Press release

Life Insurance Market Size Will Reach USD 96,675.4 Billion By 2032

The global life insurance market, a foundational element of financial planning and risk management, was valued at an estimated USD 68,765.9 billion in 2022 and is anticipated to grow from USD 72,479.2 billion in 2023 to USD 96,675.4 billion by 2032. With a projected compound annual growth rate (CAGR) of approximately 3.7% from 2024 to 2032, the life insurance market is poised for steady expansion, fueled by evolving consumer needs, technological advancements, and global economic factors.Key Companies in the Life Insurance Market Include:

Zurich, China Life, Manulife, Aegon, Prudential, State FarmparaneMetLife AliconeNew China Life, AXA, Aviva, MetLife, Berkshire Hathway, Allianz, Nippon Life, Sun Life

Get a FREE Sample Report PDF Here: https://www.marketresearchfuture.com/sample_request/22927

Key Market Drivers

Rising Awareness of Financial Security

In recent years, awareness of life insurance as a tool for long-term financial security has increased, driven by factors such as economic uncertainty, the rising cost of healthcare, and the impact of the COVID-19 pandemic. Consumers now recognize life insurance not only as a protective measure but also as a wealth-building tool that can provide retirement income, debt protection, and estate planning benefits.

Increasing Middle-Class Population

Emerging economies with growing middle-class populations, such as India, China, and Southeast Asian countries, present significant growth opportunities. With rising disposable incomes, more individuals can invest in life insurance products, boosting demand across these regions. Additionally, urbanization and lifestyle changes encourage financial planning, which often includes life insurance as a foundational component.

Technological Innovations in Insurance

Technology has transformed the life insurance industry, making it easier for consumers to access policies, file claims, and receive customer support. The rise of digital platforms and fintech solutions allows insurers to offer personalized products based on individual needs and financial goals. Insurtech innovations, such as AI-driven underwriting, predictive analytics, and mobile-first customer experiences, are streamlining processes and improving customer satisfaction, further driving market growth.

Increased Investment in Retirement Planning

An aging global population, especially in developed countries, has led to a stronger emphasis on retirement planning. Life insurance products that offer retirement benefits, including annuities and whole life policies, are increasingly in demand. As people seek to safeguard their post-retirement income, life insurance is often seen as a valuable asset in comprehensive retirement planning strategies.

Growing Demand for Term Life Policies

Term life insurance policies, which offer coverage for a specific period, have gained popularity due to their affordability and simplicity. These policies, which are ideal for younger consumers looking to protect their families or pay off debts, have become more widely accessible thanks to digital sales channels.

Key Market Challenges

While the life insurance market is expected to grow, several challenges could temper its expansion:

Regulatory Compliance: The life insurance industry is subject to stringent regulations in most countries, affecting product offerings, pricing, and customer communications. Insurers must navigate a complex regulatory landscape to remain compliant, which can limit their ability to innovate quickly.

Low Interest Rates: For insurers, low interest rates can impact profitability, particularly for policies that offer guaranteed returns. Life insurance companies rely on investment income from premiums to pay policyholders, and sustained low-interest rates have put pressure on these revenue streams.

Market Saturation in Developed Economies: In developed regions, such as North America and Western Europe, the life insurance market is relatively mature, with high penetration rates. Growth in these regions may slow, pushing companies to focus on emerging markets to maintain revenue streams.

Regional Market Insights

North America

North America holds a significant share of the global life insurance market due to high awareness, a strong financial advisory sector, and comprehensive insurance coverage. Demand in the U.S. and Canada is also driven by tax incentives and employer-provided life insurance benefits, particularly for whole life and annuity products.

Asia-Pacific

Asia-Pacific is expected to witness rapid growth in the life insurance sector, fueled by emerging middle-class populations, increasing urbanization, and rising disposable incomes in countries like China, India, and Indonesia. The digital transformation in these countries has also made it easier for consumers to access life insurance policies, contributing to market growth.

Europe

Europe is a mature market with steady growth projected, as consumers continue to prioritize life insurance for retirement and estate planning. However, strict regulatory requirements and moderate economic growth may limit the pace of expansion in this region.

Latin America and the Middle East & Africa

These regions are seeing gradual adoption of life insurance products due to growing awareness and improved accessibility through digital channels. While still developing, these markets present significant long-term growth potential for global insurers.

Know More about the The Life Insurance Market Report: https://www.marketresearchfuture.com/reports/life-insurance-market-22927

Market Forecast and Future Outlook

The life insurance market's projected CAGR of 3.7% from 2024 to 2032 indicates steady growth, supported by technological advancements and increased global awareness. Demand will likely remain strong for traditional policies, including term and whole life, as well as hybrid products that combine insurance with investment features. As consumers' financial needs evolve, life insurers are also expected to offer more customized and flexible products to accommodate various income levels and risk preferences.

Competitive Landscape

The life insurance industry is highly competitive, with key players focusing on digital transformation, new product development, and customer-centric services to differentiate themselves. Major players in the market include:

Allianz SE: A leading global insurer, known for its broad product offerings in both developed and emerging markets.

