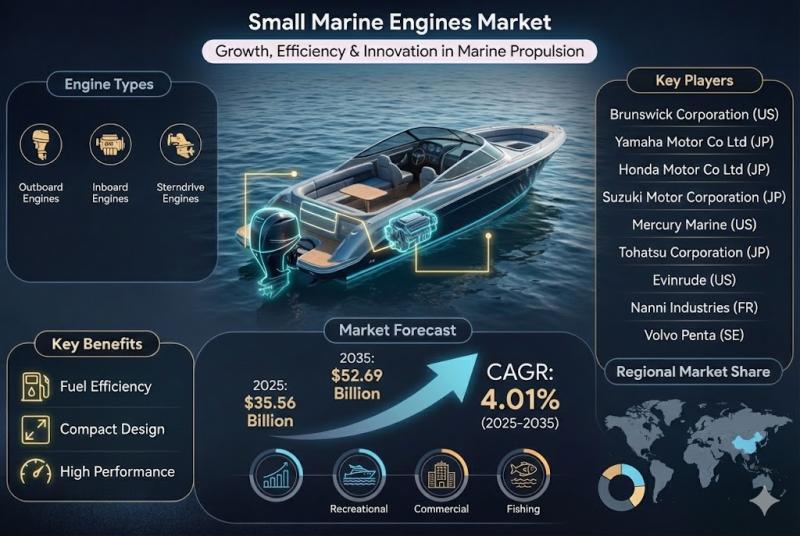

Small Marine Engines Market Size to Reach USD 52.69 Billion by 2035, Growing at …

The global Small Marine Engines Market is positioned for steady growth as demand rises for propulsion systems in recreational boats, support vessels, coastal craft, and other small-to-medium watercraft. According to Market Research Future, the small marine engines market was estimated at USD 34.19 billion in 2024 and is projected to grow to approximately USD 35.56 billion in 2025. Over the forecast period from 2025 to 2035, the market is expected…

Aviation Engine MRO Market Size to Reach USD 73.58 Billion by 2035, Growing at a …

The Aviation Engine Maintenance, Repair, and Overhaul (MRO) Market is a critical backbone of the global aviation industry, ensuring that aircraft engines - among the most complex and costly components - remain safe, efficient, and airworthy throughout their service life. As air traffic continues to rebalance and grow globally, the demand for engine MRO services has surged, driven by fleet expansions, aging aircraft, and the high operational costs associated with…

More Releases for HNW

Wealth in the UK: HNW Investors; Understanding HNW investors and wealth manageme …

The UK wealth management industry has a long history, and this is reflected in the profile of the countrys high net worth (HNW) clients. The majority originate from the financial services industry and are sophisticated enough to deal with their financial affairs. However, to save time they opt for discretionary asset management services, as UK wealth managers maintain their reputation as trusted professionals. Investment portfolios are built around traditional asset…

Wealth in China: HNW Investors; Understanding HNW investors and wealth managemen …

Summary

The Chinese private banking industry is hard to penetrate. However, wealth managers that are aware of the local make-up of the HNW market will find it to be highly profitable. Chinese HNW investors have mainly sourced their wealth through a mixture of entrepreneurship and earned income. While investors value professional advice, they are reluctant to relinquish control and tend to prefer advisory mandates. The average portfolio is heavily invested into…

Wealth in China: HNW Investors; Understanding HNW investors and wealth managemen …

Summary

The Chinese private banking industry is hard to penetrate. However, wealth managers that are aware of the local make-up of the HNW market will find it to be highly profitable. Chinese HNW investors have mainly sourced their wealth through a mixture of entrepreneurship and earned income. While investors value professional advice, they are reluctant to relinquish control and tend to prefer advisory mandates. The average portfolio is heavily invested into…

Wealth in Brazil: HNW Investors; Understanding HNW investors and wealth manageme …

Summary

The majority of wealth in Brazil originates from the construction and finance industries, and can be attributed to a range of sources. These investors are confident enough to deal with their financial affairs, but to gain access to sophisticated products and achieve better returns they opt for management services. Investment portfolios are built around cash and bonds, but it is expected that alternative holdings will continue to gain importance.

Request Sample…

Wealth in Poland: HNW Investors; Understanding HNW investors and wealth manageme …

Summary

The Polish HNW population is dominated by entrepreneurs who prefer to stay in control of their finances, even if they lack experience in capital markets. While they do approach wealth managers for investment advice, Polish HNW investors like to sign off most decisions regarding their portfolios. With the 2008-09 financial crisis fresh in mind, they focus on low-risk products which do not offer high margins to banks. Hence the main…

Wealth in Germany: HNW Investors; Understanding HNW investors and wealth managem …

Summary

Germany is a strong industrial nation with a commercial landscape dominated by SMEs. This is reflected in the background of German HNW individuals – most are either family business owners or inheritors. The manufacturing industry dominates as the leading generator of wealth, followed by construction. Expats constitute 11.3% of the population and are largely from nearby countries such as the UK, Italy, and Austria. Discretionary mandates are preferred by German…