Prudential plc: Operating in both the U.S. and Asia-Pacific, Prudential has a strong focus on retirement planning and hybrid life insurance products.

MetLife, Inc.: Known for its diverse portfolio, MetLife leverages technology to improve customer experience and expand its reach.

AXA S.A.: One of the world's largest insurers, AXA offers a comprehensive range of life and health insurance products, with a growing focus on sustainable finance.

These companies and others continue to focus on expanding their digital capabilities and investing in new technologies to streamline operations and improve customer experience.

Top Trending Research Report:

Car Insurance Market https://www.marketresearchfuture.com/reports/car-insurance-market-22576

Cryptocurrency Exchange Platform Market https://www.marketresearchfuture.com/reports/cryptocurrency-exchange-platform-market-22319

Balanced Funds Market https://www.marketresearchfuture.com/reports/balanced-funds-market-23875

Banking Market https://www.marketresearchfuture.com/reports/banking-market-23852

Financial Consulting Software Market https://www.marketresearchfuture.com/reports/financial-consulting-software-market-23902

Mpos Terminals Market https://www.marketresearchfuture.com/reports/mpos-terminals-market-23919

Credit Card Issuance Services Market https://www.marketresearchfuture.com/reports/credit-card-issuance-services-market-23888

Forex Cards Market https://www.marketresearchfuture.com/reports/forex-cards-market-23847

Cancer Insurance Market https://www.marketresearchfuture.com/reports/cancer-insurance-market-23920

Aerospace Insurance Market https://www.marketresearchfuture.com/reports/aerospace-insurance-market-23909

About Market Research Future:

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact Us:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Life Insurance Market Size Will Reach USD 96,675.4 Billion By 2032 here

News-ID: 3732644 • Views: …

More Releases from MRFR ( Market Research Future Report)

Fungicides Market Size USD 22.06 Billion in 2025, Projected to Reach USD 33.41 B …

The Fungicides Market is entering a phase of steady expansion driven by increasing demand for higher agricultural productivity, rising incidences of crop diseases, and an evolving emphasis on sustainable farming practices. As fungal pathogens continue to threaten staple and high-value crops alike, fungicides - chemical and biological agents designed to prevent or control the spread of fungi - are becoming indispensable tools in crop protection strategies worldwide. According to Market…

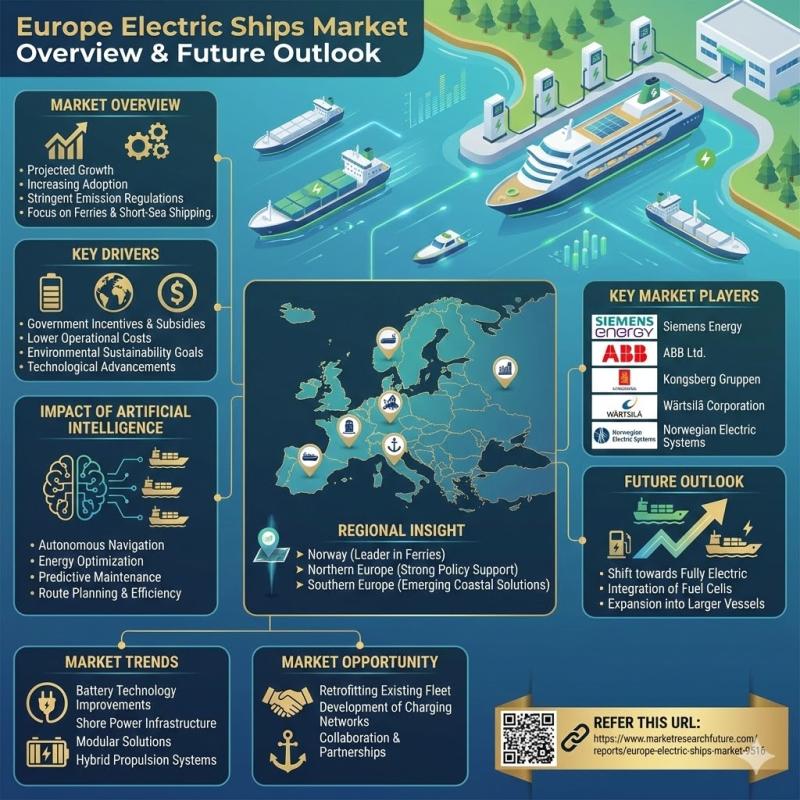

Europe Electric Ships Market Size USD 3.48 Billion in 2025, Projected to Reach U …

The Europe Electric Ships Market is entering a transformative phase driven by mounting environmental regulations, rapid technological advancements, and an accelerated shift toward sustainable maritime transport solutions. As countries across the continent work to decarbonize their shipping industries and curb emissions from marine vessels, electric ships - powered by batteries, hybrid systems, or fully electric propulsion - are increasingly seen as essential to achieving ambitious climate goals. According to Market…

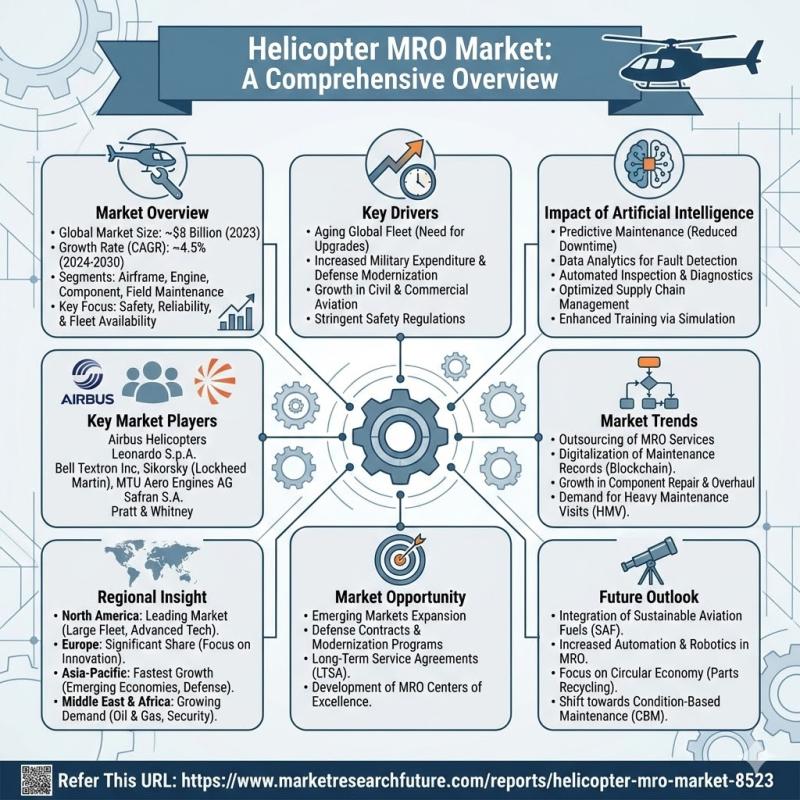

Helicopter MRO Market Size USD 104.0 Billion in 2025, Projected to Reach USD 277 …

The global Helicopter MRO (Maintenance, Repair, and Overhaul) Market is entering a period of significant growth, fueled by increasing helicopter deployments across commercial, military, and emergency service applications. Helicopters have become indispensable in sectors such as offshore oil and gas operations, law enforcement, medical emergencies, tourism, and defense, creating a pressing need for maintenance and repair services to ensure operational reliability and airworthiness. According to Market Research Future (MRFR), The…

Commercial Aircraft Lighting Market to Grow from USD 1.303 Million in 2025 to US …

The Commercial Aircraft Lighting Market is entering a phase of methodical growth, driven by expanding airline fleets, advancements in lighting technology, increased focus on energy efficiency, and a rising emphasis on passenger comfort and safety. As airlines modernize cabins and enhance operational efficiency, lighting systems - both interior and exterior - are playing an increasingly strategic role in overall aircraft design and in-flight experience. According to Market Research Future (MRFR),…

More Releases for Life

Life Heater Reviews - How Does Life Heater Work? Read life heater reviews consum …

The Life Heater emerges as a revolutionary heating solution, redefining efficiency and safety standards for residents in the United States and Canada. More than a conventional heater, it boasts impressive energy savings of up to 30%, making it a beacon of sustainability in the realm of home heating. The device's convection heating system ensures rapid warmth, promising to elevate the comfort of spaces across North American homes with unprecedented speed.

The…

Russia Life Insurance Market to Eyewitness Massive Growth by 2026 | Renaissance …

A new research document is added in HTF MI database of 74 pages, titled as 'Russia Life Insurance - Key Trends and Opportunities to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled…

Life Insurance Market is Booming Worldwide | Sumitomo Life Insurance, Nippon Lif …

HTF MI recently added Global Life Insurance Market Study that gives deep analysis of current scenario of the Market size, demand, growth, trends, and forecast. Revenue for Life Insurance Market has grown substantially over the five years to 2019 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown and Face-off with COVID-19 Industry Players are seeing Big Impact in operations and identifying ways to…

Online Life Insurance Market Swot Analysis by Key Players Nippon Life Insurance, …

Global Online Life Insurance Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Online…

Life Insurance Market Next Big Thing with Major Giants HDFC Life Insurance, SBI …

A new business intelligence report released by HTF MI with title "Life Insurance Market in India 2019" is designed covering micro level of analysis by manufacturers and key business segments. The Life Insurance Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of…

Life Insurance Market to Witness Massive Growth| Allan Gray Life, Coronation Lif …

HTF Market Intelligence released a new research report of 35 pages on title 'Strategic Market Intelligence: Life Insurance in South Africa - Key Trends and Opportunities to 2022' with detailed analysis, forecast and strategies. The study covers key regions and important players such as Allan Gray Life, Coronation Life Assurance, Sygnia Life etc.

Request a sample report @ https://www.htfmarketreport.com/sample-report/1854964-strategic-market-intelligence-38

Summary

The ""Strategic Market Intelligence: Life Insurance in South Africa - Key Trends…